Vergleich neuer und alter VC-Coins: Diese neuen Coins sind aus der Wirtschaftlichkeit gefallen

Original | Odaily Planet Daily ( @OdailyChina )

Autor|Nan Zhi ( @Assassin_Malvo )

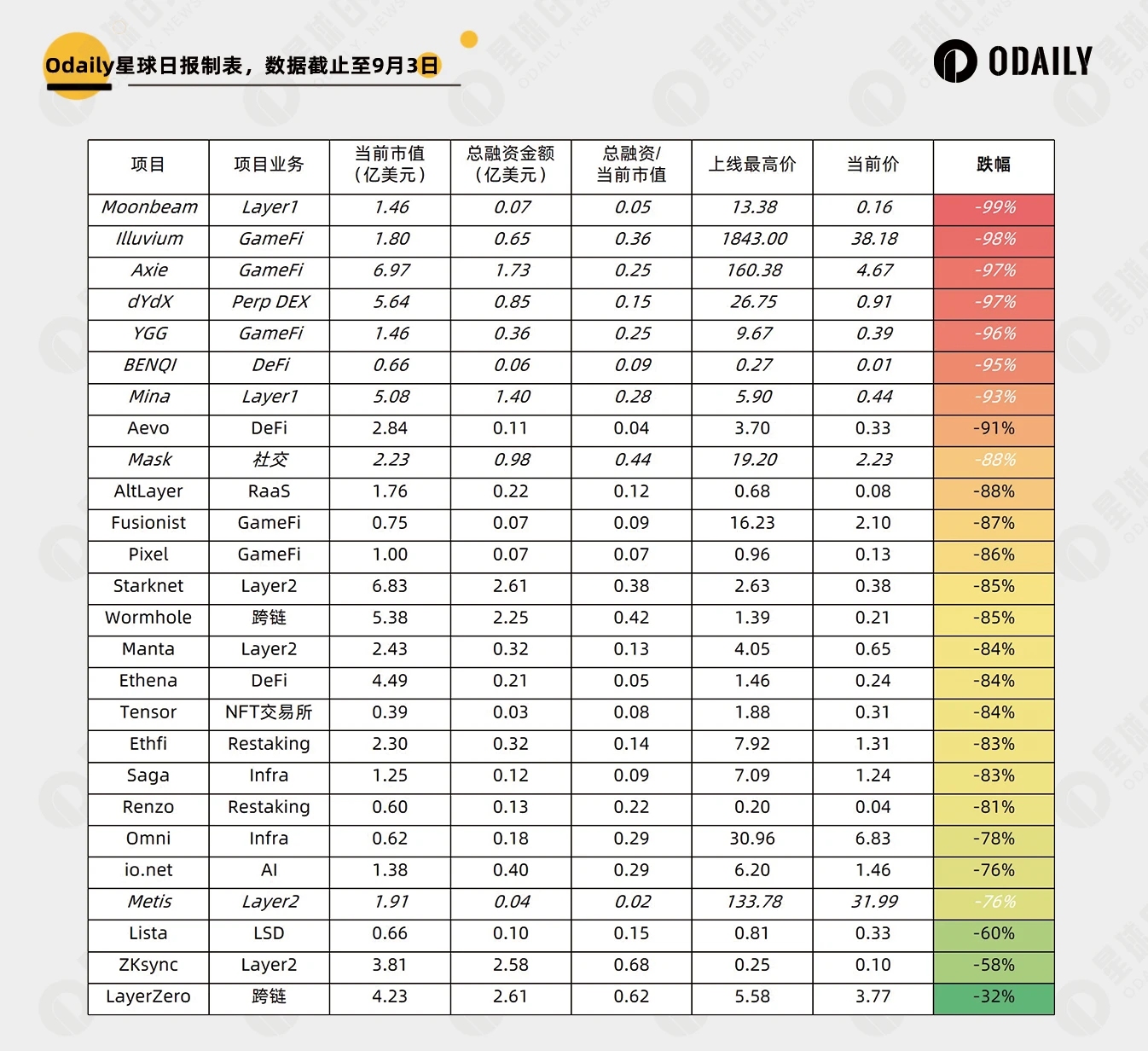

In the second and third quarters when the crypto market performed poorly, the newly launched VC coins became the target of public attack. Such tokens usually have the characteristics of low circulation and high FDV and continue to fall as the tokens are released. At present, most tokens have completed several rounds of unlocking and have fallen significantly in several rounds of market crashes. So are there any tokens that have fallen out of cost-effectiveness ?

