Fünf wichtige Indikatoren interpretieren den aktuellen Status von Bitcoin: Wie weit ist der Bullenmarkt gegangen?

Original author: Chandler, Foresight News

In 2024, the crypto asset market experienced extremely violent and wide fluctuations, especially the price of Bitcoin, which fluctuated between $50,000 and $70,000 for a long time and lasted for several months. This fluctuation is not only frequent and unpredictable, but also does not show the trend in traditional markets, nor does it follow the typical cycles of previous bull or bear markets, forcing us to re-examine the internal logic and operating mechanism of the market.

A notable feature of the current market is the obvious differentiation of investor strategies. Long-term holders and short-term traders have adopted completely different responses to this sharp fluctuation. Long-term holders usually choose to keep their positions stable during the volatility to cope with market uncertainties; while short-term traders use volatility to conduct frequent market operations and try to obtain short-term gains. It is particularly noteworthy that institutional investors, led by Bitcoin spot ETF investments, have particularly complex strategies in the current market. On the one hand, these institutions need to re-examine their holdings structure amid widespread market fluctuations, especially from the Grayscale Bitcoin Trust (GBTC) with high management fees to other Bitcoin spot ETFs; on the other hand, they also need to carefully assess the potential risks in the market and ensure that their investment strategies are consistent with market dynamics.

In this context, on-chain indicators have become a key tool for understanding the current market situation. By deeply analyzing on-chain data, we can capture subtle changes in market sentiment, gain insight into the evolution of investor behavior, and then summarize the potential trends of the market. Combining on-chain indicator data from previous bull markets, we attempt to outline the overall picture of the current Bitcoin market and provide a scientific basis for possible future market trends.

Bitcoin MVRV Z value: less than half of previous bull markets

MVRV (Market Value to Realized Value) is an important indicator in the Bitcoin and other cryptocurrency markets, used to measure market sentiment and price trends. The indicator provides information about whether the current price of an asset is overvalued or undervalued by comparing the market value and the realized value. The market value is the current market value of Bitcoin, calculated by multiplying the current price by the total number of Bitcoins in circulation; the realized value is the realized market value of Bitcoin, determined by calculating the price at which each Bitcoin was last transferred. The realized value reflects the total price actually paid by each holder in the Bitcoin market, which can effectively eliminate short-term market sentiment from the market value indicator.

The MVRV Z-score is a standard deviation test that reveals extremes in the data between market value and realized value. This indicator, represented by the orange line, is effective in identifying periods when market value is abnormally high relative to realized value. When the Z-score enters the pink area, it usually means the top of the market cycle; when the Z-score enters the green area, it means that the price of Bitcoin is severely undervalued.

By analyzing historical data, we can find that when the MVRV Z value is extremely high or low, it often corresponds to a turning point in the market. For example, the top of the Bitcoin bull market at the end of 2017 and the bottom of the bear market in 2018 and 2022 can all be found in this indicator. Although the peak of the 2021 bull market is not as high as the peak of previous years, it still briefly touched the pink area representing the top of the market. In 2024, although the price of Bitcoin has surpassed the high point of the previous bull market, its MVRV Z value is less than half of the high point of previous years.

