Südkoreas führendes Investmentforschungsinstitut hat einen fast 50-seitigen ausführlichen Taiko-Bericht veröffentlicht: Redefining Ethereum L2

Original author: FourPillar

Originalübersetzung: TechFlow

Ethereum was launched in 2015 with the goal of realizing the full potential of blockchain technology through smart contracts and decentralized applications (dapps). However, as the number of users and transaction volume of the Ethereum network grew rapidly, it encountered serious scalability issues.

Initially, the number of transactions on Ethereum was relatively small, so the processing capacity of the blockchain was not an issue. Users could process transactions quickly and cheaply, and the network operated stably. However, as Ethereums popularity quickly increased, various dapps such as DeFi, games, and NFT markets emerged, and the number of transactions surged. As a result, the time to include a transaction in a block increased, and transaction fees rose significantly. This was particularly burdensome for users who made small transactions or required fast transaction processing.

To solve the scalability problem, the Ethereum Foundation and the community have studied a variety of solutions. Among them, sharding is a prominent solution. Sharding is a scalability technology that divides the blockchain network into multiple smaller shards, greatly improving transaction throughput. Just like multiple computers can process tasks at the same time, sharding allows the Ethereum network to process more transactions quickly and efficiently. Ethereum plans to introduce this technology to greatly enhance the networks processing power.

Despite the high anticipation for this technology, Ethereum shifted from directly implementing sharding to a Layer 2 approach due to concerns about centralization and technical challenges that caused development delays.

As Ethereum fully adopts L2 solutions, multiple Ethereum L2 projects have emerged. Taiko, which will be introduced in this article, is one of them. Its development direction is unique and different from many other Ethereum L2s. Because Taiko aims to comprehensively solve the problems faced by the existing Ethereum L2, before we delve into Taiko, lets first discuss the development history of Ethereum L2 and the problems it has encountered.

1. The heyday of Ethereum L2 blockchain

1.1 The rise of Ethereum L2 blockchain: different approaches and concepts

Ethereum Layer 2 refers to blockchain infrastructure that aims to increase transaction processing speed and reduce fees while maintaining the security of the Ethereum mainnet (Layer 1). The most well-known L2 types are Plasma, Optimistic Rollup, and zk Rollup. Ethereum L2 projects began to develop their own Ethereum L2 blockchains based on their own methods, philosophies, and beliefs, pursuing the common goal of solving Ethereums scalability problems. As a result, users enjoy lower fees and faster transaction speeds. However, is this a question of direction or speed? As the number of Ethereum L2 blockchains rapidly increased, Ethereum and its scalability issues began to take a back seat.

Fundamentally, Ethereum L2 was created to solve Ethereums scalability problem, but many of these projects began to focus more on promoting their own mainnets and neglected to solve the core problem. Many Ethereum L2s chose to deliberately reduce the way they connect to Ethereum, only providing minimal value association through bridging, or even completely without support in some cases. This has led to the emergence of independent blockchains that are actually unrelated to Ethereum.

Zum Beispiel, Blast launched its mainnet on February 29, 2024 , initially emphasizing its positioning and concept as Ethereum L2. However, at some point, it began to call itself a full stack chain and gradually distanced itself from Ethereum. It is no coincidence that Blasts official account on X (formerly Twitter) changed from @Blast_L2 to @blast.

Quelle: Jim X

This shows that, despite many Ethereum L2s claiming to value connecting to Ethereum and working to expand its scalability, no real Ethereum L2 seems to be able to deliver on its promise to work with Ethereum. So what exactly is the problem?

1.1.1 Decreased connectivity with Ethereum

Many L2 solutions have increasingly emphasized their unique features and functions, resulting in a gradual weakening of connectivity with Ethereum. This intention to build an independent ecosystem stems from the pursuit of autonomy. However, this independence may hinder interoperability with the Ethereum mainnet, making it difficult for L2 and Ethereum to interact seamlessly. As a result, L2 blockchains, which were originally created to solve Ethereums scalability problems, ultimately weaken the overall integrity of the network. This deviates from the original intention of Ethereums scalability solution and may cause chaos in the entire Ethereum ecosystem.

1.1.2 Centralization for Efficiency

Some L2 projects have resorted to centralization in their quest for efficiency. While this approach may improve performance and reduce fees in the short term, it undermines the fundamental principle of decentralization of blockchain technology. This could undermine trust and security in the technology in the long term. Furthermore, centralized structures create single points of failure and increase security vulnerabilities, posing significant risks to users and developers.

1.1.3 Ignoring Developers’ Needs

As L2 projects build their ecosystems, they often cause confusion and burdens for developers. Since each L2 project adopts a different technical approach, developers are forced to learn and adapt to multiple platforms, which sets a high threshold for developing new dApps or porting existing dApps to L2 blockchains. In addition, due to the lack of standardized protocols between L2 blockchains, developers face the challenge of modifying their code to adapt to different infrastructures. This situation not only reduces developer efficiency, but also hinders innovation and growth within the Ethereum ecosystem.

L2 projects may argue that they have no choice but to make these decisions to expand their ecosystem and obtain funding. However, this trend ultimately weakens the security of the Ethereum mainnet and has a negative impact on the entire Ethereum ecosystem.

1.2 Return to the essence

Quelle: Vitalik Buterin warpcast

In July 2024, Ethereum founder Vitalik Buterin published an article criticizing the current blockchain industrys overinvestment in infrastructure. Vitalik pointed out that this overinvestment stems from investors indirectly investing money in technology rather than directly investing in tokens to comfort their moral conscience. His observation seems to coincide with the disorderly emergence of L2 projects. As a large amount of money flows into infrastructure, some projects that focus only on profits rather than Ethereums scalability narrative have emerged, causing Ethereum and its scalability issues to gradually fade out of the L2 narrative.

Of course, investment in the L2 ecosystem is not a bad thing in itself. Capital is essential to the operation of the project. However, this capital should not be the top priority. What is most important is to focus on the problems that the L2 solution is trying to solve and how it intends to achieve those goals.

L2 projects must remember their original goal of solving Ethereum’s scalability problem. It is important to maintain interoperability with Ethereum, adhere to the principles of decentralization, and provide an environment where developers can easily participate. If L2 solutions fail to achieve this balance, not only will the development of the Ethereum ecosystem be threatened, but the long-term trust and security of blockchain technology will also be threatened. When L2 projects return to their core principles and solve Ethereum’s scalability problem by working closely with Ethereum, real progress in blockchain technology will be achieved.

2. Taiko: The real Ethereum L2

So what factors are needed to become an Ethereum L2 that truly solves Ethereums scalability problem? There are three key points here: 1) Is it fully integrated with Ethereum? 2) Is it fully decentralized? 3) Does it fully consider the needs of developers in the Ethereum environment? Lets examine Taikos efforts to become a true Ethereum L2 based on these factors.

2.1 Ethereum’s equivalent of L2

The solution to Ethereums scalability problem must naturally integrate closely with Ethereum. Here, integration refers not only to system-level integration, but also to value integration and even concept integration. Of course, integration does not mean being exactly the same or repetitive in many aspects. However, this is an important quality required to become a true Ethereum L2, because many blockchains do not follow these basic principles when running as Ethereum L2.

2.1.1 Type-1 EVM blockchain

On August 4, 2022, Vitalik Buterin published The different types of ZK-EVMs , analyzing and classifying zkEVMs. According to his analysis, zkEVMs are divided into Type 1, 2, 2.5, 3, and 4. Higher numbers mean lower interoperability and compatibility with Ethereum, but higher efficiency in generating proofs and overall performance. In other words, higher-numbered zkEVM types involve changes that modify the EVM core or introduce additional modules to optimize performance.

While Vitalik notes in the article that no one zkEVM type has a clear technical advantage and that they may coexist, he concludes at the end of the article:

“Personally, I hope that over time, through improvements in ZK-EVMs and improvements in Ethereum itself to make it more suitable for ZK-SNARKs, everything will become Type 1.” — Vitalik Buterin (Founder of Ethereum)

Ultimately, in the choice between interoperability and performance, Vitalik chose interoperability over Ethereum scalability.

Although this article was written in 2022, it is still worth reflecting on in the context of the emergence of a large number of Ethereum L2 blockchains today. To truly operate as an Ethereum L2 blockchain, the ultimate goal should be to implement Type-1 zkEVM.

While Vitalik’s article only categorizes zkEVMs, from a broader perspective, the structure of L2 itself can also be extended to the type of EVM or L2 depending on whether it is fully integrated with Ethereum. From this perspective, Taiko aims to achieve Ethereum’s scalability by using a Type-1 EVM equivalent to Ethereum.

Because Taiko aims to be an L2 blockchain equivalent to Ethereum, it is inevitably relatively inferior in performance to other types of Ethereum L2 blockchains, such as type 2 or type 3. However, considering that other L2 blockchains mentioned above are not fully committed to Ethereums scalability, this trade-off is reasonable. It is worth noting that this is not a big problem because the Taiko team is aware of this and has explicitly set a goal to improve performance deficiencies through internal protocol design.

2.1.2 Based Rollup

Quelle: MEV for “Based Rollup”

Taiko not only fully integrates Ethereums system infrastructure, but also strives to keep up with Ethereum in terms of security. Taiko adopts a concept called Based Rollup, which does not require a centralized sorter to run. Instead, Ethereums validators also act as Taikos sorters, responsible for sorting transactions and blocks. Due to these characteristics, the fragmentation of the Ethereum ecosystem has the potential to be reintegrated into a whole.

Based on the characteristics of Based Rollup, Ethereums block proposers become Taikos sorters. This role comes with specific responsibilities, including maintaining their profits as Taikos MEV (maximum extractable value) beneficiaries and maintaining activity as sorters. This additional incentive mechanism prompts them to operate more carefully.

