Das Telegrammbenutzerporträt wird zum ersten Mal im gesamten Netzwerk veröffentlicht: Wie lange dauert es im Vergleich zu WeChat?

Written by: Evan, Joy, Aaron J, Waterdrip Capital

1. Now is the time to prioritize Mass Adoption

Mass Adoption has always been the core challenge of Web3. However, the market tends to focus on short-term wealth effects and ignore the sustainability of projects and the key factors to achieve Mass Adoption. Since the launch of BTC in 2009, only centralized exchanges such as Binance have become the first typical products in the Web3 field to achieve Mass Adoption with their user base exceeding 200 million.

With the approval of BTC ETF, the market ushered in a bull market that belongs exclusively to BTC OGs and believers. In contrast, due to insufficient liquidity, the performance of new coins is unsatisfactory, and altcoins are far from showing the phenomenon of flourishing in the last bull market. Most Web3 users have not enjoyed the prosperity of the bull market. In the last bull market, the number of crypto users increased rapidly from less than 50 million users in 2019 to 420 million in 2022, an increase of about 10 times. However, from the beginning of 2024 to date, the number of global crypto users has only increased by 30 million users, a much lower growth rate than the last bull market.

Global Web3 user growth chart, data source: Triple-A, https://www.triple-a.io/cryptocurrency-ownership-data

From a first principles perspective, the fundamental reason for the gap is and for this reason, now is the critical moment to put Mass Adoption into explicit construction.

2. Obstacles to Web3’s Mass Adoption

A16Z emphasized in its big-ideas-in-tech-2024 report that simplifying user experience is the basis for Web3 to achieve Mass Adoption.

Binance pointed out in its Road to One Billion On-chain Users report that achieving Mass Adoption requires two core conditions: one is that there are on-chain applications that users want to use; the other is that these applications must be easy to understand and access. Many products that have achieved product-market fit (PMF) and successfully passed the cycle have confirmed these two core conditions. At the same time, the crypto industry also needs to build the necessary infrastructure, tools, and public awareness to make the concept of digital ownership easy to understand and access for the global community.

Mark Suster, managing partner of Upfront Ventures, a long-established venture capital firm in Los Angeles, mentioned that if you want to build a Mass Adoption product, in addition to PMF, you also need to make the product profitable and have a large enough target market.

Mass Adoption is not only about acquiring users, but also about capturing the liquidity in the hands of users.

IOBC Capital believes that solving the compliance channel problem for traditional institutions to enter Web3 is also the key to Web3s mass adoption. Compliance issues are regarded as soft infrastructure. With the approval of BTC/ETH ETF, the establishment of BlackRock RWA Fund, and the candidates in the US presidential election adding the construction of Web3 to their campaign promises, the development of relevant policies and compliance channels has shown a steady and irreversible trend.

To sum up, Web3 needs to meet the following conditions to achieve Mass Adoption:

1. Satisfy a real need (i.e. PMF);

2. The target market is at least several billion people or tens of billions of US dollars;

3. Low user adoption threshold and high product usability;

4. The upstream and downstream supply and infrastructure that support the core value and experience of the product are mature;

5. Ability to acquire users on a large scale and accurately;

6. Have a long-term sustainable business model.

We can see that there are many projects in the Web3 field that have been focusing on conditions 1-4 and are constantly improving. Telegram and TON have brought dividends to condition 5. However, there has been little progress in condition 6. The core logic is:

-

PMF ≠ Business Model. A good product does not mean that you can make money.

-

Without sustainable profitability, it is difficult to acquire customers on a large scale and accurately over a long period of time. After all, airdrops can only bring low-cost bursts to projects in the early stages. If there is no sustainable profitability, who will pay for the airdropped chips in the long run?

Looking back at the last cycle, DeFi, GameFi, NFT and Metaverse all provided sufficient impetus for Mass Adoption, and they all matched the above requirements: Axie Infinity and YGG solved the income problem of a large number of unemployed people in the Philippines during the epidemic, and STEPN matched the fitness needs of users and lowered the threshold for users through the built-in wallet. However, so many projects that have achieved remarkable results, but due to the lack of sustainability of the business model, the value of non-financial return products cannot impress users to pay, resulting in their inability to continue the mission of Mass Adoption. This provides us with valuable experience and lessons.

