SignalPlus-Makroanalyse (19.09.2024): Zusammenfassung der wichtigsten Punkte der FOMC-Sitzung – Zuversichtlich gemäßigt

Chairman Powell met the expectations of risk markets with a 50 basis point rate cut, but for choosing a more substantial rate cut this time, he also confidently emphasized that a soft landing of the economy remains the basic scenario, and repeatedly reiterated that the U.S. economic performance is quite good.

Key Summary:

-

With inflation falling, a soft landing remains the base case. The U.S. economy is in good shape, and our decision today is to keep it that way. The U.S. economy is basically fine. I believe inflation will fall to 2%.

-

Stay ahead. Powell pledged to “stay ahead” in rate adjustments in response to the slowdown in the job market, with a particular eye on hiring rates (the 50 basis point rate cut is our commitment not to fall behind). The Fed raised its unemployment rate forecasts to 4.4% in 2024 (from 4.0%), 4.2% in 2025 (from 4.0%), and 4.3% in 2026 (from 4.1%).

-

The 50 basis point change is intended to convey a powerful move. Powell acknowledged that a 50 basis point adjustment is a strong move, but he also said that it will not necessarily proceed at the same pace in the future (We should not assume that this is the new normal), leaving room for maneuver in future Fed meetings. Basically, dont expect 50 basis point adjustments all the time, nor do you expect a 75 basis point rate cut, but the Fed may also make multiple 50 basis point adjustments if economic data proves it necessary (We will always do what we think is good for the economy at the moment, and todays decision is no exception.).

-

The key lies in hard data. The Fed will focus on hard economic data rather than soft sentiment data, and will pay special attention to the markets reaction to lower interest rates.

-

We are united in our stance. Powell noted that all 19 members agreed that there should be multiple rate cuts this year, with 17 members believing there would be three full rate cuts and two members believing there would be four, which was a significant difference from June. The only dissenter was Bowman, who supported only a 25 basis point rate cut this time.

Markt reaction:

-

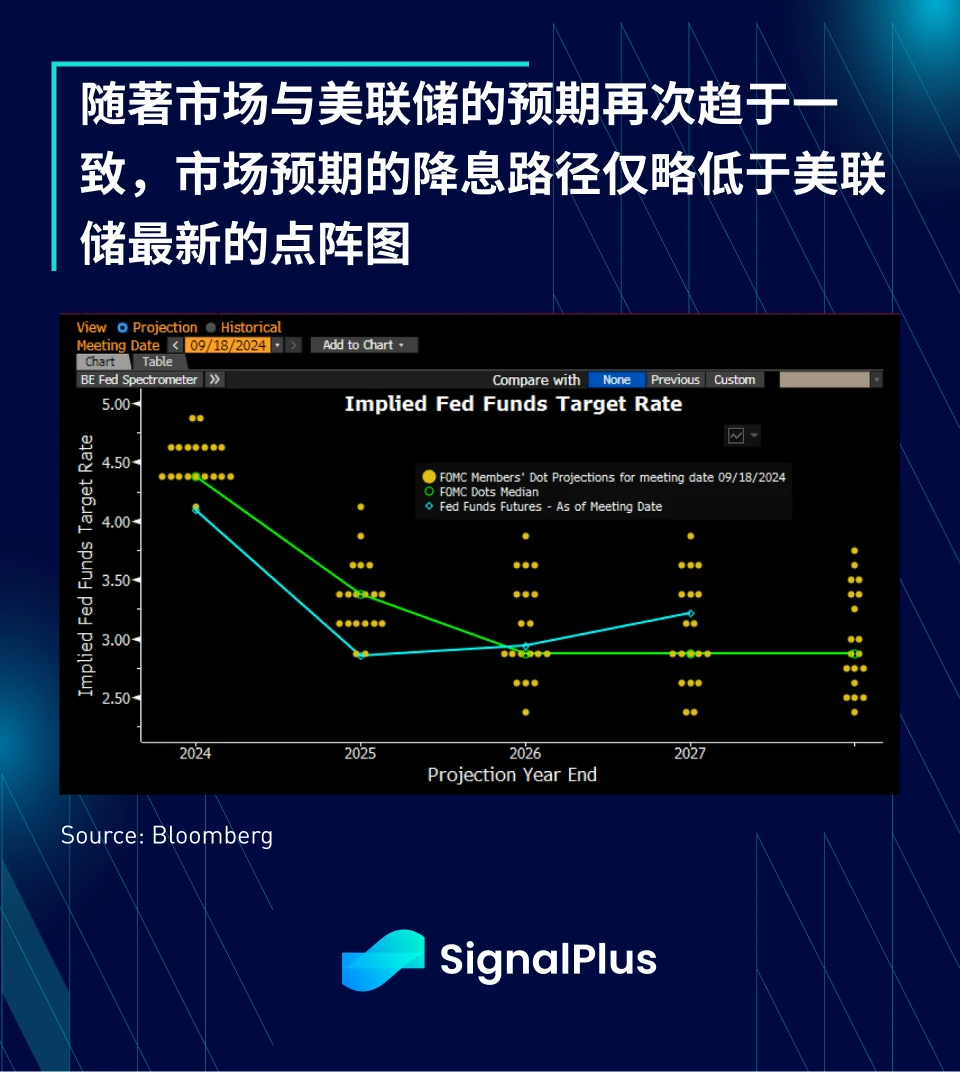

Interest Rates: The market still expects another 2.5 rate cuts in 2024, slightly ahead of the Feds dot plot median. Bond yields barely moved after the FOMC meeting as the results were largely in line with expectations.

-

Forex: The Feds decision led to a weaker dollar, especially considering that the Bank of Japan is likely to maintain a hawkish stance at its upcoming meeting, with the dollar weakening against the yen.

-

Stocks: Stocks rose as the Federal Reserve implemented forceful easing policy and said economic conditions remained good and inflation was expected to fall.

-

Cryptocurrency: Benefiting from the strong rise in the stock market, BTC rebounded to $60k, and altcoins also performed strongly, showing an improvement in overall risk sentiment.

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240919): FOMC meeting key points summary – Confidently Dovish

Original author: shaofaye 123, Foresight News The UniSat team has taken action again. Fractal Bitcoin has triggered a market boom, and the number of wallet addresses on the test network has exceeded 10 million. Pizza and Sats have risen one after another. Is it the next explosion point of the Bitcoin ecosystem or BSV 2.0? FUD and FOMO coexist, and the mainnet is about to be released. This article will take you to an overview of the early ecology of Fractal Bitcoin. About Fractal Bitcoin Fractal Bitcoin is another Bitcoin expansion solution developed by the UniSat team. By using the BTC core code, it innovates an infinite expansion layer on the main chain to improve transaction processing capabilities and speed, while being fully compatible with the existing Bitcoin ecosystem. Its…