2.2 The Path to Full Decentralization

From a systemic perspective, decentralization is a complex and inconvenient concept. Frankly speaking, if everything is handled and managed by a single center, it will be more efficient and easier to maintain. Therefore, many Ethereum L2s choose a centralized sorter model. However, this approach has flaws. For example, malicious sorters may censor transactions or cause single points of failure to increase. In this case, who will trust the system? The blockchain industry was born precisely because no one can be fully trusted. In order to eliminate these potential risks, it is crucial to achieve full decentralization.

Quelle: Based Contestable Rollup (BCR): A configurable, multi-proof rollup design

What conditions are needed to achieve full decentralization? Taiko has thought about this issue and launched Based Contestable Rollup (BCR). The key to avoiding centralization is to ensure multi-party participation, prevent collusion, and encourage competition. BCR adopted by Taiko is a rollups protocol with a competitive mechanism that plays a role in rollups proof and sorting, covering all the necessary elements.

“34,469 lines of code is going to be hard to make bug-free for a long time.” — Vitalik Buterin

The reason Taiko chose the BCR structure was to achieve full decentralization. Vitalik Buterin pointed out that zk-SNARKs is not yet a completely reliable technology. In particular, the latest zk-SNARK systems are significantly more complicated, which greatly increases the possibility of errors. Since the technology is not yet mature, it is expected to become more complex and thus more prone to technical errors. When there are such vulnerabilities, centralized rollups can prevent the problem from getting worse because there is an entity responsible and able to solve any technical errors or specific risks. However, Taiko pursues a completely decentralized environment, which makes it difficult to clearly solve these problems. Therefore, Taiko avoids relying on the structure of blindly trusting zk-SNARKs. In other words, through the BCR structure, Taiko is prepared for the possibility of rollups proof errors and has established a system that can challenge incorrect rollups proofs.

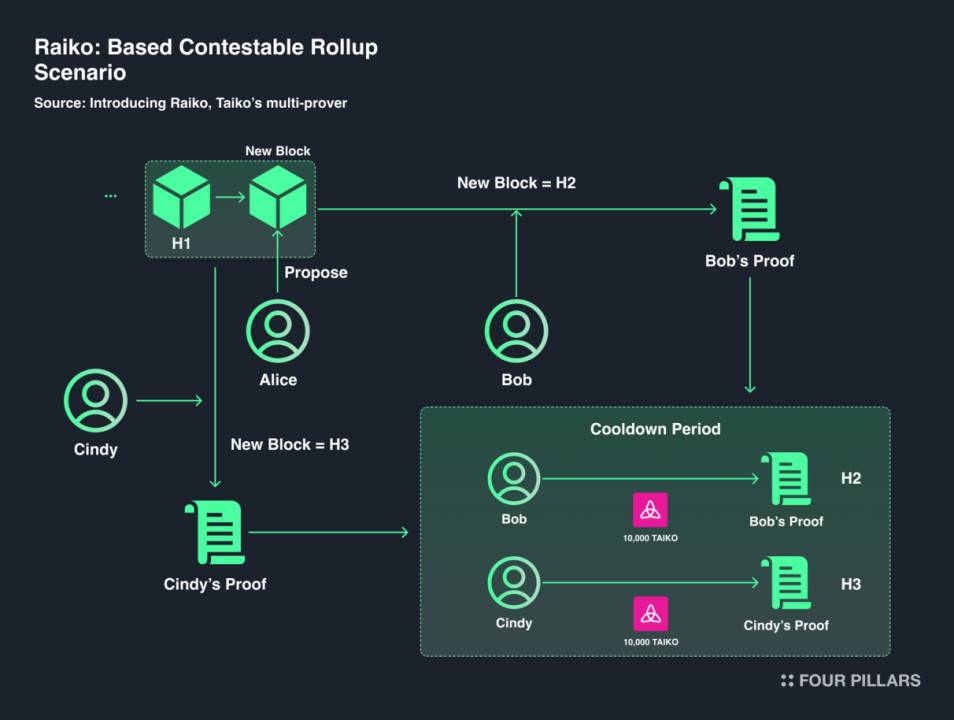

To understand how Taikos BCR works, a simple example may be more effective than a complex explanation.

Alice proposes a new block.

Bob submitted a proof of state change from H1 → H2. H1 is the parent hash and H2 is the new block hash. Bob pledged 10,000 TAIKO as security deposit. His proof entered the cooling-off period.

The state information proposed by Bob and the attached proof are publicly disclosed.

Cindy believes that Bobs state change should be H 1 → H 3, not H 1 → H 2. Cindy pledged her 10,000 TAIKO as a competitive deposit during the cooling-off period and challenged Bobs proof.

The disputed status change between Bob and Cindy is pending a higher level proof during a cool-off period. This higher level proof allows Bob and all other attesters a chance to challenge it.

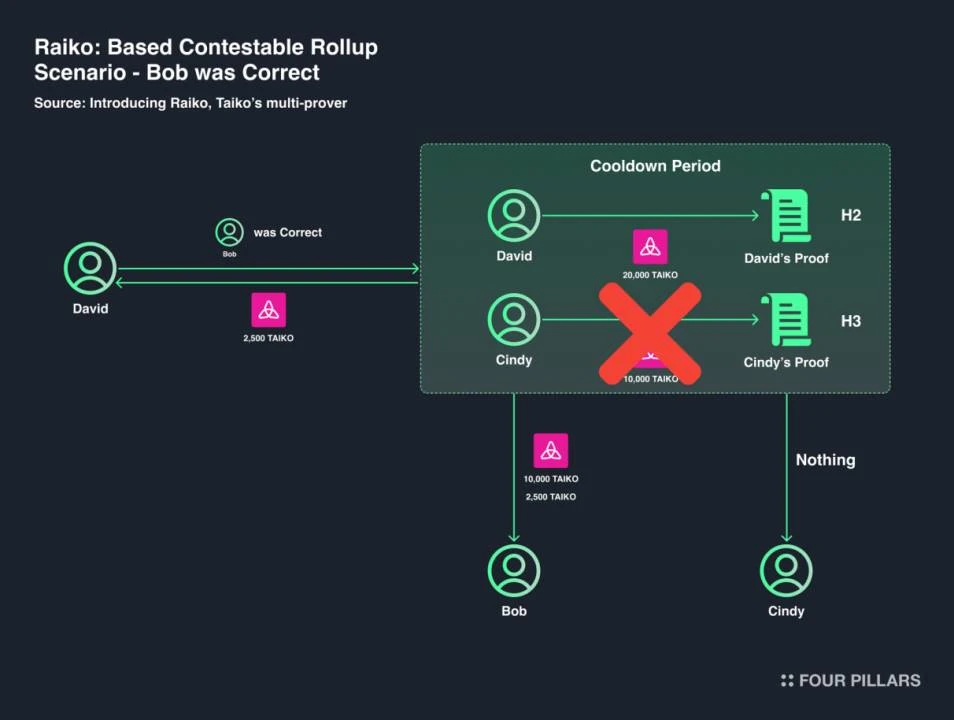

Scenario 1 – If Bobs solution is correct:

David verifies Bobs H1 → H2 solution, proving that Bob is correct. David receives 2,500 TAIKO as a reward for completing a higher level of verification, and becomes a validator for H1 → H2, staking 20,000 TAIKO as a deposit.

Cindy lost her entire deposit because she requested the wrong modification.

Bob gets his original 10,000 TAIKO deposit back and is rewarded with an additional 2,500 TAIKO for coming up with the correct solution.

Davids new plan and the cooling-off period for verification begins.

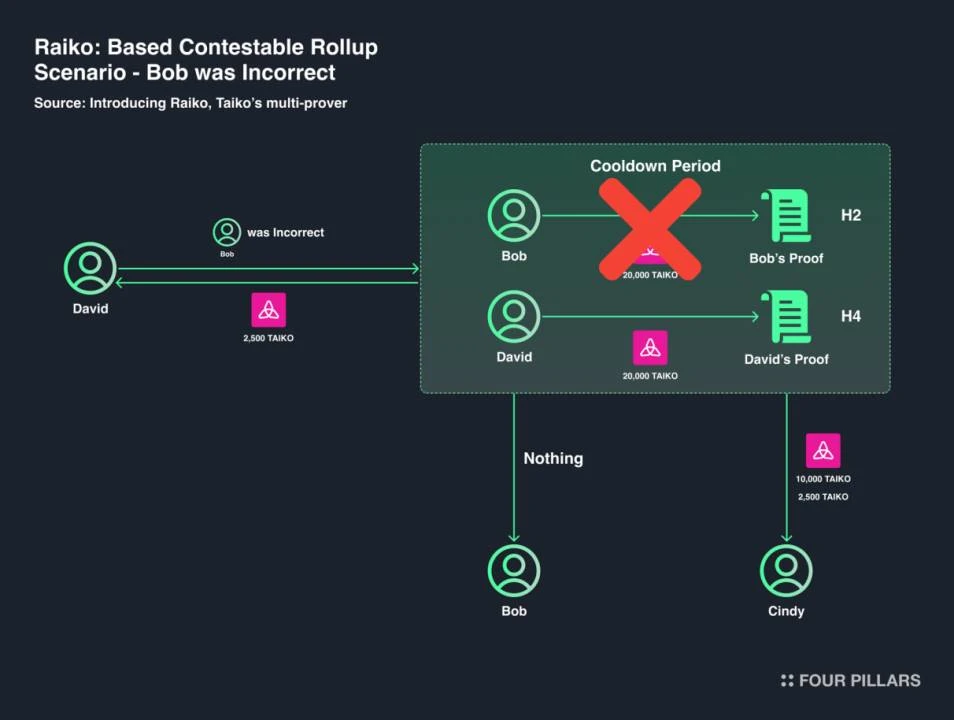

Scenario 2 – If Bobs solution is incorrect and David proposes a new solution:

David provides a three-step transition proof from H 1 → H 4, proving that Bobs transition is wrong. David is rewarded with 2,500 TAIKO and pledges 20,000 TAIKO as a deposit to provide capital support for his modified state information and proof.

