Daten interpretieren die aktuelle Marktsituation: Wird es in Zukunft höher oder niedriger gehen?

Originalautor: Ignas | DeFi-Forschung

Originalübersetzung: TechFlow

To be honest, I have been bullish since mid-2023, but recently my confidence has begun to waver. This is actually a good sign, indicating that the market is recovering. I have also received more and more private messages from veterans in the crypto community who are concerned about the market, especially ETHs recent poor performance. This is another comic reversal signal. Back in March, the consensus of the market was to follow the typical 4-year cycle. It seemed too simple, and it turned out to be true! But how bad is the situation? I wanted to jump out of the Twitter bubble and see the data myself. So here is a snapshot of some data points to help us understand where we are currently and prepare for the changes next.

US ISM Manufacturing Index

This may seem like an odd place to start, but let me explain. A year ago, I shared Delphi Digital’s catalyst for an upcoming bull run in a post . It makes sense to review previous predictions to draw important lessons.

In their analysis, Delphi details the “heavyweight” and “lightweight” narratives that will dominate the cycle.

The heavyweight narratives included the Fed’s liquidity cycle, wars, and new government policies. Delphi accurately predicted that Grayscale’s court victory would drive the emergence of a BTC ETF, but they (and others) did not anticipate that an ETH ETF would follow.

They also successfully predicted the surge in SOL, the emergence of AI Zeichen, and the dominance of memecoin. Huge respect to them.

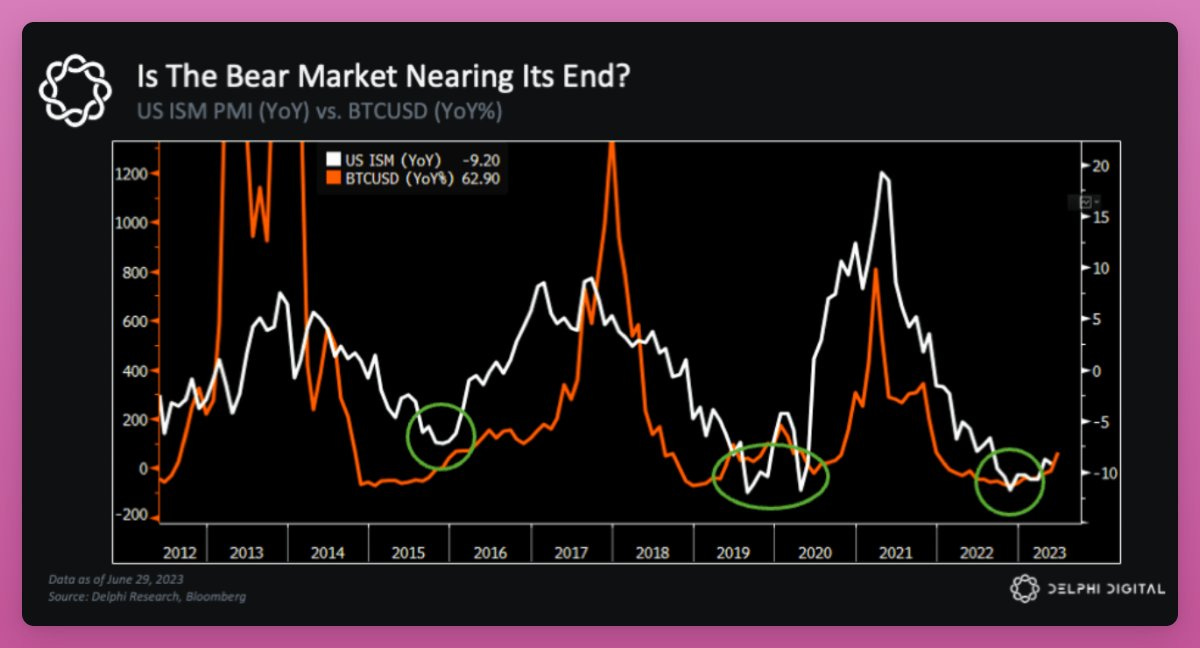

But there is one thing they seem to do better than anyone else. Check out the chart below.

They wrote: “The US ISM, one of the best predictors of asset price trends, looks to be nearing the bottom of its two-year downtrend. Equity markets are already reacting to this…”

“It’s amazing how precisely the ISM tracks the trajectory of previous cycles, including the timing of peaks and troughs. Every 3.5 years, it repeats like clockwork.”

They correctly state that the ISM can predict the price of BTC. However, the big problem is that the US ISM manufacturing index reversed its bullish trend in 2024 and started to decline.

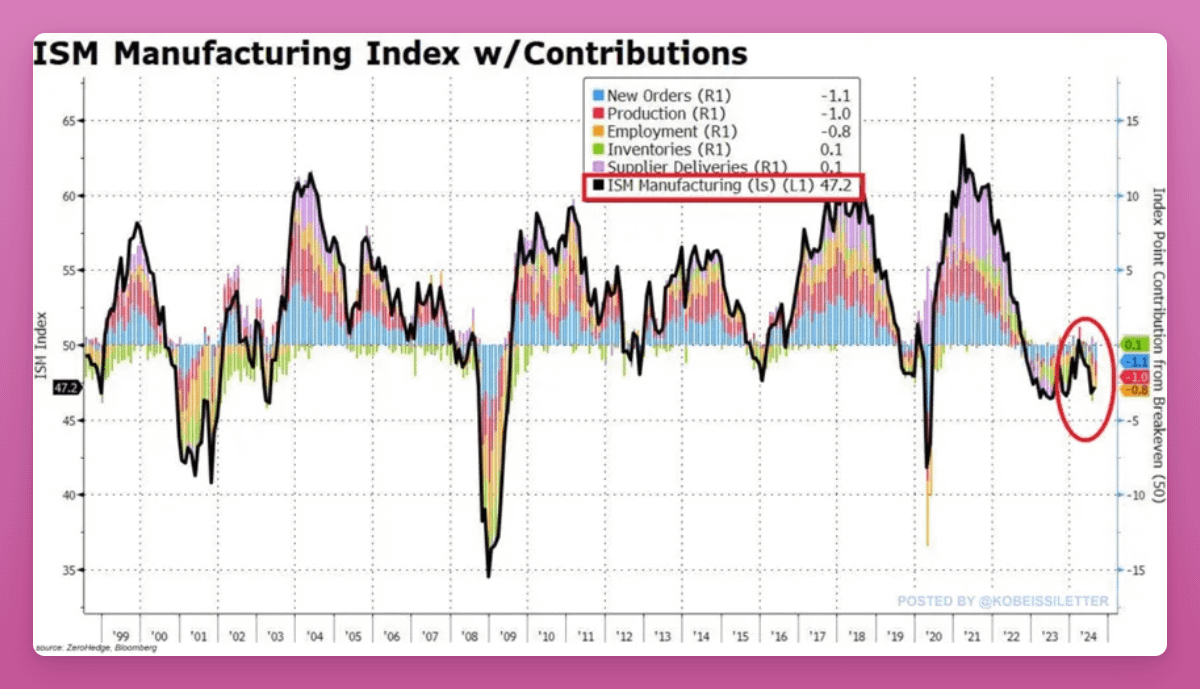

The US manufacturing sector has contracted for the fifth consecutive month, with the index falling to 47.2 points. The ISM Manufacturing PMI index fell short of expectations for last months reading of 47.5 points. Source: The Kobeissi Letter.

