Vollständiger Bericht über die Investitionstätigkeiten der Redaktion von Odaily (20. September)

In dieser neuen Kolumne werden echte Anlageerfahrungen von Mitgliedern der Odaily-Redaktion geteilt. Sie akzeptiert keine kommerziellen Anzeigen und stellt keine Anlageberatung dar (denn unsere Kollegen sind sehr gut darin, Geld zu verlieren) . Ziel ist es, die Perspektive der Leser zu erweitern und ihre Informationsquellen zu bereichern. Sie sind herzlich eingeladen, der Odaily-Community beizutreten (WeChat @Odaily 2018, Telegramm-Austauschgruppe , X Offizielles Konto ) zu kommunizieren und sich zu beschweren.

Empfehlung: Nan Zhi (X: @Assassin_Malvo )

Einführung : On-Chain-Player, Datenanalyst, spielt alles außer NFT

Aktie :

-

In terms of Meme, Ethereum is taking off again, not just slightly good, not medium good, but very good. Hold MISHA, BURGER, and DOGE (the one with the Chief Efficiency Officer). The Sol camp is paying attention to Hippo and Billy.

-

I think the current rise is just emotional, and the core trend is liquidity improvement. It will take some time to achieve this condition, so I predict that there will be a retracement before October to find the starting point of the October rise. In addition, Bitcoin has shown a trend of continuous decline in highs, and has not reversed and broken through this suppression. Therefore, the secondary level unloaded all the leverage below 55580 mentioned last week, and observed the performance of Bitcoin around 65,000.

-

SUI selling price is 1.49 USDT (coin-based contract -100%, spot -30%);

-

ETH is 2430 USDT (coin-based contract -100%, spot price has not moved, it鈥檚 too early to run);

-

SOL 142-150 cleared all the levers on the chain.

Empfohlen von: Asher (X: @Asher_ 0210 )

Einführung : Kurzfristige Verträge, langfristiger Hinterhalt auf Ferienhäuser mit geringem Marktwert, Goldfarming in Blockchain-Spielen und geldgierige Partys

Aktie :

-

BTC and ETH: There is no unity of knowledge and action. Previously, I was strongly bullish in the short term, but last Sunday I thought of a small correction. I opened a short position and closed my long position at the same time, but I ended up losing money. At present, I don鈥檛 want to chase BTC and ETH, but pay more attention to the altcoins that may catch up.

-

Copycat: The most comfortable operation I had recently was shorting FB. Various entrepreneurial plates appeared on the Bitcoin fractal last weekend, and the wealth-creating effect was gone. I decisively shorted it at 35 on Sunday night, and it fell to 28 the next day.

-

Blockchain game section: There are quite a few blockchain game projects that can be invested in recently. The key ones ( tutorials have been written for each): the MATR1X non-delete gold-making test that will start on the 22nd, Binance TG game Moonbix, Vana TG game, Alice鈥檚 second token airdrop, and Castile Beta version test.

Empfohlen von: Golem (X: @web3_golem )

Einführung : Bitcoin-Ökosystem-Fänger, haarsträubender Trainee, Spieler, der nie eine warme Mahlzeit bekommt

Aktie :

-

This week, I mainly bought BRC 20 and CAT 20 on Fractal. BRC 20 bought GLIZZY and PEOPLE, and CAT 20 bought FBULL and KITTY. At present, GLIZZY has doubled several times, and PEOPLE has almost finished buying, and the price has also tripled. In general, BRC 20 on Fractal is still the main traffic depression, although they are still small-cap stocks; CAT 20 is difficult to say the profit at present because there is no smooth and transparent trading market.

-

The early bird pre-sale of Solana鈥檚 second-generation mobile phone Seeker ends tomorrow. It seems like a good deal, so let鈥檚 research how to purchase it on behalf of others.

Empfohlen von: Wenser (X: @wenser 2010 )

Einführung : A follower of the Meme track, a hindsight player, watching friends get rich

Aktie :

-

The Sui ecosystem has generally risen, from 0.7-0.8 to nearly 1.5. I really cant make a move. I can only comfort myself that I have no vision. The Move language still has potential, so Aptos will pay close attention to it.

-

I personally feel that Upbit鈥檚 recent listing effect is even greater than Binance鈥檚, including UXLINK, CKB, and even Meme coins such as MEW. It can be seen that Hansuo is also very hungry for new traffic. In the future, we will focus on Memes that already have a basic base, including Neiro, Billy, Gmichi, Popcat, etc.

