Welche Auswirkungen hat der Eintritt von JD.com und Xiaomi in den Stablecoin-Markt?

Originalautor: Biteye-Hauptbeitragender Viee

Originalübersetzung: Biteye-Hauptmitarbeiter Crush

Recently, the Hong Kong Monetary Authority announced that JD Technology Group’s JD CoinChain Technology (Hong Kong) is one of the first institutions to enter the “sandbox” program for stablecoin issuers. This is undoubtedly a big news!

It is worth noting that behind JD.coms issuance of stablecoins are two Internet giants, Liu Qiangdong and Lei Jun. Tianxing Bank, a Hong Kong licensed virtual bank under Xiaomi Group, will assist JD.com CoinChain Technology in developing cross-border payment solutions based on stablecoins. This means that JD.com and Xiaomi may cooperate in the field of stablecoins.

The two industry giants have made in-depth arrangements in the field of digital currency. This move is not only a pursuit of past payment market opportunities, but also a forward-looking investment in future financial technology! This article will explore this event in depth and analyze the reasons why JD.com entered the stablecoin market.

01 The rise of stablecoins

1. What is a stablecoin?

Stablecoins are cryptocurrencies pegged to fiat currencies or other assets, designed to reduce price volatility and provide a relatively stable form of cryptocurrency compared to highly volatile cryptocurrencies such as Bitcoin. They are usually pegged 1:1 to fiat currencies, ensuring the stability of their value.

2. Stablecoin market structure

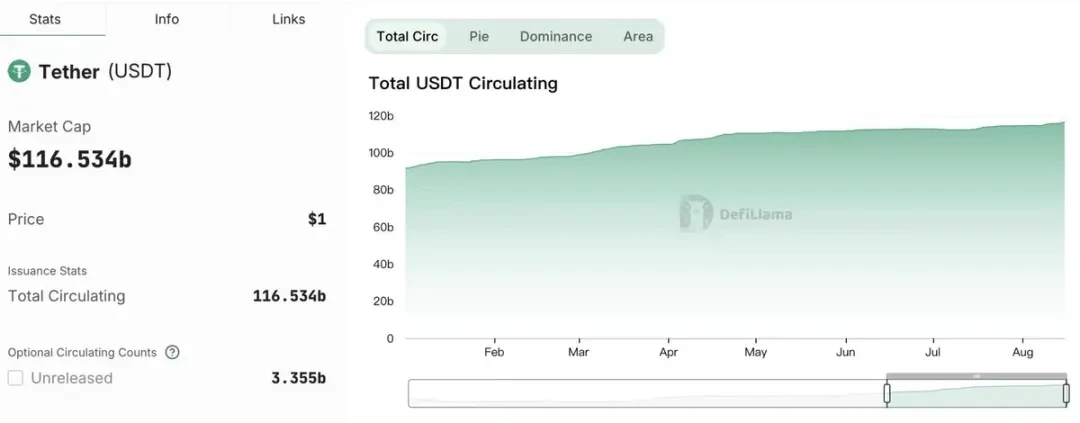

According to The Blocks latest market research, the total market value of stablecoins has exceeded US$100 billion, becoming an important and important part of the crypto market that cannot be ignored.

Quelle : https://www.theblock.co/data/stablecoins/usd-pegged/total-stablecoin-supply

Currently, USDT (Tether) occupies 70% of the stablecoin market and has become the market leader. However, if a non-US dollar-pegged stablecoin, such as JD-HKD, is launched, can it make a breakthrough in market share? In addition to the need for a suitable regulatory environment, it is more important to find scenario use cases for Hong Kong dollar stablecoins. It is particularly important to expand market share through scenario-based applications.

02 CoinChain Technology: The driving force behind the issuance of JD.com’s stablecoin

Jingdong Coinlink (Hong Kong) is a wholly-owned subsidiary of Jingdong Technology Group, focusing on the application and development of blockchain technology. It is the only stablecoin issuer under Jingdong. The company was officially registered in March this year, and only 5 months later it was selected as one of the first batch of participants in the Stablecoin Issuer Sandbox of the Hong Kong Monetary Authority. It has developed rapidly, which shows Jingdongs ambition!

JD Stablecoin, also known as JD-HKD, is a public chain-based stablecoin whose reserves consist of highly liquid and credible assets. The details are as follows:

Anchored 1:1 to the Hong Kong dollar, for every unit of stablecoin issued, JD CoinChain Technology will correspondingly hold an equivalent amount of Hong Kong dollars in its reserves.

Each JD-HKD can be redeemed at a 1:1 ratio. Its reserves are composed of highly liquid and trusted assets and are securely held in independent accounts of licensed financial institutions. Regular disclosures and audits are conducted to ensure the integrity of the reserves.

This means that users can use JD Stablecoin with greater confidence and enjoy a safe and stable digital asset experience.