The US ISM index affects cryptocurrencies by influencing economic sentiment, risk appetite, and the strength of the US dollar. A weak index can lead to reduced risk investments and selling, while a strong index can boost market confidence.

Additionally, it affects inflation and monetary policy expectations, and generally rising interest rates or a stronger dollar have a negative impact on cryptocurrencies.

If the US ISM is one of the best indicators for predicting asset prices, we need to keep a close eye on the trend to catch a bullish reversal.

Cryptocurrency ETFs

Our new ETFs are facing a tough time.

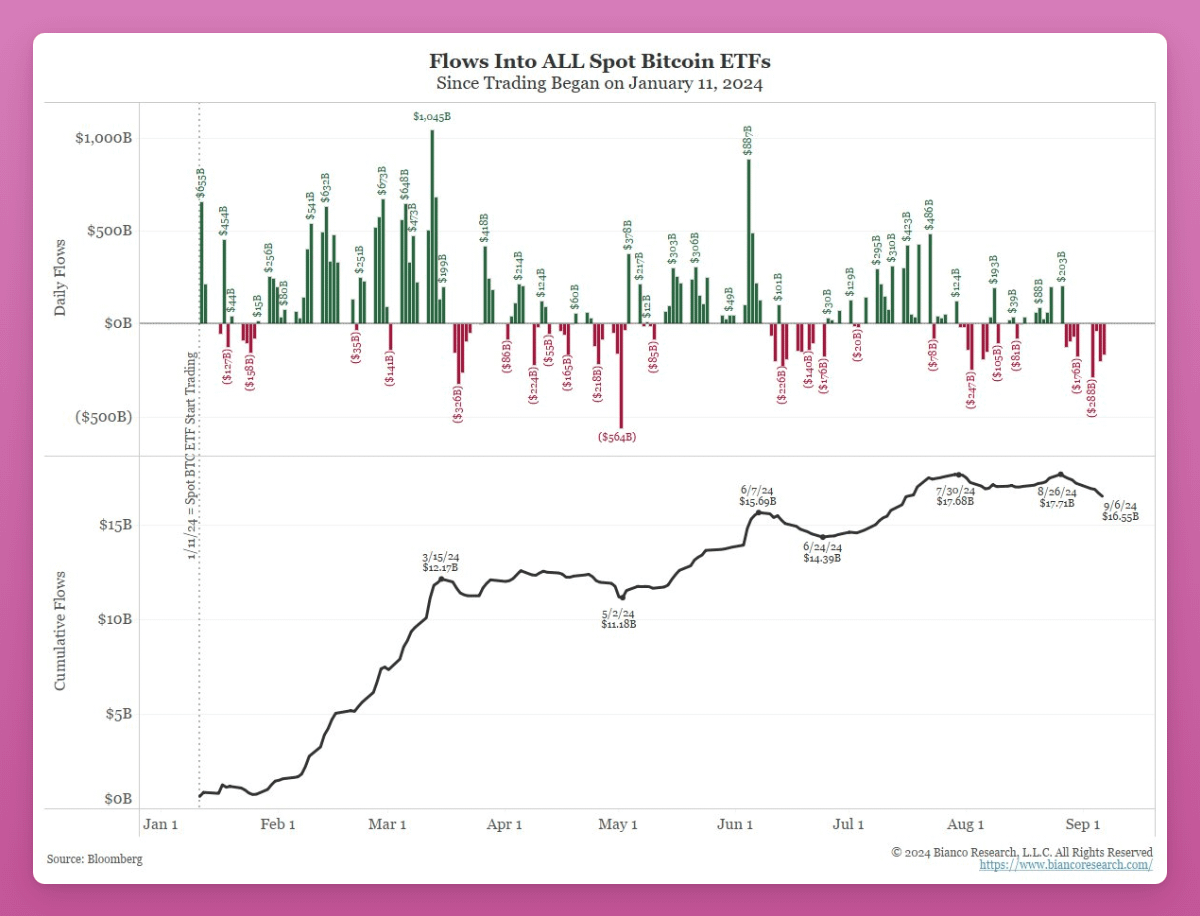

In the past 9 days, BTC ETFs have seen outflows totaling $1 billion in 8 days. This is the longest period of negative outflows since the ETF was launched.

The situation has worsened.

On Friday, spot BTC closed at $52,900, leaving ETF holders facing a record $2.2 billion in unrealized losses, equivalent to a 16% loss, according to Jim Bianco. As of this writing, the situation has improved slightly.

He also noted that the buyers of ETFs are not institutions or baby boomers, but small tourist retail investors with an average transaction size of $12,000.

According to crypto quantitative analysis, most of the inflows into spot BTC ETFs come from on-chain holders transferring funds back to traditional financial accounts, so the amount of new funds entering the crypto market is very limited.

The institutions involved were mainly hedge funds focused on basis trading (profiting from funding rates) rather than directional investing. Wealth advisors showed little interest .

Therefore, the baby boomers are not yet involved.

