Crypto Market Sentiment Research Report (2024.08.16–08.23): Bitcoin rises as dovish turn to impending rate cut

Bitcoin rises as dovish stance turns to imminent rate cut

At 10 a.m. Eastern Time on Friday, August 23, Federal Reserve Chairman Powell made an important speech at the Jackson Hole Global Central Bank Annual Meeting.

**It is worth noting that Powell stated quite clearly: The time for policy adjustment has come. The policy direction is clear, and the timing and pace of interest rate cuts will depend on subsequent data, changes in the outlook and the balance of risks.

Some analysts said that although Powell confirmed the markets widespread expectation of starting interest rate cuts in September, this speech was also dovish, providing a certain clarity to the financial market in the short term, but did not provide many clues about how the Fed will act after the September meeting.

For example, if there is another negative employment report, whether there will be a sharp 50 basis point rate cut, and whether rate cuts will continue in the coming months. However, Powells speech at least confirmed that the Feds fight against inflation over the past two years is about to reach a critical turning point.

After the annual meeting, Bitcoin rose from US$61,000 to a high of US$65,000, an increase of 6.5%.

There are about 26 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

Analyse des technischen Marktes und der Stimmungslage

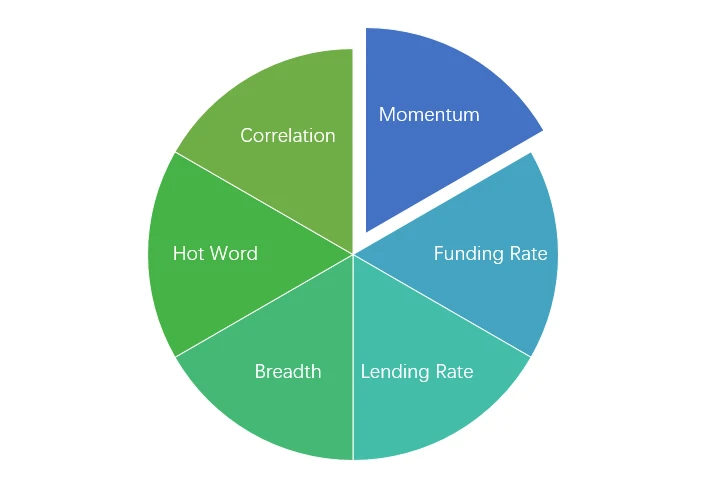

Komponenten der Stimmungsanalyse

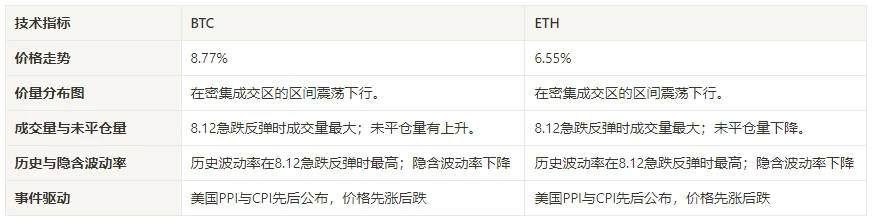

Technische Indikatoren

PrEis Trends

In the past week, BTC prices rose 8.77% and ETH prices rose 6.55%.

Das obige Bild ist das Preisdiagramm von BTC der letzten Woche.

Das obige Bild ist das Preisdiagramm von ETH der letzten Woche.

Die Tabelle zeigt die Preisänderungsrate der letzten Woche.

