Sind Staking-Belohnungen versteckte Kosten der Blockchain?

Original author: Franklin Templeton Digital Assets

Originalübersetzung: Alex Liu, Foresight News

Are staking rewards a cost to blockchain?

There has been debate in the cryptocurrency community about whether staking rewards should be considered a cost of the network, as these token incentives increase the total token supply (thus diluting passive holders). This debate is further complicated by the fact that there is no consensus on the definition of cost and there are different understandings of cost. The purpose of this research article is to define whether staking rewards are a cost of distributed networks from our perspective.

What are staking rewards?

Staking rewards are given to token holders who choose to stake their tokens on the Proof of Stake (PoS) network. This process involves locking up digital assets to help validate transactions and secure the blockchain network. These staked tokens serve as collateral for the validator, promising to act in an honest manner. If fraudulent transactions are validated, part of this collateral will be lost (slashing). This collateral is denominated in the native asset of the blockchain (ETH for Ethereum and SOL for Solana).

Staking rewards cause inflation in the token supply as they are distributed via newly minted tokens to honest validators who stake their capital to secure the network. For example, as of September 18, 2024, the annualized inflation rates for ETH and SOL are approximately 0.8% and 5.0%, respectively, which is entirely generated by staking rewards.

dispute:

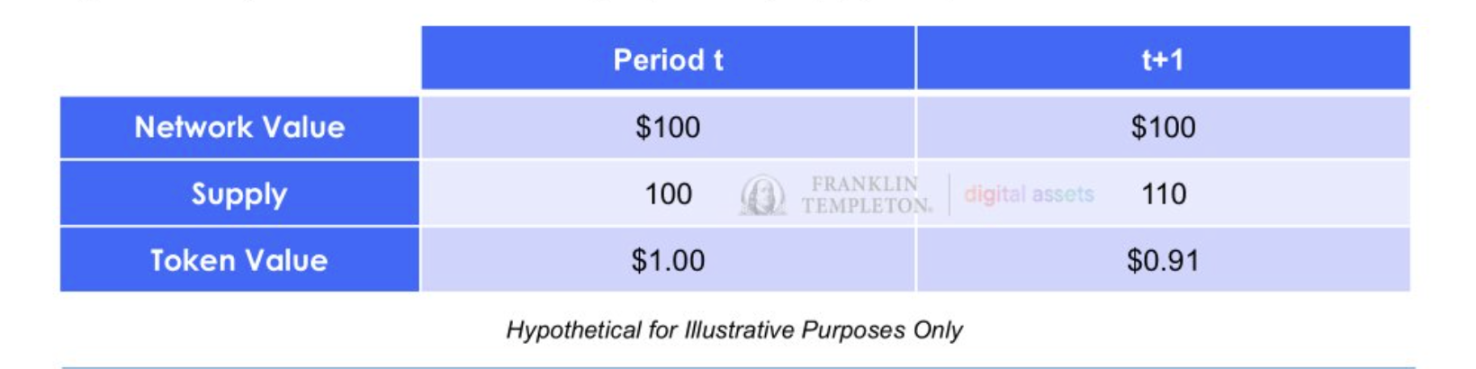

From one perspective, network value is affected by the number of tokens, and staking rewards introduce new supply, distributing the same value to more tokens, thereby reducing the token price. Conversely, another view is that network value is defined by market cap, and therefore staking rewards are not a cost to the network because they are purely a transfer of value from non-stakers to stakers. Our view is that both views are correct, but they are just looking at the problem from different perspectives. Staking rewards are a cost to the token price because supply is increasing; but it is not a cost to the network value because token supply affects the total number of tokens, not the total value. The following table illustrates the hypothetical dynamics of the change in supply from period t to period t+1 on the token value:

We believe the key point is that while the overall network value remains constant, an increase in the token supply causes the value of each token to decrease. We do not believe that increasing the supply changes the network value. And to believe that the value of a token will not be affected by an increase in supply is like believing that money will fall from the sky.

