Arthur Hayes: With the Fed cutting interest rates and the yen strengthening, is Bitcoin to the Moon?

Originalautor: Arthur Hayes

Originalübersetzung: TechFlow

(Any opinions expressed here are the author’s personal opinions and should not be used as the basis for investment decisions, nor should they be interpreted as advice to participate in investment transactions.)

I ended my summer vacation in the Northern Hemisphere and headed to the Southern Hemisphere for two weeks to ski. I spent most of my time on a backcountry ski tour. For those of you who haven’t experienced this, the process is to attach skins to the bottom of your skis so you can glide upwards. Once you reach a high point, you remove the skins, switch your boots and skis to downhill mode, and enjoy the rich powder snow. Most of the mountains I visited can only be accessed this way.

A typical four to five hour ski day consists of 80% uphill skiing and 20% downhill skiing. Therefore, this activity is energy intensive. Your body burns calories to maintain body temperature and homeostasis. Your legs are the largest muscle group in your body and are always working whether you are skiing uphill or downhill. My basal metabolic rate is about 3000 kcal, and with the energy required for leg work, my total daily energy expenditure is over 4000 kcal.

Due to the sheer amount of energy required to complete this activity, the combination of foods I consume throughout the day is crucial. I eat a large breakfast in the morning that includes carbs, meat, and vegetables; what I call real food. Breakfast keeps me full, but as I head into the cold woods and start the initial ascent, these initial energy reserves are quickly depleted. To manage my blood sugar levels, I keep snacks that I dont normally eat, just like Su Zhu and Kylie Davies did to avoid a BVI bankruptcy court-appointed liquidator. I eat an average of a Snickers bar and syrup every 30 minutes, even if Im not hungry. I dont want my blood sugar levels to drop too low and affect my performance.

Eating sugary processed foods is not a long-term solution to my energy needs. I need to consume real food as well. After each lap, I usually stop for a few minutes, unpack my pack, and eat the food I prepared. I prefer a crisper with chicken or beef, sautéed leafy greens, and plenty of white rice.

I pair periodic sugar spikes with longer burning, clean, real food intake to keep me performing throughout the day.

My purpose in describing the pre-meal preparation for a ski trip is to elicit a discussion about the relative importance of the price and quantity of money. To me, the price of money is like the Snickers and syrup I eat, giving me a quick glucose boost. The quantity of money is like the slow, long-lasting burning real food. At last Fridays Jackson Hole central bank conference, Powell announced a policy shift, with the Federal Reserve (Fed) finally committing to lowering its policy rate. In addition, officials from the Bank of England (BOE) and the European Central Bank (ECB) also said they would continue to lower their policy rates.

Powell announced the shift at approximately 9am GMT-6, which corresponds to the red oval. Risk assets represented by the SP 500 (white), gold (yellow), and Bitcoin (green) all rose as currencies fell. The U.S. dollar (not shown) also weakened over the weekend.

The initial positive reaction of the market is justified as investors believe that assets priced in a fixed supply of fiat currencies should rise if money becomes cheap. I agree with this view; however… we forget that future expected rate cuts by the Fed, Bank of England and ECB will reduce the interest rate differential between these currencies and the yen. The risk of the yen carry trade will re-emerge and could spoil the party unless the amount of money is increased in the form of central bank balance sheet expansion, i.e. printing money.

Please read my article Spirited Away for an in-depth discussion of this yen carry trade. I will be referring to this phenomenon frequently in this article.

USDJPY strengthened by 1.44%, while USDJPY fell immediately after Powell announced the policy shift. This was expected, as the expected interest rate differential between USD and JPY will narrow due to falling USD rates and flat or rising JPY rates.

The rest of this article seeks to delve deeper into this and look ahead to the critical months ahead before an apathetic American electorate elects either Trump or Biden.

Premise of the Bull Thesis

As we observed in August this year, a rapidly appreciating yen is a dangerous prospect for global financial markets. If rate cuts in the three major economies lead to an appreciation of the yen against their domestic currencies, then we should expect a negative market reaction. We are faced with a battle between positive (rate cuts) and negative (yen appreciation) forces. Given that the total amount of global financial assets financed in yen exceeds tens of trillions of dollars, I believe that the negative market reaction to the yen carry trade caused by a rapidly appreciating yen will outweigh any benefit from a small rate cut in the dollar, pound, or euro. Moreover, I believe that policymakers at the Federal Reserve (Fed), the Bank of England (BOE), and the European Central Bank (ECB) realize that they must be willing to ease policy and expand their balance sheets to offset the adverse effects of a stronger yen.

