Bitget Research Institute: AAVE führt den DeFi-Sektor an, die Volatilität der Mainstream-Währungen erholt sich und der Markt m

In den letzten 24 Stunden sind viele neue beliebte Währungen und Themen auf dem Markt erschienen, was die nächste Gelegenheit sein könnte, Geld zu verdienen , einschließlich:

-

Sectors with strong wealth-creating effects are: DeFi (AAVE, UNI), BGB;

-

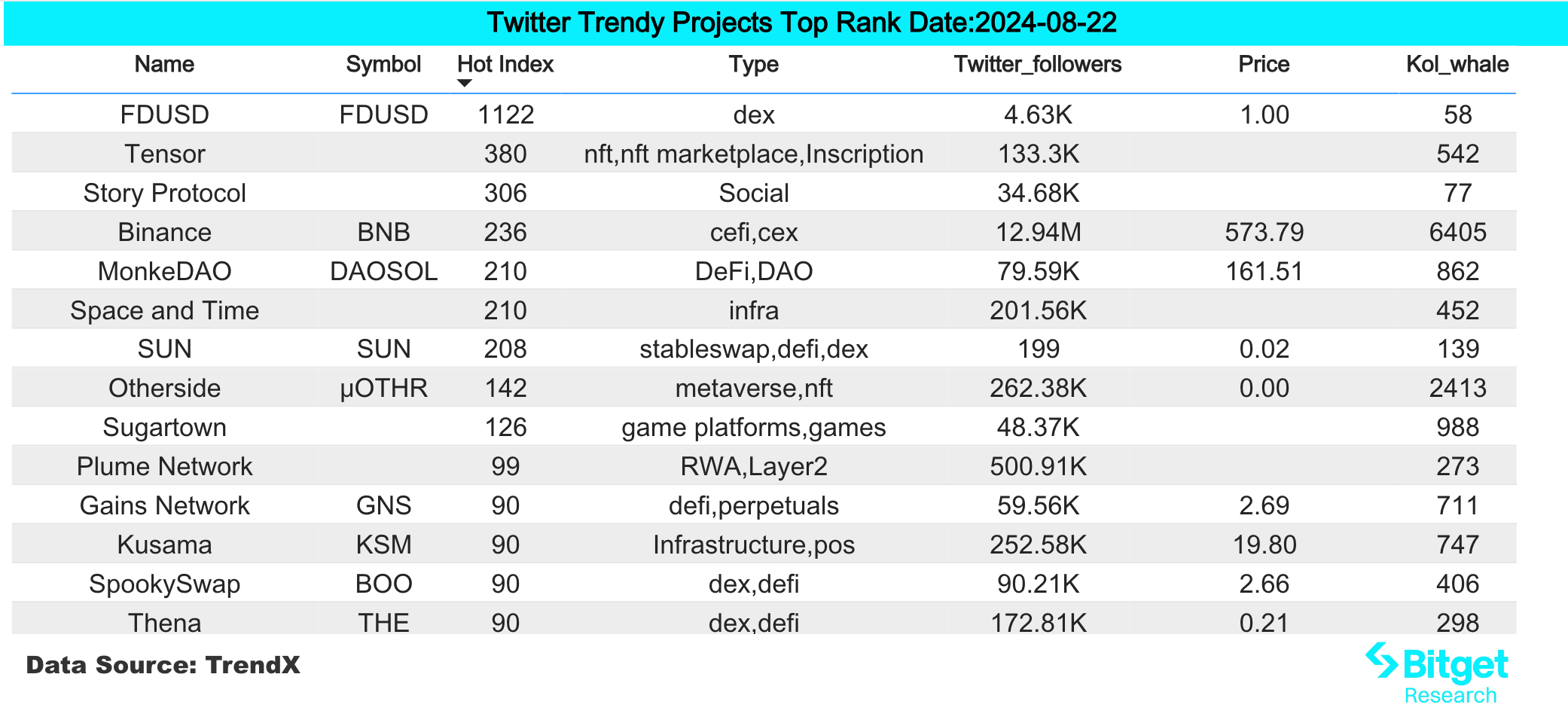

The most searched tokens and topics by users are: DOGS, Story Protocol, Matic;

-

Potential airdrop opportunities include: Solayer, Symbolic;

Data statistics time: August 22, 2024 4: 00 (UTC + 0)

1. Marktumfeld

Yesterday, the U.S. Department of Labor announced that the labor market had revised down the number of new jobs by 818,000, indicating that the U.S. job market was clearly not as strong as previous data had shown. After the data was released, the market briefly surged and then fell back.

