Wöchentliche Empfehlungen der Redaktion (0810-0816)

Weekly Editors Picks ist eine funktionale Kolumne von Odaily Planet Daily. Planet Daily deckt nicht nur jede Woche eine große Menge an Echtzeitinformationen ab, sondern veröffentlicht auch viele hochwertige, ausführliche Analyseinhalte, die jedoch möglicherweise im Informationsfluss und den aktuellen Nachrichten verborgen sind und Ihnen entgehen.

Daher wählt unsere Redaktion jeden Samstag aus den in den letzten 7 Tagen veröffentlichten Inhalten einige hochwertige Artikel aus, deren Lektüre und Sammlung es wert ist, sich Zeit zu nehmen, und bietet Ihnen aus der Perspektive der Datenanalyse, der Branchenbeurteilung und der Meinungsäußerung neue Inspirationen in der Kryptowelt.

Kommen Sie jetzt und lesen Sie mit uns:

Investitionen und Unternehmertum

Web3 Growth in 2024: Over 100 Startups Have Raised Over $1 Billion

There are not many new first rounds of financing, and venture capital firms are increasing their investments in successful projects.

Attribution/analytics, loyalty, and social startups received the most new funding, accounting for 80% of funds raised across all 10 categories.

Messaging was the second category to receive the most funding, with ad networks and community tools being the most crowded categories.

Was treibt den Kryptowährungsmarkt an? Einführung in das Binance CPT-Framework

Capital, people and technology form the basis of the “CPT” framework.

Bull market catalysts include: approval of the spot Ethereum ETF, the macro environment, the US presidential election and Bitcoin conference, and the impact of Bitcoin halving.

a16z: Token-Rechte in Anlagebedingungen, wie können Raubgeschäfte vermieden werden?

In early rounds, structuring legal rights around tokens is complex, and some investors may exploit the lack of clear definition of market standards to take advantage of unsuspecting entrepreneurs. For this reason, we need a foundational principle that defines the scope of token rights and restrictions: incentive alignment.

Clauses a16z Crypto and other large crypto VCs use to align incentives with entrepreneurs include (with example clauses): token rights, lock-up periods, protective clauses, network utilization, and compliance.

Luftabwurf Leitfaden zu Chancen und Interaktionen

Must-attend this week: Fractal Bitcoin interactive points, Scallop high-yield stablecoin mining

Der Markt ist zu langweilig? Spielen Sie das Minispiel, das bald für Airdrops bestätigt wird

Super Champs, MoonFrost, The Beacon, Earn Alliance, ChronosWorlds.

Wohlfahrt für die Mao-Partei: Ein Artikel über die interaktiven Projekte von sign-in

InfinityAI, the Bitcoin fractal network ecosystem; Movement, the first L2 using Move built on Ethereum; CARV, which focuses on building a modular data layer for AI and Web3 games; GoPlus, a Web3 user security data platform; Plume Network, a modular L2 built for all RWAs; and Morph, an Ethereum L2 solution.

Ethereum und Skalierung

What the Ethereum ecosystem needs to consider at this moment is not to reshape DeFi Summer, but to get out of the shadow of pure DeFi culture. How to integrate Ethereum into the Web2 world as much as possible and move from virtual to real is what everyone should really expect in the new summer.

Sollte Ethereum das Konzept der Ultraschallwährung aufgeben?

CryptoQuant analysts said the Dencun upgrade makes Ethereum inflationary again, potentially destroying its properties as an “ultra-sound” currency.

A power law effect is starting to emerge, with dominant L2 solutions attracting a disproportionate number of users, while Ethereum remains underutilized because the cost of posting data to Ethereum remains relatively constant despite growth.

If you want ETH to be the chain for settlement and security now, rather than the chain for users, inflation is not necessarily a bad thing, it helps improve liquidity and propagation across all these ecosystems. Making ETH (artificially) scarce would hinder these properties (see: Bitcoin).

Multi-ecology and cross-chain

The article focuses on the IDO platform Monad Pad, the MEV infrastructure and liquidity staking platform aPriori, the liquidity staking protocol Kintsu, the decentralized order book transaction Kuru, the NFT trading platform Poply, the decentralized prediction market Castora, and the liquidity staking protocol Magma.