3. Advantages and challenges of TON ecosystem in achieving Mass Adoption

3.1 Advantages

A social fission network based on 1 billion users — capable of acquiring users on a large scale

As of now, Telegram has 950 million monthly active users, and its social network provides a broad space for the implementation of social fission marketing for the project. Social fission (Word-to-Mouth) marketing is one of the most efficient ways to acquire customers on a large scale, and large-scale and efficient acquisition of users is an important prerequisite for achieving Mass Adoption.

Comparison of marketing methods and channel effects in the Web2 era, data source: Miniton

Relying on this advantage of the TON ecosystem, the TON ecosystem has successfully nurtured multiple ecological projects with tens of millions of users, of which 60% of active projects are in the game category. Among them, Notcoin was the first to achieve this goal, attracting more than 35 million crypto users since its launch. Its token $NOT took less than a month from launch to release on the exchange, and achieved a 400% increase within two weeks of launch, becoming one of the few Alt Coins with outstanding performance in this round of bull market.

Further attract developers through the mini program framework – maximize coverage of end-user needs (PMF)

For the ecosystem and infrastructure, the PMF of a product is a probabilistic problem. The ecosystem can solve the PMF problem by increasing the number of products – eventually there will be a product that meets the needs of users. Obviously, the combination of Telegram mini-programs + TON ecosystem has attracted a large number of developers to develop a large number of mini-programs to infinitely meet the various needs of users.

The reasons why developers have settled in Telegram and TON are very clear: there are a large number of users here, and the conversion rate from exposure to opening the application is very high: the mini program provides users with the shortest access path, without entering the URL or downloading, just click and use – this not only lowers the user threshold, but also improves the products conversion rate of acquiring users.

Banana Gun is a Telegram bot that will be available on Binance on July 18, 2024. It not only facilitates automated and manual trading on the Ethereum network, but also supports users to manually buy and sell tokens on the Solana network. Banana Gun’s success is undoubtedly due to the bot and applet support provided by Telegram, as well as the advantage of reaching users on Telegram.

Highly integrated MPC wallet — low threshold and high ease of use

TON currently provides two wallet tools for users: Telegram Wallet and TON Space. Except for users in the United States, all other users can open Telegram Wallet by adding a wallet robot and start TON Space in the Telegram Wallet applet. When trading in the Telegram app, from registering and opening an account to transferring money to every payment, Telegram Wallet provides the most convenient user experience at present, with an experience close to that of WeChat Pay.

With the low-threshold wallet provided by the TON ecosystem, Catizen in the TON ecosystem has achieved a 10% on-chain user conversion rate, with 25 million players, approximately 1.5 million on-chain game players and more than 500,000 paying users worldwide, with in-game revenue exceeding US$16 million.

On July 23, Binance Labs announced an investment in Catizens issuance platform Pluto Studio. He Yi, co-founder of Binance and head of Binance Labs, said: Binance Labs has always been keen to support projects like Pluto Studio that have the potential to attract billions of users to Web3. We look forward to supporting more visionary builders who aim to build products designed for mass adoption.

3.2 Challenges

Single reliance on Telegram

The biggest advantage of the TON ecosystem is that it has the official exclusive support of Telegram: it is the only Web3 infrastructure integrated with Telegram and promoted within it. This is both an advantage and the biggest risk. Any changes in Telegram may have a systemic impact on TON. For example, on the day when Telegram founder Pavel Durov was arrested, the TVL of the TON ecosystem fell by more than 60% in a single day, highlighting the systemic risks behind a single reliance on centralized organizations.

DeFi track is underdeveloped

Although users are the basis of funds, not all products and teams have the ability to monetize traffic. We believe that the current widespread lack of payment ability of Telegram users is not an ecological problem, but a product form and team problem. For example: Catizen and a considerable number of Trading Bots/applets have captured the liquidity behind Telegram traffic very well. At the same time, in the high-income Web2 WeChat mini-games, about 60% of the traffic comes from decentralized product fission. Despite this, the TVL scale of the TON ecosystem is still unreasonable, which is mainly related to the lack of projects in its DeFi track. At present, STON.fi Und DeDust account for 80% of the total TVL of the TON ecosystem.