In terms of ETFs, Bitcoin ETF had a net inflow of US$39.5 million yesterday, and has continued net inflows for five consecutive trading days; Ethereum ETF had a net outflow of US$18 million, and has continued net outflows for five consecutive trading days.

In terms of the track, the old DeFi sector of the crypto market exploded collectively yesterday, with AAVE, UNI and others leading the rise. The main reason is that AAVE has set new highs in all fundamental data, continues to be profitable, and is already proposing to reform the AAVE token economics, hoping to introduce a revenue sharing mechanism to enhance the practicality of the token.

2. Wohlstandsschaffender Sektor

1) Sector changes: DeFi (AAVE, UNI)

Hauptgrund:

-

AAVE protocol indicators continue to grow, exceeding the previous cycle high. Strong profit performance reflects the high fit between the product and the market, but the price of the currency is still undervalued, and the market discovers and repairs the valuation. The Aave Chan Initiative (ACI) has just launched a proposal to reform the AAVE token economics, hoping to introduce a revenue sharing mechanism to enhance the utility of the token. UNI is also exploring a revenue sharing mechanism.

Rising situation: AAVE rose 39.3% in the past 7 days, and UNI rose 12.0% in the past 7 days;

Faktoren, die die Marktaussichten beeinflussen:

-

Protocol indicators: Protocol indicators are the key to judging the activity of the protocol, including daily activity, transaction volume, profitability, etc. For example, AAVE can reach a historical high in terms of protocol indicators in the current market environment, and the market will naturally give a corresponding market value valuation for repair. On the contrary, if the protocol indicators cannot grow, then the market has no reason to be optimistic about the development of the protocol.

-

Profit distribution: More and more DeFi protocols link their own tokens to protocol revenue. This business model repeatedly activates the enthusiasm for token trading. Investors have good reasons to hold the token. Therefore, the promotion of the protocols profit distribution will greatly affect the token price.

2) Sectors that need to be focused on in the future: BGB

Hauptgrund:

-

Bitget Exchange has recently started in-depth cooperation with the popular Telegram Bot project DOGS. Influenced by the cooperation, Bitget application has entered the top ten in the download volume of App Store Finance in 11 countries. Under the premise of steady development and cooperation with many projects, users have more reasons to hold BGB and look forward to the subsequent relevant actions of the exchange;

Faktoren, die die Marktaussichten beeinflussen:

-

Activities such as LaunchPad/LaunchPool: As an exchange token, one of the important uses of BGB is to participate in the exchange LaunchPad/LaunchPool and other activities. Bitget has recently cooperated with many major projects and has a deeper cooperation with popular projects. If LaunchPad/LaunchPool has a good benefit effect, the demand for BGB will increase significantly, and the price will also rise.

3. Beliebte Suchanfragen von Benutzern

1) Beliebte Dapps

DOGS

The market focuses on DOGS, a high-traffic Telegram Mini Bot project in the TON ecosystem. The DOGS airdrop will end on August 22, and TGE will be held on August 26. DOGS already supports pre-charging the airdrop directly to Bitget. In addition, Bitget has also launched the BitgetLuckyDogs event, where users who deposit 1,000 DOGS can automatically participate in the lucky draw (up to 1 BTC grand prize).

2) Twitter

Story-Protokoll

Story Protocol is an IP management protocol that uses blockchain technology to change the way humans record history. The project recently completed a $80 million Series B financing, led by a16z Crypto, and other participating institutions include Foresight Ventures, Hashed, etc. As of now, PIP Labs, the open team behind Story Protocol, has raised $140 million and is valued at $2.25 billion. The market attention is very high, and it may become a leading project in the new track of blockchain. It is recommended to pay attention.