Cindy gets her original 10,000 TAIKO deposit back and receives an additional 2,500 TAIKO as a reward for successfully challenging Bobs erroneous status change information.

Bob forfeited his entire deposit for proposing the wrong state change information and proof.

Davids new plan and the cooling-off period for verification begins.

This structure incentivizes rollup validators to stay accountable when challenging by using competitive deposits and prevents unnecessary attacks. Notably, the deposit required to compete increases significantly as the number of validation rounds increases, thus preventing unnecessary competitive rounds.

In addition, Taiko adopts multiple proof systems in BCR. This system allows different rollup verification systems (such as SGX, ZK, SGX+ZK, etc.) to be used according to different stages to ensure the flexibility and more stable operation of the system. Despite these advantages, this design also has a disadvantage: when the competition frequency is low, the validator is not active enough. The validator mechanism needs to make a profit through a lot of competition, so in an environment with insufficient competition, they may choose not to participate. To address this problem, Taiko implemented dynamic adjustments to different rollup verification systems to solve this challenge.

In the early stages of the service, there may be a low frequency of competition. To address this, a group of validators called Guardian Provers will utilize a multi-signature scheme as a security guarantee until the system matures. As the system matures, their role will gradually decrease and eventually disappear to achieve full decentralization.

2.3 Built for EVM builders

The various features of Ethereum L2 and the more decentralized L2 are attractive and necessary. However, we often overlook a key question: Why do Ethereum L2s exist? Who are they designed for? The answer is simple: they exist for ecosystem participants who want to use these Ethereum L2s. Among them, developers who attract a large number of users and promote the development of the entire L2 ecosystem are particularly important. However, in this golden age of Ethereum L2 blockchains, a large number of infrastructures with their own rules have emerged. This situation is like operating the same service in countries with different laws and regulations, and it takes a lot of unnecessary time and money to deal with the differences.

In order to help developers focus resources on service development effectively, we need to standardize rules and narrow the gap between infrastructures. To this end, it is crucial to introduce infrastructures that have been historically verified or widely used by many developers. Yes, we need to introduce infrastructures used in the Ethereum environment. This will enable developers to leverage the methodology and expertise they have accumulated on Ethereum, making it easy to integrate into the Ethereum L2 blockchain.

“Taiko can only make a difference in the world if it helps others change the world.” – Taiko Labs

In this regard, Taiko has demonstrated a real commitment to developers. As Taikos blog post states, Taiko will benefit ecosystem participants, especially developers, by allowing them to work freely. To deliver on this promise, Taiko continues to open source all development and adopts a framework called Based Booster Rollup (BBR) to help EVM developers transition faster and easier.

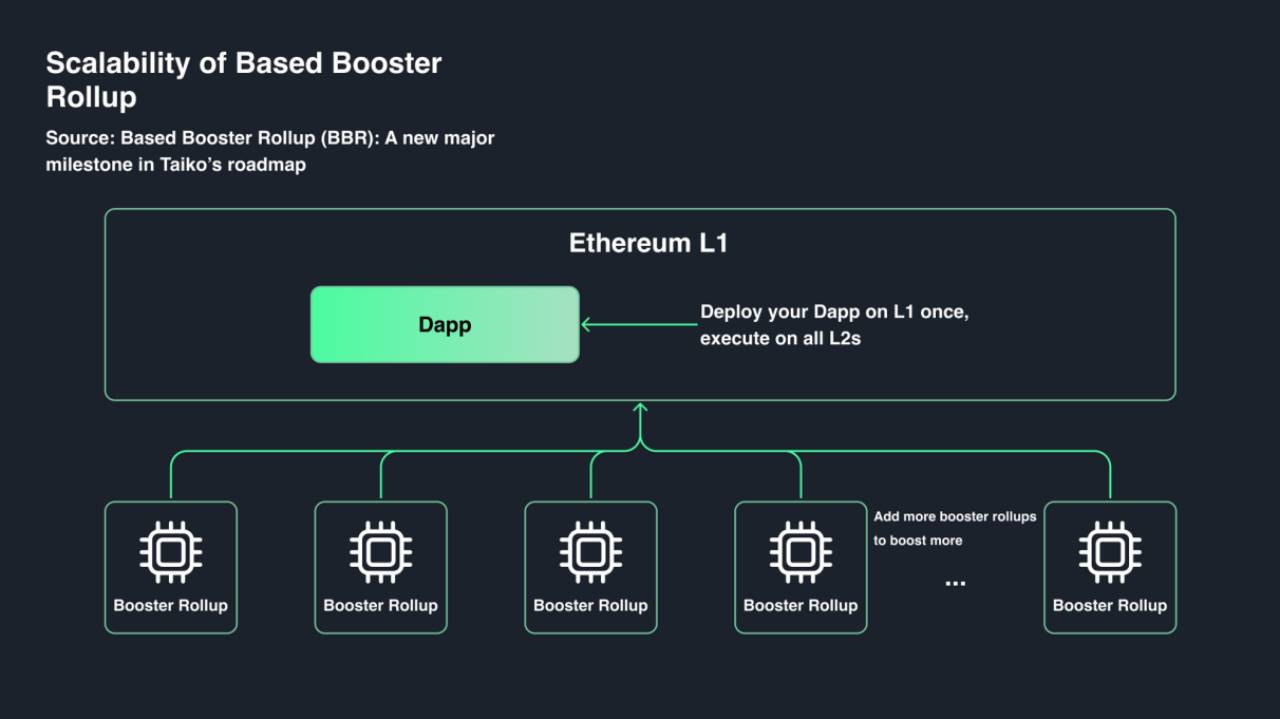

BBR is an extension of the advantages of Based Rollup from a developers perspective, exploring how to apply the advantages of Based Rollup to the application layer of the core infrastructure of the blockchain. With Taikos BBR, developers only need to deploy their dApp once on L1 Ethereum to achieve automatic dApp deployment on all L2s without additional work or resource investment.

