Welche weiteren Optionen für Dapps gibt es neben Anwendungsketten?

Originalautor: Pavel Paramonov

Originalübersetzung: TechFlow

Is everything really moving towards AppChains?

Yes, but its not actually true.

The main reason dApps turn to sovereign chains is that they feel they are being treated unfairly.

This is not without reason, as most dApps are operating at a loss.

You can refer to recent examples like the zkxprotocol outage, and many other applications in the past like utopialabs_ , yield , FujiFinance , and many more.

But is this because the business model is truly flawed, or is there something truly wrong with the protocol?

The main (and often only) source of revenue for a dApp is transaction fees. Users pay these fees because they directly benefit from the service.

However, users are not the only actors that benefit from dApp usage.

In the transaction supply chain, there are multiple participants who profit, mainly block proposers, even though they are the last to see the transaction. In the case of L2, these participants are called sequencers.

MEV is being extracted in large quantities, which is not always a bad thing, but the value created by dApps is being taken away from them, so they are not able to get the full value they provide.

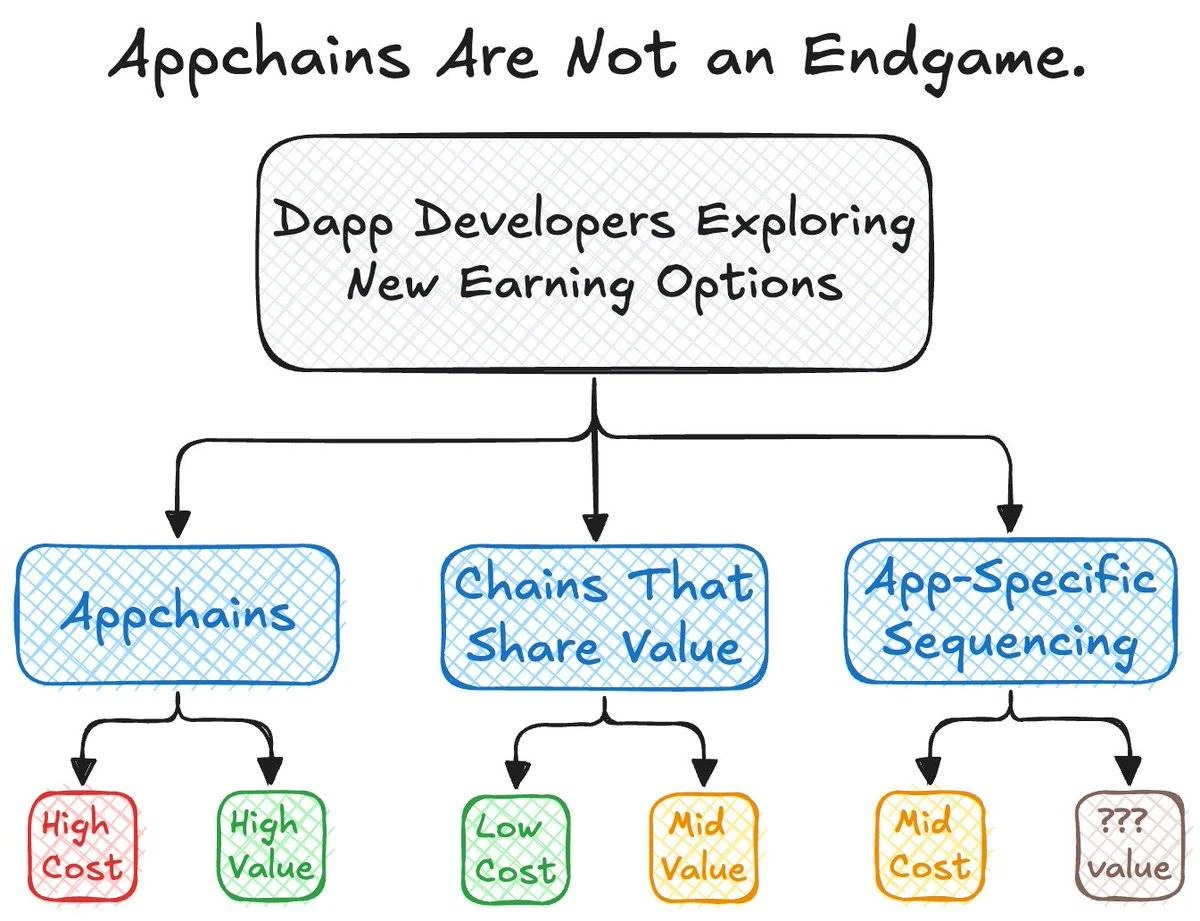

Zurzeit gibt es drei Möglichkeiten, dieses Problem zu lösen:

-

Become an application chain.