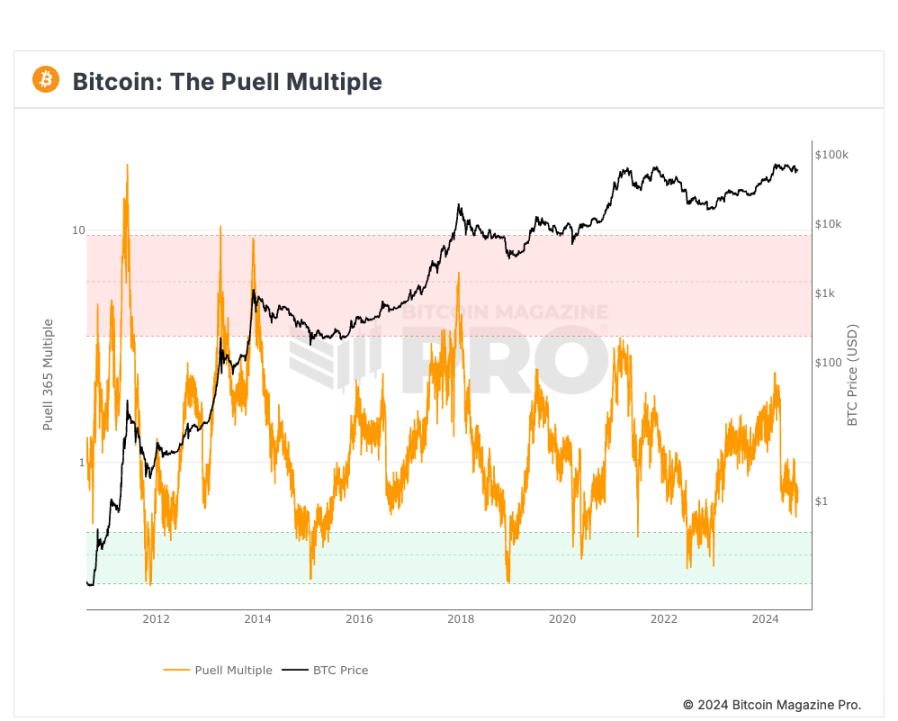

Puell Multiplier: This rounds high is only 2.4

The Puell multiplier is another indicator that is consistent with the cycle peak. This indicator calculates the ratio of current miner revenue to the average of the past 365 days. Miner revenue is mainly the market value of newly issued Bitcoin (the newly added Bitcoin supply will be obtained by miners) and related transaction fees. It can be used to estimate the miners income. The formula is: Puell multiplier = miner income (newly issued Bitcoin market value) / 365-day moving average miner income

The Puell multiplier is of great reference value in judging whether the price of Bitcoin deviates from the reasonable range. The sale of mined Bitcoin is the main source of revenue for miners, which is used to subsidize the capital investment in mining equipment and electricity costs during the mining process. Therefore, the average miner income over the past period of time can be indirectly regarded as the minimum threshold for maintaining the opportunity cost of miners operations. When the Puell multiplier enters the green zone, it means that the daily issuance value of Bitcoin is abnormally low, which is usually a good opportunity to buy at the bottom. Historically, investors who bought in during these periods often received excess returns. On the contrary, when the Puell multiplier enters the red zone, it indicates that miners income is significantly higher than the historical standard. At this time, the price of Bitcoin often reaches a high point, which is a good time to take profits.

The Puell multiplier during the March 2024 rally also only reached 2.4, which is also not enough to indicate that the market has reached its peak. With the Bitcoin halving event, the reduction in mining rewards has further squeezed the profit margins of miners. According to the 2024 Q2 financial results disclosed by Bitcoin mining company BitFuFu, the cost of self-mining BTC (including all direct costs such as electricity, hosting fees, and the cost of purchasing hash rate, but excluding depreciation) averaged US$51,887 per BTC, compared to US$19,344 per BTC in the same period of 2023. In this case, the mining costs of miners have approached or even exceeded the market price of Bitcoin, which puts them under tremendous operating pressure.

The sudden drop in the Puell multiplier reflects the markets reaction to this cost increase. Although the price of Bitcoin has risen before and after the halving, the Puell multiplier has not yet reached its historical high, indicating that the market has not fully digested these changes and the expected price surge has not occurred. This phenomenon may indicate that the Bitcoin market has entered a new stage, and miners have to face higher costs and lower profit margins. At the same time, this may also lead to a reduction in the supply of Bitcoin in the market, which will have a certain support effect on prices in the medium and long term.

