Analyse der interaktiven Aktivitätsstrategie von GraFuns: Unterstützt von DWF und Floki, mit über 2 Millionen registrierten Adressen

Original | Odaily Planet Daily ( @OdailyChina )

Autor|Nan Zhi ( @Assassin_Malvo )

On September 2, the Pump platform GraFun launched a registration and deposit campaign. One day later, the official announced that 500,000 users had registered. Later on September 20, GraFun announced that it had received support from DWF Labs and Floki , and the community began to promote the project on a large scale. The current registered addresses have exceeded 2.39 million.

After completing the activity, users will receive GRA (the official has not yet specified whether it is a token or a point), and the main way to obtain GRA is to hold BNB in the wallet. This activity will end in two days. What is the current distribution of points? Is it still in time for the last train? Odaily will analyze the on-chain data in this article to try to answer this question.

A quick overview of the protocol mechanism

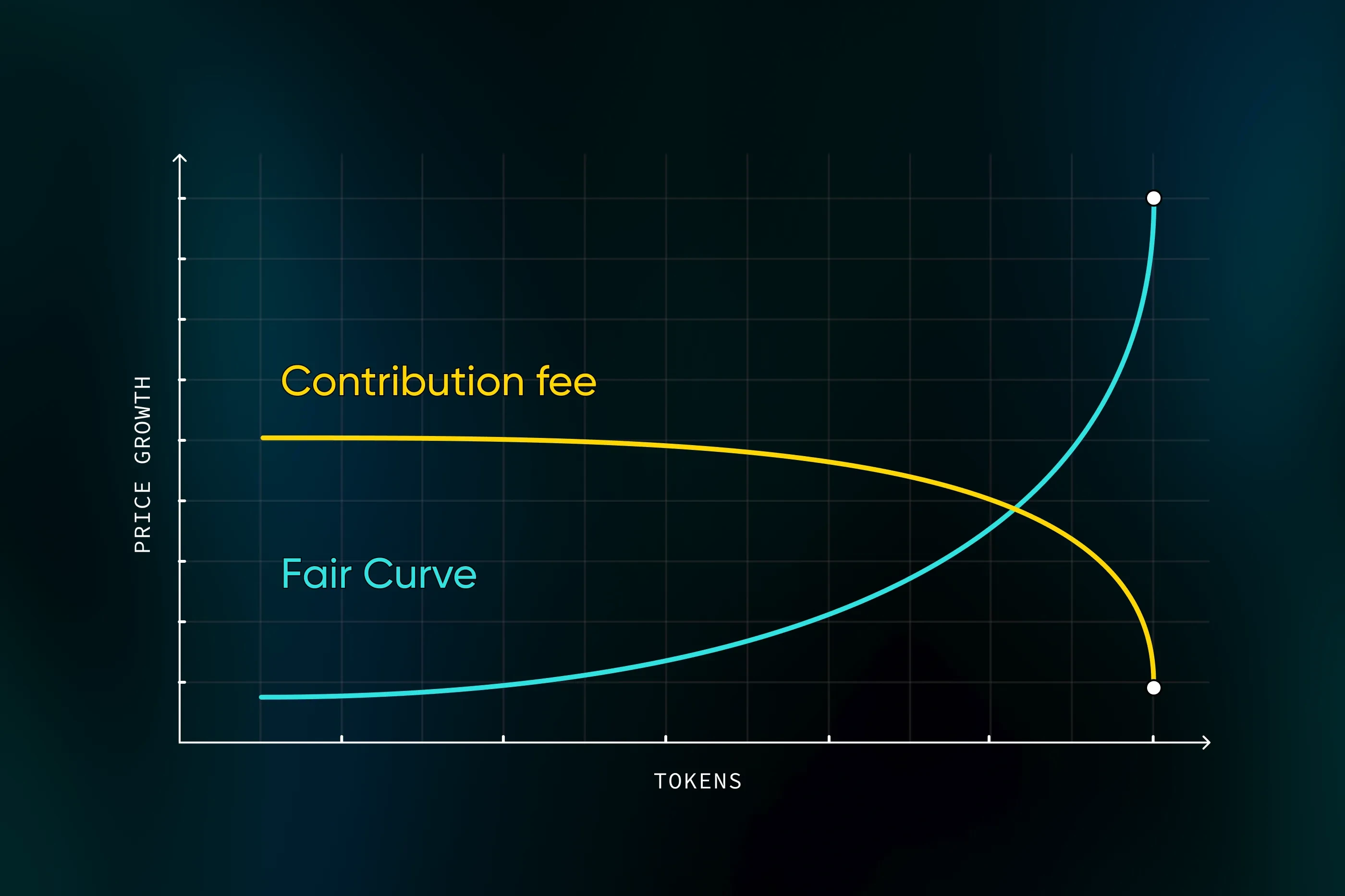

GraFun is essentially a PumpFun-type project with modifications to the Bonding Curve mechanism. GraFun disclosed that its internal Bonding Curve was designed by DeXe Protocol and named Fair Curve .

DeXe said that the traditional Bonding Curve has problems with price manipulation and frequent Rugs due to the large difference in purchase prices. In GraFuns Fair Curve model, a portion of the tokens purchased by traders will be allocated to the DAO treasury managed by token holders , aiming to reduce the circulation and reduce the risk of early buyers dumping the market.

Under this model, early buyers pay a lower price but contribute a larger share to the DAO (which in turn raises the price for early buyers). As more and more participants join, the token price rises and the portion sent to the DAO gradually decreases.