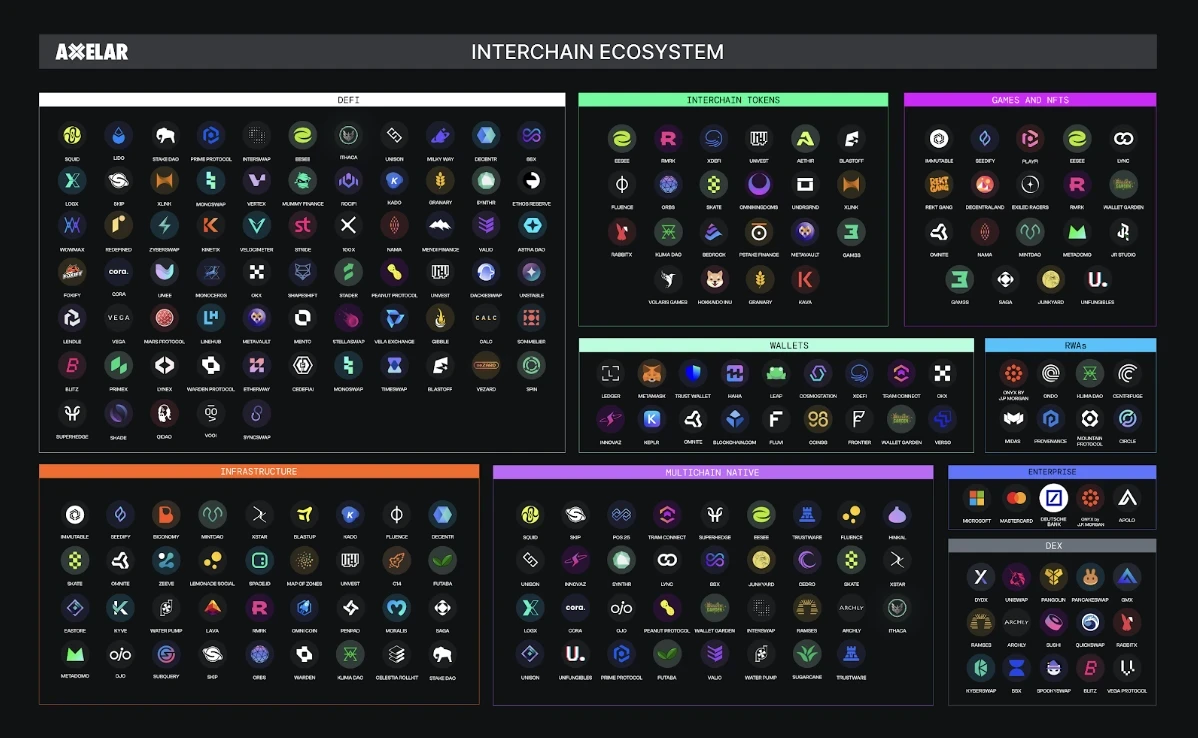

Axelars full-chain ecosystem overview in one article: On-chain and Wall Street

At present, Axelar has built two huge and expanding ecosystems: new and old participants in Web3 (covering the on-chain and Token fields) and traditional Wall Street giants (involving off-chain and RWA fields).

DeFi-DeFi-Banken

Coinbase-Forschungsbericht: Stablecoins und die neue Zahlungslandschaft

A relatively basic reading on stablecoins for non-circle users, covering the comparison between stablecoins and traditional finance, recent news and related data.