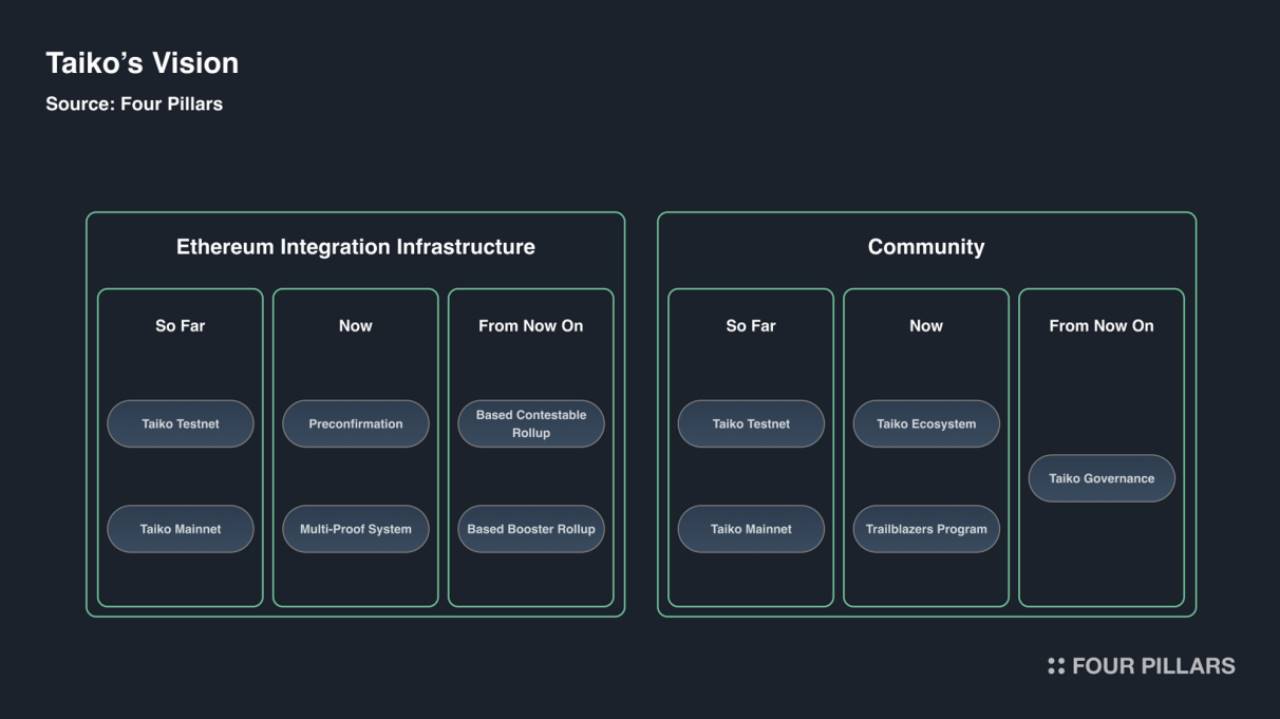

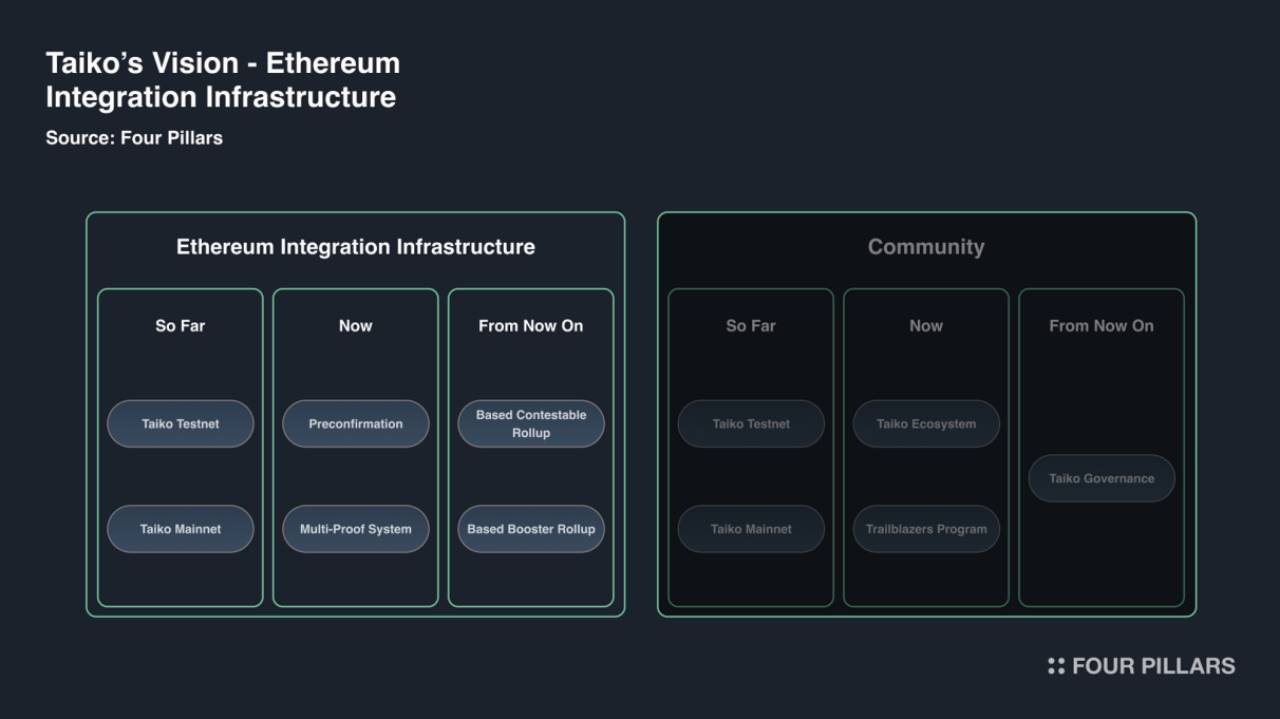

3. Taiko’s wish: Ethereum integrated infrastructure and community

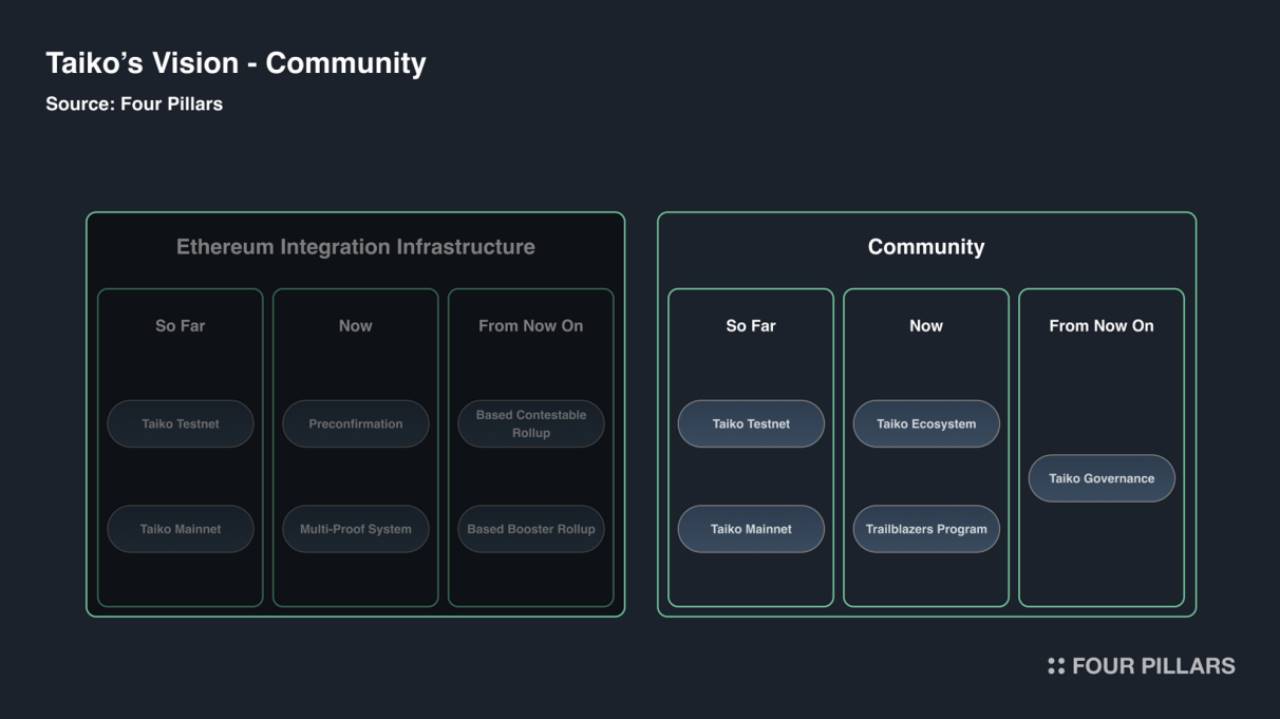

We have explored the direction Taiko is pursuing. Despite having three powerful ideas as a foundation, ideas alone cannot bring about significant changes in the industry. These ideas must be implemented within a planned timeline so that others can benefit from them, forming a virtuous cycle and becoming an industry disruptor. So, lets look at the process of how Taiko intends to become an industry disruptor from the perspective of the past, present and future.

3.1 Ethereum Integrated Infrastructure

One of the key pillars is infrastructure. As the cornerstone of becoming a true Ethereum L2, Taiko is leveraging multiple technical advantages to build this infrastructure. Lets take a look at how Taikos infrastructure history has developed.

3.1.1 So far — from Taiko testnet to mainnet

Taiko is not trying to accomplish all goals at once. In order to achieve the major goal of launching the mainnet, it has conducted as many as seven alpha testnets, gradually preparing for the realization of Taikos vision. Lets first take a look at the contents of these seven stages of alpha testnets.

Alpha Testnet-1 (Snæfellsjökull)

All developers can deploy smart contracts, and users can use all Ethereum and Solidity tools just like on Ethereum. This makes it possible for everyone to test transactions. This version allows anyone interested to run an L2 node and opens up the participation of block proposers. To this end, Taiko plans to run a few nodes and propose blocks, inviting everyone to join. The testnet includes a cross-chain bridge for transferring assets between the testnet and Ethereum, and a block browser for checking transaction history.

Alpha Testnet-2 (Askja)

This is the first testnet that has successfully verified that the network can run through a proof-of-concept mechanism open to everyone. It lays the foundation for the full decentralization of this version. In addition, the monitoring and alerting functions of the blockchain network are implemented, and developers can directly deploy their decentralized applications (dApps) to this testnet without modifying the code used on Ethereum.

Alpha Testnet-3 (Grímsvötn)

This release establishes and implements a token economic model based on a new fee and reward model. It also includes testing the necessary proof cooling mechanism in the proof mechanism, as well as preliminary testing of the starting layer of Taiko L3.

Alpha Testnet-4 (Eldfell L3)

In this version, the initial layer of L3 was deployed for the first time, and the concept of rollup-on-rollup was introduced. Since Taiko L2 is fully integrated with Ethereum, Taiko actually treats L2 as L1 and tries to expand to L3. In addition, a new staking-based verification mechanism is introduced to prevent the centralization of validators and ensure that they receive reasonable rewards.

Alpha Testnet-5 (Jólnir)

This release introduces a new proposal and validation implementation based on Proposer-Builder Separation (PBS). PBS is a series of processes involving economic mechanisms between proposers and validators to ensure the decentralized nature of block construction. Unlike the previous testnet that did not introduce this aspect, this version of block construction adopts an open market model.

Alpha Testnet-6 (Katla)

In the sixth testnet Katla, the initial version of BCR (Blockchain Consensus Rule) was implemented. Since Taiko aims to be the L2 equivalent of Ethereum, this version tests and prepares for the latest updates of Ethereum (such as EIP-4844), although these updates have not yet been activated. In addition, the cross-chain bridge has been updated and the blockchain browser has been enhanced to provide more comprehensive information.

Alpha Testnet-7 (Hekla)

The last testnet, Hekla, focused on activating EIP-4844, which had been prepared in the previous testnet. This successfully implemented and adopted the new rollup storage mechanism Blob on the Ethereum mainnet. In addition, this testnet version introduced several improvements, including adjustments to L2 block gas issuance, activation of snap sync, and modifications to EIP-1559 settings. Based on the features applied and tested in this version of the testnet, the mainnet is now ready without any problems.

