FBI gibt Münze heraus, um Strafverfolgungsbehörden zu behindern? Mehrere Market Maker wegen Marktmanipulation angeklagt

Original title: FBI Issues Zeichens to Trap and Charge Crypto Companies for “Price Manipulation”

Original source: Coin 68

U.S. officials have sued four cryptocurrency companies, accusing them of manipulating the market and hyping a token created by the FBI.

The FBI issued tokens to set up a scam, then sued crypto companies that specialized in hype

On October 9, the U.S. Department of Justice sued four cryptocurrency companies, Gotbit, ZM Quant, CLS Global, and MyTrade, as well as 18 executives of these companies, accusing them of manipulating the market and hyping cryptocurrency tokens.

U.S. prosecutors said the four defendant companies established cryptocurrency projects but provided false information and conducted wash trading to create the illusion that these projects were active and in high demand. The defendants began to sell the goods for arbitrage.

All four companies pleaded guilty and forfeited $25 million worth of crypto assets.

Meanwhile, Gotbit, ZM Quant, CLS Global and MyTrade are the market makers hired to wash trade these tokens.

It is worth noting that in order to investigate this case, the US Federal Bureau of Investigation (FBI) created a token called NexFundAI as a bait, and then hired market makers to establish a market and eventually collect criminal evidence.

According to DEXTools data, the NexFundAI token was issued at the end of May 2024, and its price rose sharply in the following days, and then remained stagnant for a long time until it fell sharply at the end of August and has now stopped trading.

NexFundAI token price chart, screenshot from DEXTools at 10:55 am on October 10, 2024

The U.S. Department of Justice said this was the first time that U.S. authorities had prosecuted financial crimes in the cryptocurrency industry. This was seen as a reflection of the U.S. authorities increased crackdown after cryptocurrency scams in 2023 caused Americans to lose $5.6 billion. Previously, the U.S. Authorities also fined Binance $4.3 billion for money laundering.

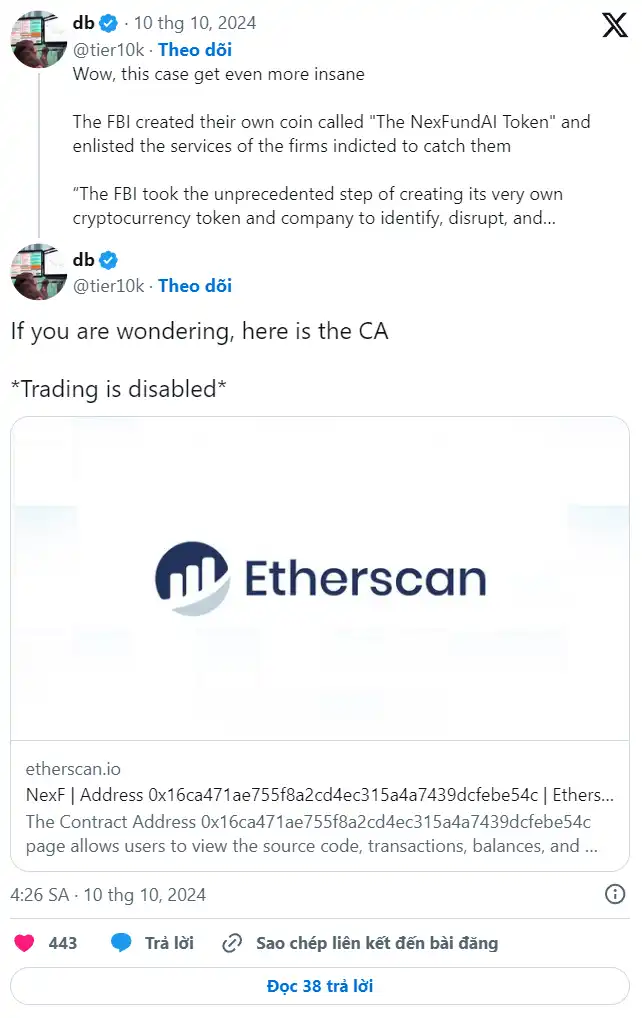

This incident also sparked controversy in the crypto community on Twitter. Most people were surprised by the FBI’s practice of setting up a trap to catch criminals. Now everyone must act with caution to avoid being involved in memes from unknown sources. Fell into the governments trap when interacting with tokens.