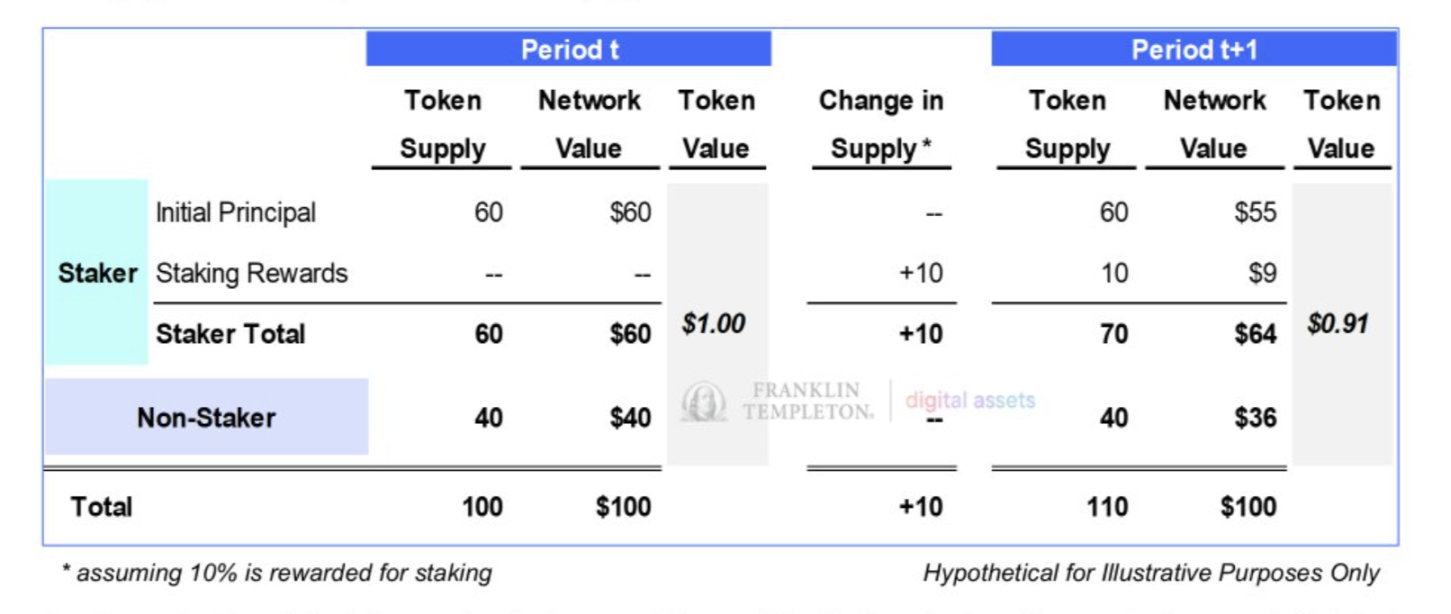

We further elaborate on this point in the figure below, from the perspective that staking rewards are simply a transfer of value from non-stakers to stakers. The figure shows the process of token price and value transfer from period t to period t+1 in a PoS network. We assume that 60% of the token supply is staked and the inflation rate is 10% (through staking rewards). As can be seen, the network value remains unchanged because the only important variable in these two periods is the token supply.

As shown in the table, the token value has been diluted by ~9% , further supporting our view that staking does not impact network value, but dilutes the value of the token. The change in network value for non-stakers is the same percentage as the change in overall token value. For stakers, the initial staked principal is diluted just like non-stakers; however, stakers gain more through staking rewards than they lose through dilution. Investors can monitor the staking yields on these rewards through on-chain data or third-party staking indices such as the CESR Index – Composite Ethereum Staking Yield, which tracks such yields on the Ethereum chain.

So, are staking rewards a cost to the network? We believe that staking rewards are not a cost to the overall value of the network. However, staking rewards do represent an expense to token holders at this moment in time.

This article is sourced from the internet: Are staking rewards a hidden cost of blockchain?

Related: Crypto Markt Sentiment Research Report (August 2–9, 2024): Has recession arrived? U.S. non-farm payrolls in July fell f

Recession has arrived? US non-farm payrolls in July fell far short of expectations Image source: https://hk.investing.com/economic-calendar/nonfarm-payrolls-227 The US non-farm payrolls report for July surprised the market, with the number of new jobs hitting a three-and-a-half-year low and the unemployment rate rising to a three-year high, triggering the Sams Rule, a recession indicator with 100% accuracy. Panic spread rapidly, and traders began to bet on the possibility of a 50 basis point rate cut in September, and predicted that the rate cut this year would exceed 110 basis points. This week, both US stocks and Bitcoin rebounded after a significant decline. The Sahm Rule is an indicator proposed by economist Claudia Sahm to predict economic recessions. The rule is based on changes in the unemployment rate and has a trigger condition:…