Die neue Grenze von DeFi: der Aufstieg von On-Chain-Darkpools, die Integration von Datenschutz, Effizienz und Dezentralisierung

Originalautor: Tiger Research Reports

Originalübersetzung: TechFlow

Zusammenfassung der wichtigsten Punkte

-

In traditional financial markets, large-scale transactions by institutional investors can have a significant impact on market prices, which can cause other market participants to face losses. In order to mitigate these effects, dark pools were introduced as an alternative trading system in which transaction details remain confidential until the transaction is executed.

-

While dark pools have continued to grow since their inception, they have eroded trust due to information leaks and abuses by operators. As a result, regulators in several countries have taken steps to increase oversight of these platforms. In light of this, blockchain-based dark pools have emerged as a potential solution.

-

On-chain dark pools provide traders with privacy protection while eliminating the need for centralized intermediaries. This solves multiple problems faced by the traditional financial system. Moreover, the growing demand for private transactions is expected to drive the development of the on-chain dark pool market in the near future.

DeepChao Note: In traditional financial markets, dark pools are private trading platforms that allow institutional investors to conduct large securities transactions without disclosing transaction information. Transactions conducted in dark pools will not be displayed in real time on the open market, and transaction information is usually delayed or only part of the information is released.

1. Einleitung

The volatility of traditional financial markets continues to rise, driven primarily by technological advances and a variety of market factors. Large-scale transactions by institutional investors, especially block trading and the evolution of high-frequency trading (HFT) technology, are the main causes of this volatility.

This heightened market volatility poses significant risks to regular investors. As a result, institutional investors seek alternatives that can execute large trades while minimizing market disruption. One solution that is gaining traction is dark pools, an alternative trading system designed to conduct private trades.

Dark pools differ from traditional exchanges in several key ways. First, transaction details such as order price and volume are not disclosed until the trade is executed. Second, dark pools primarily support large orders, and some platforms set minimum order sizes to filter out smaller trades. Finally, they use unique execution methods, including centrally matching large orders and executing trades at the midpoint of the market spread. These features allow institutional investors to execute large-scale trades at favorable prices without revealing strategic information to competitors, thereby reducing the impact on market prices.

Quelle: Nasdaq

Dark pools are mainly developed in the United States and Europe. In the United States, dark pools once accounted for about 15% of the total trading volume, with a peak of 40% of the average daily trading volume. Currently, more than 50 dark pools have been registered with the Securities and Exchange Commission (SEC), and the number is still increasing. In Europe, the introduction of the Markts in Financial Instruments Directive (MiFID) in 2007 promoted the development of dark pools.

This trend is also expanding in Asia. Hong Kong and Singapore have adopted dark pool systems since 2010, while Japan and South Korea are introducing these platforms within their respective regulatory frameworks.

Japanese dark pool trading trends, source: JPX

While dark pools were originally designed for institutional investors to handle large trades, recent data shows a shift toward smaller trades. According to FINRA (Financial Industry Regulatory Authority), the average trade size in the top five dark pools in the United States is only 187 shares. This shift is attributed to two factors: First, the emergence of platforms targeting ordinary investors has diversified the types of trades within dark pools. Second, the growing preference of institutions to split large orders into smaller trades to reduce market impact has changed the trading patterns within these platforms.

2. Challenges faced by dark pools in traditional financial markets

Dark pools offer clear advantages by not disclosing trade details until they are executed, thereby reducing market impact and lowering the cost of large trades. However, criticism surrounding dark pools persists, leading some countries to either avoid adopting dark pools or restrict their use. This is mainly due to several key concerns.

First, while dark pools enable cost-efficient, large-scale trading, this comes at the expense of transparency. In public markets, information about trades occurring within dark pools is hidden until the trade is completed. This lack of transparency makes monitoring and regulation more difficult, raising concerns about potential negative impacts on financial markets. Second, the concentration of liquidity in dark pools reduces liquidity on public exchanges. This increases transaction costs for ordinary investors and can reduce market efficiency.

Third, while dark pools maintain confidentiality, platform operators have been known to intentionally leak information. Documented cases show the harmful effects of these leaks, which have heightened suspicion of dark pools.

3. The inevitable rise of on-chain dark pools

Some believe that decentralized finance (DeFi) systems offer a solution to the problems faced by traditional dark pools. As mentioned earlier, dark pools operate primarily on the assumption that operators will not exploit customer information. This is a key factor in ensuring transaction confidentiality. However, in the traditional dark pool space, there are many cases where operators leak information in exchange for compensation.

