Rückblick auf Investitionen und Finanzierungen im 3. Quartal: Der Primärmarkt ist rückläufig, und im 4. Quartal könnte es zu einer Wende kommen

Original | Odaily Planet Daily ( @OdailyChina )

Autor | Fu Howe ( @vincent 31515173 )

In the third quarter of 2024, primary market investment and financing showed a downward trend.

At the macro level, the Federal Reserve started a new round of interest rate cuts after a lapse of four years, with the first cut of 50 basis points in September; with the US election approaching, the crypto market faces the last critical node of the year.

From the perspective of the crypto market, meme coins have become a new growth point, but they still face problems such as weak radiation, short duration and unpredictability, making it difficult to become a new internal driving force. No new economic model has yet emerged.

Due to a combination of factors, the performance of the primary market declined compared with the previous quarter, with both the number and amount of investment and financing in Q3 lower than the previous quarter.

Looking back at Q3 primary market investment and financing activities, Odaily Planet Daily found that:

● Financing declined in Q3, and Q4 will usher in a key turning point ;

● There were 272 financings in Q3, with a total disclosed financing amount of US$1.813 billion;

● The underlying infrastructure is gradually moving towards a toB business model;

● The largest single investment amount was $100 million for Celestia;

● Robot Ventures ranked first with 22 investments in Q3.

Note: Odaily Planet Daily divides all projects that disclosed financing in Q1 (the actual close time is often earlier than the news release) into five major tracks based on the business type, service object, business model and other dimensions of each project: infrastructure, application, technology service provider, financial service provider and other service providers. Each track is divided into different sub-sectors including GameFi, DeFi, NFT, payment, wallet, DAO, Layer 1, cross-chain and others.

Financing declined in Q3, and Q4 will usher in a key turning point

In the last quarters report , the view was that the first small peak of the bull market had passed. The primary market financing data in Q3 verified the accuracy of this view. At the same time, based on the trend at the macro level, it is expected that the crypto market will usher in a key turning point in Q4.

Judging from the above figure, Q3 financing is not as good as the previous quarter in terms of quantity and amount, showing a downward trend, and is approaching the starting point of the first small peak of this bull market at the end of 2023.

At the same time, the crypto market also showed a certain degree of correction, but the subsequent interest rate cuts by the Federal Reserve and the results of the US election have made the crypto market face a new round of expected growth space.

From this, we can judge that Q3 is in a stage of overall correction, and Q4s investment and financing data will reflect the later trend of the crypto market.

The number of financings in Q3 was 272, with a total disclosed financing amount of US$1.813 billion

