Die Geschichte hinter dem massiven ETH-Verkauf der Ethereum-Stiftung erneut interpretieren

Original author: Ebunker

Is the Ethereum Foundation a “top-escape master”?

On August 23, the Federal Reserve released its expectations of a rate cut, and the cryptocurrency market ushered in a wave of upward trends. However, an on-chain operation followed – the Ethereum Foundation transferred 35,000 ETH to the Kraken exchange in the early morning of August 24.

On August 23, the Federal Reserve released its expectations of a rate cut, and the cryptocurrency market ushered in a wave of upward trends. However, an on-chain operation followed – the Ethereum Foundation transferred 35,000 ETH to the Kraken exchange in the early morning of August 24.

The last time the Ethereum Foundation transferred a large amount of ETH to Kraken was on May 6 last year, when the foundation transferred 15,000 ETH to the Kraken exchange. In the following 6 days, the price of ETH plummeted from $2,006 to $1,740, a drop of 13%.

Due to the record of several large-scale shipments at relatively high points in the past, the Ethereum Foundation is nicknamed the Master of Escape by the market.

For example, the Foundation successfully completed two shipments at high points during the 2021 bull market:

(1) On May 17, 2021, the Ethereum Foundation sold 35,053 ETH at an average price of US$3,533. Subsequently, the crypto market experienced the 5.19 crash, and the price of the coin fell to around US$1,800, almost halving;

(2) On November 11, 2021, the Ethereum Foundation once again sold 20,000 ETH at an average price of $4,677, and the market then began to fall. Both sales can be regarded as precise escapes from the top.

However, from a longer time perspective, the Ethereum Foundation does not always sell at the highest point.

According to data compiled by Wu Blockchain, the Ethereum Foundation also sold 100,000 ETH at a unit price of US$657 on December 17, 2020 and 28,000 ETH at a unit price of US$1,790 on March 12, 2021, both before the Ethereum price skyrocketed, and missed the subsequent huge gains.

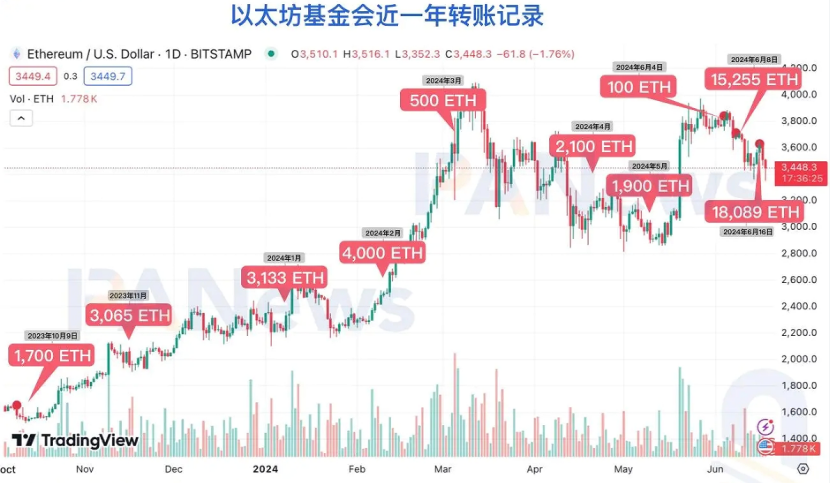

Gemessen an den Transferaufzeichnungen der Ethereum Foundation im vergangenen Jahr ist es nicht schwer festzustellen, dass es sich bei ihren Aktivitäten im Wesentlichen um reguläre Verkäufe handelt. Es ist nicht korrekt, sie nur durch ein paar Verkäufe zu hohen Preisen als Top-Fluchtmeister zu bezeichnen.

Why is the Ethereum Foundation selling ETH?

Regarding the recent transfer of 35,000 ETH to the exchange, Aya Miyaguchi, executive director of the Ethereum Foundation, explained, This is part of the Ethereum Foundations fund management activities. The Ethereum Foundation has an annual budget of approximately US$100 million, which mainly consists of grants and salaries, and some recipients can only accept legal tender. For a long time this year, the Ethereum Foundation was told not to conduct any financial activities because the regulations are complicated and plans cannot be shared in advance. However, this ETH transfer transaction does not mean a sale, and subsequent sales may be planned and phased out.