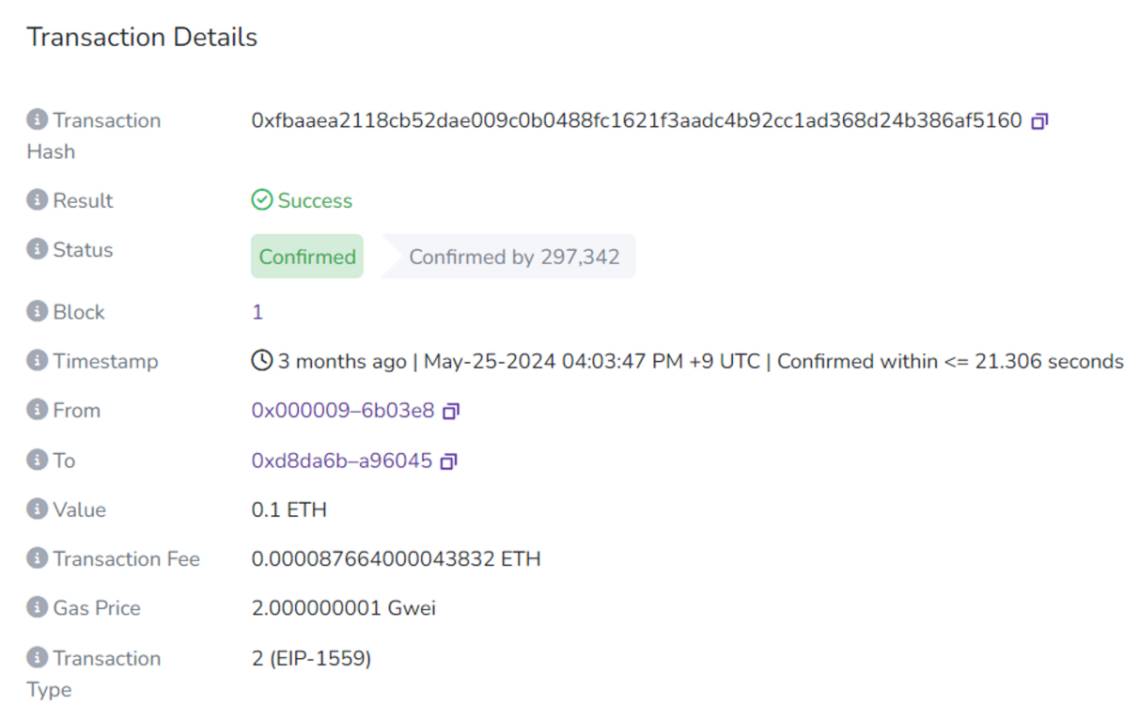

Quelle: Taiko Mainnet #1 Block

Taiko Mainnet

The blockchain network content verified and secured during the testnet is presented to the world through the mainnet release. It is worth mentioning that Ethereum founder Vitalik Buterin generated the next block immediately after the genesis block, adding importance to it. General users can transfer ETH from Ethereum to the Taiko mainnet through the cross-chain bridge and interact directly with decentralized applications (dApps) on the Taiko blockchain. Developers in particular can run nodes, propose and verify blocks, and actively participate in this Taiko blockchain with great potential. In terms of technology, Taiko has introduced implementation modules such as BCR and Raiko, reflecting its determination to become a true Ethereum L2.

3.1.2 Now – Pre-confirmation and Multi-Proof Systems

As Taiko successfully launched the mainnet through six testnets, it is also constantly consolidating its internal structure to become a more advanced Ethereum L2. Two of the most notable developments are the pre-confirmation and multi-proof systems, which we will explore in detail below.

Pre-confirmation

Even after the mainnet launch, Taiko is still working to inherit the security and determinism of Ethereum. However, this development also brings the risk that block proposers may face survival difficulties due to lack of profitability. For example, in an ecosystem with scarce liquidity like Taiko, users usually give low tips to block proposers, making Taikos 12-second block time insufficient for any block proposer to be profitable. Therefore, Taiko Labs is temporarily operating proposers without pursuing profits to prevent this from happening. If no action is taken, the block time of the Taiko mainnet will continue to increase.

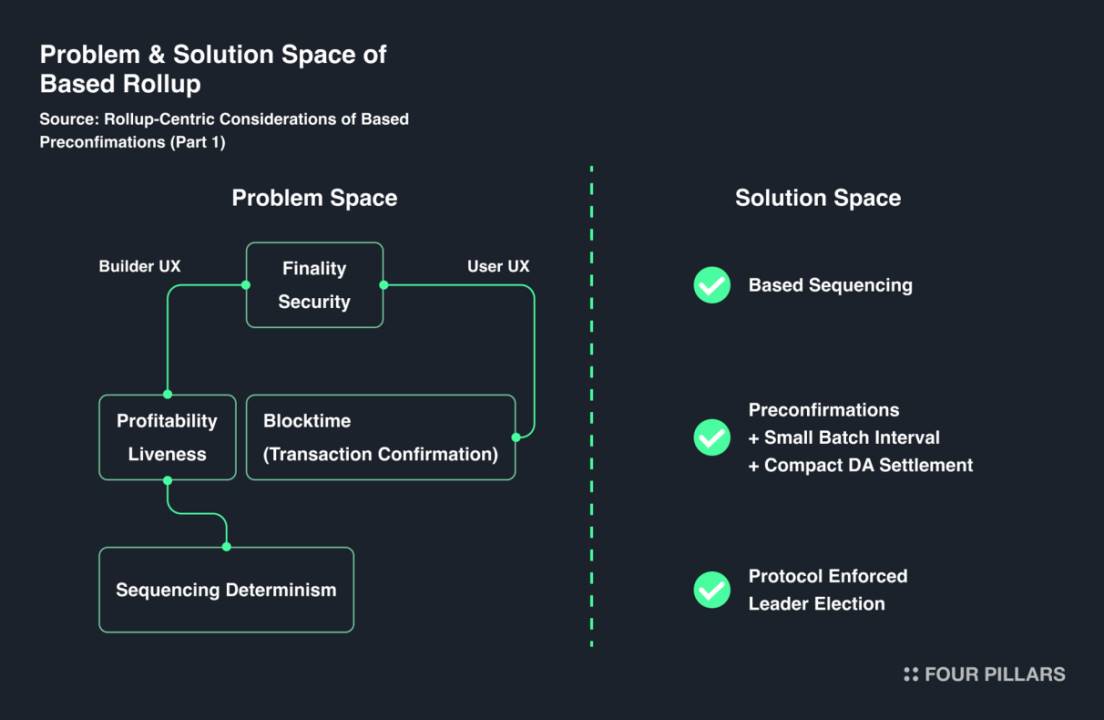

In order to solve the profitability problem of L2 block construction, the improvement of block time, and the efficiency of data release, Taiko plans to introduce a concept called pre-confirmation. Pre-confirmation is the main focus of research and development in the second half of 2024, and will also play an important role outside the Taiko mainnet. Through pre-confirmation, L2 block construction can become more efficient and stable, allowing users to enjoy faster transaction confirmation speeds. In addition, pre-confirmation can simplify and enhance the rollup structure by integrating the roles of L2 and L1 proposers. This is associated with the sorting-based mechanism, which may encounter difficulties in actual operation when considering the profitability of builders, the startup survival mechanism, and the configuration of fast block times. However, if multiple pre-confirmation participants perform pre-confirmation, a fork may occur on the Taiko mainnet. Therefore, despite some controversy, mechanisms such as leader selection are being discussed as a practical compromise.

Multi-factor authentication system

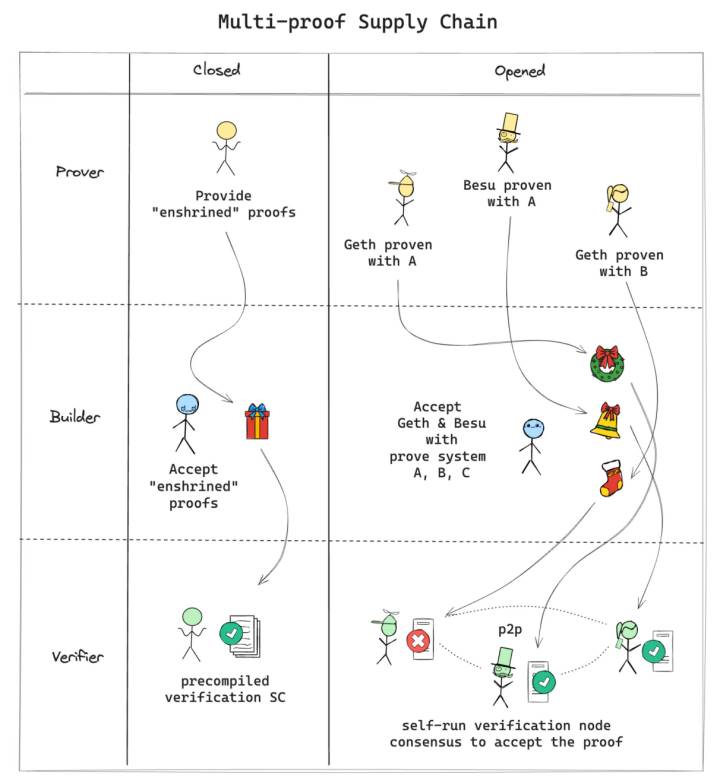

Another topic of Taikos research and development is a multi-authentication system that aims to integrate multiple clients and various authentication systems. The multi-authentication approach reduces the risk of vulnerabilities in client implementations and authentication systems, ensuring that even if one authentication method is compromised, the other methods are protected from the same vulnerability.

Quelle: Taikos Approach to Multi-Proofs

First, Taiko plans to build an open multi-client system in which each client is able to independently verify blocks. This allows users to choose their preferred client for block verification, bringing the advantages of accessibility and scalability. In addition, it serves as a basic measure to prevent single points of failure, which contributes to the safe operation of the main network. However, since this requires Ethereum (as an L1 network) to support multi-client functionality, Taiko plans to use a closed system that uses multiple improved types of validators until this support is fully implemented.

In addition, Taiko runs a free-market multi-verification system where proposers look for validators, propose blocks, and verify them using the verification system of their choice. In addition, this multi-verification system emphasizes modularity and openness, allowing multiple clients and verification systems to collaborate when generating multiple verifications. To this end, Taiko has worked with companies such as Powdr Labs and Risc Zero to improve interoperability between compilers and zk-SNARK systems and build a modular ZK stack.

The implementation of these concepts is called Raiko. Raiko supports multiple zkVMs and uses SGX for enhanced security. The system increases the flexibility of block proofs through the ZK/TEE architecture and improves zkVM and TEE through standardized input methods. Taiko plans to continue integrating more zkVMs and expand Wasm zkVM. The system aims to provide a user-friendly and integrated environment for EVM-compatible block proofs.