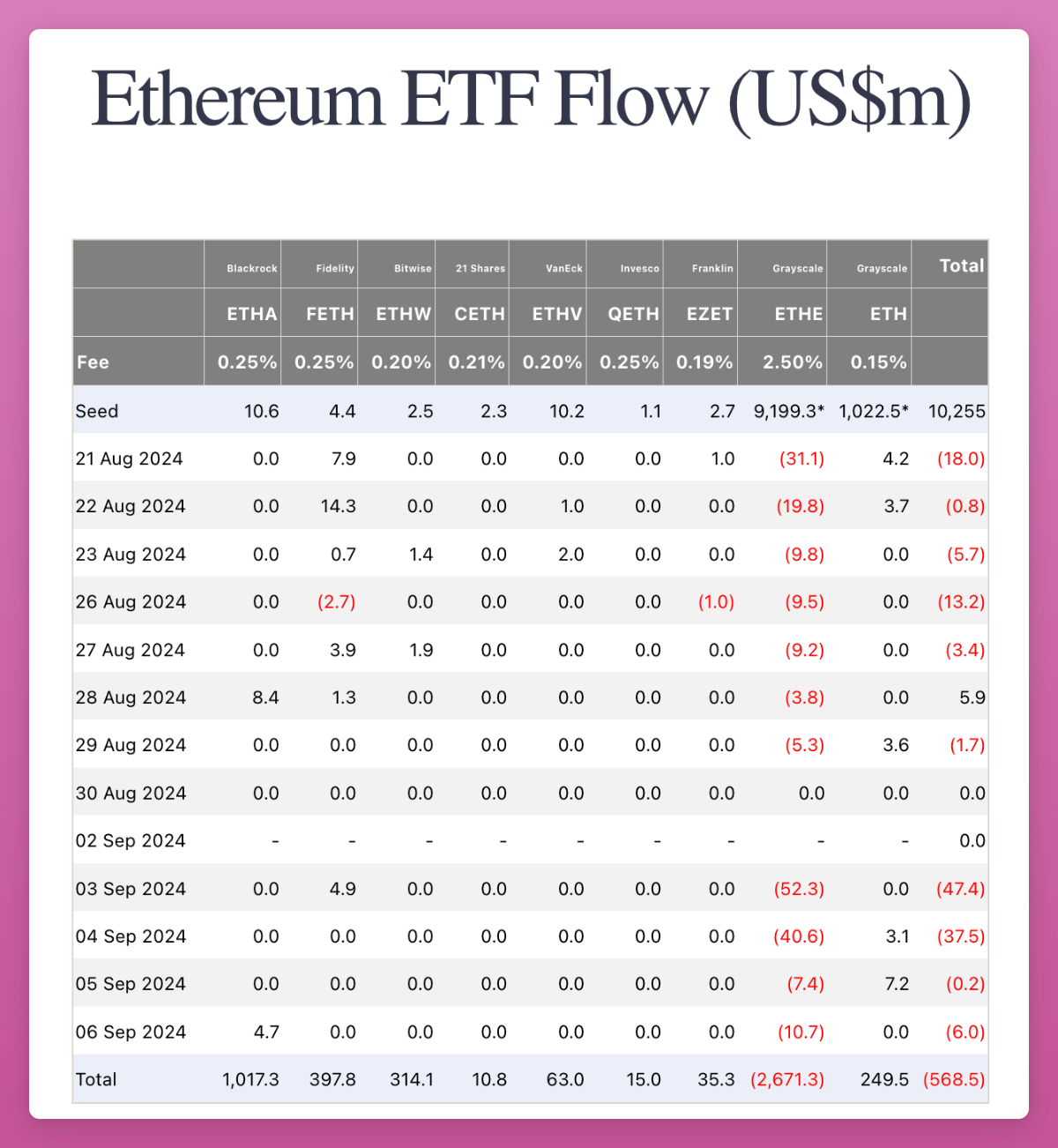

However, the situation is getting worse. Just look at the fund flows of ETH ETFs.

Did you notice those zeros?

ETH ETFs haven’t even attracted retail interest. Even Blackrock’s ETHA has only seen inflows in two of the past 13 days. Cumulative flows for all ETF issuers are negative.

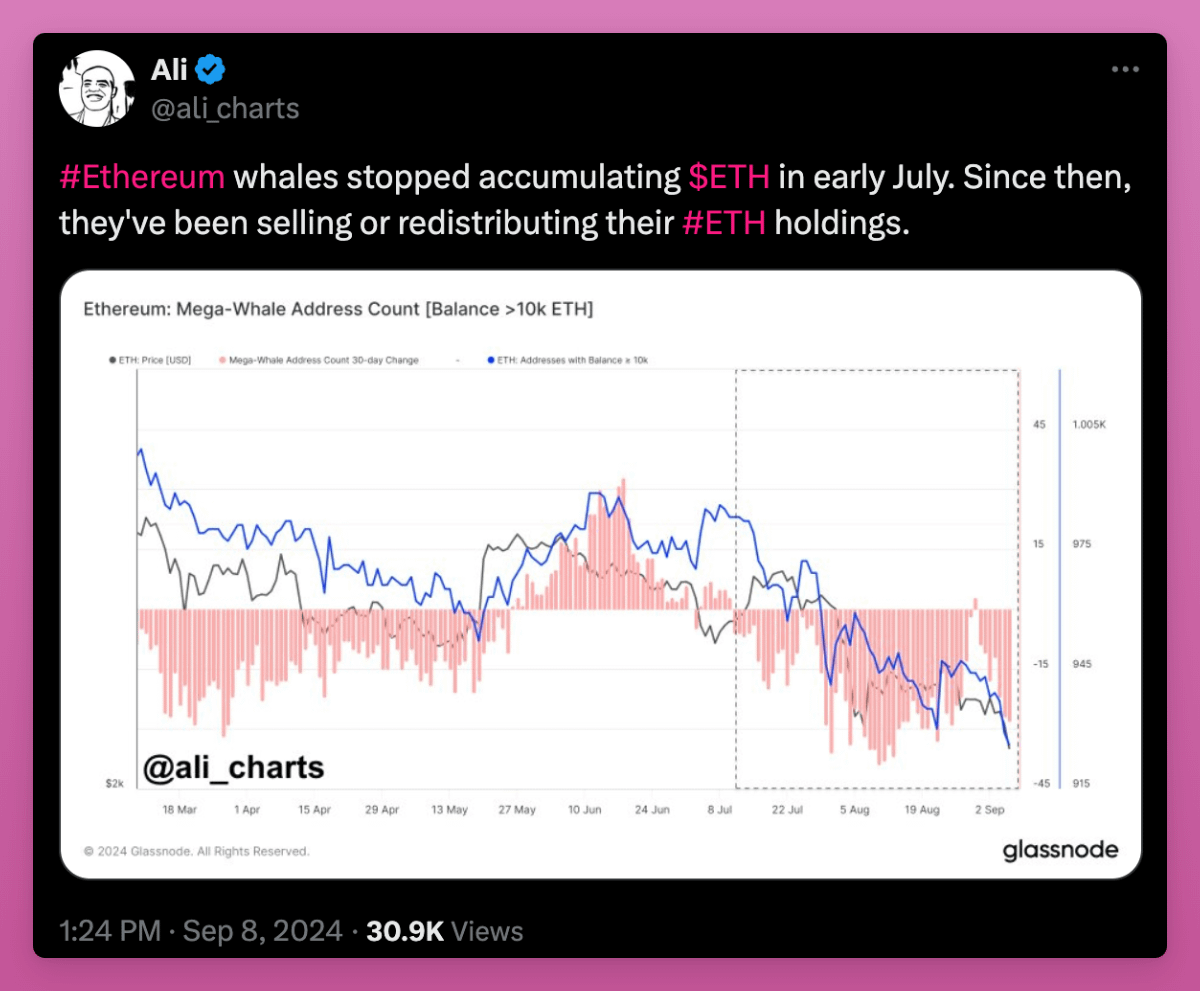

The sell-off by ETH big holders has dealt another heavy blow to the market since July.

The only good news is that Grayscale ETHE is not selling ETH on a massive scale. Grayscale still holds $5 billion in ETH, but with daily inflows below $10 million, the demand for the ETF is not enough to absorb these outflows.

Although the data seems unfavorable, I shared my optimistic view on ETH below. Since that post, the discussion about ETH roadmap and the value enhancement of L2 over L1 has become increasingly heated. I am optimistic that the community can finally start focusing on the value accumulation of L1.

What exactly do venture capital firms do?

One of the most perplexing issues of this cycle has been the low funding levels. While BTC has rebounded, funding activity continues to lag, and I have been updating the chart below to reflect this.

Venture capital firms may know something about the situation, so they are not very optimistic about the industry, or they are chasing highs like retail investors. My exchanges with some venture capital firms show that venture capital in the crypto field is like retail investors, but with more funds.

While total funding was much lower than in 2021, the median pre-money valuation nearly doubled, from $19 million in the first quarter to $37 million in the second quarter, close to an all-time high.