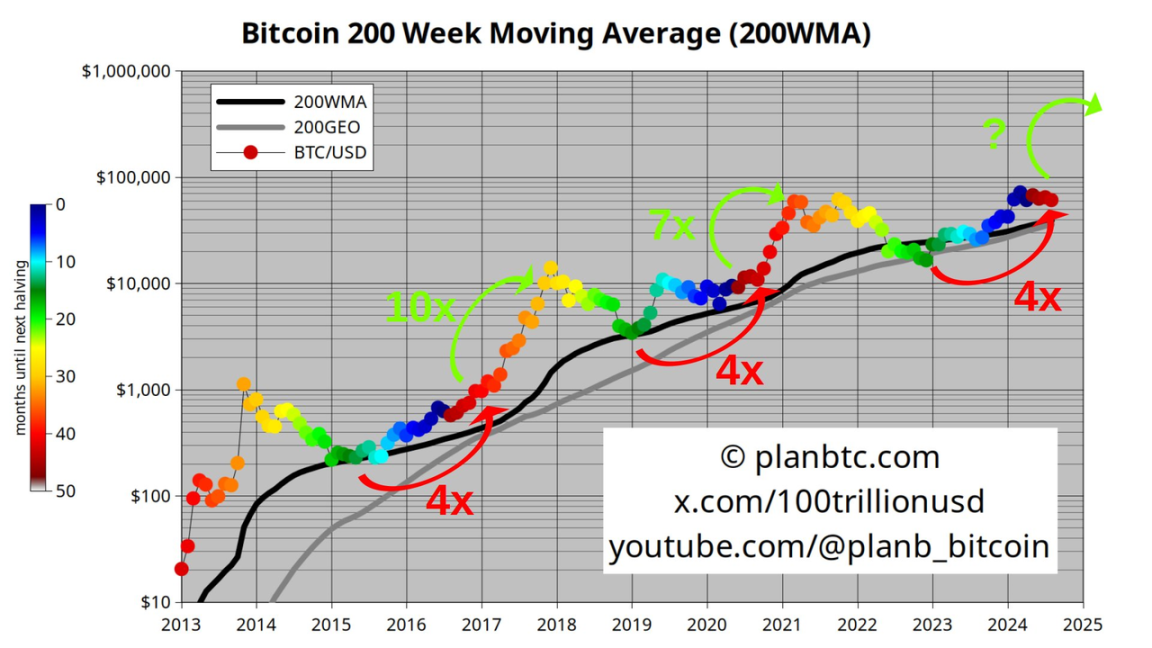

PlanB鈥檚 200-week moving average heat map: The pullback is about to end

PlanBs 200-week moving average (200 WMA) is a key indicator used to analyze the long-term trend of Bitcoin. It is often regarded as an important support and resistance level in the market, and is also an effective tool to measure changes in market sentiment. During the bear market of 2018-2019 and the market volatility caused by COVID-19 in 2020, the 200 WMA showed its significant role as an important support line. Even in the bull market of 2021, although the price of Bitcoin has experienced multiple pullbacks, every time the price approaches the 200 WMA, it will be effectively supported and re-enter the rising channel.

Historical data shows that when orange and red dots appear on the price chart, it usually means that the market is overheated, and this is a good time to sell Bitcoin. Recently, PlanB also said that according to the 200 WMA heat map, Bitcoin has increased 4 times from the bottom in 2022 to the current price, and historically 7-10x is from the current state.

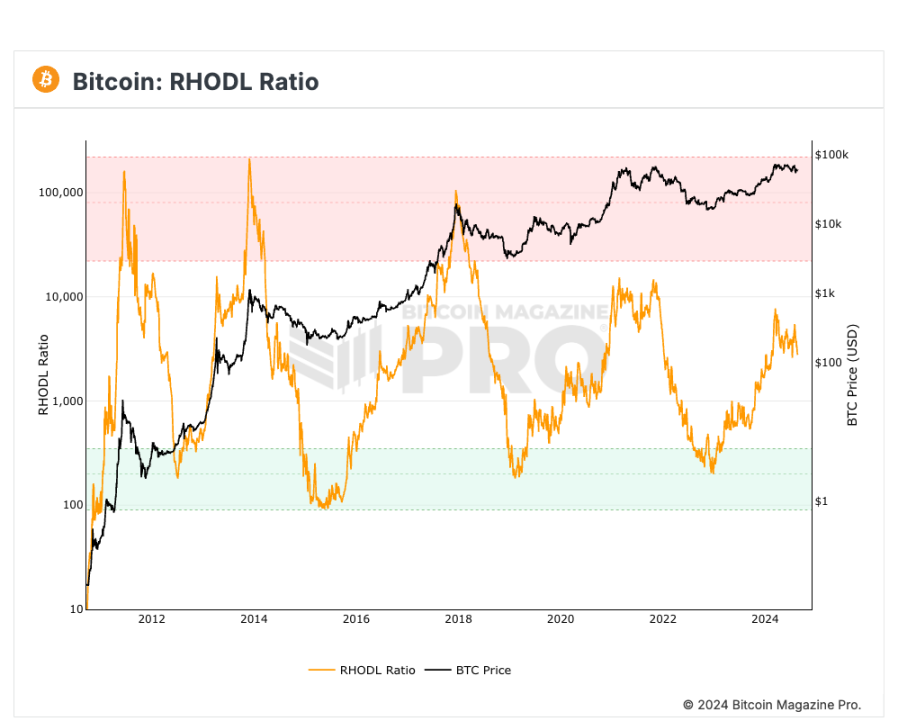

RHODL Ratio: The overall speculative enthusiasm in the market has weakened

The RHODL (Realized HODL) Ratio was created by blogger Philip Swift (@positivecrypto) in June 2020. It is an important indicator for evaluating speculative activities and holder behavior in the Bitcoin market. It measures the markets activity and speculation by comparing the number of Bitcoins held over different holding periods, especially the number of UTXOs (unspent transaction outputs) in the short term (1 week to 1 month) and the long term (1 year to 2 years). Specifically, the RHODL Ratio is calculated by dividing the number of long-term UTXOs by the number of short-term UTXOs. A higher ratio usually means a larger number of short-term holders, suggesting that there may be stronger speculative behavior in the market; conversely, a lower ratio indicates that long-term holders account for a higher proportion and the market is relatively stable.