According to crypto analyst DefiIgnas, after transferring 35,000 ETH, the Ethereum Foundation currently still holds about 273,000 ETH, accounting for about 0.25% of the total supply of ETH. According to the latest report, the Ethereum Foundation allocated $30 million in the fourth quarter of 2023 and $8.9 million in the third quarter. The funds are mainly used for global conferences (such as the famous Devcon and Devconnect), online courses, innovative projects, etc.

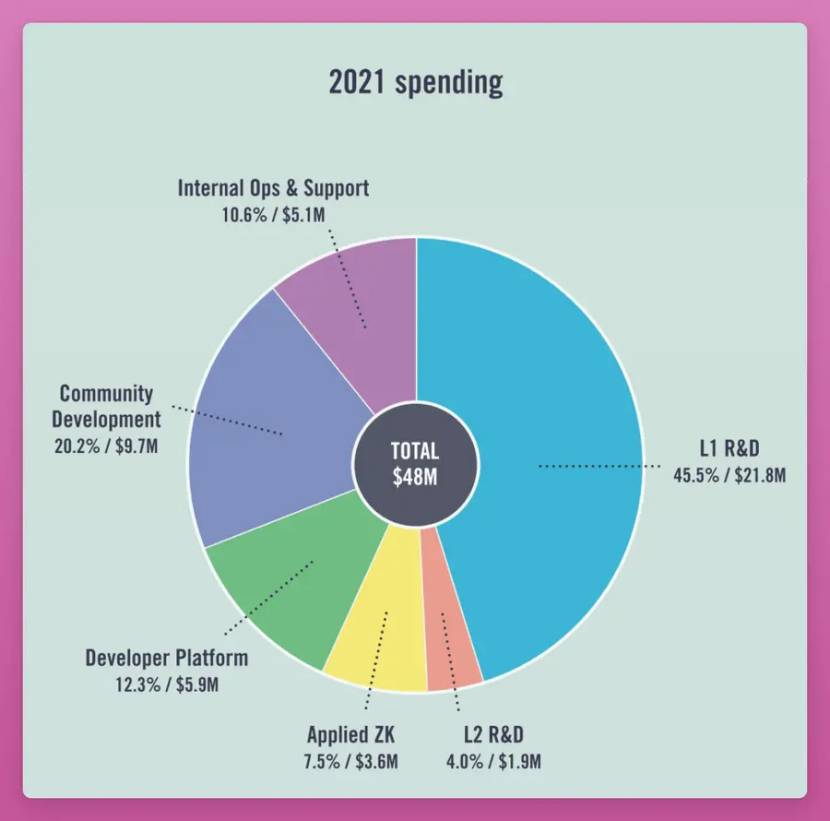

In addition, the 2021 report shows that the Ethereum Foundations total expenditure on internal expenses, external grants and rewards was US$48 million, including US$21 million on L1 RD, US$9.7 million on community development (including grants and education), and US$5.1 million on internal operations (salaries, legal fees, etc.).

In addition, the foundations sale of tokens is not an isolated case. For example, Polkadot has been controversial for its crazy spending.

The market impact of the Ethereum Foundation’s sell-off and the direction of improvement

