On the evening of October 10, Uniswap Labs finally released another major product development after V4 and UniswapX – Unichain. According to the official statement of Uniswap Labs, after years of building and expanding DeFi products, the Uni team has seen many areas in DeFi that need improvement. This Optimism super chain based on OP Stack aims to create the necessary conditions for the advancement of cross-chain DeFi and Ethereum expansion roadmap, and become a fast and decentralized liquidity chain.

The Unichain testnet was launched today, and the mainnet will be launched later this year. The Uniswap Foundation will provide funding and project support to help developers develop on Unichain. After the announcement, the price of UNI continued to rise, with a 24-hour increase of 15%, breaking through $8 at one point. However, while everyone was surprised by the Uniswap chain, the biggest concern was still the old question: Did it empower UNI?

Unichain Architecture Interaction Introduction

Entsprechend Unichains official website and its white paper, Unichain is an L2 built on OP Stack with two key innovations: verifiable block construction and Unichain verification network.

Among them, the verifiable block construction mechanism was built by Uniswap in cooperation with Flashbots, which achieves an effective block time of 200-250 milliseconds by splitting each block into four Flashblocks. Unichain will currently start with a block time of 1 second, and will soon launch a block time of 250 milliseconds. In addition, Unichain can also significantly improve market efficiency while reducing transaction delays by increasing the frequency of arbitrage and reducing the value loss of MEV.

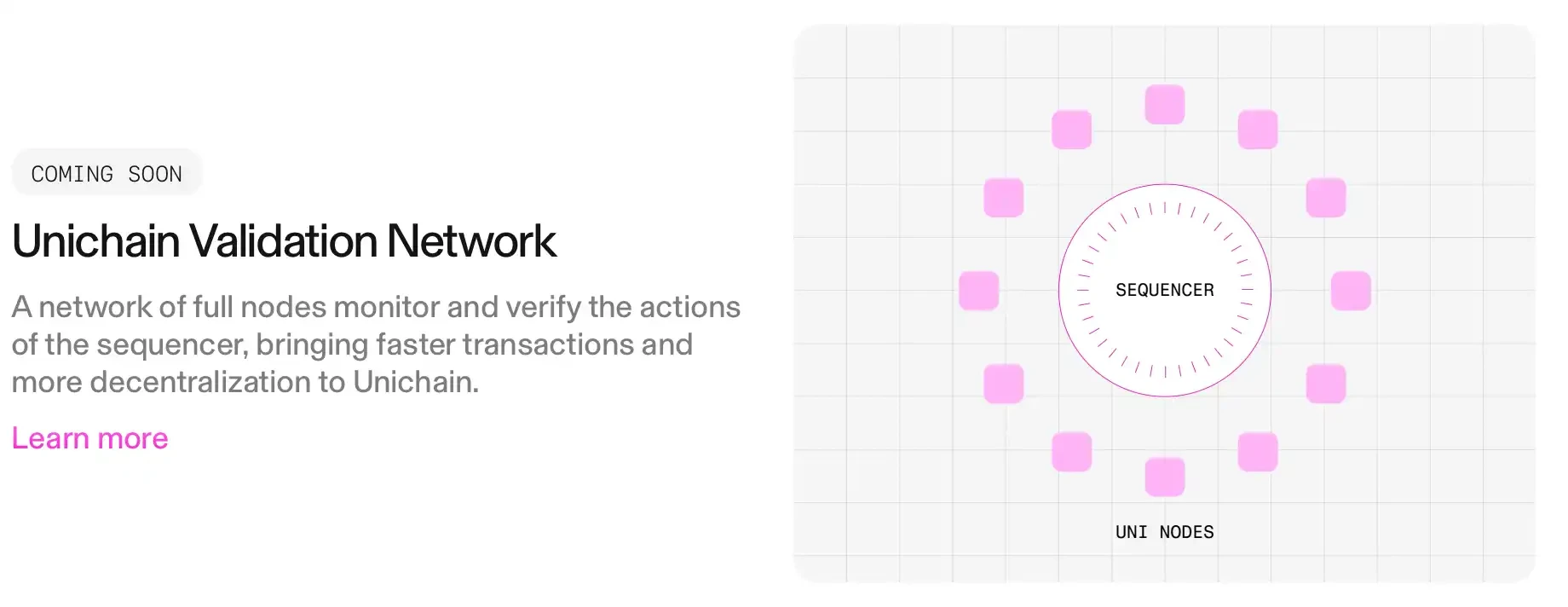

The Unichain Validation Network is a decentralized network of Unichain node operators designed to reduce certain key risks in the block ordering process, achieve faster economic finality to allow for faster settlement of cross-chain transactions, and support potential future expansion.

Unichain is based on the OP Stack superchain and combines the Intent Bridge to facilitate the seamless flow of liquidity between chains and provide users with fast, cheap and extensive access to liquidity. According to the official introduction, the development process of Unichain is completely open source and its code base is available to all OP Stack superchains.

It is worth noting that Unichain can reduce users transaction costs by about 95% in the short term. Although Unichain currently relies on a single sorter to improve efficiency, the team has made certain mechanism innovations on the current mainstream L2 model, allowing full nodes to help verify blocks to improve the decentralization of Unichain.

