Interpretieren Sie den neuen Vorschlag ACP-77: Wie kann Avalanche L1 freigeschaltet werden?

Originalautor: Eden Au , The Block

Originalübersetzung: Felix, PANews

Wichtige Punkte:

-

ACP-77 is a community proposal that will change the validator dynamics for Avalanche L1 (formerly known as subnets).

-

Avalanche L1 validators will no longer need to validate the main network and stake at least 2,000 AVAX. Instead, they will follow the requirements set by the sovereign Avalanche L1.

-

Avalanche L1 validators will pay an ongoing dynamic fee to register information on the P-Chain.

-

The proposal benefits both institutional and retail Avalanche L1 as regulatory compliance and low barriers to entry for validators can be achieved.

Avalanche has long been a proponent of horizontal scaling using “subnets,” which are now being rebranded as Avalanche Layer 1 (L1). Avalanche L1s are sovereign, often application-specific blockchains that can be individually tailored to meet the specific needs of different use cases.

This infrastructure has attracted many crypto-native and institutional clients to use Avalanche L1 to host their own Web3 platforms, including Japanese gaming giant Konami’s NFT platform and Intain’s security tokenization platform.

Over the years, Avalanche L1 has undergone several upgrades to enhance its capabilities. For example, the Banff upgrade enables cross-subnet communication through Avalanche Warp Messaging (AWM). Meanwhile, Evergreen provides a framework for enterprises to launch privacy-preserving and regulatory-compliant permissioned Avalanche L1.

Despite this, the existing Avalanche L1 verification requirements still have a high entry threshold. Current Avalanche L1 validators need to verify Avalanches main network at the same time, including the contract chain (C-Chain), platform chain (P-Chain) and transaction chain (X-Chain).

For reference, mainnet validators must allocate at least 8 AWS vCPUs, 16 GB RAM, and 1 TB storage for network validation. They also need a minimum stake of 2,000 AVAX.

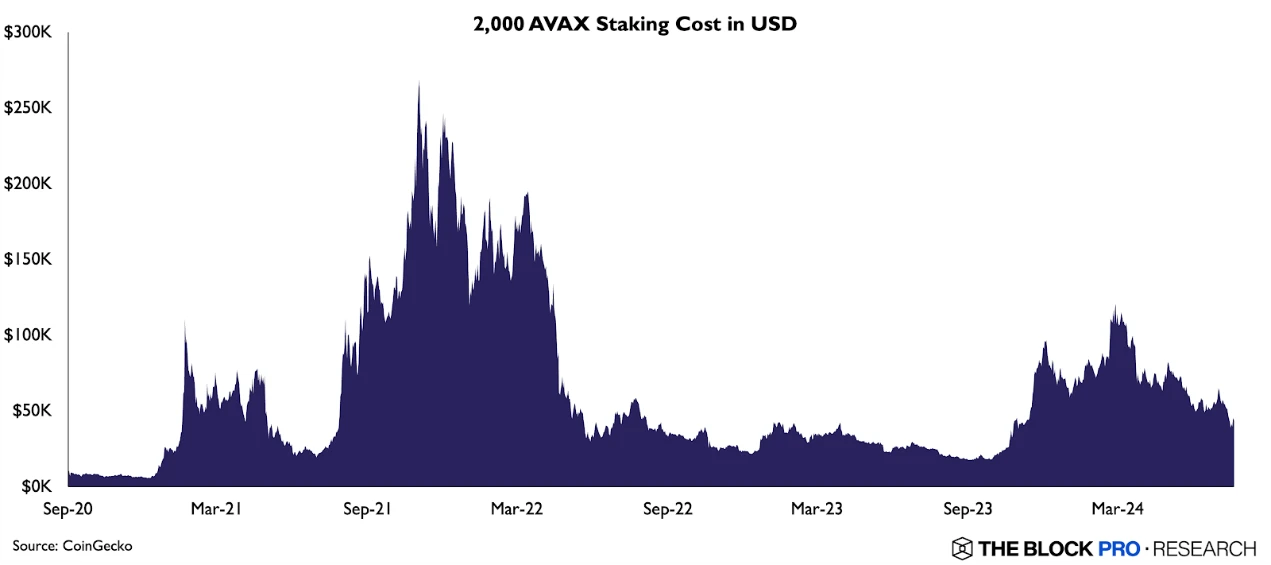

In the early days of the network, this staking requirement was not high. However, due to the appreciation of the token over the years, it reached over $250,000 at the peak of the previous market, equivalent to $41,000 today. This high overall operating cost hinders the decentralization of the Avalanche L1 validator set and may hinder the reliability and adoption of the Avalanche ecosystem in the long run.