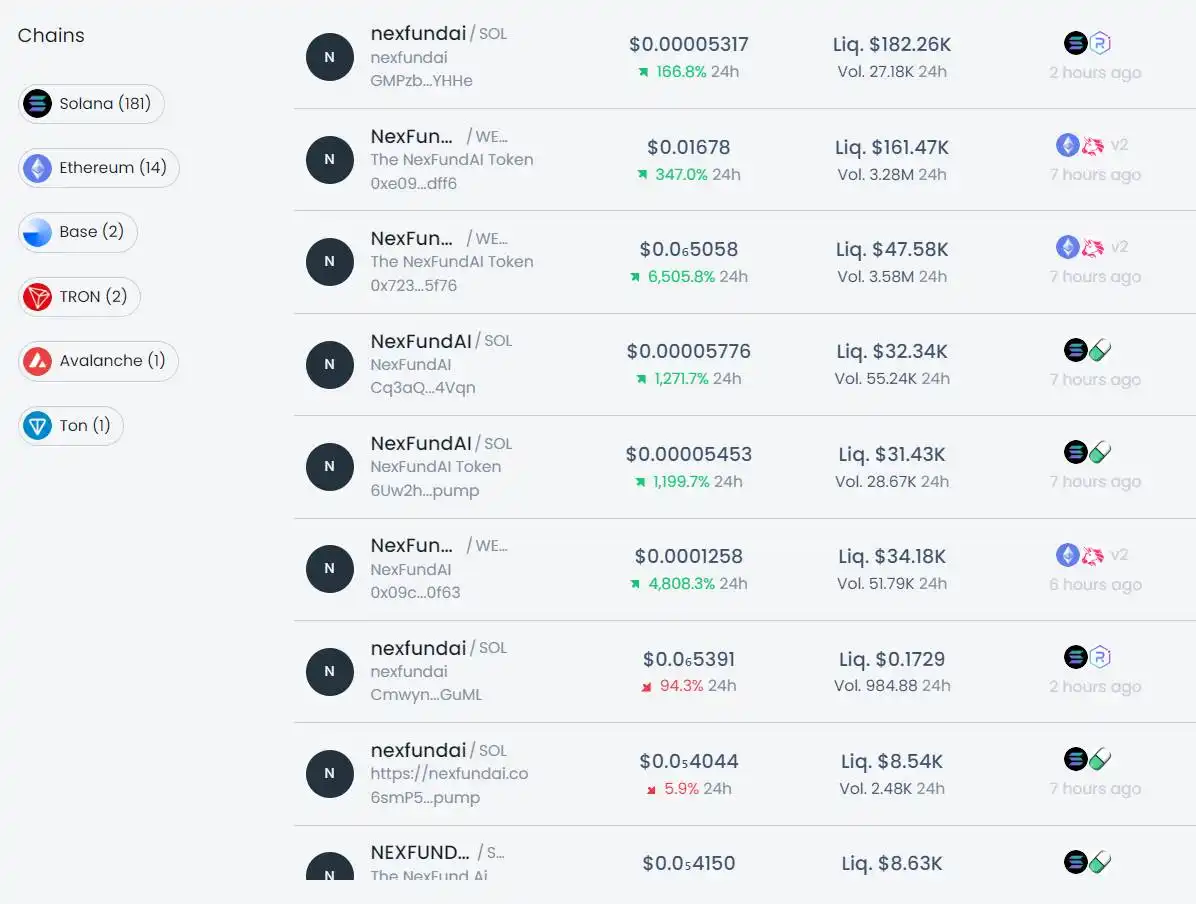

However, in the past few hours, a large number of meme tokens with names similar to NexFundAI have been created and actively traded.

The token named NexFundAI is being traded, screenshot from DEXTools on the morning of October 10, 2024

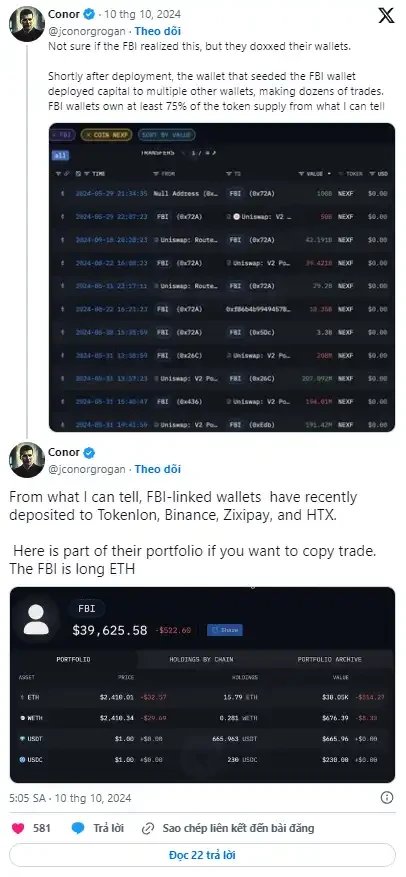

Blockchain analyst @jconorgrogan also discovered the FBI’s crypto wallet.

This article is sourced from the internet: FBI issues coin to sting enforcement? Multiple market makers accused of market manipulation

Verwandt: Cube Exchange: Erkundung der nächsten Billionen-Dollar-Marktchance im Solana-Ökosystem

Der Zusammenbruch von FTX hat nicht nur das Vertrauen unzähliger Anleger zerstört, sondern auch das Fundament des gesamten Kryptomarktes erschüttert. Viele Anleger haben aufgrund dieses Vorfalls kein Vertrauen mehr in Kryptowährungen und begannen, die Zuverlässigkeit der gesamten Branche in Frage zu stellen. Die einst glamouröse zentralisierte Handelsplattform gehörte augenblicklich der Vergangenheit an. Dieser Vertrauensverlust hat drastische Marktschwankungen ausgelöst und der Preis von Kryptowährungen ist in kurzer Zeit eingebrochen. Die Liquidität des Marktes ist fast versiegt und die Gelder der Benutzer wurden in großem Umfang geschädigt. Ein solch katastrophales Ereignis verdeutlicht die enormen Risiken einer übermäßigen Abhängigkeit von zentralisierten Handelsplattformen und weckt bei den Benutzern des Kryptomarktes auch Zweifel an der Sicherheit,…