03 JD.com’s Inextricable Bond with Blockchain

JD.com’s history with blockchain can be traced back to 2017. With the rise of blockchain technology, JD.com began to actively explore this emerging field.

In 2017, JD Finance cooperated with China UnionPay to successfully build the first cross-regional and cross-operator alliance chain Zhizhen Chain based on the public network in China. The establishment of this alliance chain not only improved JDs ability in blockchain technology, but also laid the foundation for subsequent multi-party cooperation. Subsequently, Wanda Group and China Merchants Bank also joined the alliance chain, forming a cooperation network covering multiple industries.

In 2018, JD Finance launched JD Digital Assets based on blockchain technology. In the same year, it also released a blockchain anti-counterfeiting and traceability platform, using blockchain technology to achieve full traceability of goods, thereby enhancing consumers trust in product quality.

In 2021, JD.com launched its own NFT platform Lingxi, which is another important attempt by JD.com in the blockchain field. The platform aims to provide users with trading and collection services for digital artworks, further expanding the boundaries of JD.coms application of blockchain technology.

It was not until July 2024 that JD CoinChain Technology (Hong Kong) announced that it would issue a stablecoin in Hong Kong that was anchored 1:1 to the Hong Kong dollar.

So why did JD.com choose to enter the stablecoin market?

04Reasons for JD.com to enter the stablecoin market

Liu Qiangdong has said on many occasions that JD.com has many regrets in its layout in the payment field, especially the failure to keep up with the rapid development of mobile payments. JD.coms vigorous development of stablecoins seems to reflect its determination to catch up after missing the opportunity to develop the payment market.

Therefore, the reasons can be analyzed from many aspects:

1. Enriching financial product lines: JD.com’s layout in the field of financial technology has begun to take shape, and the launch of stablecoins will further enrich JD.com’s financial product lines. It will get involved in the encryption industry, attract more users to participate in its financial ecosystem, and provide more diversified financial services, such as lending, investment, etc.

2. Improve cross-border payment efficiency: On the one hand, with the approval of Bitcoin ETF and Ethereum ETF, cryptocurrencies have entered the public eye more quickly and attracted the attention of the global financial market. The introduction of stablecoins will improve JD.coms efficiency in the field of cross-border payments, provide support for JD.coms internationalization strategy, and make it more competitive in the global market.

3. Most importantly, the profit from issuing stablecoins is considerable : According to DeFiLlama data, the market value of stablecoins has increased by nearly 28.4% to $166.96 billion since the beginning of this year (August 15). Tether, the issuer of the leading stablecoin USDT, has a profit that is close to that of Wall Street giants! Net profit in the first half of 2024 reached $5.2 billion, a record high. Whats more shocking is that the entire team has only about 100 employees.

However, if we think about this further, entering the stablecoin market actually reflects the anxiety of Chinese e-commerce giants to go overseas collectively.

JD.com and Xiaomi, two giants in Chinas Internet industry, have achieved great success in e-commerce and smart hardware respectively. After the epidemic, the competition for going overseas has become more and more fierce, among which cross-border payment has become a top priority. However, challenges such as efficiency issues of cross-border payments and geopolitical risks have always plagued these companies going overseas. Perhaps in order to seek new growth points, both companies have begun to pay attention to the fields of financial technology and cryptocurrency.

In this context, JD.coms stablecoin issuance is particularly important. It is not only a strategic move for JD.com to cope with market changes, but also an attempt to improve the efficiency of cross-border payments. Through stablecoins, JD.com hopes to provide users with more convenient payment solutions and overcome existing payment barriers. At the same time, this also provides support for JD.com and even other Chinese e-commerce giants to enhance their competitiveness in the global market.

05 Conclusion

JD.com and Xiaomis strong alliance in the stablecoin market marks a new round of layout of the two industry giants in the field of financial technology. This move is not only a catch-up of past payment market opportunities, but also a deep investment in the future digital economy.

With the continuous development of the stablecoin market, whether JD.com and Xiaomi can achieve a counterattack in this wave is worthy of our continued attention!

This article is sourced from the internet: What is the impact of JD.com and Xiaomi entering the stablecoin market?

Earlier this year, when USDT exchange outflows exceeded $1 billion, Bitcoin soon began to trend down, suggesting that investors may be taking a risk-off stance. One analyst noted that the current price action “feels extremely similar to what Bitcoin did last year,” when it traded sideways for two months after a sharp drop in August. Cryptocurrency prices have rebounded sharply from last week’s volatility, with Bitcoin (BTC) bouncing back above $60,000 after falling below $50,000 during the Aug. 5 crash. But further gains may be elusive — at least according to one indicator that points to recent local highs. Crypto analytics firm IntoTheBlock noted that more than $1 billion in Tether stablecoin USDT was withdrawn from cryptocurrency exchanges on Tuesday, the largest single-day withdrawal since May. IntoTheBlock analysts said: In…