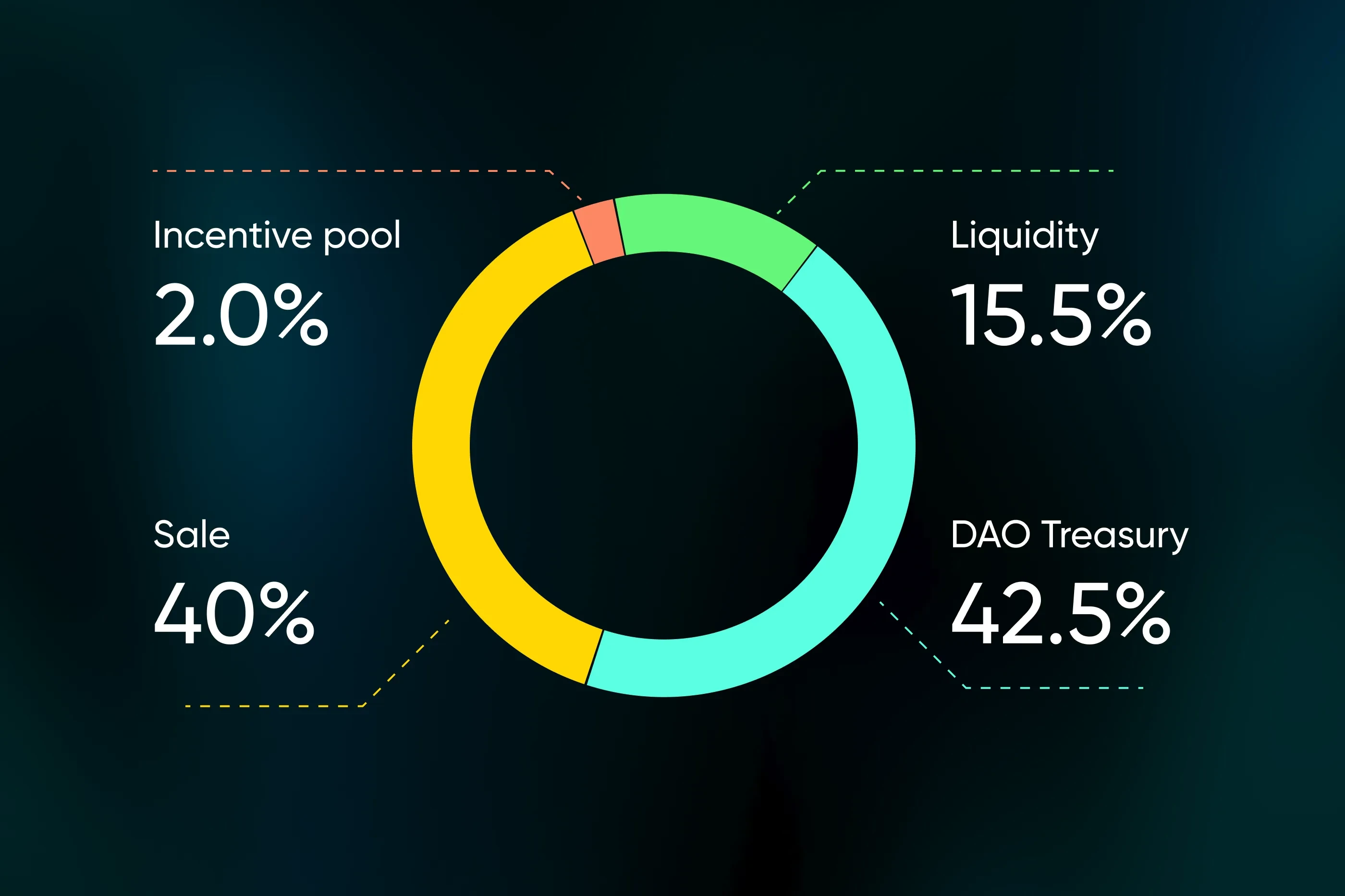

After the internal trading of tokens is completed and liquidity is added to DEX (such as PancakeSwap), 42.5% of the token supply will be retained in the DAO and controlled by the community, which can be used for long-term operations such as incentives, liquidity, and listing. However, DeXe has not yet disclosed the channels and processes through which the community can operate this part of the tokens.

Punkte-Aktivitäten

Basic Requirements

During the registration phase of GraFun , you need to complete the steps of wallet linking and Telegram account verification. Since Telegram is a mandatory step, whether it can be done depends on how many Telegram accounts the user has .

After completing the registration, basic tasks include inviting new users, subscribing to YouTube, changing Telegram account names, etc. It is suitable for users who have a large number of Telegram accounts but limited funds.

The most important source of points is to hold BNB in your wallet:

BNB holding rules

After registration, you can get GRA by holding more than 0.05 BNB in your wallet (no deposit required), and points are settled every hour. After registration, the longer BNB is stored in your wallet, the higher the additional GRA incentive will be. The official correspondence between BNB and GRA is as follows :

-

0.05 BNB = 6.2 GRA/hour;

-

0.1 BNB = 8.3 GRA/hour;

-

0.5 BNB = 15.9 GRA/hour;

-

1 BNB = 20.7 GRA/hour;

-

10 BNB = 42 GRA/hour;

Obviously, as BNB holdings increase, the efficiency of obtaining GRA slows down rapidly, so the efficiency of multiple accounts is significantly higher , but it depends on whether users can register/purchase Telegram accounts in batches .

In addition, the functional relationship between the two is fitted by Odaily as f(x) = 19.58 ⋅ x^( 1/3). For example, if you hold 100 BNB, you will get 89.5 GRA per hour. Readers who plan to make further calculations can refer to this.