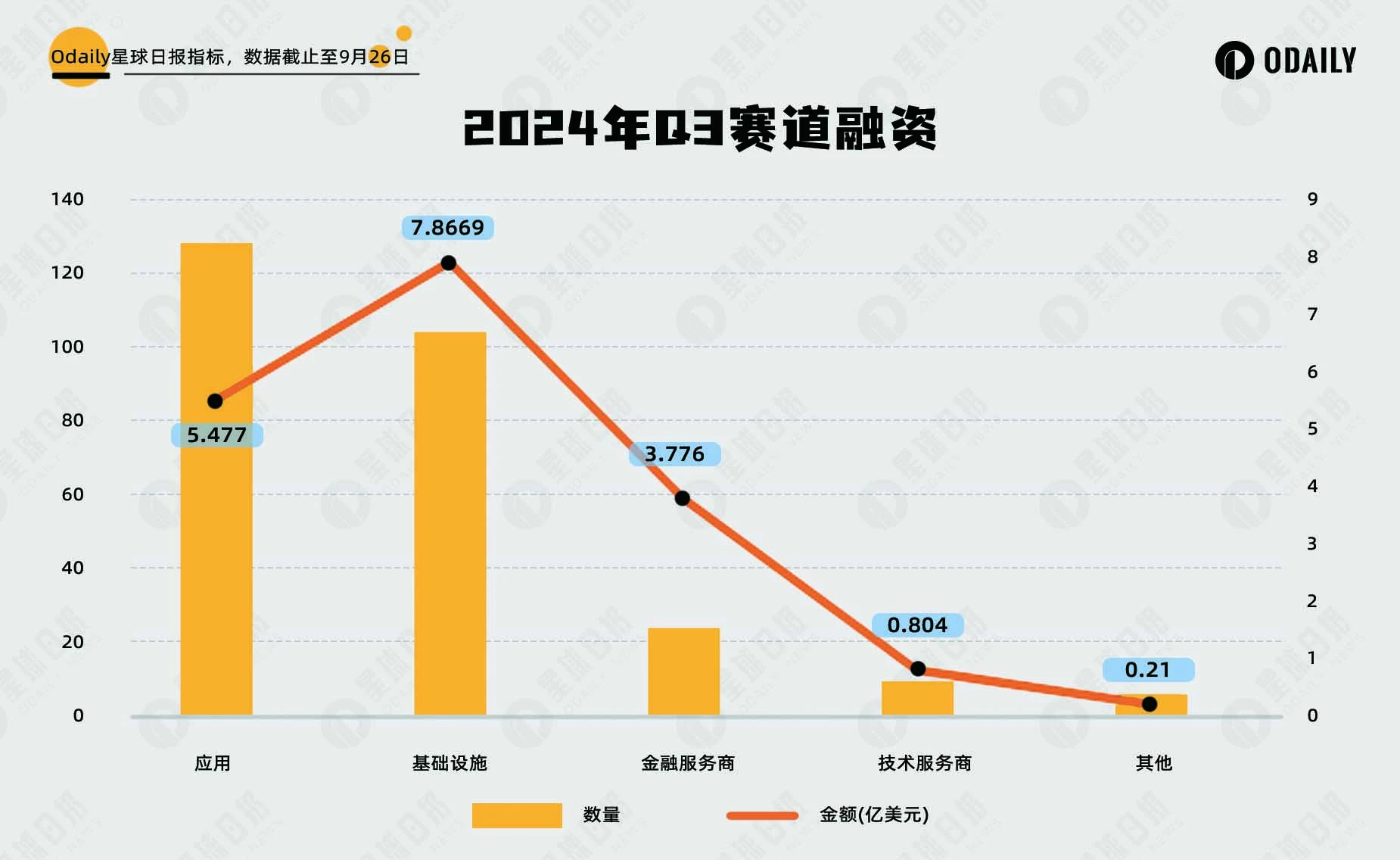

According to incomplete statistics from Odaily Planet Daily, from July to September 2024, there were 272 investment and financing events in the global crypto market (excluding fund raising and mergers and acquisitions), with a total disclosed amount of US$1.813 billion, distributed in infrastructure, technology service providers, financial service providers, applications and other service providers. Among them, the application track received the most financing, a total of 128 transactions; the infrastructure track received the most financing, with a financing amount of US$787 million. Both still lead other tracks in terms of financing amount and quantity.

From the above figure, we can see that the number and amount of financing in each track are basically the same as the proportion of the previous quarter. The number and amount of financing of financial service providers have increased compared with the previous quarter. This may be due to the accelerated integration of traditional finance and the encryption industry. Digital currency banks in many regions and countries have attracted the attention of capital.

The underlying infrastructure is gradually moving towards a toB business model

According to incomplete statistics from Odaily Planet Daily, financing events in the Q3 segmented tracks were concentrated in DeFi, underlying infrastructure and GameFi, accounting for nearly half of the total financing events, including 62 transactions in the DeFi track, 54 transactions in the underlying infrastructure track, and 31 transactions in the GameFi track.

From the distribution of sub-track financing:

DeFi, games, and some AI and other application sectors ranked in the top five in terms of financing. Among them, the DeFi sector ranked first, and related financing mostly occurred in new public chain ecosystems or new models. The token launch platform has become a popular investment project in the DeFi sector, reflecting the important position of meme coins in the current market; the game sector still attracted the attention of many capitals, and the previous Tap to earn model games are about to usher in a wave of coin issuance.

The AI+ sector is still an important target for capital, and AI projects of various types, such as AI tools, AI large language models, and AI+blockchain, have received high financing amounts and attention. However, most projects are still in the early stages of development, and it is still unknown when they will be launched and whether they can seize the Web2 market.

The underlying infrastructure sector is still hot, and new middleware and modular public chain projects are constantly emerging, basically optimizing the underlying part based on the existing public chain. In addition, more underlying projects adopt the toB business model and do not have the tendency to issue coins.

The NFT-related sectors are still at a low point, with no new growth in the past two quarters. Previous blue-chip projects and NFTfi-related platforms have no highlights worth noting.

The largest single investment amount was $100 million for Celestia

From the table of the top 10 Q4 financing amounts, it is not difficult to see that the CeFi sector accounts for 1/3 of the large financing projects, including the cross-border payment and settlement blockchain company Partior, the global stablecoin payment network Bridge, and the Singapore digital asset exchange SDAX. To a certain extent, it shows that the application of digital currencies in the crypto market in traditional finance is constantly strengthening. Although the growth of the intrinsic value of the current crypto market is limited, the external expansion channels of the crypto market have been greatly improved.

As of September 26 this quarter, the largest amount of financing occurred in Celestia, but the community has some doubts about this financing, believing that this was a deliberate release of financing news before the large-scale unlocking of TIA, with the intention of raising the price of the currency to facilitate shipments by institutions and project parties.

In addition, the open source artificial intelligence development platform Sentient is also worthy of everyones attention. Sentient is built on Polygon and radiates the EVM ecosystem led by Ethereum. By creating a decentralized artificial general intelligence (AGI) platform, it encourages contributors to jointly build, replicate and expand AI models and rewards contributors.

Robot Ventures ranked first with 22 investments in Q3

Institutions were more cautious in their investments in Q3 compared to the previous quarter: Robot Ventures ranked first mit 22 investments, OKX Ventures and Binance Labs tied for second with 16 investments, Animoca Brands ranked third with 14 investments, and Spartan Group, a16z and Polychain all invested more than 10 times.

Among the projects invested by the above-mentioned institutions, except for Animoca Brands which focuses on the gaming sector, the investment proportions of the remaining institutions are dominated by infrastructure, followed by DeFi, which is generally in line with the general distribution of various tracks in the previous sub-sectors.

This article is sourced from the internet: Review of Q3 investment and financing: the primary market is down, and Q4 may see a turning point

Related: Arthur Hayes new article: The Feds Treasury, Yellens Decision, and the Crypto Bull Markt Schedule

Original author | Arthur Hayes (BitMEX co-founder) Compiled by Odaily Planet Daily ( @OdailyChine ) Translator| Azuma ( @azuma_eth ) Editors note: This article is a new article Water, Water, Every Where published by BitMEX co-founder Arthur Hayes this morning. In the article, Arthur outlines the tendency of US Treasury Secretary Yellen to use Treasury bonds to withdraw the Federal Reserves reverse repurchase funds and bank reserves, and explains how the flow of these funds will improve the market liquidity situation. Arthur also mentioned the impact of this trend on the cryptocurrency market and predicted the markets next trend and the price performance of mainstream tokens such as BTC, ETH, and SOL. The following is Arthurs original text, translated by Odaily. Because Arthurs writing style is too free and easy,…