-

Choose an L1/L2 that can create value.

-

Implement an application-specific sorting mechanism.

Like all things in crypto, every solution has its trade-offs.

1. Becoming an application chain: high cost + high value

You get many benefits: extract as much value as possible, control your own network (if you are L2), it is easier to scale, avoid competition for block space, etc.

The downside is: this is really expensive and more challenging to implement because you have to build both the application and the chain.

Even if you want to build an L2 and use a solution like alt_layer .

The argument that “every application will eventually become an appchain” is generally wrong for three reasons:

-

Not every decentralized application (dapp) is large enough to require migration to Lisk.

-

Some dapps benefit directly from the architecture of the underlying chain.

-

Dapps adapt well on other chains.

2. L1/L2 can return value: low cost + medium value

It’s much cheaper to deploy an application on a rollup or L1 because you don’t need to create new rules for validation, inclusion, consensus, transaction flow, etc.

In the case of rollups, moving your application from Ethereum to a rollup is usually very simple, as rollups are either EVM-compatible (e.g. Arbitrum ) or EVM-equivalent (e.g. taikoxyz ).

You still need to consider the architecture of the underlying chain, but you don’t have to build it from scratch.

Maybe in the future we will achieve true chain abstraction and developers can just focus on their dapps, but that’s another topic.

Developers receive a medium value reward because it is not high value (you don’t own the chain’s economic system), but it is not low value (in addition to transaction fees, you will also receive some other rewards).

There are almost no such implementations at the moment, as sharing MEV with dapps is still a complex process and we need more RD.

3. Application-specific ranking: Moderate cost + uncertain value

The concept of application-specific ordering is relatively new and people often confuse it with appchains. The difference is simple:

Appchain focuses on sequencing and execution.

Self-ordering decentralized applications (dapps) only focus on ordering and outsource the execution to L1/L2.

This is a medium cost because you need to consider ordering of transactions beyond just building a dapp, and the value is uncertain because the concept is still relatively new and involves different concerns.

First, you are still dependent on the proposer because there is an inclusion game: you can send any bundle you want, but whether your bundle is included in the block is up to the proposer.

If you would receive all the MEV (Maximum Extractable Value), then the proposer has no clear incentive to include your bundle in the block.

Hence, this creates another incentive market for proposers. They (dapp + proposer) should cooperate or they will lose value and power.

Furthermore, its value is uncertain, as we cannot be sure whether the shared value from L1/L2 will exceed the value the dapp creates for itself by ordering transactions.

Any chain is a dark forest (not just Ethereum!). So back to the original question:

Is everything really moving towards AppChains?

-

Yes (some dapps benefit from having their own chain rather than staying on an existing chain).

-

No (there are other solutions suitable for dapp needs).

This forest is huge and its worth exploring all the options.

There is some diversity in every landscape within the world’s crypto space, so choose the option that best suits your needs, or build your own solution!

This article is sourced from the internet: In addition to application chains, what other options are there for Dapps?

In the past 24 hours, many new hot currencies and topics have appeared in the market, and it is very likely that they will be the next opportunity to make money. The sectors with relatively strong wealth-creating effects are: TON ecology; Hot search tokens and topics among users are: REVOX, Linea, RWA; Potential airdrop opportunities include: LayerN, LIFI; Data statistics time: June 24, 2024 4: 00 (UTC + 0) 1. Market environment In the past two weeks, the BTC spot ETF has shown a continuous net outflow trend. BTC fell below $63,000, ETH on-chain gas fell to 1-2 gwei, and market sentiment dropped to freezing point. High-market-cap new coins ZRO and ZK led the decline of altcoins, and their prices have fallen by 30%-50% from the price at the time…