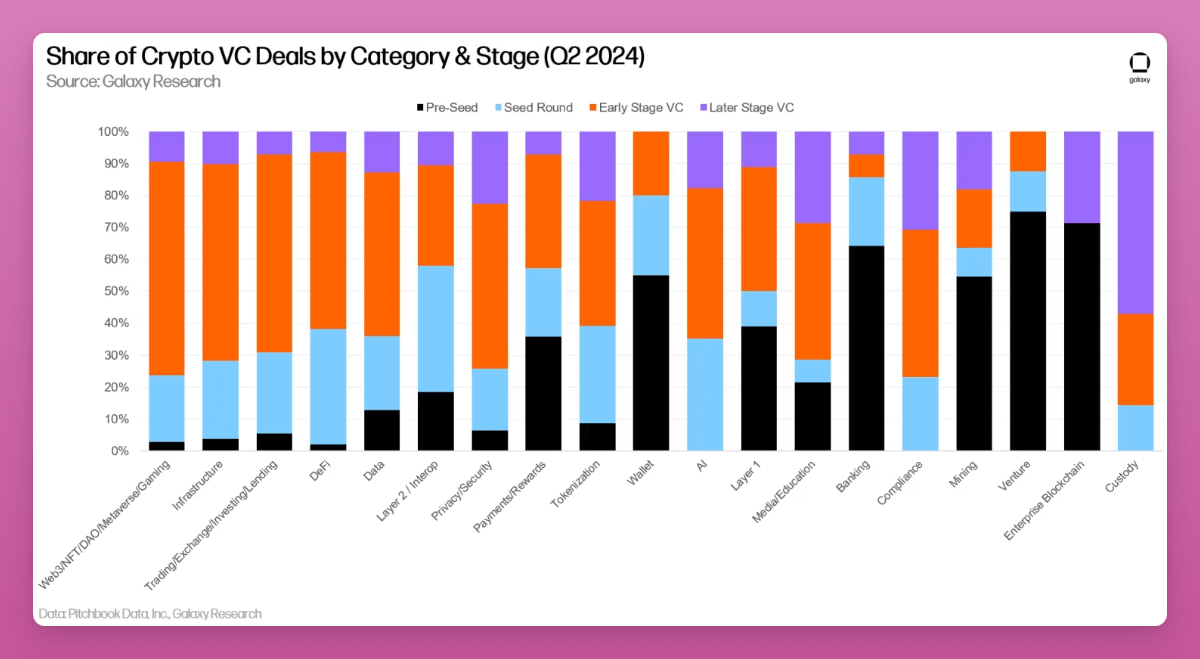

According to Galaxy’s Q2 2024 VC Report , despite limited available funding, competition and FOMO have driven up valuations, especially among early-stage startups.

This phenomenon is understandable. As cryptocurrency prices rebound, venture capitalists are scrambling to invest in a few quality protocols. For example, Paradigm failed to participate in Eigenlayers investment and chose to support its competitor Symbiotic.

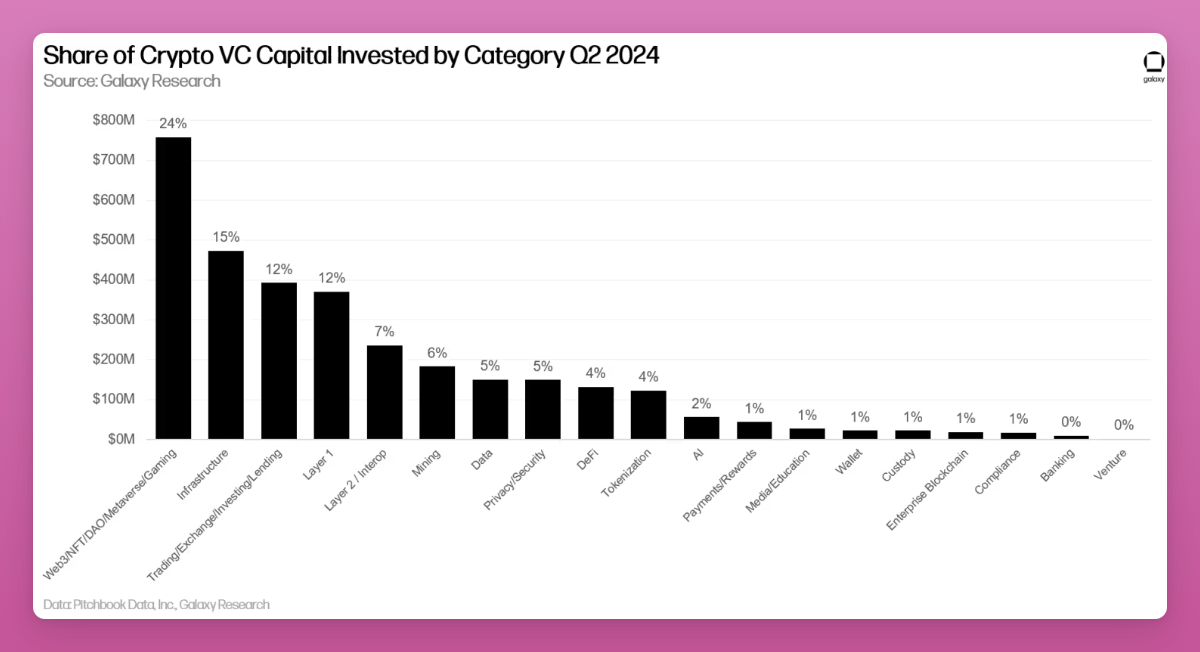

Another interesting phenomenon is that despite the lower interest from retail investors, Web3, NFT, DAO, Metaverse and Gaming projects are leading in fundraising, raising a total of $758 million in the second quarter, accounting for 24% of total venture capital.

The two largest deals were Farcaster ($150 million) and Zentry ($140 million). Infrastructure, Layer 1, and Transaction categories followed closely behind. It should be noted that the combination of cryptocurrency and AI still attracts only a small amount of capital.

I feel that the market demand for games and the metaverse is low at the moment. At my DeFi creative agency Pink Brains, we hired someone to research and build a community for GameFi and the metaverse, but we had to put this project on hold due to low interest in games.

Interestingly, Bitcoin L2 raised $94.6 million during the quarter, up 174% year-over-year, indicating growing VC interest in the BTCFi ecosystem.

Investors are still full of expectations for the Bitcoin ecosystem, believing that more composable block spaces will emerge, thereby attracting DeFi and NFT models to return to the Bitcoin ecosystem. ——Excerpt from Galaxys 2024 Q2 Venture Capital Report .

Additionally, Galaxy reported that early-stage deals accounted for nearly 80% of investment capital in the first quarter, with pre-seed deals accounting for 13%, indicating that the market is optimistic about the prospects of cryptocurrencies.

Despite the challenges facing late-stage companies, new innovative ideas continue to attract venture capitalist attention.

I personally feel that fundraising activities have decreased because there are very few new private messages inviting me to participate in the KOL round.

However, I usually do not participate in KOL rounds because I do not think I have a special advantage in the private equity market. I prefer to choose investments with higher liquidity and hope to maintain the independence of the content.