In line with my skiing metaphor, the Fed is trying to get the sugar rush of rate cuts before hunger sets in. From an economic perspective, the Fed should be raising rates, not cutting them.

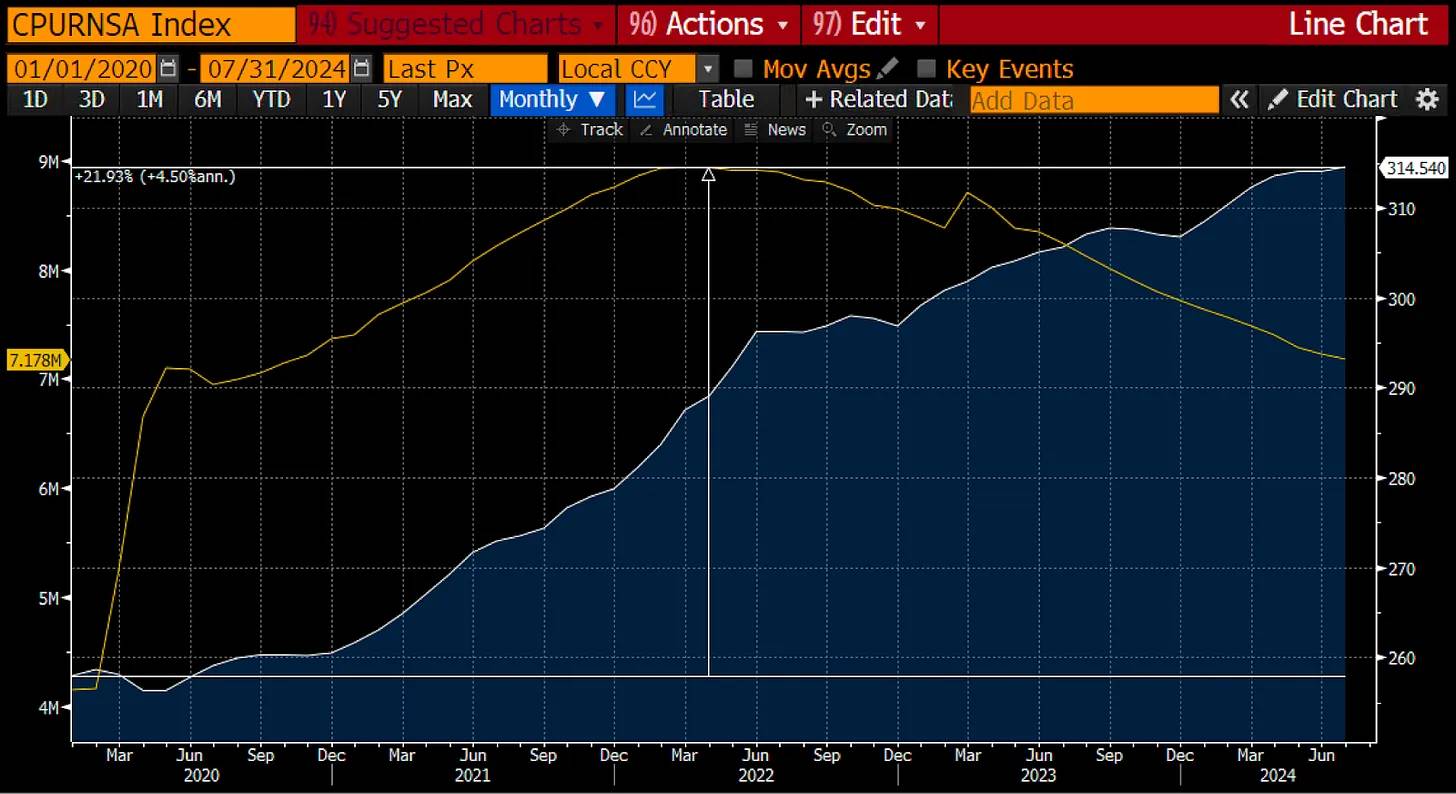

The manipulated US Consumer Price Index (white) has risen 22% since 2020. The Fed’s balance sheet (yellow) has increased by over $3 trillion.

