friend.tech gab auf, das Wachstum von Farcaster stagnierte … Warum sind soziale Netzwerke so schwierig?

Original | Odaily Planet Daily ( @OdailyChina )

Autor: Azuma ( @azuma_eth )

There were two negative hot spots in the decentralized social track today.

One is that the friend.tech team has set the Admin and ownership parameters to 0x 000…000, which means that the teams developers have given up control of the smart contract and the protocol will not be upgraded or improved in the future. Many disappointed users and investors pessimistically interpret this as friend.tech having chosen a soft rug.

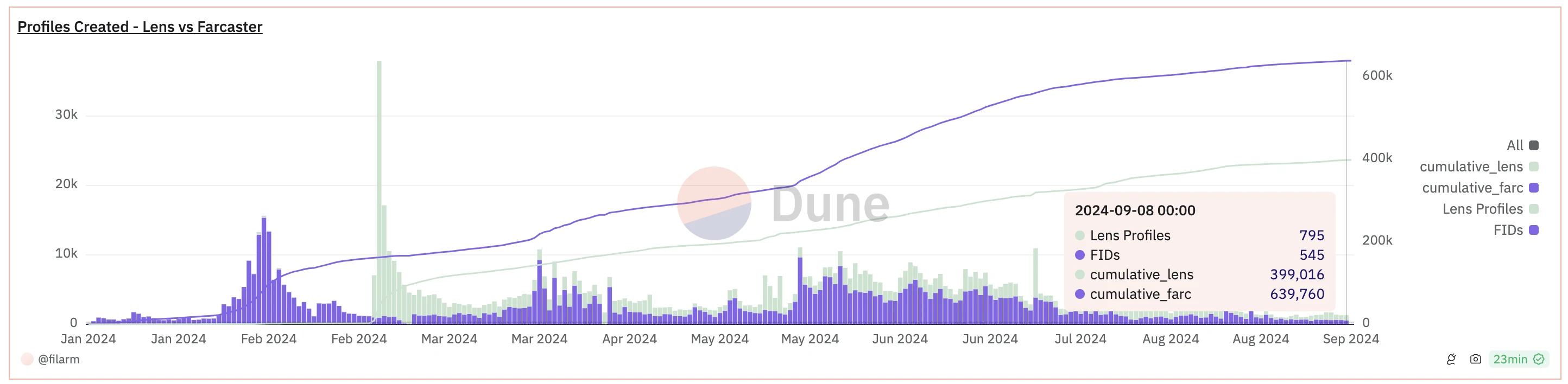

Another is that Farcasters new user growth has almost stagnated , with the number of new users on September 8 being only 545, a significant drop from the peak of about 15,000 in February this year.

As two phenomenal hot projects in the decentralized social track, friend.tech and Farcaster have experienced a surge in traffic in the fall of last year and the spring and summer of this year. The former launched the token FT in March this year after receiving financing from Paradigm, while the latter received a $150 million Series A financing led by Paradigm in May with a valuation of $1 billion. The two major protocols have driven Die popularity of the entire track by their explosion at different stages.

In May this year (shortly after Farcaster raised funds), Fred Wilson, co-founder of USV, the lead investor in Xs (then still Twitter) first round of financing, and venture capitalist, wrote on X that his X account had been dormant for the past 18 months, but during these 18 months, he had been active on Farcaster and shared his views on technology, startups, venture capital, music, life, etc. on the chain through the protocol. Fred also called on his X followers to follow his Farcaster account instead.

At that time, many believers in decentralization regarded Freds declaration as a milestone event of decentralized social networking is about to explode, but in retrospect, it was more like a short-term high point of a round of market . In the following months, the traffic observed from friend.tech, Farcaster, Lens and other products showed a downward trend, and this trend was more prominently presented today with the fermentation and discussion of the above two hot events.

Why is social networking so difficult? This is not a problem unique to Web3. Looking back at the development history of Web2 social networking, you will find that there are only a few successful ones and countless failures. In general, creating a universal social product is a very difficult challenge. Customer acquisition, retention, and allowing users to establish new relationships in new products are all extremely complicated.

Three major obstacles to decentralized social networking

Combining the cases of setbacks in decentralized social networking, we can roughly attribute them from three perspectives.

First, current decentralized social products generally lack certain irreplaceable advantages, making it difficult for users to form a must-have demand for them.

In other words, the product itself is not irreplaceable at the social level – What I can do with you, I can do elsewhere. This is a challenge that all emerging social products need to face, because traditional social giants have almost covered all potential service directions, and it is difficult for new products to find a functional innovation that is strongly related to demand.