In this article, Odaily will compare the financing data and circulating market value of mainstream new projects in the past year and the VC coins in the previous bull market to explore the answer to this question.

Top VC Coins Binance New Coins

-

Statistical objects: This section counts the top tokens launched at the same time on multiple exchanges, such as STRK (Starknet), W (Wormhole), etc., as well as new coins launched on Binance Launchpool for the first time, a total of 21 tokens are counted.

-

Data source: circulating market value, financing amount, and current price are from Rootdata. Some projects have not disclosed the financing amount. Only the disclosed valuation amount is displayed here. Highest price on listing refers to the highest point in the 4H closing price in the Binance K-line data since the token was launched, ignoring the short-term highest price of the pin.

-

Judging method: Use total financing amount divided by current market value as the cost-effectiveness standard. The larger the value, the higher the cost-effectiveness.

The results are shown in the figure below. It can be clearly seen that the cost-effectiveness of several major money-making projects is much higher after they have also fallen by 60%-80% due to the huge amount of financing .

In addition, in terms of sectors, Layer 2, cross-chain and LSDRestaking are the most cost-effective sectors, while GameFi and DeFi are the least cost-effective sectors .

If we switch the evaluation dimension to cost-effectiveness and judge by the extent of decline, GameFi occupies four places in the top ten (Xai is a Layer 3 specifically for games).

If the game data is excellent and has a direct cash flow relationship with the token, the corresponding project can be preliminarily considered to have fallen out of cost-effectiveness.

OKX New Coin

The data source and evaluation method remain unchanged, and the statistical object is changed to the projects that are first listed on OKX. The data obtained is as follows.

Among them, ZKJ (Polyhedra) and PRCL (Parcl) can be ranked in the first tier in terms of cost performance, referring to the data in the previous section, while Zeus and Zeta are in the middle.

Comparison of old “VC coins”

In the last bull market, there were also many tokens that received a lot of investment. Here we recognize that these projects have survived several years of unlocking + bear market experience and their value has been fully priced in by the market and can serve as good comparison objects.

Layer 2 and LSD: Old and New

In the first section, we mentioned that Layer 2 and Restaking are the “most cost-effective among new coins”. So how do they compare to the old Layer 2 and LSD projects? Odaily’s statistical results are as follows.

It can be seen that after experiencing multiple rounds of declines, the current cost-effectiveness of new projects in these sectors is equal to or even exceeds that of old projects. Before the next round of large-scale unlocking comes , there is a certain opportunity to buy at the bottom.

Full range comparison

We have also selected projects that raised funds and listed tokens in the first half of 2021, such as dYdX, Mask, Axie Infinity, etc., which are marked in italics and white in the figure below.

Overall, the relative value of old projects is still slightly higher than that of new projects , and most new coins still have considerable room for downward movement .

The downside potential of new coins is more obvious when sorted by decline. As shown in the figure below, these VC tokens that were so successful in the last bull market eventually fell by more than 95% from their highest points (the statistical average is 93%), while the current average decline of new coins is only 78%.

A drop from 78% to 93% means there is another 68% drop (1-(1-93%)/(1-78%)), but this drop may require a long unlocking and bear market to achieve .

abschließend

In Summe, the tokens of Layer 2, cross-chain, and LSDRestaking sectors have fallen out of cost-effectiveness in the short term, but in the long run, the new coins of various VC systems still have considerable room for downward movement.

Readers are advised to consider factors such as the projects revenue, whether there is a connection between the token and the projects revenue, and the subsequent token release ratio before making further decisions. They may consider short-term bottom-fishing or long-term shorting of tokens with low cost-effectiveness.

This article is sourced from the internet: Comparison of new and old VC coins: these new coins have fallen out of cost-effectiveness

Original | Odaily Planet Daily ( @OdailyChina ) Author: Golem ( @web3_golem ) Odaily Planet Daily has reviewed the airdrop projects that can be claimed from August 18 to August 24, including the Meme projects that can be claimed for free on Telegram. It also sorted out the interactive tasks and important airdrop information added last week. For details, see the text. Kamino Project and air investment qualification introduction Kamino is an automated liquidity solution in the Solana ecosystem, based on the centralized liquidity market maker (CLMM) mechanism. The project announced on August 20 that the second season airdrop rewards are now available for collection. The second seasons allocation will be automatically staked when collected. A total of 350 million KMNOs were distributed in the second season for 4 months…