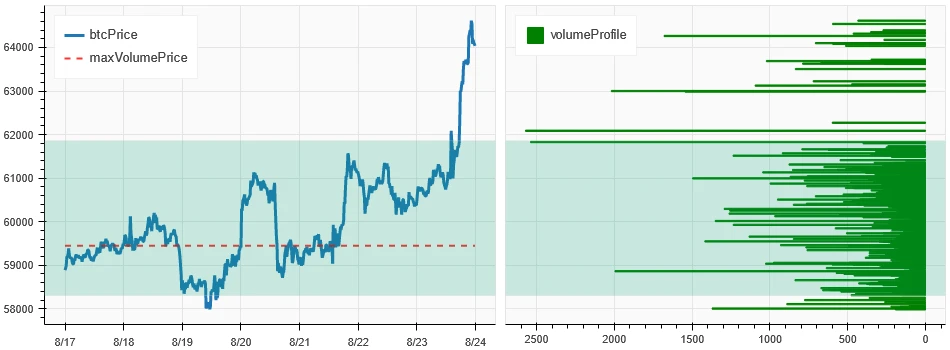

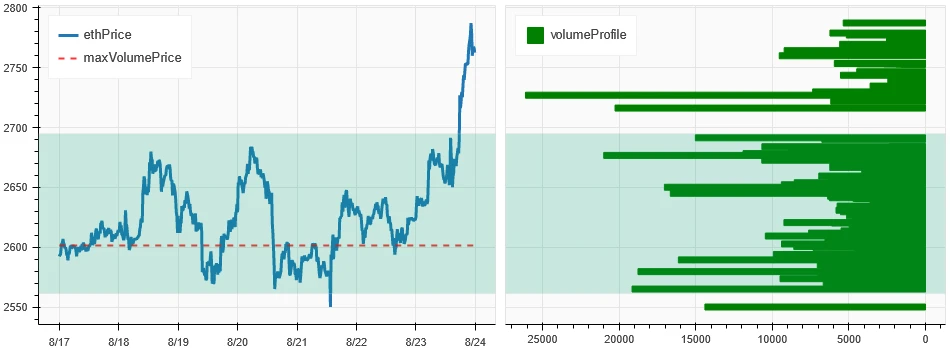

Preis-Volumen-Verteilungsdiagramm (Unterstützung und Widerstand)

In the past week, both BTC and ETH broke through the concentrated trading area and formed an upward trend.

Das obige Bild zeigt die Verteilung der BTC-Handelsgebiete mit hoher Dichte in der vergangenen Woche.

Das obige Bild zeigt die Verteilung der ETH-Handelsgebiete mit hoher Dichte in der vergangenen Woche.

Die Tabelle zeigt die wöchentliche intensive Handelsspanne von BTC und ETH in der vergangenen Woche.

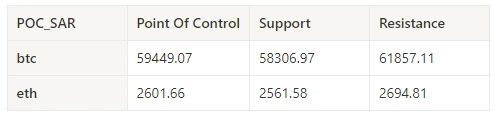

Volumen und offenes Interesse

In the past week, the trading volume of BTC and ETH was the largest when they rose to 8.23; the open interest of BTC and ETH both increased slightly.

Oben im obigen Bild ist der Preistrend von BTC dargestellt, in der Mitte das Handelsvolumen, unten das offene Interesse, hellblau ist der 1-Tages-Durchschnitt und orange der 7-Tages-Durchschnitt. Die Farbe der K-Linie stellt den aktuellen Zustand dar, grün bedeutet, dass der Preisanstieg durch das Handelsvolumen unterstützt wird, rot bedeutet, dass Positionen geschlossen werden, gelb bedeutet, dass Positionen langsam akkumuliert werden und schwarz bedeutet, dass der Zustand überfüllt ist.

Oben im obigen Bild ist der Preistrend von ETH dargestellt, in der Mitte das Handelsvolumen, unten das offene Interesse, hellblau der 1-Tages-Durchschnitt und orange der 7-Tages-Durchschnitt. Die Farbe der K-Linie stellt den aktuellen Zustand dar, grün bedeutet, dass der Preisanstieg durch das Handelsvolumen unterstützt wird, rot bedeutet, dass Positionen geschlossen werden, gelb bedeutet, dass Positionen langsam angesammelt werden und schwarz bedeutet, dass Positionen überfüllt sind.