Imperfect commercial services

Developers usually focus on four aspects of the ecosystem:

1. Platform scale

2. Completeness of infrastructure

3. Efficiency in reaching users

4. Support for traffic monetization

Among these four aspects, the 3rd and 4th points are commercial services/infrastructure. In these two aspects, TON has only achieved 50% of each point.

In terms of reaching users, TON has achieved large-scale and efficient reach: the current customer acquisition model of the TON ecosystem, excluding the sharing fission model, mainly relies on the non-performance marketing CPM method of Telegram Ads and the point wall diversion between mini programs. However, due to data privacy protection, accurate reach and performance marketing cannot be achieved unless Telegram violates its product principles and collects a lot of user privacy data.

In terms of traffic monetization, TON provides excellent payment tools, such as Web3 payment tools Telegram Wallet and TON Space, and Web2 payment tool Telegram Star. However, most of the products that best match user needs are not suitable for paid monetization methods, such as free tools and light games. These free products that are not suitable for paid monetization are often

Establishing a stable and reliable business model is an indispensable prerequisite for products to achieve Mass Adoption. The inadequacy of TON ecosystem in business services/infrastructure seems to have become the last unclear obstacle to building Mass Adoption products.

There are also many players in the issue of business model sustainability. MiniTon is a commercial monetization service provider funded by the TON Foundation. It provides TaaS (Tournaments as a Service) profit solutions for casual game and competitive game developers, helping them get rid of the dilemma of relying solely on advertising monetization. It also reconstructs the social operation model of games based on the Friend Tech protocol to establish a sustainable and stable Web3 business model.

The profit model of competitive games (EF RK) is listed as one of the three major game monetization models along with the profit model based on advertising (IAA) and in-game purchases (IAP). This model has been widely used in PvP games such as chess and card games. The annual market size of such games in the Web2 market exceeds 30 billion US dollars, and it has always been the best-selling category in social programs, and is known as the driving force of Mass Adoption in the Web2 field. MiniTon uses encryption technology to not only seamlessly combine the profit model of competitive games with Telegram, but also use encrypted social protocols to optimize the operating model of PvP games with a market size of more than 30 billion US dollars.

MiniTon received key investment and incubation from Waterdrip Capital in the early stages of its development. Currently, MiniTon has provided players with a social competitive platform. Through game battle contracts, players can also experience e-sports in stand-alone casual games and establish new social connections. Developers can access the monetization solution provided by MiniTon in just 1.5 days of development time by accessing the SDK.

So far, MiniTon has completed the Alpha I closed beta test, with 30,000 users participating in the beta test and a 1% payment conversion rate. It is expected to launch the Alpha II test version at the end of September and expand the test scale to hundreds of thousands of users.

It is worth noting that MiniTon’s game contract is a multi-chain protocol that does not rely entirely on a single ecosystem and therefore has a strong ability to resist systemic risks.