Consider a scenario involving a dark pool called “BlackTiger” and a stock called “Tiger.” Assume that institution A intends to purchase 5 million shares of Tiger from institution B. The operator of BlackTiger leaks this information to investor C in exchange for compensation. Since dark pool trades can take time to execute, investor C waits for the price of Tiger to drop before purchasing a large number of shares. After the dark pool trade is publicly disclosed, the stock price rises, enabling investor C to sell these shares at a profit, thereby exploiting information asymmetry.

This practice undermines trust in centralized dark pools in traditional finance. One reason this problem persists is that operators can make significant profits by exploiting this information asymmetry, and these profits often outweigh the risk of potential penalties. Although some countries have tried to address these issues through stricter regulations, suspicion of dark pool operators remains strong.

4. Implementation Methods of On-chain Dark Pools

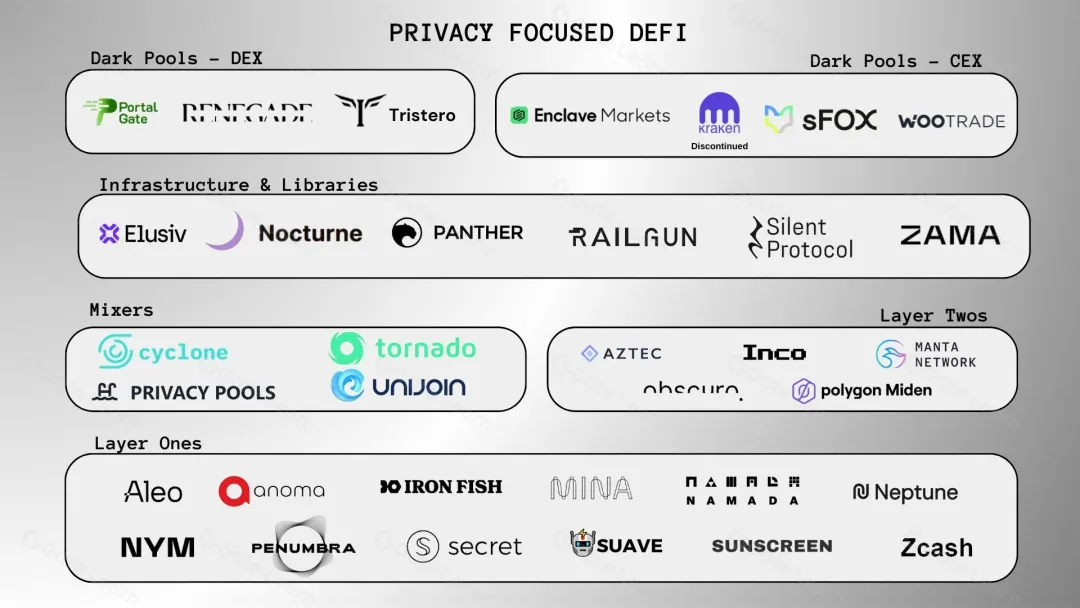

Quelle: Delphi Digital

In the decentralized finance (DeFi) space, some platforms have partially implemented dark pool functionality. Decentralized exchanges (DEX), such as Uniswap, provide traders with a degree of anonymity by leveraging automated market makers (AMMs) to match token trades without revealing the identities of the participants. DEXs operate using blockchain networks and smart contracts, eliminating the need for intermediaries or centralized control. This effectively eliminates the trust issues that often exist in traditional dark pools, where operators can abuse customer information.

Source: Renegade

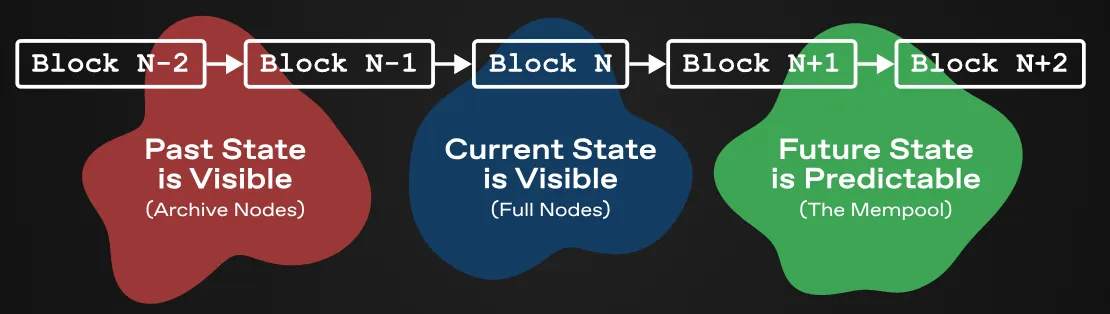

However, it is difficult for decentralized exchanges (DEX) to fully replicate the confidentiality of traditional dark pools due to the inherent transparency of blockchain technology. Wallet addresses associated with certain institutions or large traders are often marked and traceable, and transaction details are visible to everyone on the blockchain. Services like block explorers and trackers make both completed and pending transactions easily accessible. Traders and platforms often take advantage of this transparency. This can lead to increased market instability, as well as issues such as trade copying and maximum extractable value (MEV) attacks, creating a less than conducive environment.