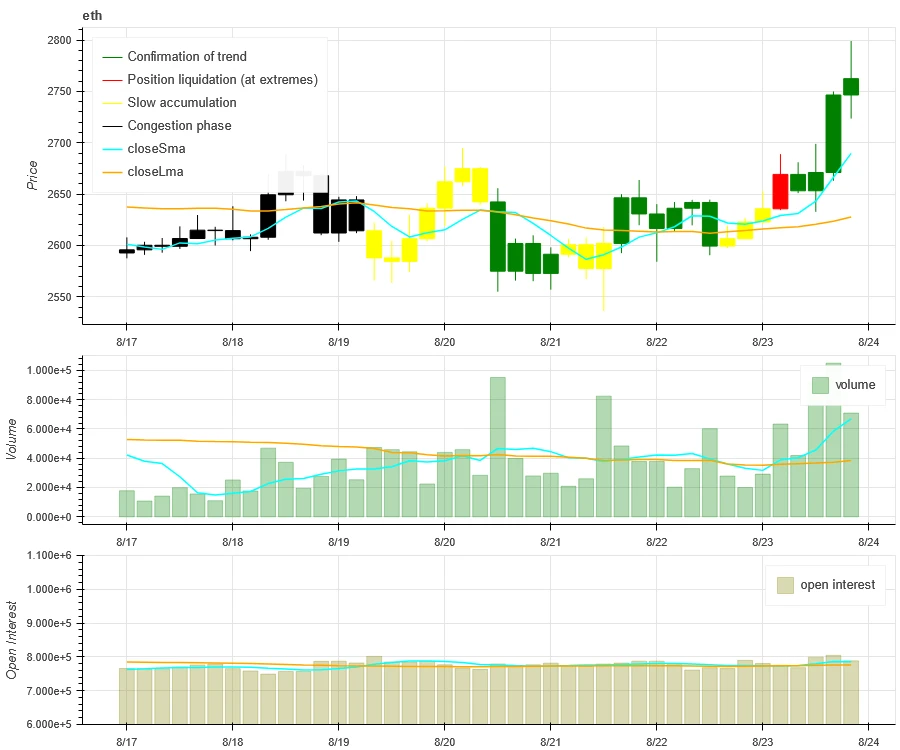

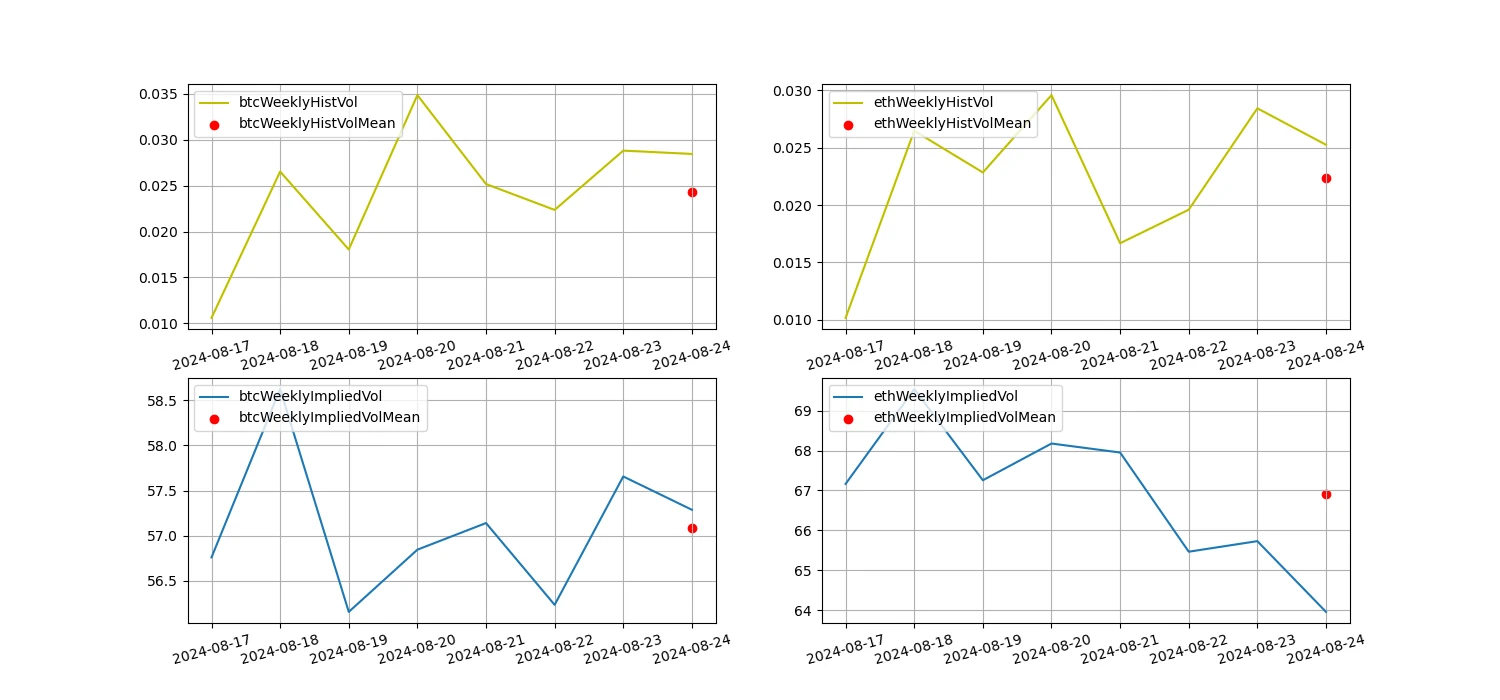

Historische Volatilität vs. implizite Volatilität

In the past week, the historical volatility of BTC and ETH was highest when they fluctuated in a wide range of 8.20; the implied volatility of BTC increased while that of ETH decreased.

Die gelbe Linie ist die historische Volatilität, die blaue Linie die implizite Volatilität und der rote Punkt ist der 7-Tage-Durchschnitt.