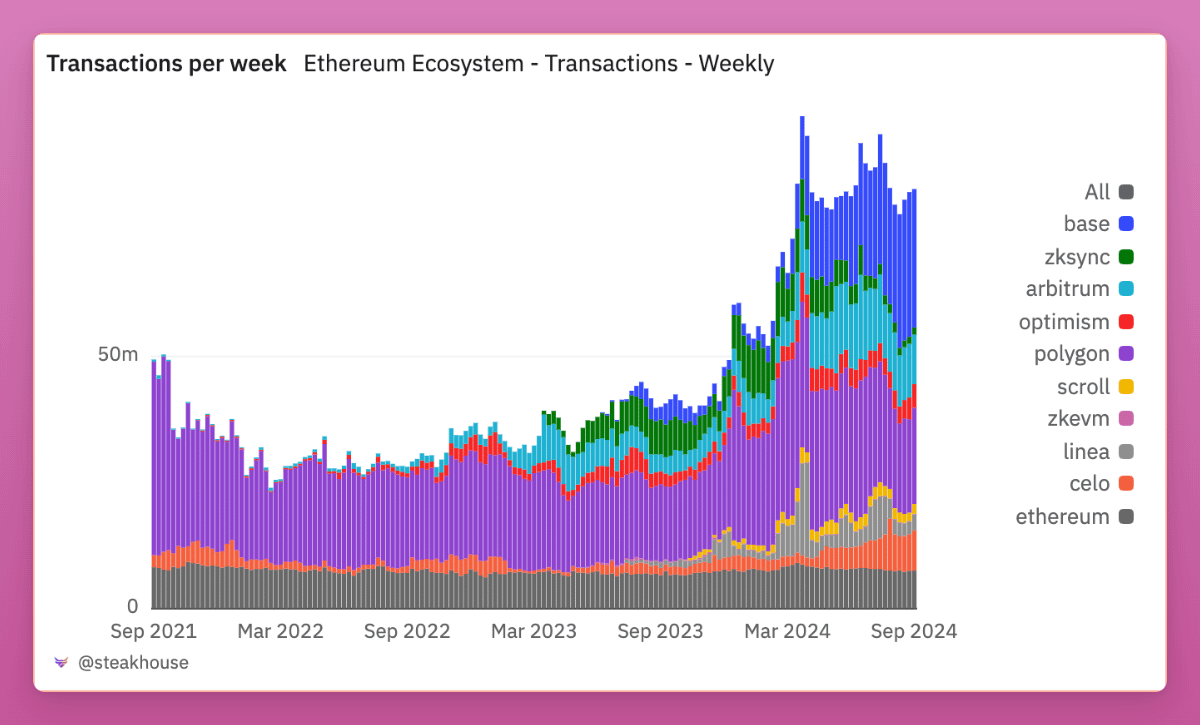

Regarding the current status of L2 – Base is the highlight, while others are relatively inferior.

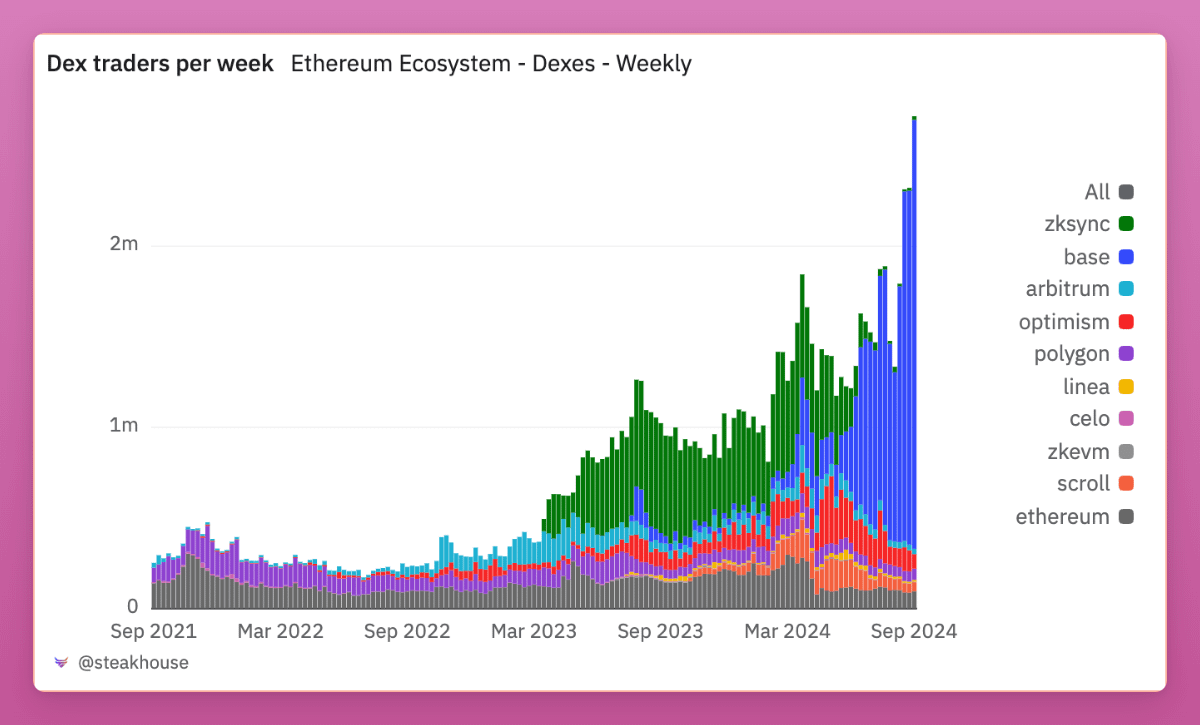

The good news is that activity on L2 is growing rapidly. The number of active wallets and weekly transactions are both increasing, and the volume on decentralized exchanges has also been on an upward trend for a year.

However, Base is growing much faster than the others. Please see the blue line in the chart which represents the number of weekly active wallets.

Base continues to attract new users while other L2s lose users. This growing dominance is particularly evident in the number of traders on decentralized exchanges, where Base holds a whopping 87% of the market share!

So, what is going on?

Base first launched the Smart Wallet during the Onchain Summer event. While the ability to create a wallet through Passkeys is novel, I mainly minted multiple NFTs through this app just to experience it.

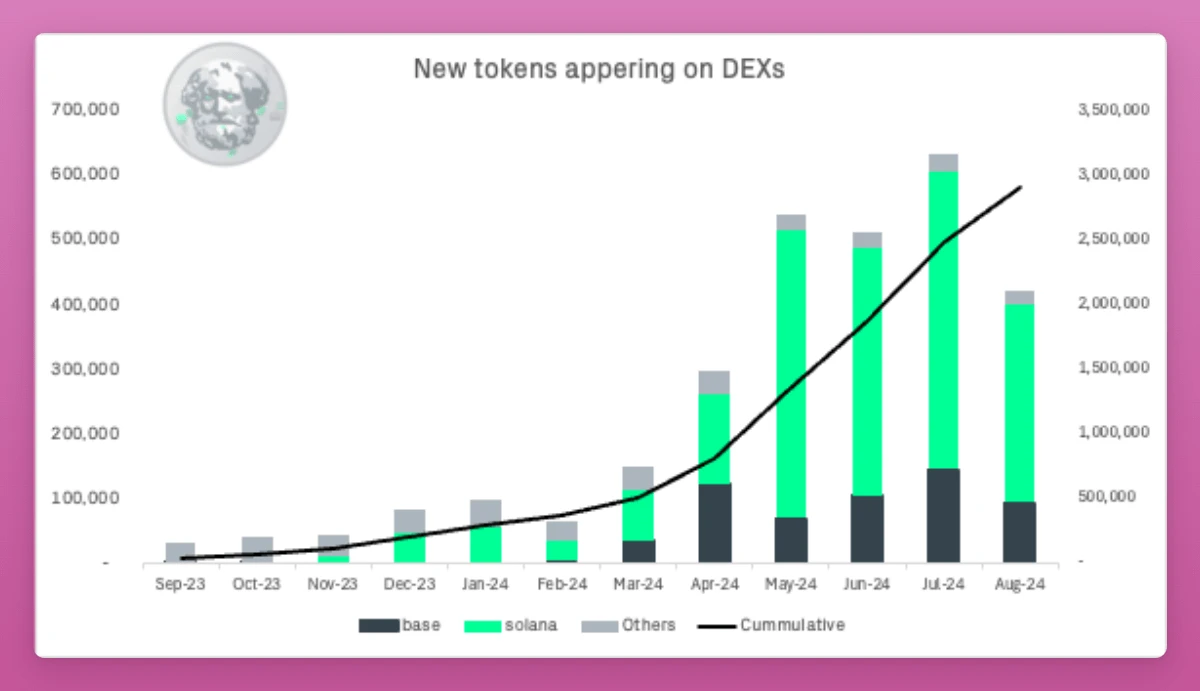

However, the real highlight of Base this summer is the speculation around meme coins, which has greatly driven the transaction volume and the number of wallets to all-time highs. It can be seen that Base and Solana are the main driving forces for most new token issuances on decentralized exchanges.