To address these challenges, on-chain dark pools have introduced technologies such as Zero-Knowledge Proofs (ZKP), Multi-Party Computation (MPC), and Fully Homomorphic Encryption (FHE) to implement private transaction mechanisms. ZKP ensures that participants can prove the validity of transactions without revealing the actual input, thereby maintaining the confidentiality of transactions. For example, traders can prove that they have enough token balances to complete a transaction without exposing their entire balance.

Source: Renegade

One notable on-chain dark pool is Renegade, which uses Multi-Party Computation (MPC) for order matching and Zero-Knowledge Proofs (ZKP) to execute matched trades. This ensures that no information about orders or balances is revealed until the trade is completed. Even after the trade is completed, only the traded tokens are visible. Smart contracts verify the ZKP, thereby reducing the risk of malicious behavior by block producers or sequencers. Other protocols, such as Panther, also leverage ZKP and cryptography to facilitate private on-chain transactions.

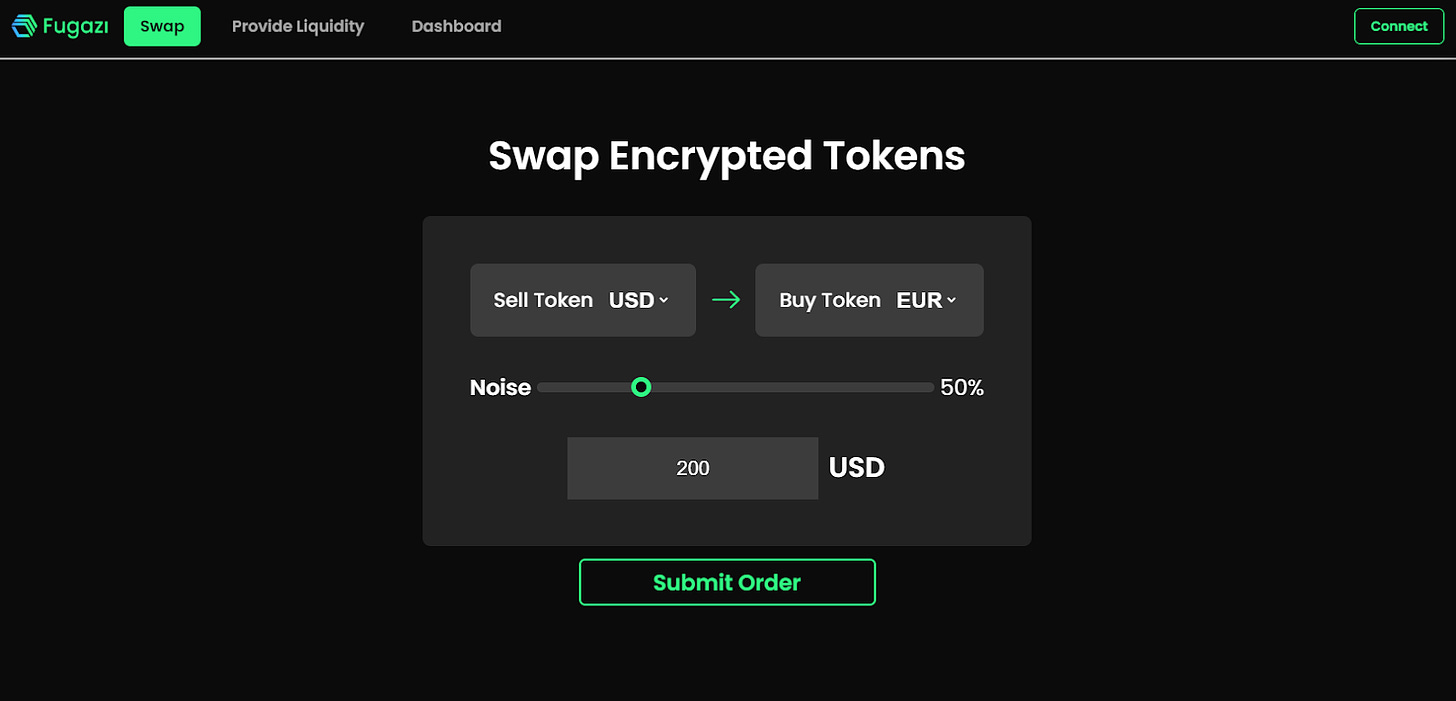

Source: ETH Online 2024

Meanwhile, decentralized exchanges (DEXs) based on automated market makers (AMMs) such as Uniswap and Curve are vulnerable to front-trading and back-trading attacks, which refers to transactions being copied or manipulated by third parties monitoring the transaction memory pool, resulting in adverse price outcomes for the original trader.