Ereignisgesteuert

This past week, the Federal Reserve’s annual meeting hinted at an upcoming rate cut, and Bitcoin rose 6.5% in response.

Stimmungsindikatoren

Momentum-Stimmung

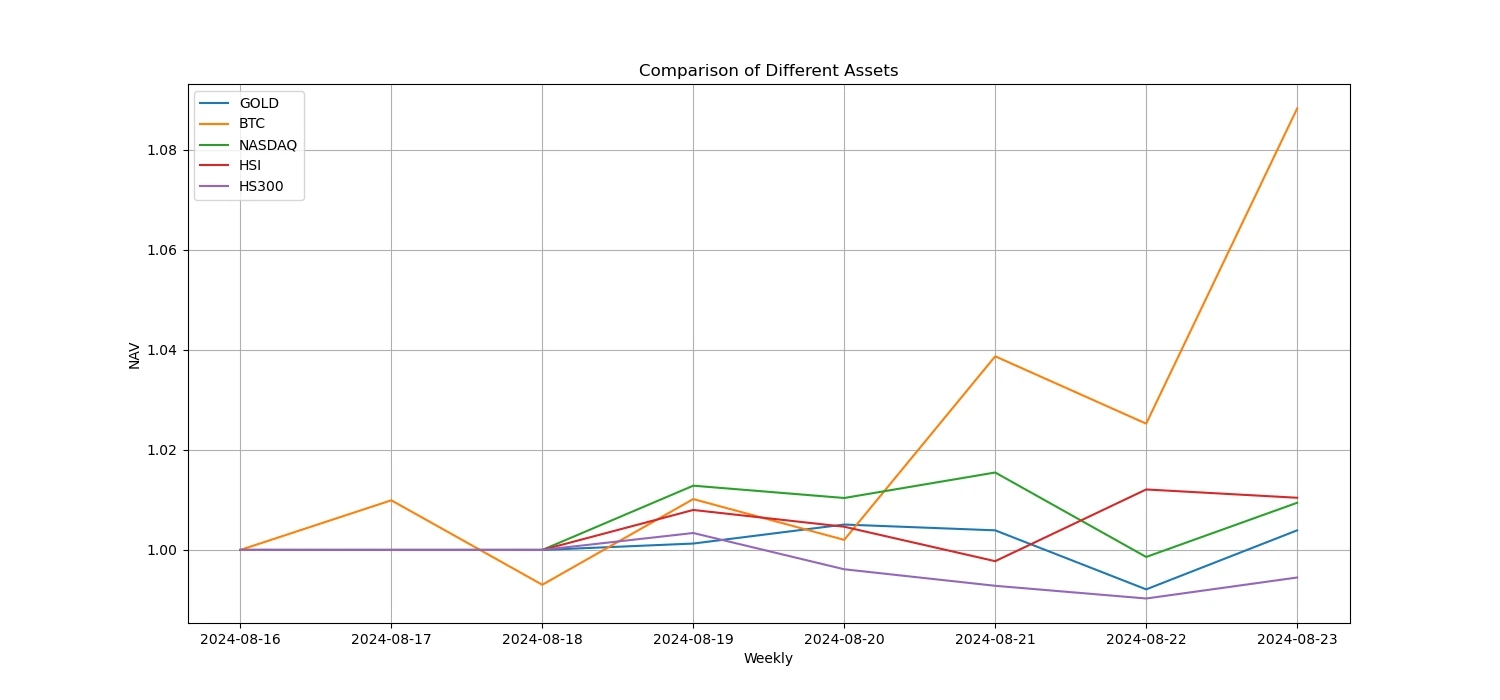

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/CSI 300, Bitcoin was the strongest, while CSI 300 performed the worst.