The U.S. government is running record deficits in part because the cost of issuing debt has not yet been limited enough to force politicians to raise taxes or cut subsidies to balance the budget.

If the Fed really wants to maintain confidence in the dollar, it should raise interest rates to curb economic activity. This will keep prices down for everyone, but some people will lose their jobs. It will also curb government borrowing because the cost of issuing debt will rise.

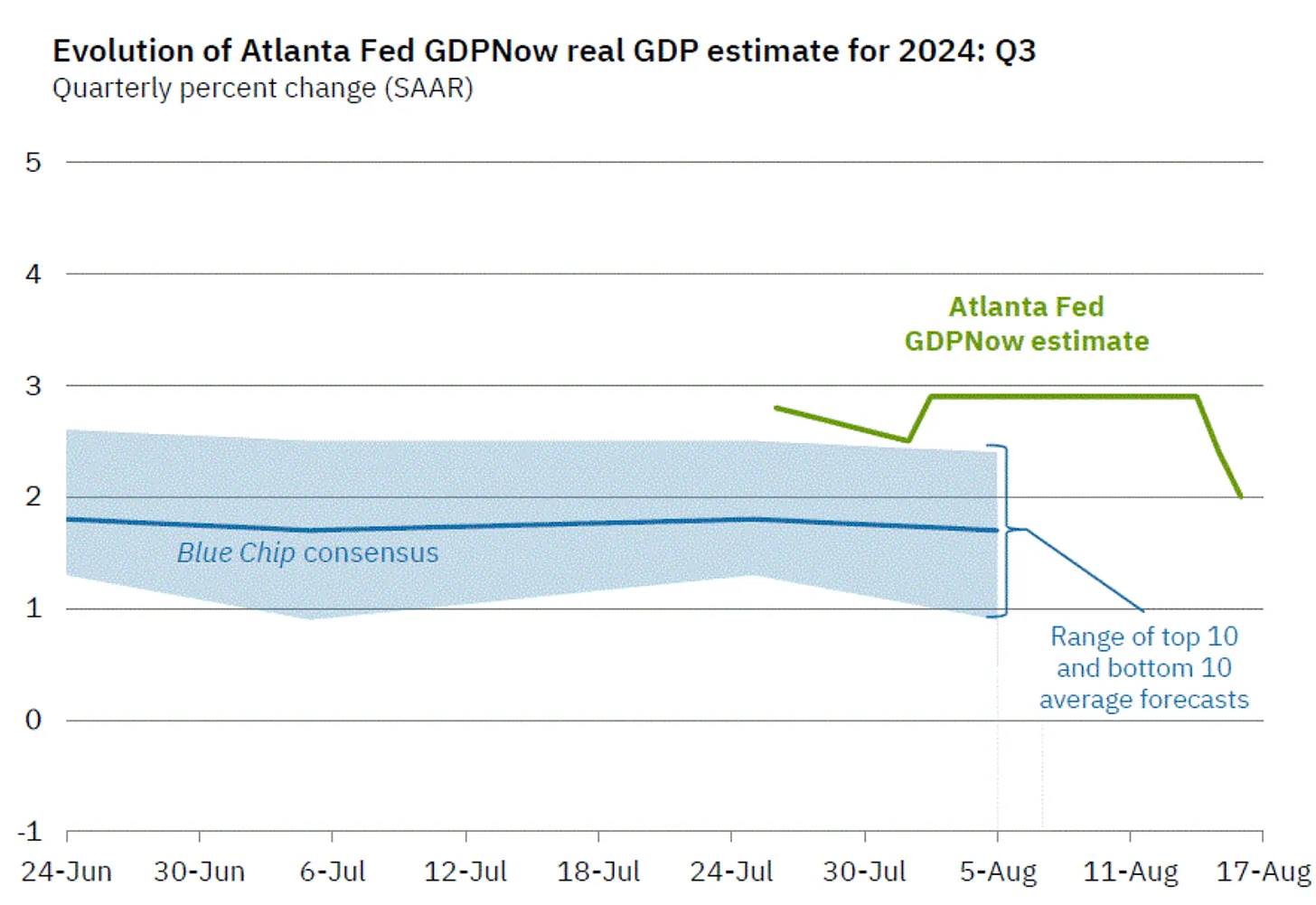

The U.S. economy has only experienced two quarters of negative real GDP growth post-COVID. This is not a weak economy that requires rate cuts.