In practical applications, the RHODL Ratio performs well in identifying the top of the Bitcoin market cycle. When the 1-week RHODL band value is significantly higher than the 1-2 year band value, it usually indicates that the market is overheated, which is a signal that the price may have reached its peak. In this case, the RHODL Ratio enters the red zone, which is often a good time for investors to take profits. At present, the RHODL Ratio does not show any signal that Bitcoin has reached the top of the bull market. Although the price of Bitcoin has previously reached a wave of relative highs after breaking through the previous high, the RHODL Ratio has shown a fluctuating downward trend in the past few months of volatile market conditions. This downward trend reflects that the market heat is gradually fading, but the number of short-term holders remains at a high level due to the fluctuations in market sentiment. This shows that although the overall speculative enthusiasm in the market has weakened, the activities of short-term investors are still active, showing that the market has not yet fully entered the cooling stage.

LTH/STH realized market value ratio: the main uptrend may not have arrived yet

The cyclical changes in the market value share of LTH/STH compiled by on-chain analyst @Murphychen provide us with a way to observe the trend of the Bitcoin market. By analyzing the wealth distribution of long-term holders (LTH) and short-term holders (STH), we can better understand the cyclical shifts in the market.

At the low point of a bear market, long-term holders usually account for most of the wealth in the market, and the blue line (LTHs realized market value share) reaches the peak of the cycle. At the peak of a bull market, short-term holders dominate the market supply, the red line (STHs realized market value share) reaches a high point, and the price of Bitcoin is often at a cyclical high. Whenever the red line crosses the blue line, it means that the market may enter the main upswing stage, marking the beginning of a bull market; conversely, the red line crossing the blue line often indicates the end of a bull market.

On March 9, 2024, the red line briefly crossed above the blue line, and then crossed below the blue line again on April 15. This short-term crossover may be caused by the short-term FOMO sentiment caused by the major positive news of the ETF, which caused short-term investors to take over the chips of long-term holders. However, due to the lack of sustained capital inflows, this short-term market boom quickly subsided and could not support a longer-term upward trend. A similar phenomenon occurred between July and November 2016, when the market trend was interrupted for about four months. Although the current market has experienced short-term fluctuations, judging from this brief breakthrough, it cannot be confirmed that the main upswing phase of this cycle has begun.

In general, although the price of Bitcoin has experienced a sharp and wide range of fluctuations in 2024 and has broken through the previous highs, multiple key on-chain indicators show that the market has not yet reached the height of the previous bull market top. Both the MVRV Z-value and the Puell multiplier show that the market has risen but has not yet reached its historical high, while the 200-week moving average continues to provide strong support for prices, indicating that the market correction may be nearing its end. In addition, the downward trend of the RHODL Ratio and the complex crossover signals of the realized market value share of LTH/STH further suggest that the market heat is gradually fading, but it has not completely cooled down, and there may be fluctuations in the short term.

These indicators show that the current market is still in the adjustment stage and has not entered the typical bull market main upswing. But on the other hand, in the current complex and uncertain market environment, we seem to have ushered in a new round of bull market that cannot be completely carved in the boat to seek the sword, especially in the context of the launch of spot ETFs accelerating the progress of the Bitcoin bull market. The introduction of spot ETFs has brought more institutional investment funds, increased market participation and liquidity, and also brought new complexity to the market. With the change of market sentiment and the reconfiguration of funds, there may be a new upswing cycle in the future.

This article is sourced from the internet: Five major indicators interpret the current status of Bitcoin: How far has the bull market gone?

Next weeks highlights Trump: An interview with Elon Musk will be held next Monday night ; The new CPI data will be released soon ; gm.ai: GM will be launched on August 14 (possibly delayed) ; Grayscale: New CEO appointment will take effect on August 15 ; The Arbitrum community launched a vote to “unlock token utility by enabling ARB staking”, which ends on August 16 ; FTX has initiated the next phase of the liquidation process, and customers must choose the Bahamas or US process options before 4:00 on August 17 ; From August 12 to August 18, more noteworthy events in the industry are previewed below. August 12 Trump: An interview with Elon Musk will be held next Monday night Odaily Planet Daily reported that former US President…