3.1.3 Looking to the future – through BCR and BBR

Despite Taiko’s significant progress, the goal of becoming a disruptor still seems far away. Ultimately, Taiko’s path to achieving its ultimate vision relies heavily on two core elements, BCR and BBR, which have been initially implemented but still need further refinement.

Although we have explained BCR and BBR above, let’s review them again.

BCR allows users and developers to propose blocks, run nodes, and deploy smart contracts just like on Ethereum, and introduces a dispute resolution mechanism that can quickly handle errors in rollups. This ensures certainty and accuracy within the blockchain, making BCR the cornerstone of Taikos core technology.

Quelle: Based Booster Rollup (BBR): A new major milestone in Taikos roadmap

BBR builds on the advantages of Based Rollup to provide higher efficiency and comprehensive Ethereum interoperability. This allows users to use integrated dApps on all L2s without switching between them, while developers can deploy dApps once and have them automatically adapt on all L2s. In addition, BBR solves the fragmentation problem that exists in all rollups while significantly reducing transaction costs and increasing throughput. Therefore, Taiko believes that BBR has the potential to fundamentally expand the Ethereum ecosystem, and once this technology is applied, users and developers of all Ethereum networks can look forward to a better experience.

Taikos mainnet is designed to support developers, users, and builders, enabling them to operate flexibly and efficiently in the Ethereum environment, focusing on these two core pillars. However, since these pillars are not perfect yet, they need to continue to evolve and improve as important technical components to help realize Taikos vision. As these two pillars become stronger and more complete, Taiko will be able to propose a new standard for L2, providing full Ethereum interoperability, full decentralization, and closer to users and builders.

3.2 Community

Another important pillar is the community. In order to ensure that the platform that Taiko builds through its infrastructure is truly valuable, community involvement is crucial. To this end, Taiko is working on multiple areas, including token issuance, token economics development, ecosystem activation, and the establishment of a governance environment. Lets take a look at some of Taikos efforts in these areas.

3.2.1 So far – TAIKO token issuance and distribution

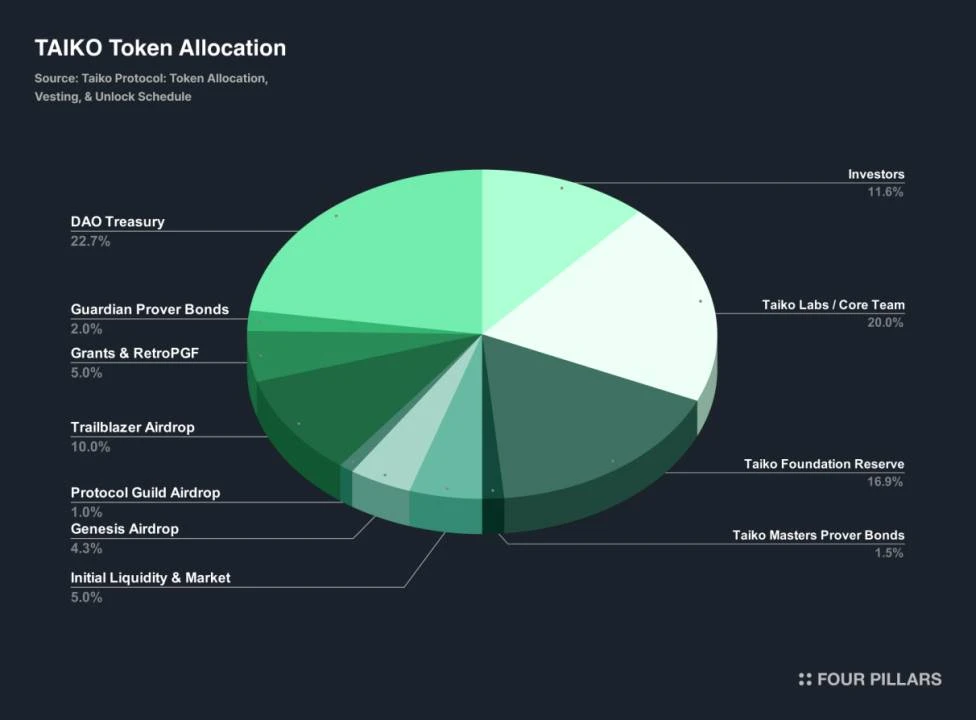

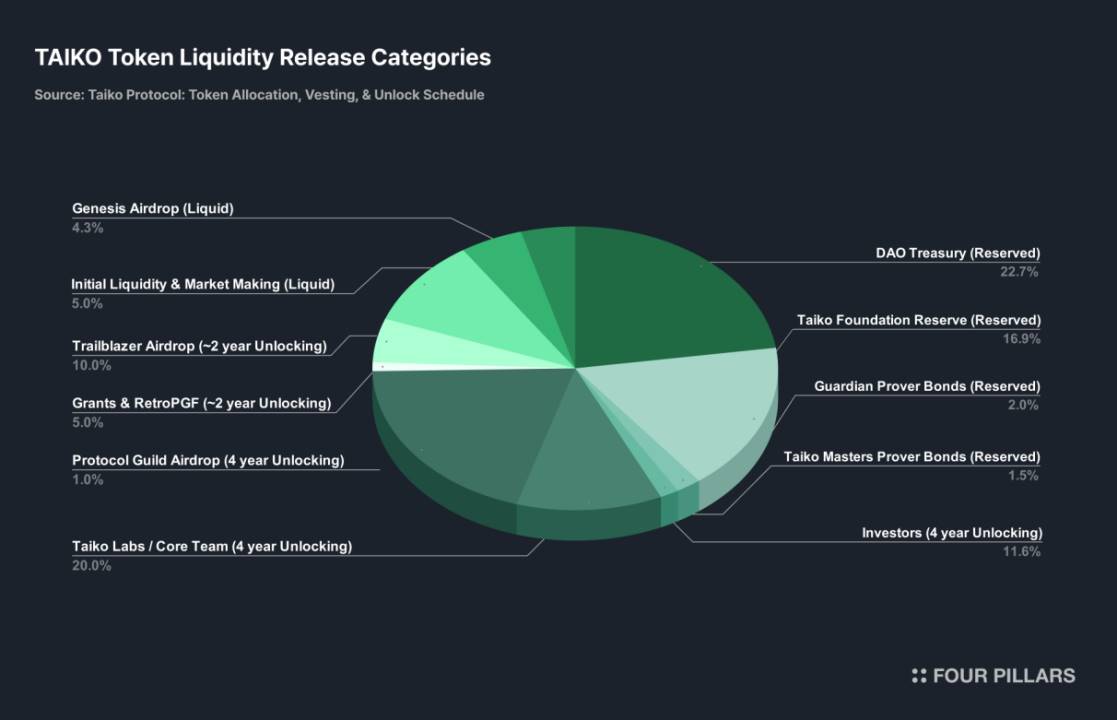

After the Taiko mainnet went live, an airdrop of TAIKO, the native token of the Taiko network, was launched. TAIKO is at the core of Taikos economic mechanism and token economics, with a total issuance of 1 billion tokens. TAIKOs Zeichen Generation Event (TGE) takes place on June 5, 2024. The specific distribution is as follows: 11.62% of the total supply is allocated to investors, and 9.81695% is allocated to the Taiko Labs core team, as shown in the attached figure.

The distributed TAIKO tokens have an initial 12-month lock-up period. After the lock-up period, 25% of the locked tokens will be unlocked, and the remaining 75% will be gradually released over three years. This vesting structure is designed to minimize market volatility, encourage long-term participation in the Taiko ecosystem, and ultimately contribute to the success of the Taiko project.

The token liquidity release plan is illustrated in the figure above, where green represents tokens that have been distributed, yellow represents tokens that will be distributed within 2-4 years, orange represents tokens that will be gradually distributed over three years after one year of launch, and pink represents tokens allocated to protocol development, DAO governance and network, with a period of five years or longer.

3.2.2 Now – The Expanding Taiko Ecosystem

Quelle: Introducing Trailblazers: Explore Taiko and get rewarded

Taiko’s Trailblazers program is a loyalty program where users can earn experience points (XP) and claim rewards through various on-chain activities on the Taiko mainnet. 10% of the total TAIKO token supply has been allocated to the program, and users can earn more experience points and level up by participating in activities. Certain NFT holders will receive experience bonuses, and the program offers a variety of activities and special events.

The program aims to encourage users to explore the Taiko ecosystem and actively participate in the community. Experience points can be gained by participating in activities such as cross-chain, increasing transaction volume, and proposing blocks on the Taiko mainnet. At the end of each season, rewards will be issued based on the accumulated experience points.

In addition, the Trailblazers program introduces a faction system where users can team up and compete within two factions (Based and Boosted). Users can collect badges associated with each faction, which bring bonuses such as additional experience points (XP). At the end of the season, the faction with the highest experience points will receive additional rewards. Developers can also participate in this program and receive rewards for the best performing applications.

The Trailblazers program aims to attract more users to join the Taiko ecosystem and allow them to gain experience and rewards through various activities.

The Taiko ecosystem is growing rapidly with Taikos active support. More details on this will be presented in Chapter 4.

3.2.3 From Now On – Full Decentralization with Taiko Governance

In order to achieve full decentralization, Taiko will allow the community to participate in decision-making through the DAO. Major decisions will be made through voting by TAIKO token holders to determine the operational direction of the network. However, Taikos governance is still in its early stages and is not yet fully active. Therefore, the first committee will be established by Taiko Labs, and the addition and removal of committee members will be decided by voting in the Taiko DAO.

3.3 A Challenging but Progressive Path

Taiko is making steady progress, albeit slowly, towards its ideals and goals. Taiko places a special emphasis on being a user- and developer-friendly blockchain, which is reflected in the growing Taiko ecosystem after the mainnet launch. In the next chapter, we will delve deeper into the development of the Taiko ecosystem.