Even the most recent estimate for real GDP in the third quarter of 2024 is at +2.0%. Once again, this is not an economy suffering from overly restrictive interest rates.

Just like I eat candy and syrup when Im not hungry to keep my blood sugar levels from dropping, the Fed is committed to never letting financial markets stagnate. The United States is a highly financialized economy that requires continuously rising fiat asset prices to keep the populace feeling wealthy. Stocks are flat or down in real terms, but most people arent paying attention to their real returns. Stocks that are rising nominally are also increasing capital gains tax revenue in fiat terms. In short, falling markets are detrimental to Pax Americanas financial health. Therefore, Yellen began interfering with the Feds rate hike cycle in September 2022. I believe Powell, at the direction of Yellen and Democratic leaders, is sacrificing himself by cutting rates when he knows he shouldnt.

I present the chart below to illustrate what happened to stocks when the US Treasury, under Yellen’s stewardship, began issuing large amounts of Treasury bills (T-bills), draining flows from the Fed’s reverse repo program (RRP) and into broader financial markets.

To understand what I’m saying in the previous paragraph, refer to my article Water, Water, Every Where .

All prices are referenced to 100 on September 30, 2022; this was the peak of RRP, at about $2.5 trillion. RRP (green) is down 87%. The nominal fiat dollar return on the SP 500 (gold) is up 57%. I believe that the US Treasury has more power than the Fed. The Fed was raising the price of money until March 2023, but the Treasury found a way to increase the amount of money at the same time. The result was a nominal stock market boom. When priced in gold, the oldest form of actual money (the others are fiduciary money), the SP 500 (white) is up only 4%. When priced in Bitcoin, the newest and most solid currency, the SP 500 (magenta) is down 52%.

The US economy is not hungry for rate cuts, but Powell will provide a sugar rush. Because monetary authorities are extremely sensitive to any decline in fiat stock prices, Powell and Yellen will soon provide real food in some form, namely, expanding the Feds balance sheet to offset the impact of the appreciation of the yen.

Before discussing the appreciation of the yen, I want to quickly touch on Powell’s spurious rationale for lowering interest rates and how this further strengthens my confidence in higher risk asset prices.

Powell made his adjustment based on a terrible jobs report. U.S. President Bidens Labor Department (BLS) released a shocking revision to previous employment data a few days before Powells speech at Jackson Hole, noting that the employment estimate was about 800,000 too high.

Biden and his dishonest economist backers have been touting the strength of the labor market during his administration. This labor market strength puts Powell in a dilemma as top Democratic senators, like Elizabeth “Pocahontas” Warren, call on him to cut rates to stimulate the economy so that Trump doesn’t win the election. Powell faces a dilemma. With inflation exceeding the Fed’s 2% target, Powell can’t cut rates because inflation is falling. He also can’t cut rates on the grounds of a weak labor market. But let’s sprinkle a little political misdirection smoke on this situation and see if we can help our “beta cuck towel bitch boy” out.

Biden was dumped by the Obamas after he acted like a vegetative person on prescription drugs in a debate with Trump. His replacement is Kamala Harris, who, if you believe mainstream media reports, had nothing to do with any of the policies implemented by the Biden/Harris administration over the past four years. Therefore, the BLS can admit their misstep without affecting Harris, since she was never actually involved in the administration she was Vice President for. Such an amazing political masterstroke.

Powell could have used this opportunity to blame the weak labor market for the rate cut, but he didn’t. Now he’s announced that the Fed will start cutting rates in September, and the only question is how big the first cut will be.

I have more confidence in my predictions when politics override economics. This is because of Newtonian political physics – politicians in power want to stay in power. They will do whatever it takes, regardless of economic conditions, to get re-elected. This means that incumbent Democrats will use all monetary policy tools to keep the stock market rising until the November election, no matter what happens. The economy will not be short of cheap and plentiful fiat money.

Impact of Yen Fluctuations

Exchange rates between currencies are primarily influenced by interest rate differentials and expectations of future interest rate changes.

The chart above shows the USD/JPY exchange rate (yellow) versus the USD-JPY interest rate differential (white). The interest rate differential is the Feds effective funds rate minus the Bank of Japans overnight deposit rate. When USD/JPY rises, the yen depreciates and the dollar appreciates; when it falls, the opposite is true. When the Fed began tightening monetary policy in March 2022, the yen depreciated sharply. The yen depreciated to its highest level ever in July, when the interest rate differential was at its widest.