Quelle: Archimed Capital

Surprisingly, even though the meme coin craze has faded and summer has ended, trading volumes have remained high.

This may also be related to the airdrop: multiple crypto industry insiders I met during KBW speculated that the launch of Base Token is a high possibility. So, be sure to create your smart wallet and try an app or two. Farcaster may be a good choice 🙂

About SocialFi

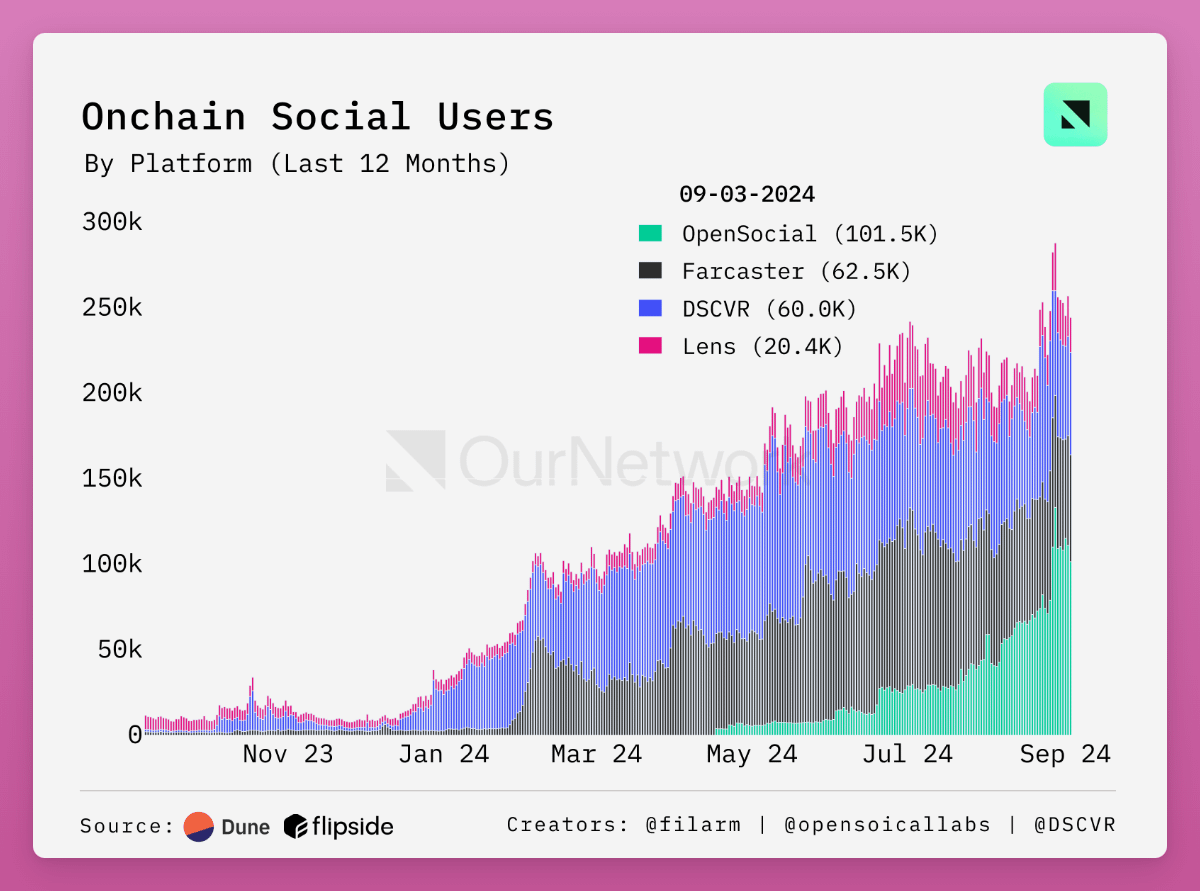

While there is some dissatisfaction with Racer and Friend Tech, SocialFi is another area that has seen significant user growth.

While Farcaster and Lens have a higher profile on X, APAC’s OpenSocial Protocol recently reached 100,000 DAUs, surpassing Farcaster’s 65,000 and Lens’ 25,000 combined. However, few people on X seem to understand the specific features of OpenSocial. Solana-powered DSCVR has also quietly reached 60,000 DAUs, but has barely attracted any attention.

Despite my losses on Friend.tech, I remain bullish on SocialFi. SocialFi is one of the few sectors in crypto that has transcended pure speculation. Vitalik Buterin mentioned in an AMA that he is most bullish on the decentralized social media sector.

Yano pointed out that OpenSocial was overlooked because crypto news media and X are mainly dominated by the West, while OpenSocial originated in Asia: Indonesia, Vietnam and India are its main sources of users, with the United States ranking fourth.

OpenSocial is committed to building a decentralized social platform that gives creators and communities full control over their social networks and data. Users can build and manage their own social applications, communities, and assets independently without relying on large platforms such as Facebook or Twitter. This provides users with more control, ownership, and opportunities to profit from content interactions, making social media more open and fair.

Similar to Lens and Farcaster, OpenSocial is a platform that hosts multiple applications and interfaces. Among them, Social Monster (SoMon) leads in terms of daily active users. You can try it here , although the current experience is still full of loopholes…

The point to highlight here is that the narrative around cryptocurrency is often dominated by Western audiences, but in reality, real users around the globe may use cryptocurrency in different ways than described by the crypto OGs on X.

Understand current market conditions with quick charts

I want to share a few data points to help you understand the current state of our market.

According to the IPOR Stablecoin Index, on-chain leverage has subsided as lending rates have returned to levels seen before the 2023 market rally. During the period of active airdrop activity, lending rates had risen sharply, but due to the poor performance of the airdrop, many investors chose to close their revolving positions.