4. Taiko’s Ecosystem

The Taiko ecosystem is a dynamic and collaborative space that aims to create a highly “Ethereum” friendly environment for developers and users. Although it is in its early stages, it aims to provide the tools and support that Ethereum has. Key milestones include the Alpha-1 testnet in December 2022 and the mainnet launch in May 2024, which includes a genesis airdrop and lays the foundation for community-driven development and governance.

A key project of Taiko is its grant program, which provides financial and other support to projects on the platform. Taiko supports developers by providing the resources needed to realize their ideas. Through these grants, Taiko not only helps individual projects, but also strengthens the entire ecosystem, encouraging the development of products for the wider Ethereum community.

Next, let’s explore the various components that make up the “Taiko Ecosystem”.

4.1 Taiko Organizational Structure

Quelle: What is Taiko? | Docs

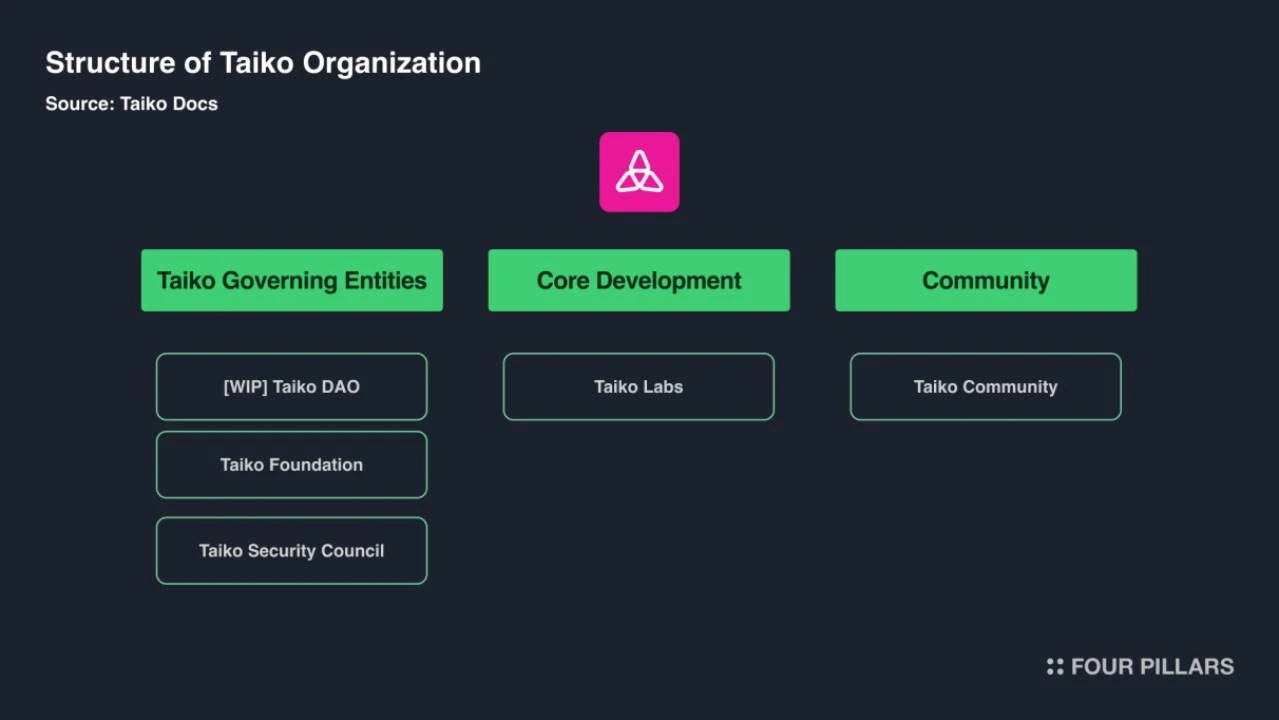

Taiko L2s organizational structure consists of several key components, each of which plays a different role in managing the Taiko ecosystem.

4.1.1 Taiko Management Entity

Taiko DAO

This DAO will be developed as the governance body of the Taiko Protocol. TAIKO token holders will have voting rights and can participate in decision-making on smart contract upgrades and other network-related issues. Such a democratic structure ensures that the community collectively controls all smart contract aspects of the Taiko Protocol. In addition, the Taiko Treasury is managed by the DAO, processing the revenue generated by the Taiko Protocol and ensuring that financial resources are appropriately allocated to support the continued development and operational needs of the protocol.

Taiko Foundation

The Foundation is responsible for the management of the Taiko protocol and its ecosystem. It supports the Taiko DAO and token holders by providing transparent funding for technology development, ecosystem growth, partnership agreements, and event organization.

Taiko Safety Committee

The Security Committee elected by Taiko DAO is responsible for responding to emergencies and taking necessary measures to ensure the security of the protocol. It is responsible for overseeing key upgrades and changes and managing Guardian Provers to ensure the integrity and security of the Taiko protocol.

4.1.2 Core Development

Taiko Labs

This is a group focused on research and development of the Taiko protocol. Taiko Labs is committed to driving technological advancements to improve the functionality and performance of the protocol.

4.1.3 Community

Taiko Community

Includes all Taiko-related social groups and accounts, such as Taiko Discord and Taiko Twitter. The community is the main platform for communication, interaction and information dissemination among Taiko enthusiasts and stakeholders.

4.2 Taiko Team Members

Daniel Wang – Co-founder and CEO

He is an experienced blockchain entrepreneur and technologist, best known for founding the Loopring Foundation, one of the early zkRollups built for decentralized exchanges. His leadership of Loopring between 2017 and 2021 established the protocol as a key player in the DeFi space, improving the efficiency of transactions and payments. Prior to that, Wang held senior engineering positions at ZhongAn Insurance, JD.com, and Google, honing his skills in managing complex systems and large teams. At Taiko, Wang has successfully raised $37 million in funding and is leading the Ethereum equivalent of zkRollup, designed to scale Ethereum while retaining its core principles of decentralization and security.

Terence Lam, Co-founder and COO

He plays a key role in the companys strategy and operations. With three decades of experience working in the Web2 and Web3 industries, including experience in multinational Fortune 500 companies and numerous startups, Terence brings a wealth of experience to Taiko. He played a key role in obtaining $37 million in funding from well-known venture capital firms such as Lightspeed Faction and Hashed. Prior to joining Taiko, he was an associate professor at the University of Hong Kong and graduated from several prestigious universities including Harvard Business School.

Brecht Devos, Co-founder and CTO

He has extensive technical experience from his work at Loopring. At Taiko, Brecht played a key role in designing the technical architecture of Ethereums equivalent zkRollup, including the innovative contestable Rollup (BCR) and accelerated Rollup (BBR) designs. The architecture is designed to simplify the Layer 2 value chain, reduce trust assumptions, and promote developer adoption. His leadership was critical to the successful execution of six testnets involving more than 1.1 million unique wallets and an active developer community, preparing for the successful launch of Taikos mainnet.

Ben Wan, Chief Community Officer

As Chief Community Officer at Taiko, Ben Wan has played a key role in growing the largest crypto community on Discord with over 1,000,000 members. His leadership has been instrumental to the success of the Taiko testnet and the rapid growth of the mainnet. Ben’s background in managing global IT projects for major multinational companies enables him to effectively guide and support Taiko’s diverse, global community.

4.3 Ecosystem Overview

Taikos ecosystem is built in a community-driven model, emphasizing open source development. In addition, Taiko supports a variety of applications and tools covering multiple fields, including DeFi, cross-chain bridges, and Web3 infrastructure. Since Taiko is fully compatible with EVM, dapps on Ethereum can be ported more easily and with reduced risks.

Let’s take a deeper look at this ecosystem, from infrastructure to user experience.

Quelle: Ecosystem – Taiko

4.3.1 Core Infrastructure

From the beginning, the ecosystem has prioritized developer-friendly tools. Key partnerships have been established with industry leaders to provide core services: ANKR for RPC, Covalent and Subgraphs for indexing, Pyth and Redstone for oracle solutions, and Tenderly for developer tools. This combination of services ensures that developers have access to high-reliability infrastructure from the earliest testnet stages. Here is an overview of the key projects involved:

ANKR

ANKR provides remote procedure call (RPC) services, which are essential for developers to interact with blockchain networks. RPC services facilitate communication between dApps and blockchains, allowing developers to efficiently execute commands and retrieve data. ANKRs infrastructure is known for its reliability and speed, which is essential to maintaining seamless operations in the Taiko ecosystem.

Covalent and Subgraphs for indexing

Covalent and Subgraphs provide indexing solutions that enable developers to easily query blockchain data. Covalent provides a unified API that integrates data from multiple blockchains, making it easier for developers to access and analyze blockchain information. Subgraphs is part of The Graph protocol and enables efficient querying through decentralized indexing services. Together, these tools provide developers with the infrastructure they need to build data-driven applications and efficiently access and utilize blockchain data.

Python and Redstone for Oracle Solutions

Oracles are core components in blockchain ecosystems as they deliver external data to smart contracts. Pyth and Redstone are two oracle solutions integrated into the Taiko ecosystem. Pyth focuses on providing high-fidelity financial market data, which is critical for DeFi applications that require real-time price information. Meanwhile, Redstone provides a flexible and decentralized oracle network that supports multiple data feeds.

Tenderly for developer tools

Tenderly provides a set of developer tools that optimize the development and debugging process of smart contracts. It features real-time monitoring, alerts, and advanced debugging capabilities to help developers quickly discover and resolve problems. Tenderlys tools are particularly useful during the testing and deployment phases because they can provide in-depth analysis of the performance and behavior of smart contracts.