In response, projects like Fugazi have gained recognition on ETH Online, introducing mechanisms such as batch transaction processing and noise orders to prevent MEV attacks. Fugazi bundles user transactions with random noise orders and then performs fully homomorphic encryption (FHE). This prevents third parties from identifying specific transaction details and performing front-end transaction attacks. While many on-chain dark pools use peer-to-peer (P2P) systems to reduce slippage, Fugazis approach of combining AMM with measures to mitigate MEV attacks is a promising development to protect participants.

5. The Dilemma of On-Chain Dark Pools: Transparency

One of the main concerns surrounding on-chain dark pools is whether they will affect the transparency of blockchain networks. Since the birth of blockchain technology, it has faced a series of challenges such as the blockchain trilemma (balancing scalability, decentralization, and security). Similarly, the transparency issue brought about by on-chain dark pools is another challenge that requires extensive research and experiments to solve.

Source: vitalik buterins blog

In essence, there may be a trade-off between transparency and security in blockchain systems. The development of on-chain dark pools, which aims to minimize security risks and market impact, is a response to the inherent transparency of blockchain. Even Ethereum founder Vitalik Buterin proposed the concept of stealth addresses to alleviate privacy issues arising from publicly available information such as wallet addresses and Ethereum Name Service (ENS) records. This shows that while transparency is a major advantage of blockchain, achieving mass adoption may require a balance between transparency and user privacy without compromising user experience.

6. The Prospects of On-Chain Dark Pools

Source: blocknative

The growth potential of on-chain dark pools is expected to grow significantly. This is evidenced by the rapid growth of private transactions within the Ethereum network. While private transactions only accounted for 4.5% of total Ethereum transactions in 2022, they have recently surged to over 50% of total gas fees. This shows that people are working hard to avoid robots that influence trading outcomes.

Users can leverage private mempools to conduct private transactions, but this still relies on trusting a small group of operators who control these mempools. While private mempools offer greater censorship resistance than public mempools, the fundamental problem remains: block producers can still monitor and potentially exploit transaction information. Given these challenges, the market for on-chain dark pools—where transactions can be securely hidden while remaining transparently accessible—is expected to continue to grow.

7. Can on-chain dark pools revolutionize the financial market?

Dark pools in traditional financial markets face a serious crisis of trust due to incidents such as money laundering, hacker attacks, and information leaks. As a result, regions such as the United States and Europe, which once led the way in dark pool adoption, have introduced regulations to enhance transparency and set clear conditions for non-public trading. In contrast, markets such as Hong Kong have limited access to dark pools, restricted participation, and prohibited ordinary investors from participating in dark pool trading.

Despite these challenges, on-chain dark pools with strong censorship resistance and security could be transformative for the financial industry. However, in order for on-chain dark pools to achieve widespread adoption, two key issues must be addressed. First, the platforms and entities operating these pools must be thoroughly vetted to guarantee their stability and reliability as they rely on blockchain networks and smart contracts. Second, on-chain dark pools currently lack a clear regulatory framework. Institutional investors must participate with caution and ensure that they review all relevant regulatory requirements before participating in such markets.

This article is sourced from the internet: The new frontier of DeFi: the rise of on-chain dark pools, the integration of privacy, efficiency and decentralization

Verwandt: Wie kann man die Layer2-Strategie von Ethereum objektiv bewerten?

Originalautor: Haotian In letzter Zeit sind die Stimmen von FUD Ethereum und @VitalikButerin lauter geworden. Insbesondere haben ausländische KOLs sehr interessante Diskussionen zu Themen wie Blobs-Speicherplatznutzung und Layer-2-Umsatz geführt. Wenn wir die Emotionen des Sekundärmarkts beiseite lassen, wie sollten wir Ethereums Layer-2-Strategie einfach anhand der Daten bewerten? Als nächstes möchte ich meine Meinung äußern: Lassen Sie uns in die Zeit vor dem Ethereum-Cancun-Upgrade zurückgehen. Alle waren begeistert von RaaS und DA War, weil die Layer-2-Off-Chain-One-Click-Ausgabe wie Pilze nach einem Regen aus dem Boden geschossen ist, was die Nachfrage nach Ethereum-Mainnet-DA-Funktionen in Layer-2-Batch-Transaktionen direkt ankurbeln und dann einen Preiskampf um Blobs-Speicherplatz auslösen wird. Dann wurde eine große Menge ETH zerstört…