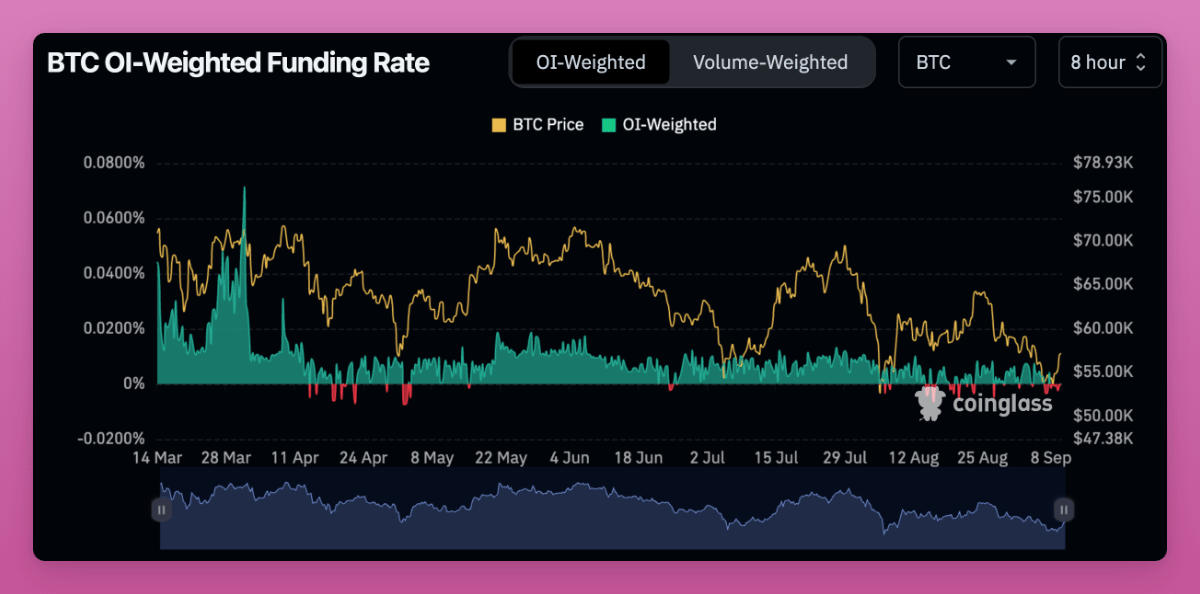

We can also clearly observe a leverage reset in Bitcoin open interest rates.

Note that the funding rate was higher in March, turned negative in April, and was negative again in July and August. Negative rates mean that shorts need to pay longs, which usually indicates that traders expect the market to fall. However, open interest (OI) is now back to positive.

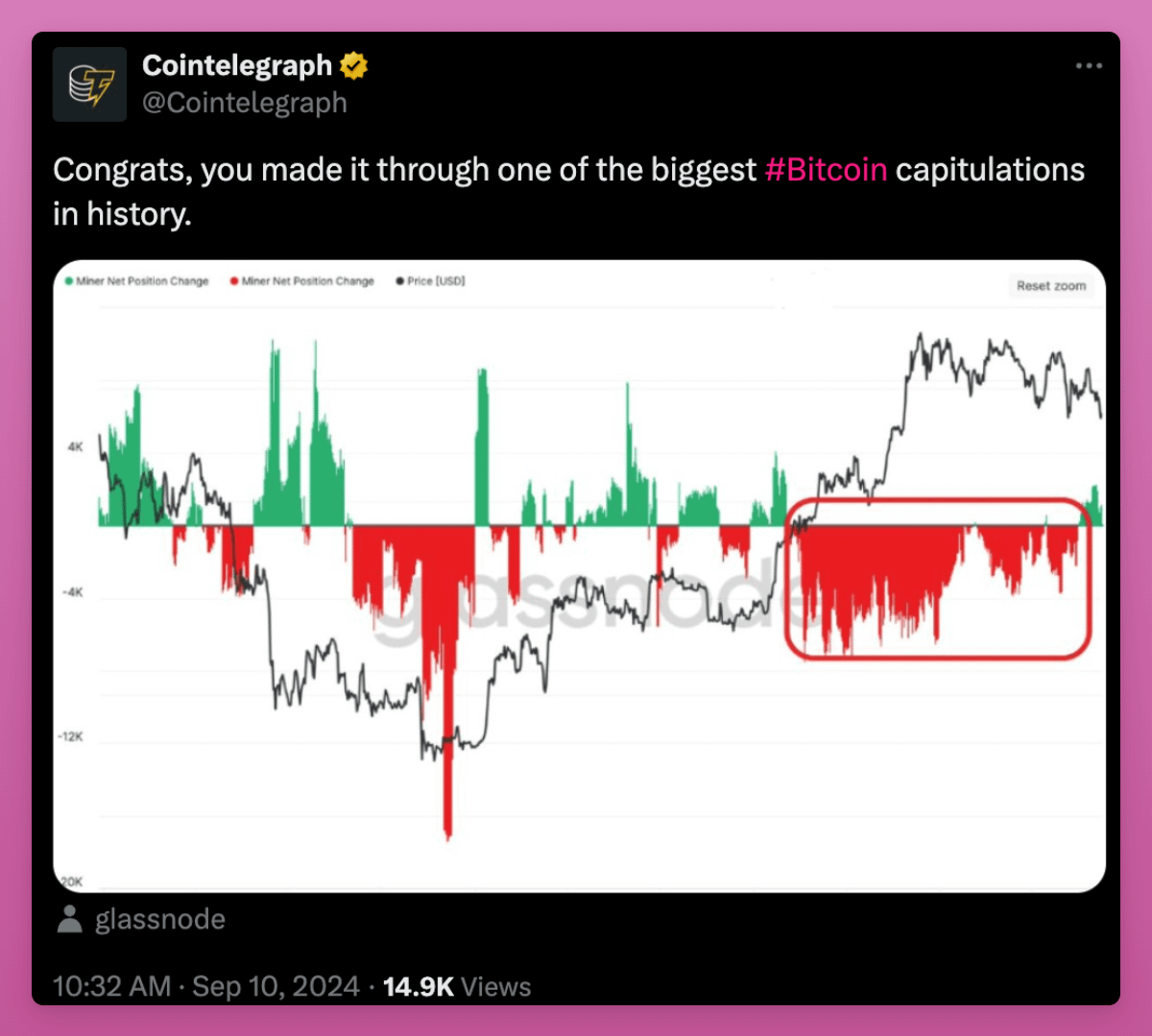

Another bullish indicator is the selling behavior of miners. Miners seem to have stopped selling and have started accumulating Bitcoin again.

