SignalPlus-Volatilitätsspalte (20240911): Unentschieden

At 9:00 am Beijing time, Trump and Harris held their first presidential debate as scheduled. Neither mentioned cryptocurrencies, but mainly discussed traditional topics such as foreign policy and immigration. According to data from Polymarket, as the debate progressed, the balance of victory slowly shifted to Harris, and the market reaction also highlighted traders attention to the election results. Although cryptocurrencies were not directly mentioned, the expectation of Trumps declining chance of winning was undoubtedly transmitted to the price of digital currencies. The political uncertainty brought about by the draw made traders more cautious, and short-term negative risk aversion reappeared, causing BTC to fall by -1.6% in one hour and then tested the $56,000 support.

Source: Polymarket

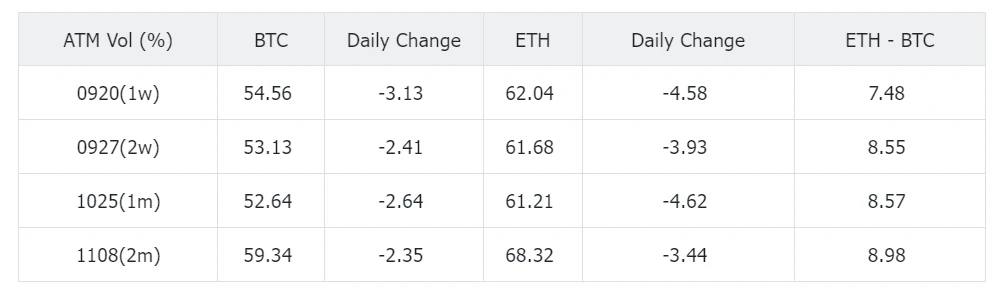

After the debate, the price completed the correction from the high point and consolidated around 56500. The actual intraday volatility of BTC is about 43%, which is much lower than the pricing in the options market yesterday. The implied volatility curve has also been significantly revised down on this basis, and the front end still prices a 60% volatility for tonights CPI data.

Quelle: SignalPlus

Source: Deribit (as of 11 SEP 16: 00 UTC+ 8)