4.3.2 Application- DeFi

Since the mainnet launch at the end of May, the DeFi space has seen significant growth, integrating both established and local blockchain projects. Users have access to a variety of DEXs, including OKU (Uniswap V3) and local versions Ritsu and Henjin DEX. Other notable projects include:

iZUMi Finance (DEX)

iZUMi Finance, a multi-chain DeFi protocol, has expanded its services to the Taiko blockchain, committed to providing liquidity solutions. On Taiko, iZUMi Finance launched iZiSwap, providing trading pairs and introducing features such as limit orders in a decentralized manner. This expansion to Taiko is in line with iZUMi Finances goal of supporting multiple networks and enhancing on-chain liquidity in various blockchain ecosystems.

KiloEx and DTX (derivatives)

KiloEx and DTX are derivatives trading platforms in the Taiko ecosystem. Both protocols provide hedging, speculation and risk management tools, offering a range of derivatives such as futures and swaps.

Deri (Options)

Deri is a decentralized options trading protocol in the Taiko ecosystem. It enables users to trade options, which are financial instruments that give the holder the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific time. Deri offers a variety of options contracts, allowing traders to hedge against price volatility or speculate on future price movements.

XY Finance (cross-chain exchange)

XY Finance is a protocol in the Taiko ecosystem that focuses on enabling cross-chain exchanges. It allows users to seamlessly exchange assets between different blockchain networks, improving interoperability and liquidity in the decentralized finance (DeFi) space.

4.3.2 Applications – Games

The gaming space offers a diverse range of experiences, from shooters and MMORPGs to strategy and gambling games. Notable titles include: CrackStack, Looperlands, 21 BJ, Ultiverse, and EVM Warfare. This diversity reflects the ecosystem’s commitment to providing engaging and innovative gaming experiences that cater to the preferences of different players and have the potential to attract a large number of users to the platform.

Crack Stack

Crack Stack is a game embedded in the Taiko blockchain ecosystem that combines puzzle and strategy elements. Players need to strategically place blocks in stacking challenges to achieve specific goals or overcome obstacles. The game uses blockchain technology to ensure fair competition and transparency, allowing players to earn rewards and compete with other players around the world.

Looperlands

Looperlands is an NFT gaming platform in the Taiko ecosystem, known as a pixel universe where players can play, create, and explore. It provides a metaverse experience with various games and activities that allow users to interact with NFT assets. The platform focuses on creativity and community participation, enabling players to build their own worlds and experiences.

21BJ

21BJ is a Taiko blockchain-based gaming project that brings the classic card game Blackjack to the digital world. It offers a decentralized version that allows players to play Blackjack against other people or AI opponents. The combination of blockchain technology guarantees transparency and fairness, as all game results can be verified on the Taiko network. Players can also earn rewards and participate in tournaments, making 21BJ a competitive and attractive option for card game enthusiasts.

Ultiversum

Ultiverse is a massively multiplayer online (MMO) game in the Taiko ecosystem that provides an interstellar travel experience. It uses NFT assets as avatars, allowing players to explore the vast universe and participate in various activities. Ultiverse focuses on social interaction and community building, giving players the opportunity to cooperate and compete in a dynamic digital environment.

EVM Warfare

EVM Warfare is a strategy game based on the Taiko blockchain that combines elements of warfare and resource management. Players engage in tactical combat and use various strategies to outsmart their opponents and achieve victory.

4.3.3 Application- NFT

Native and mature NFT markets coexist in the ecosystem, providing diverse options for creators and collectors. Loopexchange is a native solution, while OKX NFT Marketplace brings its mature market to the platform. Creator-centric tools such as NFTs 2 Me and Mintpad provide artists with the ability to mint and manage their digital assets. Notable series such as Taikonauts, Taikoons, and Trailblazers Faction Badges have emerged, each with unique utility.

NFTs2Me

NFTs2Me is a comprehensive NFT creation tool designed to help artists and creators by simplifying the process of launching NFT projects. It covers the entire NFT lifecycle, including creation, deployment, and contract management, providing users with an intuitive platform to manage their digital assets.

Mintpad

Mintpad is a user-friendly platform that simplifies the publication and management of NFT collections. It takes care of everything from artwork generation to smart contract deployment and metadata generation, streamlining the process. Mintpad allows creators to design custom minting sites or embed minting functionality on existing sites, providing flexibility and ease of use.

Taikoons

Taikoons are a well-known NFT series in the Taiko ecosystem, known for providing significant advantages to holders, such as providing XP boosts for the Trailblazers Program. These NFTs enhance the user experience by providing additional rewards and incentives for users to participate in on-chain activities. Taikoons are highly sought after within the community, reflecting their value and importance in the loyalty and engagement programs of the Taiko ecosystem.

4.4 Taiko Grants

Quelle: Grant Program – Taiko

The Taiko Grants program is designed to support community projects that promote the Taiko ecosystem. It supports the realization of these projects by providing financial rewards and developer resources.

Taiko Grants are divided into three tracks: Community, Partner, and Request for Proposal (RFP). The Community track supports builders and early-stage projects on Taiko, supporting diverse projects such as games, media, zero-knowledge proof (ZKP) applications, and artificial intelligence (AI). The Partner track supports mature projects with active user bases, including crypto service providers seeking to integrate with Taiko. The RFP track is for experienced builders or teams working on high-impact projects requested by Taiko Labs, focusing on Taikos protocol or ecosystem.

The grant program runs in cycles with specific application opening dates, deadlines, and review periods. For example, in the second cycle, applications for the community track open on December 4, 2023, close on January 15, 2024, and reviews close on February 15, 2024. During the review phase, the grant committee evaluates the proposals, provides feedback, and selects winners to launch the project. The program encourages projects that align with Taikos mission and support open source or public product initiatives.

4.5 Latest progress after the mainnet launch

Since the launch of the Taiko mainnet, there has been significant progress in all aspects of the network. Over the past 90 days, Taiko has achieved significant growth in network activity, profitability, user engagement, and technological advancement. In this section, we will look at these metrics.

4.5.1 Transaction and User Growth

Taiko’s mainnet has seen growth in network activity, achieving over 100 million transactions. This surge in activity is further reflected in the network processing up to 2,000,000 transactions per day, demonstrating its strong capacity and growing adoption. The expanding user base is reflected by attracting over 1,000,000 unique wallet addresses, reflecting strong user interest and engagement in the Taiko ecosystem.

4.5.2 Profitability and Decentralization

One of the noteworthy achievements after the mainnet launch is that Taiko Labs proposers have achieved decentralization, permissionlessness, and profitability. This milestone overturns the current understanding of Ethereum and brings new possibilities for Ethereum scaling solutions. Although Taiko has suffered losses in the past, it is steadily moving towards profitability as more and more dapps are launched. The next few months will be a critical period to observe.

Quelle: Onchain Profit – growthepie

4.5.3 Lower operating costs

Taiko has made several technical advances aimed at optimizing network performance and reducing costs. In particular, gas fees for Taiko L1 contracts have been reduced by 30%, increasing profitability for proposers. In addition, liveness deposits and validity and dispute deposits for SGX proofs have been reduced by 50%, which reduces capital costs and enables more participants to participate in Taikos permissionless transaction ordering.

5. Now is the time to pay attention to Taikos progress

Quelle: Taiko Mirror

Nine years have passed since Ethereum made its global debut. During this period, Ethereum has experienced tremendous growth and has undergone many changes to address the challenges encountered during the expansion process. Among them, Layer 2 solutions have become a key choice for Ethereum to solve scalability issues, ushering in the current era of Ethereum L2 prominence. However, over time, some solutions have emerged that deviate from the original Ethereum L2 vision, making their relationship with Ethereum more competitive or antagonistic, thereby weakening Ethereums security.

Now, the key is to focus on identifying L2s that are truly aligned with the Ethereum vision – projects that have the potential to be true partners of Ethereum rather than threats. This means we need to carefully discern which entities are truly focused on solving the scalability challenges set by Ethereum and take appropriate steps to do so. Based on this, Taiko has attracted widespread attention. Taiko is striving to become an L2 comparable to Ethereum, a fully decentralized L2, and a developer-first L2. It is worth noting that Taiko has invested a lot of effort in achieving these goals and is supported by a strong technical foundation such as BCR and BBR.

Of course, many other Ethereum L2 projects are also working in their own ways, so it remains uncertain which project will ultimately dominate in this era of Ethereum L2 dominance. However, Taiko is attracting attention because it is steadily turning its clear direction, which is to solve the fundamental challenges of Ethereum, into practical results.

Haftungsausschluss

This article was written in partnership with Taiko Labs for general information purposes only and does not constitute legal, business, investment or tax advice. It should not be used as the basis for any investment decision and should not be relied upon for accounting, legal or tax guidance. References to specific assets or securities are for illustrative purposes only and do not constitute recommendations or endorsements. The opinions expressed in this article are those of the author and do not necessarily reflect the views of any affiliated agency, organization or individual. The opinions in this article are subject to change without being updated.

This article is sourced from the internet: South Koreas top investment research institution released a nearly 50-page Taiko in-depth report: Redefining Ethereum L2 solutions

Related: TAO rebounds strongly, here are 12 AI projects worth paying attention to on the subnet

Original author: TechFlow The crypto market was devastated after this week’s “Black Monday,” but tokens in different sectors rebounded a day later. Among them, the most popular one is Bittensor (TAO). Coinmarketcap data showed that among the top 100 tokens by market value yesterday, Bittensor (TAO) rose 23.08%, ranking first on the rebound list. Although the AI narrative is not as hot as it was at the beginning of the year, the choice of hot money also represents optimism about the leading projects in the sector. However, Bittensor has also suffered a certain degree of fud before. The community believes that the project is overrated and there is no practical application in the subnet. Although the usefulness of a crypto project is not directly related to the token price, is…