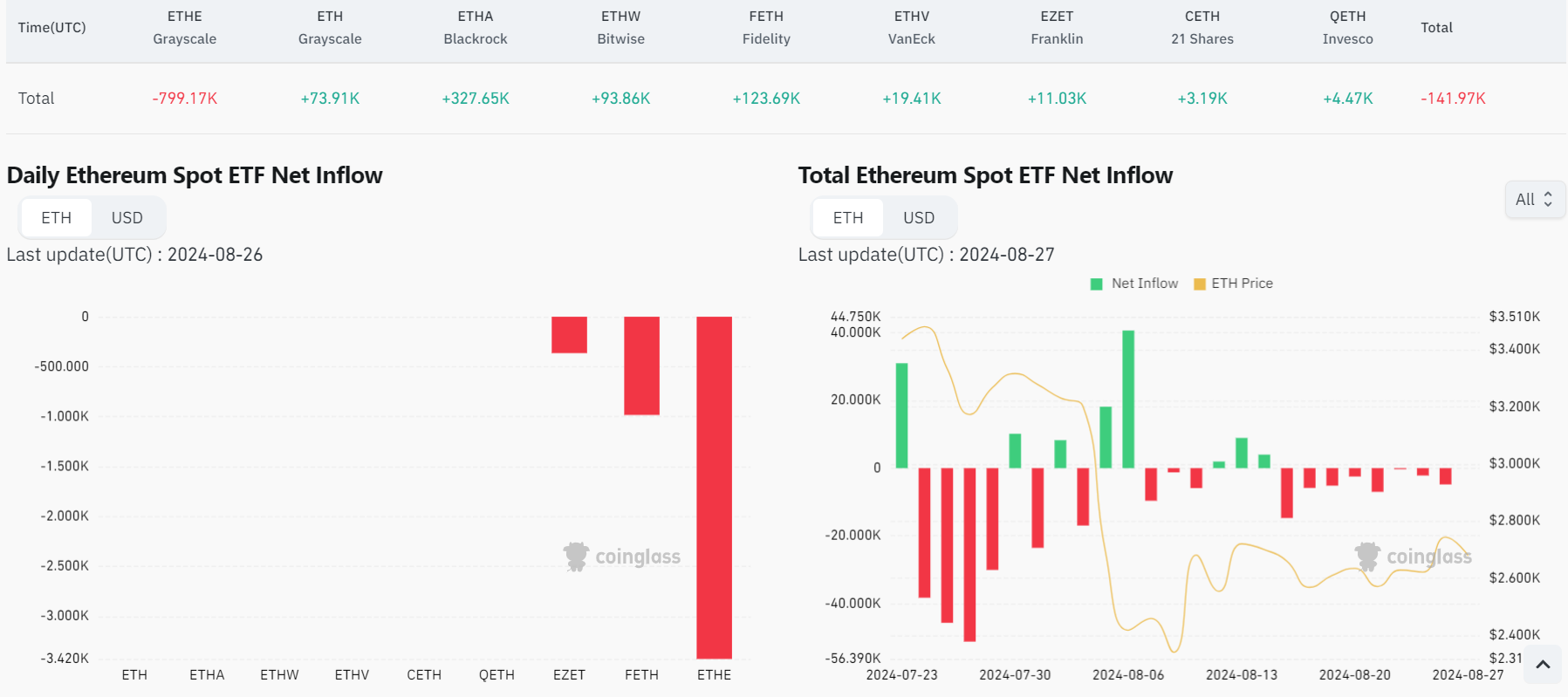

As can be seen from the above figure, since the Ethereum ETF was listed on July 23, as of August 26, Grayscales ETHE has accumulated a net outflow of 799,000 ETH, with an average daily net outflow of 32,000 ETH (other ETH are in a net inflow state, with an overall net outflow of about 141,900 ETH). In comparison, the 35,000 ETH recently sold by the Ethereum Foundation is not particularly large.

In fact, the Ethereum Foundation’s selling of ETH is understandable, after all, the team’s development and operation requires financial support. Moreover, the 273,000 ETH held by the Foundation only accounts for 0.25% of the total supply. From the perspective of market capitalization, the Foundation’s selling behavior has little direct impact on market liquidity, and the negative effects are more reflected in market sentiment, such as causing ETH holders to lose confidence and follow suit.

In addition, the Ethereum Foundation has previously announced a $100 million budget, but the communitys recent response highlights the growing need for regular disclosure of detailed financial information. For example, regular release of detailed reports containing financial and basic updates, including team expenditures, the schedule for selling ETH (which should fully consider how to reduce the impact on the market), how and where funds are used, team size and allocation, etc., and providing the community with interfaces for announcements, activities, financial activities, etc. about the Ethereum Foundation, so that community sentiment will become more stable, and ETH holders will pay more attention to, understand and support the Ethereum Foundation to help promote the development of Ethereum.

We expect the ETH Foundation to bring more developers and users to Ethereum, the most famous smart contract blockchain, through continuous RD public relations, community operations and market education.

This article is sourced from the internet: Interpreting the story behind the Ethereum Foundations massive sale of ETH again

Related: Exploring the economics of points: How to design an effective points program?

Original author: kenton.eth Original translation: Ismay, BlockBeats Editors note: Points programs have become an important tool for projects to gain user loyalty and promote product growth. The author of this article, Kenton, founder of Sense Finance and former MakerDAO integration engineer, discusses in detail the design and implementation of points programs and their advantages and disadvantages in practical applications. From the successful experience of projects such as Ethena, Napier and Blur, we can see that a reasonable points strategy can not only effectively improve the projects KPI, but also gain an advantage in market competition. However, points programs also face problems such as lack of transparency and user fatigue, and are in urgent need of further innovation and optimization. A new era of digital loyalty is dawning on Web3, driven…