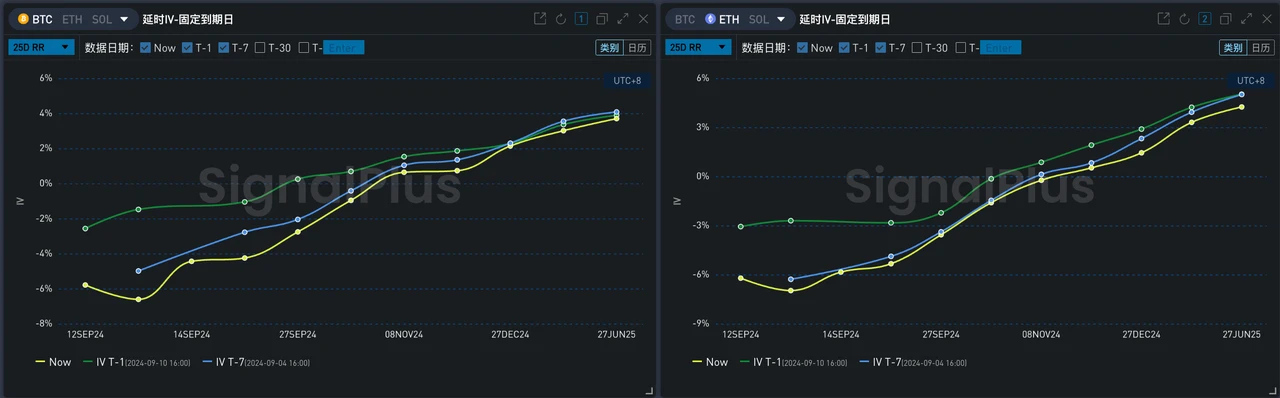

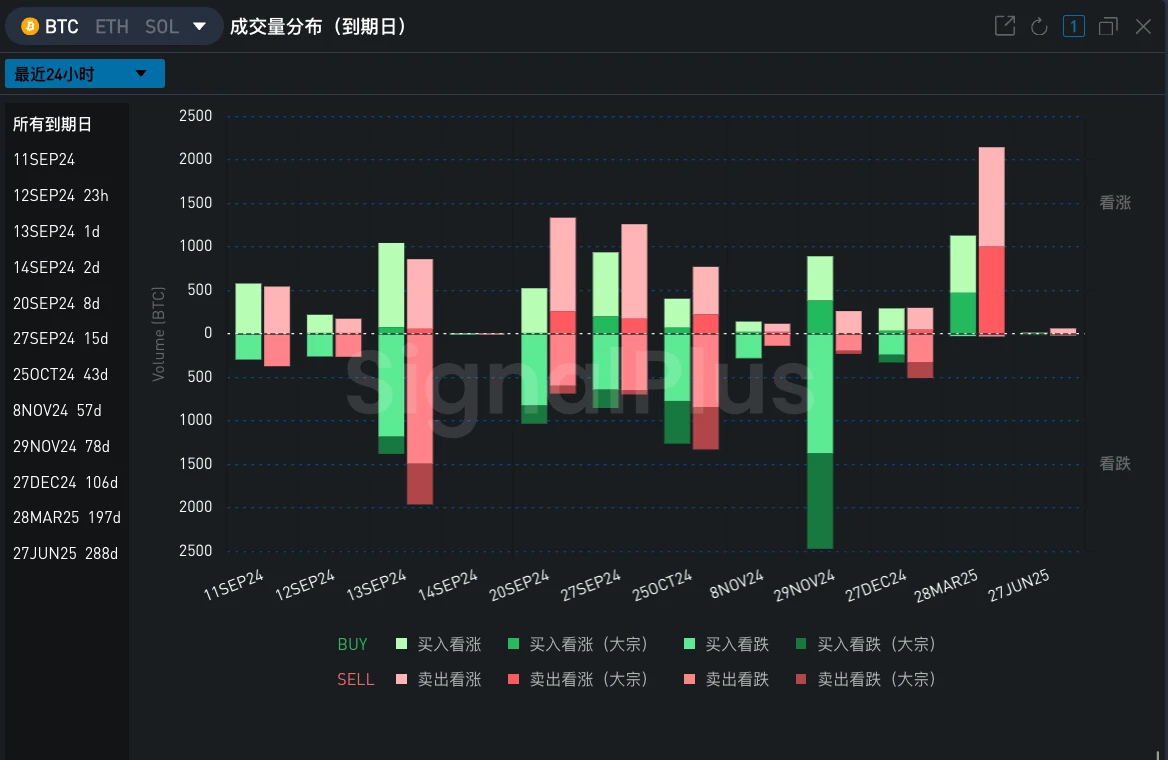

On the other hand, the change of Vol Skew reflects the recent ups and downs of the market sentiment. Yesterday, the performance of BTC spot ETF ending negative inflow was regarded by investors as a shift in market sentiment. The price challenged 58,000 and led to the return of Vol Skew. Today, although Ethereums ETF also ended the outflow of funds and BTC continued to inflow, the negative risk aversion caused by political uncertainty still poured cold water on the enthusiasm that had just been ignited in the market. Correspondingly, from the perspective of trading, the price rebound and the return of Vol Skew created cheap opportunities to buy Put on BTC, and a lot of put options were bought in various terms, especially at the end of November. On ETH, the flow brought by this market is a large number of selling Calls. The more representative one is the 20 SEP multiple custom strategies from bulk, which sold 2350 and 2400 call options at the same time and obtained high Premium income.

Source: SignalPlus, 25 D RR changes

Source: SignalPlus, transaction data

Source: SignalPlus, ETH block trade data

Sie können die SignalPlus-Handelsfahnenfunktion unter t.signalplus.com verwenden, um weitere Kryptoinformationen in Echtzeit zu erhalten. Wenn Sie unsere Updates sofort erhalten möchten, folgen Sie bitte unserem Twitter-Konto @SignalPlusCN oder treten Sie unserer WeChat-Gruppe (Assistent WeChat hinzufügen: SignalPlus 123), Telegrammgruppe und Discord-Community bei, um mit mehr Freunden zu kommunizieren und zu interagieren.

Offizielle SignalPlus-Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240911): Draw

Related: Black Wukong hurts Web3 people

Original author: Biteye core contributor Viee Original translation: Biteye core contributor Crush Black Myth: Wukong became a top-tier game overnight, topping the Steam online rankings on the first day of its release, setting a record for the number of online users for a stand-alone game. TON ecosystem Meme coin DOGS has been launched on Binance’s 57th new coin mining phase for the first time, and will be opened on leading exchanges such as Binance, OKX, and Gate.io in two days. These two things should be unrelated, but one is a AAA masterpiece that took 7 years to develop and cost 400 million RMB. You play for 1 hour and they spend 20 million RMB. The other is a token that is low-cost and airdropped to spread by FOMO across the…