As for friend.tech, its innovation is more focused on the Fi side of SocialFi, that is, realizing the monetization of influence and the circulation of value through Key, but the social level has not brought any substantial changes; Farcaster and Lens are almost replicas of X in terms of social functions. Although the on-chain social graph based on addresses also has certain innovative significance, it has little to do with user needs.

From this point of view, the cases that are more worthy of reference in the Web2 field are TikTok, which broke through with short videos, and Discord, which is irreplaceable in large-scale community management scenarios.

Second, current decentralized social products have obvious disadvantages in terms of network effects.

The so-called network effect can be simply explained as the value of a single product increases as the number of users using the product increases, and this value will also be fed back to all individuals using the product.

In this regard, Farcaster actually did quite well in the early days. The protocol formed a high-quality user group with certain technical characteristics by attracting a group of investors, founders, and developers. The collision of ideas among this group also attracted a large number of loyal users who were seeking knowledge. I remember that Farcaster co-founder Dan Romero would hold exclusive AMAs on the platform in the early days, and invited Vitalik, Coinbase founder Brian Armstrong and other bigwigs to attend and comment with the help of personal resources. As a media worker, I also once regarded Farcaster as an irreplaceable source of information.

However, the problem is that only a small number of people are obsessed with technical discussions, and the PGC model such as high-quality AMA is not scalable, which makes it difficult for Farcaster to maintain its early growth. From the perspective of ordinary users, especially those who have certain needs for content promotion (such as project parties and KOLs), the social reach effect within Farcasters own traffic pool is still not ideal, and the value feedback that individuals can obtain is relatively low – I want to get brand exposure, why not go to X; I want to attract new users, why not go to Telegram…

Third, the current decentralized social products have generally seen a decline in wealth effect, which is the most critical and fatal problem.

The so-called wealth effect can essentially be understood as a subsidy mechanism for users. The entry threshold of the Web3 world is already high, and the user profile is more speculative, so users need to be given more sufficient value subsidies to attract users to abandon mainstream social platforms and switch to new products.

In response to this, Yan Meng, co-founder of Solv Protocol, commented on X today: Essentially, the new Web3 Social platform cannot afford the migration costs of users. Users just want to add a payment transaction function. You want them to give up their social relationships and data assets accumulated over many years. Well, its not impossible, but how much do you want to pay? The more active people on Farcaster are his investors or relatives. If it develops, their migration costs can be reimbursed. What about ordinary users? No hope.

For decentralized social products, the “subsidy” mechanism is presented in the form of tokens (including tradable NFTs), but the effectiveness of this mechanism has long been greatly reduced. On friend.tech, FT is now temporarily reported at 0.073 USDT, which has fallen by more than 97% from the high of 3.26 USD. The price trend of Key itself has been criticized; and on Farcaster, with the growth of the total number of users and the decline of the airdrop benefit effect in the industry, the expectation of airdrop profit is also declining… This has caused the subsidy mechanism of new decentralized social products to gradually fail, thereby weakening the attractiveness of the product itself.

It’s too early to say no, but new exploration is needed

As mentioned earlier, the popularity of decentralized social networking a few months ago was like the short-term high point of a market trend. Based on this logic, we are unwilling to regard the current low point as a failure of decentralized social networking, but would rather regard it as a periodic low point in the long-term market trend.

Although friend.techs exit seems to be a foregone conclusion from the perspective of individual products, more decentralized social products including Farcaster, Lens, and UXLINK still have ample development potential. Looking to the future, we are looking forward to decentralized social products finding unique innovation directions and irreplaceable positioning at the social level, and we also hope that more products can gradually accumulate considerable network effects through various strategies.

At the same time, we also hope to see more attempts at decentralized social products at the Fi level. Although friend.tech has failed, its exploration at the Fi level is still worthy of recognition. Blockchain and tokens naturally have financial attributes, and a good economic model design may be a potential path to achieve a sustainable wealth effect (subsidy mechanism).

This article is sourced from the internet: friend.tech gave up, Farcaster’s growth stagnated… Why is social networking so difficult?

Related: GoPlus Research: Deep into Eigenlayer, designing and building AVS

Original author: GoPlus background From last year to today, EigenLayer, as a core narrative in the Ethereum ecosystem, has accumulated more than $10 billion in TVL. However, most people may simply regard it as a financial infrastructure, mainly because the most well-known feature of EigenLayer is its Restaking concept. This initial impression makes it easy for people to think that EigenLayer is just a platform that helps users get additional staking income. In fact, when we think deeply, a key question emerges: Why can re-staked ETH or LST (liquidity staking tokens) generate additional income? The answer to this question reveals the true nature of EigenLayer. I think EigenLayer is actually a revolutionary financial-driven cloud computing infrastructure. This definition may sound contradictory at first, but it precisely reflects the innovation of…