Currently, Unichain supports seamless transactions across dozens of chains, and users can add the Unichain Sepolia testnet to their existing Ethereum wallets. Here is some useful information:

Chain ID: 1301

RPC URL: https://sepolia.unichain.org

Currency Symbol: ETH

Block Explorer: https://sepolia.uniscan.xyz/

The tools that can be used to obtain testnet ETH are:

Alchimie : Use an Alchemy account to claim testnet ETH once every 24 hours;

QuickNode , receive testnet ETH every 12 hours;

Superchain , claim 0.05 testnet ETH every 24 hours, or verify your on-chain identity to get more tokens;

thirdweb , receive testnet ETH every 12 hours.

UNI is finally empowered?

Back to the question that everyone is most concerned about, has UNI been empowered on Unichain? The answer is yes, but not ideal.

UNI does have a real use case in Unichain. As mentioned above, in order to improve the decentralization of Unichain, the Uniswap team designed a validator network and used UNI as a staked token. To become a validator in UVN (Unichain Validator Network), node operators must stake UNI on the Ethereum mainnet. The number of staked tokens not only determines the influence of the validator, but also its commitment to participate in network maintenance.

The Unichain network divides time into fixed-length cycles, and at the beginning of each cycle, the network takes a snapshot of the current staked balance, which provides the basis for the calculation of rewards. As each cycle begins, the network calculates the value of each staked token and distributes rewards accordingly.

Participants can increase the validators stake weight through staking and voting, thereby increasing their chances of becoming active validators. Active validators are those with the highest stake weight, who are eligible to issue proofs and earn special compensation during the cycle.

Active validators need to run an instrumented Reth Unichain node online, which is responsible for proposing and validating blocks. Validators need to sign block hashes and publish them to the UVN service smart contract at the end of each cycle as proof of the validity of their work. The service smart contract verifies these proofs and immediately issues rewards based on the validators stake weight.

If a validator fails to publish a valid proof within an epoch, they will not receive a reward, and any unallocated rewards will be carried over to the next epoch.

Therefore, compared with the useless mascot tokens in the past, the UNI token of Unichain has indeed gained certain empowerment and demand pressure. However, compared with the direct dividend model that has been highly sought after in the market recently, the chain empowerment model that has taken a detour is more like scratching the itch of investors. At the same time, in terms of staking income, we also need to wait for further observation from the community.

What has Uniswap Labs done in the past year?

As the leader of DEX, Uniswaps every move is watched by the entire industry. Before the announcement of the launch of Unichain, the market was obviously paying attention to several major events of Uniswap. One was the launch of version V4, the other was the regulatory disposal issues faced by institutions such as the SEC and CFTC, and most importantly, how the changes to the fee mechanism would empower UNI token holders.

In February this year, the Uniswap Foundation stated that the release of V4 is tentatively scheduled for the third quarter of 2024. At the same time, Uniswap is also intensively updating and iterating existing products. On March 12, Uniswap successfully launched a non-custodial, zero-cost limit order function on the web app. On April 7, Uniswap announced that the web version has been launched on UniswapX, providing users with MEV protection, gas-free transactions, and no-cost functions for failed transactions. It also includes the launch of a web plug-in wallet and the launch of domain name services.

In terms of supervision, the SEC issued a warning to Uniswap Labs in April this year, planning to take enforcement action against it. In September, the U.S. Commodity Futures Trading Commission (CFTC) also issued an order to Uniswap Labs, accusing it of providing illegal digital asset derivatives transactions.

Weiterführende Literatur: Uniswap, which has always been protected by the US courts, is involved in another lawsuit. Can it win the SEC this time?

On February 23, the Uniswap Foundation announced that it would release a proposal to activate Uniswap protocol governance, which would distribute any protocol fees proportionally to UNI token holders who have staked and delegated their voting rights. As soon as the news came out, the price of UNI tokens skyrocketed, rising from $7 to a high of around $12 overnight. But until May, the fee switch was still not turned on, and there was even news that the Uniswap Foundation announced the postponement of the vote on the fee mechanism under pressure from a VC institution.

Weiterführende Literatur: What happens if Uniswap turns on the fee switch?

This time, Uniswap wants to consolidate its liquidity moat through the chain built by its own team. Will it bring hope to UNI token holders?

This article is sourced from the internet: UniSwap launches Unichain, will UNI be empowered?

Original | Odaily Planet Daily ( @OdailyChina ) Author | Fu Howe ( @vincent 31515173 ) Last night, Binance announced that Launchpool has launched the 58th project Hamster Kombat (HMSTR), a crypto exchange CEO simulator P2E game built on the Telegram mini-program platform. From Notcoin (NOT) to Toncoin (TON), DOGS, and now HMSTR, Binance has continued to exert its strength in the TON ecosystem, once again attracting market attention. So, what other potential investment opportunities are there in the TON ecosystem ? Recently, HC Capital published an article summarizing the TON ecosystem projects that will issue coins and airdrop in 2024, namely: Yescoin, Major, TON Station, MemeFi, X Empire, TapSwap, PocketFi and Blum. Odaily Planet Daily will introduce the gameplay of the above 8 projects for readers reference. Yescoin :…