Das obige Bild zeigt den Trend verschiedener Vermögenswerte in der vergangenen Woche.

Kreditzins_Kreditstimmung

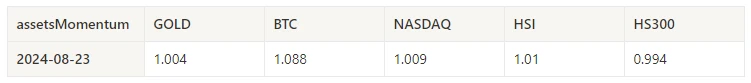

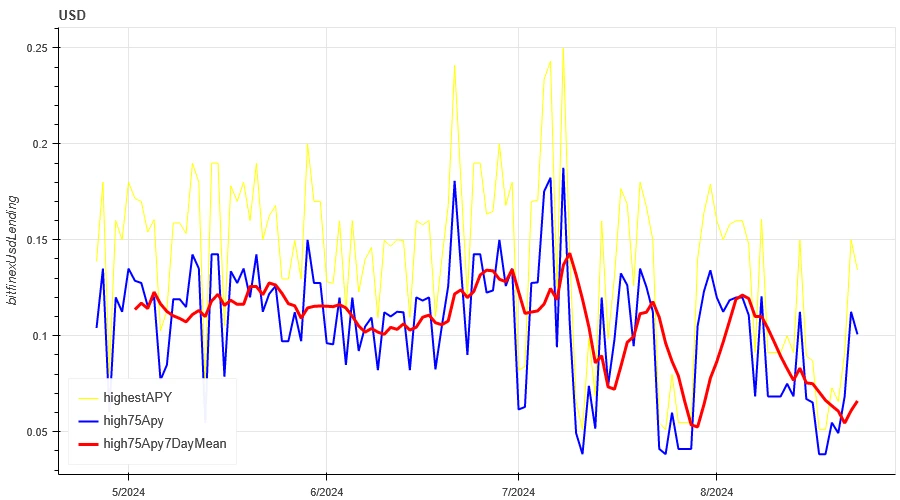

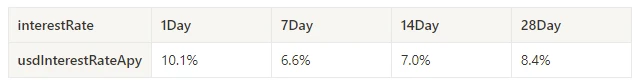

The average annualized return on USD lending over the past week was 6.6%, and short-term interest rates rose to 10.1%.

Die gelbe Linie stellt den höchsten Preis des USD-Zinssatzes dar, die blaue Linie entspricht 75% des höchsten Preises und die rote Linie ist der 7-Tage-Durchschnitt von 75% des höchsten Preises.

Die Tabelle zeigt die durchschnittlichen Renditen der USD-Zinssätze an verschiedenen Haltetagen in der Vergangenheit

Finanzierungsrate_Vertragshebelstimmung

The average annualized return on BTC fees in the past week was -1.4%, and contract leverage sentiment is turning pessimistic.

Die blaue Linie ist die Finanzierungsrate von BTC auf Binance und die rote Linie ist der 7-Tage-Durchschnitt

Die Tabelle zeigt die durchschnittliche Rendite der BTC-Gebühren für verschiedene Haltetage in der Vergangenheit.

Marktkorrelation_Konsensstimmung

The correlation among the 129 coins selected in the past week was around 0.85, and the consistency between different varieties has increased from a low level.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx , imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