The yen has recovered strongly after the Bank of Japan raised its policy rate from 0.10% to 0.25% in late July. The Bank of Japan made it clear that it would start raising rates at some point in the future. It is difficult for the market to predict when they will start raising rates. Like unstable snow layers, it is difficult to predict which snowflake or which turn on the skis will trigger an avalanche. A 0.15% reduction in the interest rate differential should have been insignificant, but it was not. The trend of a strong rebound in the yen has begun, and the market is now highly focused on the future direction of the USD-JPY interest rate differential. As expected, the yen has also received strong support after Powells policy shift, as the interest rate differential is expected to narrow further.

Here is the previous USD/JPY chart. I would like to reiterate that the yen has found strong support after Powell confirmed the September rate cut.

The short-term boost from the Fed Funds rate cut could quickly wear off if traders resume unwinding USD-JPY carry trade positions as the value of the yen surges. More rate cuts to stem the decline in various financial markets would only accelerate the narrowing of the USD-JPY rate differential, which in turn would strengthen the yen and cause more positions to be unwound. The market needs real food in the form of printed money provided by the rising Fed balance sheet to stem the losses.

If the yen appreciation accelerates, the first step will not be to resume the quantitative easing (QE) policy. The first step will be for the Fed to reinvest the cash from maturing bonds in US Treasuries and mortgage-backed securities. This will be seen as stopping its quantitative tightening (QT) program.

If the painful trend continues, the Fed may use central bank liquidity swaps and/or resume quantitative easing (QE) money printing. In this context, Yellen will increase dollar liquidity by selling more Treasury bonds and reducing the fiscal account balance. Neither of these two market manipulators will use the destructive impact of the end of the yen carry trade on the market as a reason to resume aggressive money printing. It is not in line with American values to admit that other countries have any influence on this free and democratic country!

If the USD-JPY exchange rate quickly breaks below 140, I believe they will not hesitate to provide the real food that the fiat currency financial markets need.

Trading Setup

In the final stages of Q3, fiat liquidity conditions could not be better. As crypto holders, we have the following tailwinds behind us:

1. Global central banks, especially the Federal Reserve, are reducing the cost of money. The Fed is still cutting interest rates when inflation is above its target, and the US economy continues to grow. The Bank of England (BOE) and the European Central Bank (ECB) may further cut interest rates at their upcoming meetings.

2. Bad Girl Yellen promised to issue $271 billion in Treasury bills and conduct $30 billion in repurchase operations before the end of the year. This will inject $301 billion in liquidity into the financial market.

3. The U.S. Treasury still has about $740 billion in the general account, which can and will be used to stimulate the market and help Harris win.

4. The Bank of Japan was extremely concerned about the pace of yen appreciation after its July 31, 2024 meeting, when it raised interest rates by 0.15%. As a result, it publicly stated that future rate hikes would take market conditions into account. This is a veiled way of saying if we think the market is going to fall, we wont raise rates.

Im in the crypto world; I dont follow stocks. So, I dont know if stocks will go up or not. Some people point to historical examples of stocks falling when the Fed cuts rates. Some people worry that the Feds rate cuts are a leading indicator of a recession in the U.S. and developed markets. That may be true, but imagine what the Fed would do if they cut rates when inflation is above target and economic growth is strong. They would increase money printing and significantly increase the money supply. This would cause inflation, which could be bad for certain types of businesses. But for an asset like Bitcoin with a limited supply, it would take Bitcoin to the moon.

This article is sourced from the internet: Arthur Hayes: With the Fed cutting interest rates and the yen strengthening, is Bitcoin to the Moon?

Related: 8 DeFi protocols with built-in airdrops and benefits

Original author: ROUTE 2 FI Original translation: TechFlow Hello everyone! Have a great Wednesday everyone! If you’re looking for airdrops, yield, or points programs, here are some DeFi protocols that may have potential. I intend to update this research report weekly as it helps me stay current in this field. lets start. A new week – 8 promising DeFi protocols Here are some of the protocols with untapped opportunities like yield, airdrops, etc. that you can explore today. These protocols are from different networks (EVM, non-EVM, or Cosmos) and cover various DeFi areas like derivatives, yield, DEX, etc. These projects are highlighted for their notable support and yield opportunities, but none of this should be considered financial advice, please also do your own research before interacting: 1/ Zircuit Zircuit is…