Cost of staking AVAX (in USD)

ACP-77

ACP-77 is a community proposal that will overhaul the design of how Avalanche L1s are created and managed, bringing more flexibility and autonomy to Avalanche L1 validators.

sovereignty

According to the proposal, Avalanche L1 validators will no longer need to validate the main network at the same time. They only need to synchronize with P-Chain, which tracks changes in their own Avalanche L1 validator set and handles cross-L1 communication through AWM. This change greatly reduces the operational and staking costs of participating in Avalanche L1 validation.

This separation will also allow regulated entities to validate only their permissioned Avalanche L1s, as they can now choose not to validate the permissionless mainnet, which may contain transactions that are potentially high-risk or non-compliant from their perspective.

In addition, Avalanche L1 can develop and implement its own verification rules and staking requirements, and P-Chain will no longer support the distribution of staking rewards for Avalanche L1. In other words, the sovereignty of Avalanche L1 returns from P-Chain to L1 itself, which is a milestone in achieving horizontal expansion of multiple sovereign blockchains running simultaneously.

Dynamic Fees

On the other hand, the proposal changes P-Chain’s fee mechanism from a fixed per-transaction fee to a more dynamic fee that is more in line with the user-pays principle. This change is intended to ensure the long-term economic sustainability of the network after removing the aforementioned 2,000 AVAX staking requirement.

The new dynamic fee mechanism involves ongoing payments from Avalanche L1 validators based on several factors, such as the total number of Avalanche L1 validators registered on P-Chain. Fees will adjust based on network utilization. When the total number of Avalanche L1 validators exceeds the target utilization, fees will increase, and vice versa.

The basic principle is that each additional Avalanche L1 validator adds load to the P-Chain. The P-Chain is responsible for storing the properties of the Avalanche L1 validators in memory, such as IP addresses, BLS keys, etc.

In fact, the balance on the Avalanche L1 validators P-Chain is constantly depleted and needs to be replenished regularly to maintain uninterrupted operation. This approach lowers the barrier to entry by reducing upfront staking and hardware costs while ensuring continued contribution to the economic sustainability of the network.

Zusammenfassen

In short, ACP-77 aims to redesign the relationship between Avalanche L1s and the main network. In particular, Avalanche L1s will gain greater flexibility and sovereignty because Avalanche L1 validators no longer need to abide by the strict requirements imposed on main network validators, such as the minimum staking requirement of 2,000 AVAX, which greatly reduces the operating costs of Avalanche L1 validators.

Avalanche L1 validators will pay a dynamic fee to P-Chain for the ongoing storage of important metadata used by validators for communication purposes. This ensures that the main network is fairly compensated for the critical work it provides for each Avalanche L1 validator, Avalanche L1, and cross-L1 communication.

The proposal will make it easier for institutional L1s to achieve regulatory compliance, while retail-focused L1s can benefit from a more decentralized validator set. These advantages will promote a larger and more diverse Avalanche ecosystem and expand the scale of the blockchain ecosystem.

This article is sourced from the internet: Interpreting the new proposal ACP-77, how to unlock Avalanche L1?

Related: A bull market does not mean making money. How can we maximize profits in this cycle?

Original author: Crypto, Distilled Original translation: TechFlow The bull market is not as simple as you think. Even if $BTC hits $100,000, many people will likely see their gains diminishing. Dont be that investor. Here are 15 rules to help you maximize your profits during this cycle. 1. Unrealized gains are not gains This is the most important rule of all. Set it as your lock screen, put it on the fridge – whatever you do, dont forget about it. Paper gains are just imaginary values until you actually sell. (h/t TradeSanta) 2. Avoid using leverage Altcoins already have enough firepower. You dont need more volatility to get good returns. Dont let greed kill your gains. Ive seen a lot of people fail because of alcohol and leverage – leverage…