-

The official meme coin currently selected by Tron鈥檚 SunPump is SUNDOG ( here is the specific reason ). Although it is not recommended to chase high prices at present, it can be used as a platform weather vane.

-

I still think that Web3 game projects should distinguish between game products and game tokens. I suggest paying attention to MAX, FIRE, BIGTIME, as well as GMT and GGT mentioned before.

-

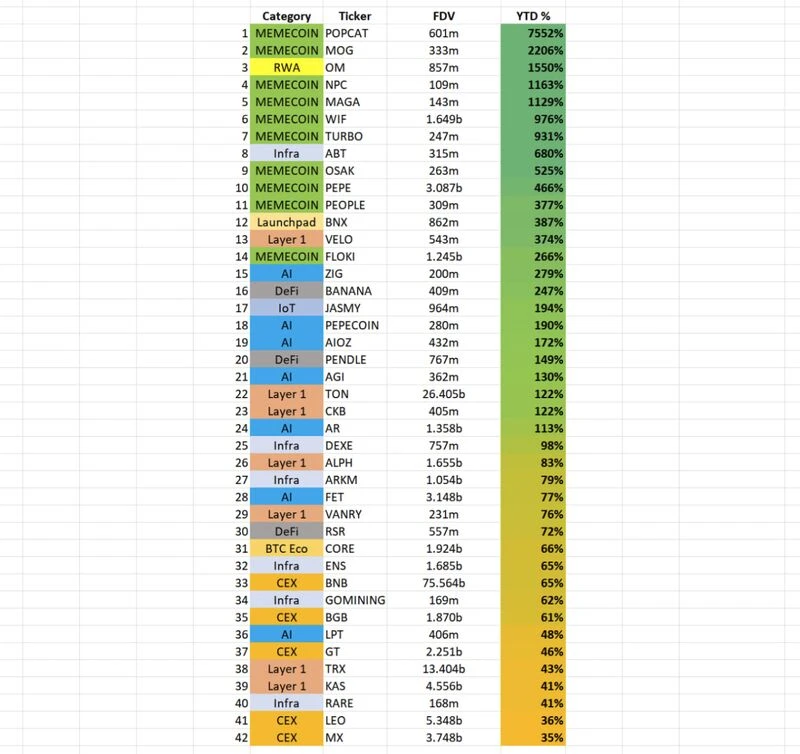

I saw a piece of data a few days ago, saying that only 42 tokens have increased more than Bitcoin this year, and most of the top 15 are Meme coins. According to the logic that the strong will always be strong, the rebound or rise still depends on these.

-

CATI is about to go online, so keep an eye on whether there are opportunities in the secondary market.

Vorherige Aufzeichnungen

Empfohlene Lektüre

Neiro and NEIRO are listed on Binance. Is the Meme coin track reaching a turning point?

This article is sourced from the internet: Full record of Odaily editorial department investment operations (September 20)

Laut unvollständigen Statistiken von Odaily Planet Daily wurden vom 9. bis 15. September im In- und Ausland 23 Blockchain-Finanzierungsveranstaltungen angekündigt, ein Anstieg gegenüber den Daten der letzten Woche (19). Die Gesamtsumme der angekündigten Finanzierungen betrug ungefähr $212 Millionen US-Dollar, ein deutlicher Anstieg gegenüber den Daten der letzten Woche ($40,74 Millionen US-Dollar). Letzte Woche war das Projekt, das die meisten Investitionen erhielt, die dezentrale Musik-Streaming-Plattform Tune.fm ($50 Millionen US-Dollar); dicht gefolgt von der singapurischen digitalen Vermögensbörse SDAX ($50 Millionen US-Dollar). Im Folgenden sind spezifische Finanzierungsveranstaltungen aufgeführt (Hinweis: 1. Sortieren nach angekündigtem Geldbetrag; 2. Ausgeschlossen sind Spendensammlungen und MA-Veranstaltungen; 3. * zeigt ein traditionelles Unternehmen an, dessen Geschäft Blockchain umfasst): Die dezentrale Musik-Streaming-Plattform Tune.fm sammelt $50 Millionen, an denen Animoca Brands und andere teilnehmen. Am 12. September…