4. How much success and failure experience can the TON ecosystem learn from WeChat?

4.1 Is WeChat worth considering?

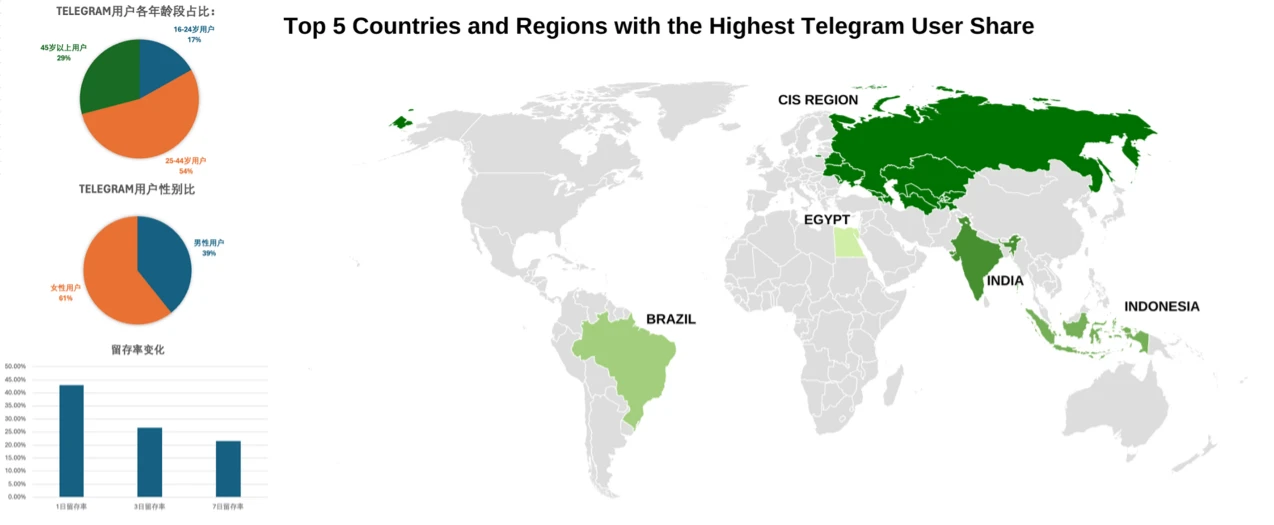

WeChat and Telegram are both social products, with communication and social relationships as their core. However, there are huge differences between Telegram users and WeChat users. The following is Telegram user data for the past week based on third-party monitoring:

Telegram user data at a glance, data source: Waterdrip Capital

4.2 The user profiles of Telegram and WeChat users are different:

Apart from the differences in geographical distribution of people, the most significant difference between Telegram and WeChat lies in the usage habits of users:

-

WeChat is a typical social networking application for acquaintances and strong social relationships, while Telegram is a pan-social relationship application, more similar to QQ.

-

The average daily usage time of WeChat is 1.5 hours, and the average daily usage time of Telegram is 0.5 hours.

As of the end of June 2024, the number of monthly active users of WeChat Mini Programs has reached an astonishing 930 million, with a penetration rate of over 90%. The customer acquisition advantage, coupled with WeChats mature commercial service infrastructure, is the core reason why developers have achieved success in the WeChat Mini Program ecosystem.

1. Ultra-light user access path: no need to download or enter URL, just click and use

2. Effective customer acquisition based on social relationships: about 60% of traffic comes from user sharing

3. New incremental market: According to data, the monthly active users of WeChat mini games will reach 755 million in February 2024, even exceeding the 650 million users of mobile game apps.

4. Efficient commercial service system: Based on WeChat advertising and WeChat payment, the revenue of mini games will reach 3 billion US dollars in 2023

Telegram Mini Program already has the first three advantages mentioned above. Compared with WeChat, Telegrams shortcomings are particularly obvious:

1. Users have weak paying ability: Most users come from areas with low paying ability;

2. Unable to deliver precise advertising: Due to the principle of privacy protection, it is impossible to provide precise marketing services like WeChat advertising, and it is difficult to attract high-net-worth or target users;

3. Low payment penetration rate: The penetration rate of Telegram wallet is only 5%, while the penetration rate of WeChat Pay is 92.4%.

But it is undeniable that Telegram is still the product with the highest penetration rate in the crypto market. By cutting into the existing high-net-worth crypto market users, the current shortcomings of the Telegram applet can be offset. Therefore, the successful model of the WeChat applet is worth referring to.

4.3 Project construction paths that can be referenced from the WeChat mini-program/mini-game ecosystem

By reviewing the development history of the WeChat mini-game ecosystem, we found that the survival of WeChat mini-game developers is highly dependent on the level of developer services provided by WeChat.