Detailed explanation of points

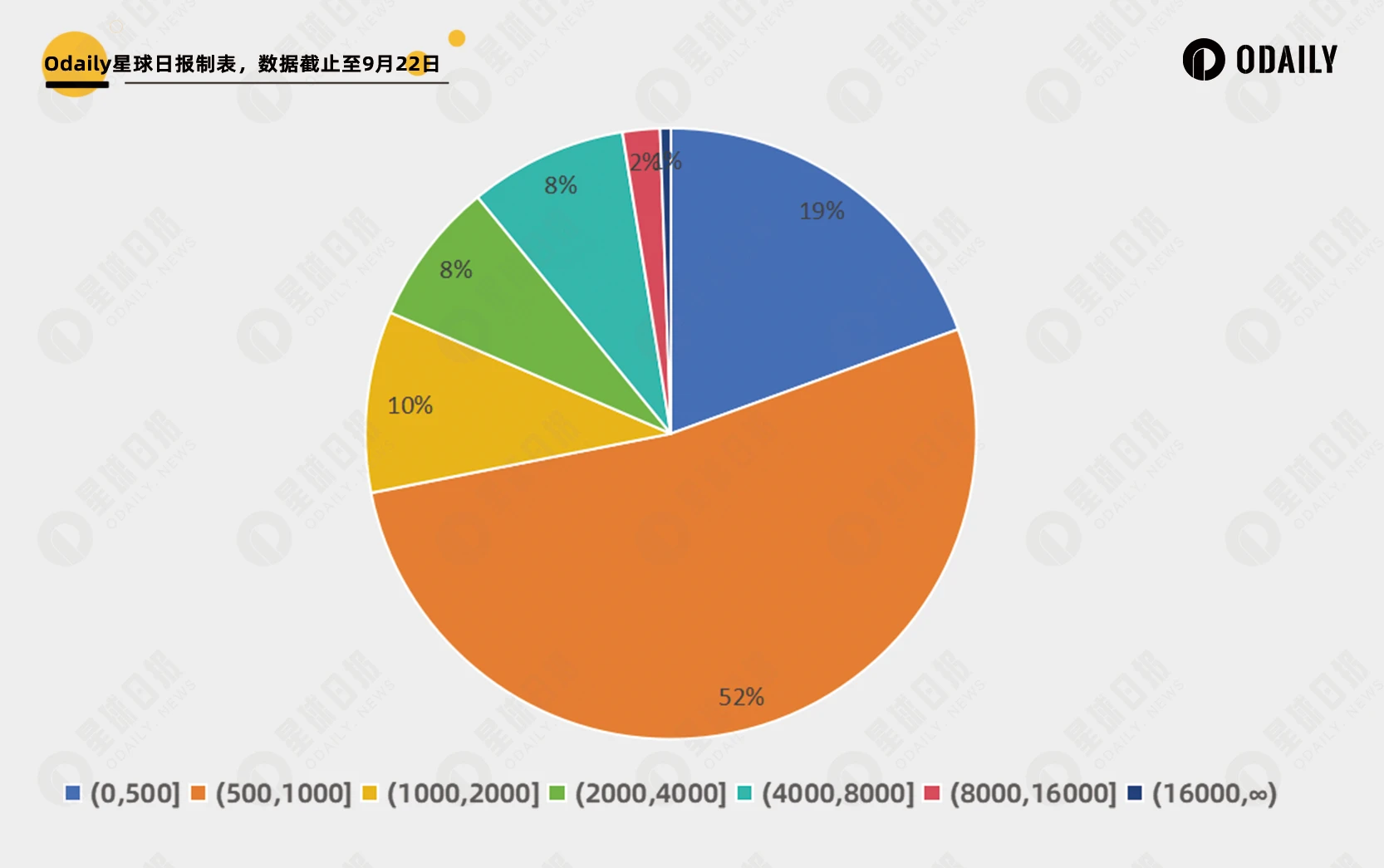

Odaily extracted 100,000 unique wallet addresses that had conducted transactions on September 21, and used the official website API to query whether these 100,000 wallets had GraFun points. It was found that a total of 1,612 wallets had this point, and the points were divided into two categories: basic task points and BNB holding points, of which:

-

There are 890 addresses with a basic score of 900 points (accounting for 55.2%), followed by 203 addresses with a basic score of 300 points (accounting for 12.6%), and the top three addresses are 127,200 points, 32,000 points, and 24,000 points. The average score is 1,018 points.

-

Of the 1,612 wallets, 548 had no BNB holdings and only performed basic registration and social media tasks. 1,064 addresses deposited BNB, with an average of 1,539 points as of 21:00 on September 22, as shown in the following figure. Assuming that this score is reached within 48 hours, a single number needs to deposit 4.39 BNB ((1539/48/19.58)^3). If it can be divided into 5 numbers, only 0.05 × 5 = 0.25 BNB is needed.

-

Furthermore, 100,000 unique wallet addresses have gone through approximately 17,500 blocks (7 hours), and the average score of 1,612 addresses is 2,034 points. This activity has lasted for 20 days, so the total score is estimated to be 20 × 24/7 × 1,612 × 2,034 = 224 million. Readers can predict their share based on this total score .

This article is sourced from the internet: Analysis of GraFuns interactive activity strategy: Supported by DWF and Floki, with over 2 million registered addresses

Related: PSE Trading: Macro and data analysis reveals a positive outlook

Original author: @zhili , @MacroFang , @chenchenzhang Key Points Part I Macro Markt Market status : The collapse of the yen carry trade led to the liquidation of a large number of positions, the market corrected its mistakes, and the Topix index led the deep V reversal. Data adjustment : Although recent CPI, PPI and other data are in line with expectations, there are doubts such as the forced adjustment of energy and used car prices, which will reduce the markets implied volatility. Fed Movement : Speeches by Fed officials indicate cautious policy adjustments, and the September dot plot is expected to continue to maintain an accommodative stance. Federal deficit : The Feds dovish stance, the Treasurys short-term bond issuance, and the bond repurchase program have eased market tensions. Although…