Marktbreite_Gesamtstimmung

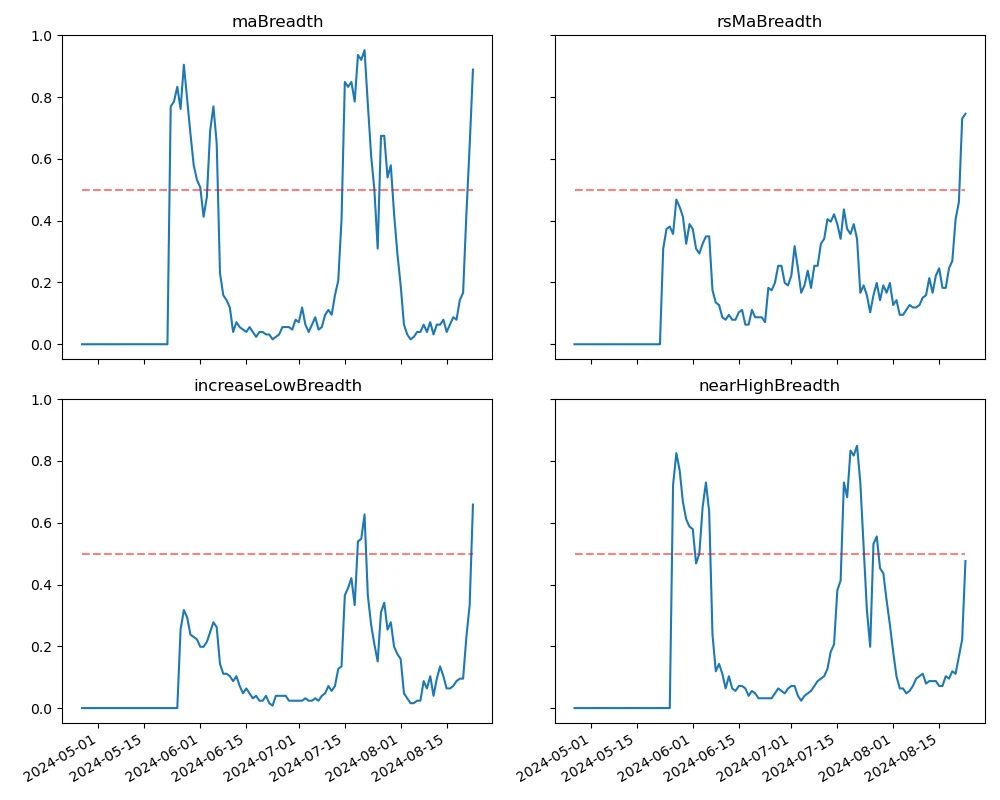

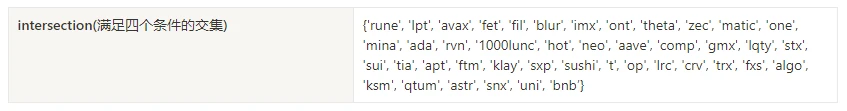

Among the 129 coins selected in the past week, 89% of them were priced above the 30-day moving average, 75% of them were above the 30-day moving average relative to BTC, 66% of them were more than 20% away from the lowest price in the past 30 days, and 48% of them were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market returned to an upward trend.

The picture above is [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot , icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

Zusammenfassen

In the past week, the price of Bitcoin (BTC) and Ethereum (ETH) fluctuated and then rose. The historical volatility peaked on August 20 when the market fluctuated widely, and the trading volume peaked on August 23 when the market rose. The open interest of both BTC and ETH increased. The implied volatility of BTC increased while that of ETH decreased. Bitcoin performed the best in comparison with gold, Nasdaq, Hang Seng Index and CSI 300, while CSI 300 performed the weakest. Bitcoins funding rate fell to negative, reflecting the pessimistic sentiment of market participants. The correlation between the selected 129 currencies remained at around 0.85, showing that the consistency between different varieties has risen from a low level. The market breadth indicator shows that most cryptocurrencies in the overall market are still back to an upward trend. The Federal Reserves annual meeting hinted at an upcoming rate cut, and Bitcoin rose 6.5% in response.

Twitter: @ https://x.com/CTA_ChannelCmt

Webseite: channelcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.08.16–08.23): Bitcoin rises as dovish turn to impending rate cut

Related: How crypto hedge funds generate excess returns: Actively manage risks and invest in BTC

Original author: Crypto, Distilled Original translation: TechFlow Coinbase just released a report on how crypto hedge funds generate excess returns. Here are the most valuable insights. Report Overview The report reveals the main strategies used by active crypto hedge funds. It provides valuable insights for any investor looking to: Better manage risk Capturing excess returns Deepen your understanding of encryption Provided valuable insights. Passive or active strategy? Regardless of your experience level, always compare your performance to $BTC. If you can’t outperform $BTC for a year or more, consider a passive strategy. For most investors, DCAing $BTC on a regular basis is usually the best option during a bear market. Bitcoin – Benchmark $BTC is the preferred benchmark for crypto market beta. Since 2013, $BTC has had an annualized return…