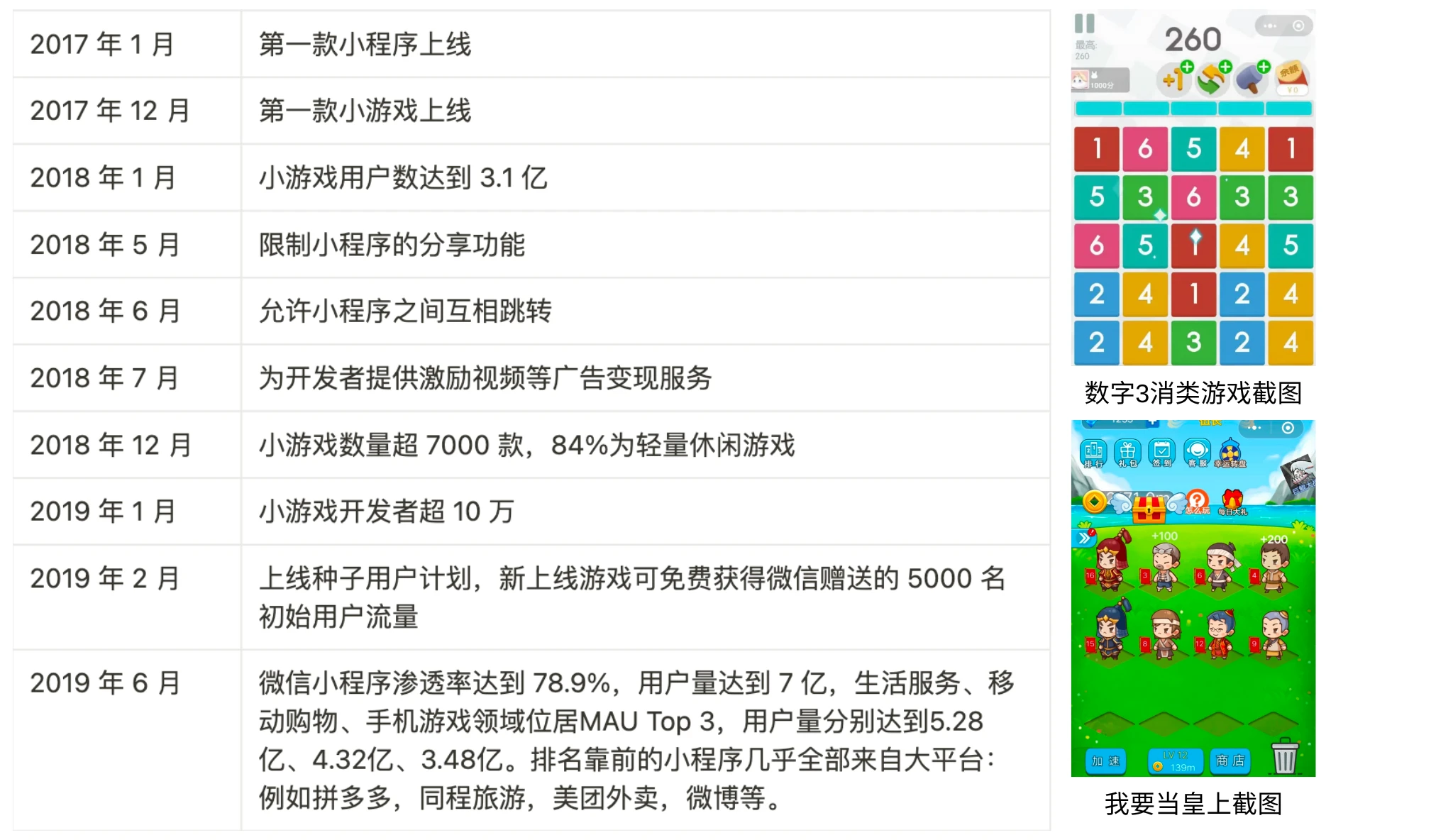

WeChat Mini Program development timeline and project examples, source: Waterdrip Capital

Timeline of the wild growth of WeChat Mini Programs

-

During this stage, WeChat operations lagged behind and the ecosystem developed barbarically: since a large number of users could be easily obtained through fission sharing, there were a large number of skin-changing games that took 5 days to develop and 3 days to recover costs after being launched, resulting in relatively rough game quality.

-

During this stage, mini-games are distributed in a decentralized manner, and the main source of customers relies on other mini-programs and WeChat advertising.

-

During this period, the revenue of mini-games and free mini-programs mainly came from advertising (IAA) monetization, that is, importing users to other mini-games or mini-programs, and connecting to WeChat advertising monetization plug-ins.

-

It is worthwhile for Web3 developers to refer to: By comparison, Telegram is also in the current stage. Excluding the phenomenal game “Pirates Are Coming” during this period, 98% of the top 50 games during this period were casual and casual competitive games. For example, “Happy Landlord”, “Digit Match 3”, “Brain Fight”, “Geometry Escape”, “I Want to Be the Emperor”, etc. The gameplay of “I Want to Be the Emperor” is the same as that of Catizen today.

2020-2022, Ecological Adjustment

-

This period had certain macro-specificities during the epidemic. For example, the health code mini program had 800 million users in 2020.