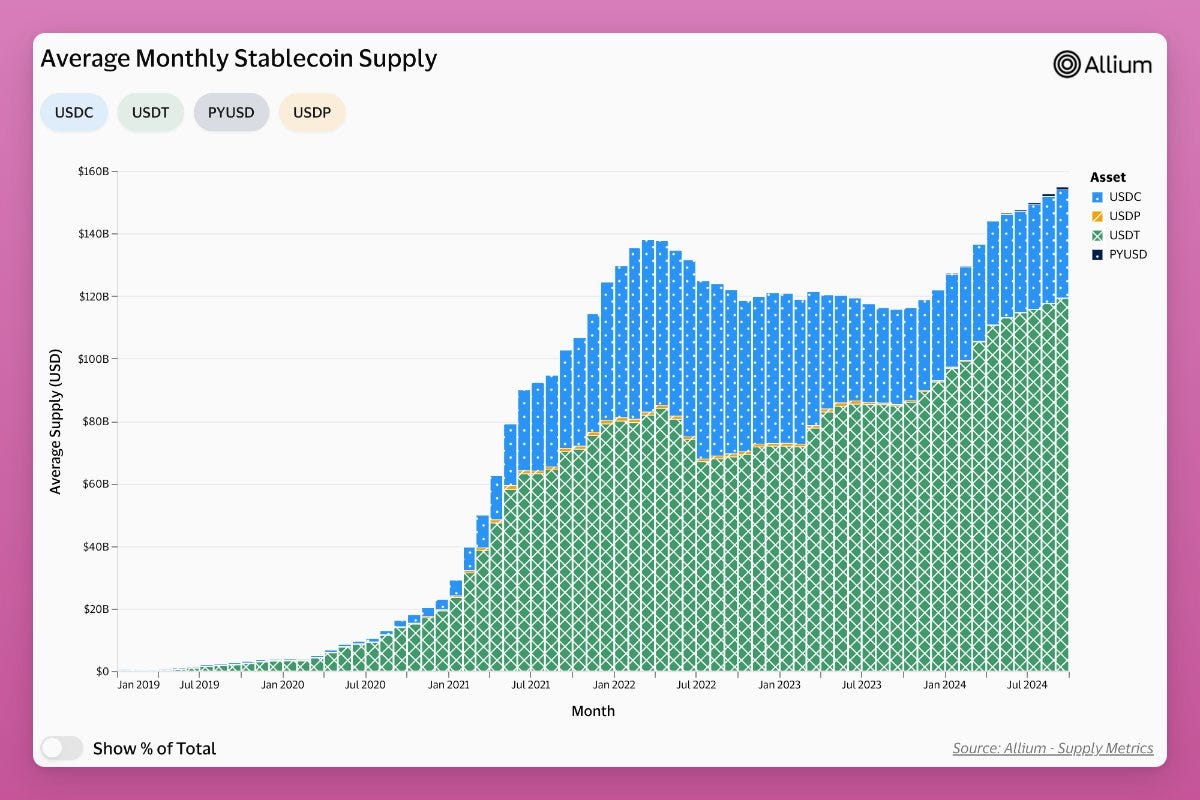

Perhaps a more bullish chart is the supply of stablecoins: their total supply is continuing to grow.

However, the biggest difference is that the supply of USDT is increasing, while the supply of USDC is decreasing from $55 billion to $34 billion. Why is this happening?

First, the Silicon Valley crash caused USDC to decouple, marking the peak of USDC supply. Nic Carter proposed another possible explanation : US policies are driving investors to less regulated offshore stablecoins, so USDCs growth is stagnant while USDT is expanding.

If this is the case, then pro-cryptocurrency regulatory policies in the United States could be a favorable factor driving USDC higher.

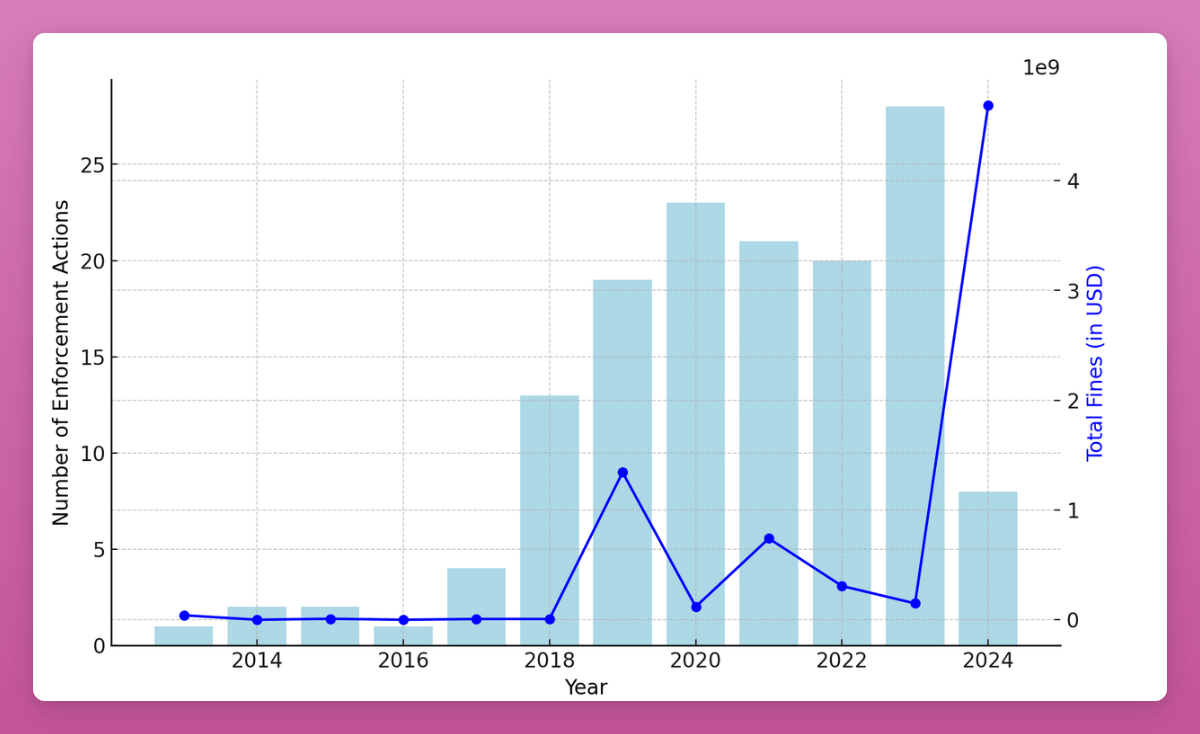

Regarding regulation, the U.S. Securities and Exchange Commission (SEC) collected $4.7 billion from crypto companies in 2024. This is a 30-fold increase from 2023.

These funds could have been used for cryptocurrency investments, but instead went to government officials rather than real victims in the crypto space.

Of course, the bulk of that was the $4.47 billion settlement with Terra. The good news is that the Social Capital report states that “the SEC is issuing fewer fines but more, focusing on high-impact enforcement actions that set precedents for the industry as a whole.”

This is not a good sign. We need the current government to change its negative attitude towards cryptocurrencies or replace it with new policies.

Summary: Will the market go higher or lower?

The current situation does not seem optimistic.

The ISM index is falling, ETH ETF demand is weak, and risk investors are cautious. These are not ideal market conditions. However, this is exactly how the market heals itself. In fact, when everyone is panicking, it often means that we may be closer to the bottom of the market than we think.

Although there are a lot of bearish data, there are also many positive signals. L2 solutions are performing well (especially Base), social platforms such as Farcaster and OpenSocial are growing, and market leverage has been cleared. Although the market heat has declined, it remains active in some key areas.

The current regulatory environment is quite chaotic. The SEC has been putting pressure on the cryptocurrency space. We need a change in US regulatory policy or a change in leadership to curb this situation. Regulatory policies that support cryptocurrencies may be a catalyst for the market to rise. Until then, the pressure remains. However, even if the Democrats come to power, they may need to deliver on their promises by increasing the money supply. In such an environment, Bitcoin is the most advantageous asset.

Ultimately, markets dont move in a straight line. We are in a phase where market sentiment is volatile, but thats not a big deal. Stay focused, follow the data, and dont get sidetracked by market noise.

Bullish trends are often not obvious until they are obvious. All in all, I remain bullish on the market outlook.

Of course, I could be wrong.

This article is sourced from the internet: Data interprets the current market situation: Will it go higher or lower in the future?

SOFA.org is a non-profit DAO organization dedicated to developing a decentralized clearing protocol. On August 29, SOFA.org had an in-depth discussion with Mr. John Cahill, COO of Galaxy Digital Asia, to explore the long-term value of the project as an industry-grade settlement system and its secure and reliable on-chain structured product suite. The discussion was hosted by the Real Moonlight Show on Binance Live. SOFA.org was established to lay the foundation for a digital clearing and settlement ecosystem for handling any financial asset on-chain, including RWAs and tokenized assets. SOFA.org was developed by professionals with rich institutional backgrounds to provide ordinary users with on-chain access to innovative products while leveraging the inherent security advantages of blockchain to ensure end-to-end transparent workflows and asset security. SOFA.org can completely eliminate trade execution…