3) Google-Suchregion

Aus globaler Sicht:

Matic

Polygon will complete the upgrade of the token MATIC on September 4 and update the new token economy. POL will become an asset with an annual issuance rate of 2%, mainly distributed to validators + community treasury, increasing the communitys influence on Polygons future planning; Coinbase will include POL in the coin listing roadmap, and POL will become a hot search term on Google in the English and European regions. So far, MATIC has risen 15% in 24 hours, and the trading heat and community attention are relatively high.

Aus den beliebtesten Suchanfragen in jeder Region:

(1) Asia: Asia has shown its focus on weighted assets, including BTC, ETH, DOGE, etc. Different Asian countries have different focuses. For example, Pakistan focuses on TON game BLUM, Indonesia focuses on ETHFI, and Singapore focuses on AI project FET.

(2) CIS region: The CIS region still maintains a high enthusiasm for ton app games. For example, the Blum project has appeared in Uzbekistan, Ukraine and Belarus.

(3) Latin America: Latin America has a relatively concentrated focus on dog-related tokens, with floki, bonk, and shiba inu appearing in the hot searches. Recently, attention to gaming projects has also increased, such as SAND, MANA, etc.

Potenzial Luftabwurf Gelegenheiten

Solayer

Solayer is building a restaking network on Solana. Solayer leverages its economic security and quality execution as a decentralized cloud infrastructure to enable higher degrees of consensus and blockspace customization for application developers.

In July 2024, Solayer announced the completion of the builder round of financing, and the specific investment amount was not disclosed. Investors include Binance labs, Solana Labs co-founder Anatoly Yakovenko, Solend founder Rooter, Tensor co-founder Richard Wu, etc.

Specific participation method: You can stake SOL and SOL LST (jitoSOL, mSOL, bSOL, INF) supported by some projects to obtain points for each Epoch. Currently, the main network is open, and staking SOL can obtain sSOL and platform points.

Symbiotisch

Symbiotic ist ein allgemeines Restaking-Projekt, das es dezentralen Netzwerken ermöglicht, leistungsstarke, vollständig souveräne Ökosysteme aufzubauen. Es bietet eine Methode für dezentrale Anwendungen, die sogenannten Active Validation Services oder AVS, um gemeinsam die Sicherheit der anderen zu gewährleisten.

Symbiotic hat vor Kurzem seine Seed-Finanzierungsrunde abgeschlossen. Paradigm und Cyber Fund beteiligten sich mit einem Finanzierungsbetrag von $5,8 Millionen US-Dollar an der Investition.

So nehmen Sie teil: Gehen Sie auf die offizielle Website des Projekts, verknüpfen Sie Ihr Wallet und zahlen Sie ETH- und ETH-LSD-Vermögenswerte ein.

Originallink: https://www.bitget.fit/zh-CN/research/articles/12560603814747

Haftungsausschluss: Der Markt ist riskant, seien Sie also beim Investieren vorsichtig. Dieser Artikel stellt keine Anlageberatung dar und Benutzer sollten prüfen, ob die Meinungen, Ansichten oder Schlussfolgerungen in diesem Artikel für ihre spezifischen Umstände geeignet sind. Das Investieren auf der Grundlage dieser Informationen erfolgt auf eigenes Risiko.

This article is sourced from the internet: Bitget Research Institute: AAVE leads the DeFi sector, the volatility of mainstream currencies rebounds and the market may soon usher in a change

Related: Attendees Guide: TOKEN2049 Singapore Surrounding Activities

The Web3 cryptocurrency conference TOKEN 2049 Singapore will be held at the Marina Bay Sands Hotel in Singapore from September 18 to 19. During the two-day event, hundreds of gatherings, seminars and peripheral activities will be held in rotation, and it is expected to attract more than 20,000 attendees from more than 7,000 companies and more than 100 countries. The event aims to provide a platform for interaction and communication for Web3 entrepreneurs, institutions, industry insiders, investors, builders and people with a strong interest in the cryptocurrency and blockchain industry. For more information, please visit the official website of the event: https://www.asia.token2049.com/ Odaily Planet Daily has compiled surrounding activities for readers and participants (continuously updated). The times marked below are all Singapore time (GMT+ 8): Token 2049 Main Conference Agenda…