-

As of October 2022, the number of monthly active users of WeChat Mini Programs reached 1 billion. On the one hand, the WeChat Mini Program ecosystem focuses on increasing the scale of traditional industries, such as education, medical care, and catering. On the other hand, it guides the gaming industry to improve product quality, provides developers with more than 100 functions and interfaces, and continuously improves its own commercialization (IAA and IAP) services.

-

During this period, the only phenomenal product of WeChat Mini Games was Sheep and Sheep. As WeChat continuously improved the requirements for the quality of game content and restricted the sharing and fission behavior, WeChat Mini Games showed a smile curve. But judging from the results, WeChats operation strategy was successful. Among the selected games, 50 games had revenues of more than 50 million, and 7 games had revenues of more than 100 million.

WeChat mini-game user smile curve, source: Waterdrip Capital

It is worth referring to for Web3 developers:

-

The best-selling games during this period were still casual competitive products, such as chess and card games. From the perspective of gameplay: card, MMORPG, management, and placement games had the highest revenue.

From 2023 to now, a stable outbreak

-

Thanks to WeChat Mini Games’ continued guidance of developers in developing high-quality content and continuous optimization of underlying technical support for mini games, a large number of mid-to-heavy and high-income games have emerged.

-

According to Tencents Q1 2024 financial report, the total user usage time of WeChat Mini Programs increased by more than 20% year-on-year. The revenue of WeChat Mini Games in 2023 increased by 3 times compared with 2022, and more than 240 games had quarterly turnover of more than 10 million in one year.

-

Reasons for the explosion of WeChat mini-programs/mini-games during this period:

-

Allowing WeChat Mini Games and Mini Programs to place ads on external platforms of WeChat (such as TikTok), further improving the efficiency of advertising;

-

Added live streaming customer acquisition channel;

-

The top best-selling game categories have gradually changed from being dominated by board games to: MMORPG, placement, card and management;

-

Commercial monetization has changed from single IAA or IAP to mixed monetization (both IAA and IAP).

4.4 Lessons TON can learn from the growth of WeChat mini-programs

-

We are constantly working to solve the issues that developers are concerned about (PMF), such as improving compatibility with game engines, improving customer acquisition efficiency, opening external performance marketing channels outside of Telegram to Telegram applets, increasing wallet penetration, and increasing support for commercial solutions.

-

Have the same rapid response speed as WeChat in adjusting to the market (in the early days of WeChat, there were multiple adjustments to its ecological operation policies every month);

-

Provide as much support as possible for each startup product, such as providing a special, free traffic support policy for each mini program (compared to the preferential policy of WeChat mini programs);

-

Encourage the ecosystem to produce high-quality content.

Quellen:

https://cointelegraph.com/news/hamster-kombat-guinness-world-record-200m-users

https://www.triple-a.io/cryptocurrency-ownership-data

https://www.blocktempo.com/how-to-judge-web3-socialfi-mass-adoption/

https://a16z.com/big-ideas-in-tech-2024/

https://www.binance.com/en/research/analysis/road-to-one-billion-on-chain-users

https://bothsidesofthetable.com/building-products-for-mass-adoption-e193e6c3226a

https://mp.weixin.qq.com/s/ n 805 J 3 icnFJB 88 eP 4 BQOhA

https://defillama.com/chain/TON

This article is sourced from the internet: Telegram user portrait is disclosed for the first time on the entire network: Compared with WeChat, how long will it take for TON to achieve Mass Adoption?

Related: BTC Ecosystem Fractal Test Network is Online, How to Interact with It for Free?

Although the market continues to fluctuate, the market seems to have begun to pay renewed attention to the severely oversold BTC ecosystem. The prices of related tokens have rebounded, and the inscription market has also warmed up slightly. Worried about being buried again by participating in secondary trading? Don鈥檛 worry, you can try the BTC ecological project鈥檚 airdrop for 0% off. Today鈥檚 0-step tutorial is about the BTC native expansion solution Fractal that I just interpreted last week (the original article can be found in the TechFlow article: Unisat鈥檚 explicit support, Bitcoin expansion solution Fractal鈥檚 light interpretation ) RGB ecological protocol BlockJoker As mentioned in the previous article, Fractal will reset the test network data many times. The last reset was completed last week (August 13). Now that Fractal has…