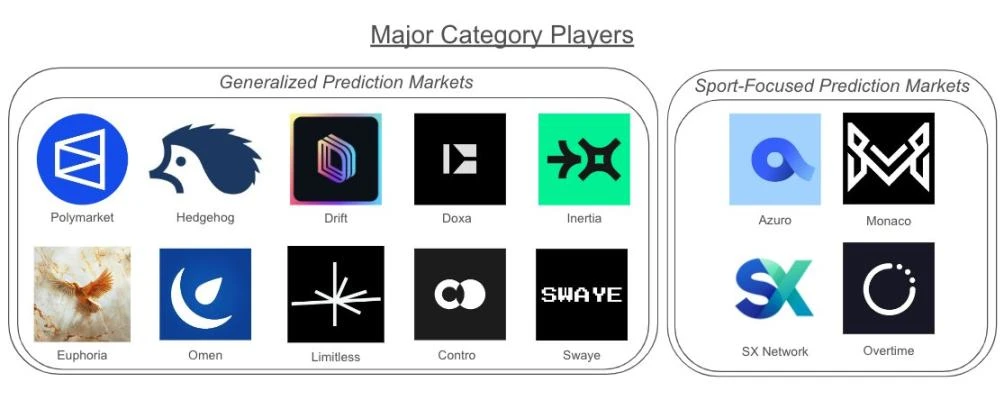

1kx: A brief discussion on new players and development trends in the prediction market

New players generally focus on two common themes: permissionless markets (open market creation and incentive layers) and solutions (relying on artificial intelligence for market settlement, or creating more efficient systems) – these two points are also where Polymarket can improve.

Prediction markets can make money from transaction fees, a portion of trader profits (the Web2 model follows this path), and counterparty profits and losses (Web2 likes to serve losing customers).

Wie kommt man an unbegrenztes Geld?

An introduction to soft liquidation of clickbait.

By holding Bitcoin and using the soft liquidation mechanism for fiat currency lending, we can obtain continuous cash flow during the appreciation of Bitcoin without having to sell Bitcoin or worry about liquidation caused by short-term price fluctuations messing it up. With a certain amount of Bitcoin, the fiat currency available for disposal without labor gradually increases over time.

Under the soft liquidation mechanism, even if liquidation occurs, we will buy back the collateral at almost the same price as the selling price during the price recovery process to ensure that the position remains almost unchanged. However, due to the premise that Bitcoin will appreciate relative to credit currency over a longer time scale, liquidation will inevitably rise in the future. (Soft liquidation is initiated by external arbitrageurs, and borrowers will suffer relatively less losses than hard liquidation, and need to avoid falling into the liquidation range frequently. This also reflects the design philosophy opposite to Uni v3: LP hopes that the price will fall within the range as much as possible to earn fees, and borrowers hope that the price will fall within the range as little as possible to reduce losses.)

Trading Bot: Eine weitere Möglichkeit für Dex zu überleben

The Dex Trading Bot track is becoming an emerging area in the cryptocurrency market that deserves close attention due to its broad user base, clear application scenarios and significant profit potential.

The services provided by Dex Trading Bot include: automated trading, optimized trading experience, sniping function, one-click copy function, limit orders and DCA.

Dex Trading Bots profit model can be divided into three types: subscription fee system, transaction fee system, and mixed system.

Bots advantages over traditional Dex include: quick response, automated trading, reduced MEV losses, higher flexibility, improved user experience,

List of 5 good places to earn mining income this week

Jupiter, Merkl, Dolomite, Brahma, Kamino.

What motives do the big guys in the cryptocurrency circle have to “put out the fire” of Curve?

Yield is a matter of horizontal comparison of web3 and is no longer a specific sub-segment.

As an infrastructure layer protocol, Curve no longer needs to be developed after a certain stage. It is also mature enough and updates do not affect its usage.

Curve provides a complete framework, and the chips are decentralized. (Compared to Uniswap) The prospect of cross-cycle planning will be better (the premise is that it is believed that the future of the chain needs incentives).

There are many project parties that buy CRV. Liquidity mining was the core way to get started in the last cycle. In the early stages of a project, liquidity was rented. CRV solves the problem that a project party does not need to inflate its own economic model in the early stages of its launch, but instead uses the liquidity of renting CRV, thereby solving the problem of token inflation and using the token for other utilities. At the same time, the token is still meaningful after being unlocked. CRV can also support transactions of non-stable currencies, similar to Uniswap. At the time of purchase, those that could not be purchased in the queue were given priority to the project party. The project will not die and will not be cannibalized by Uniswap in a short time.

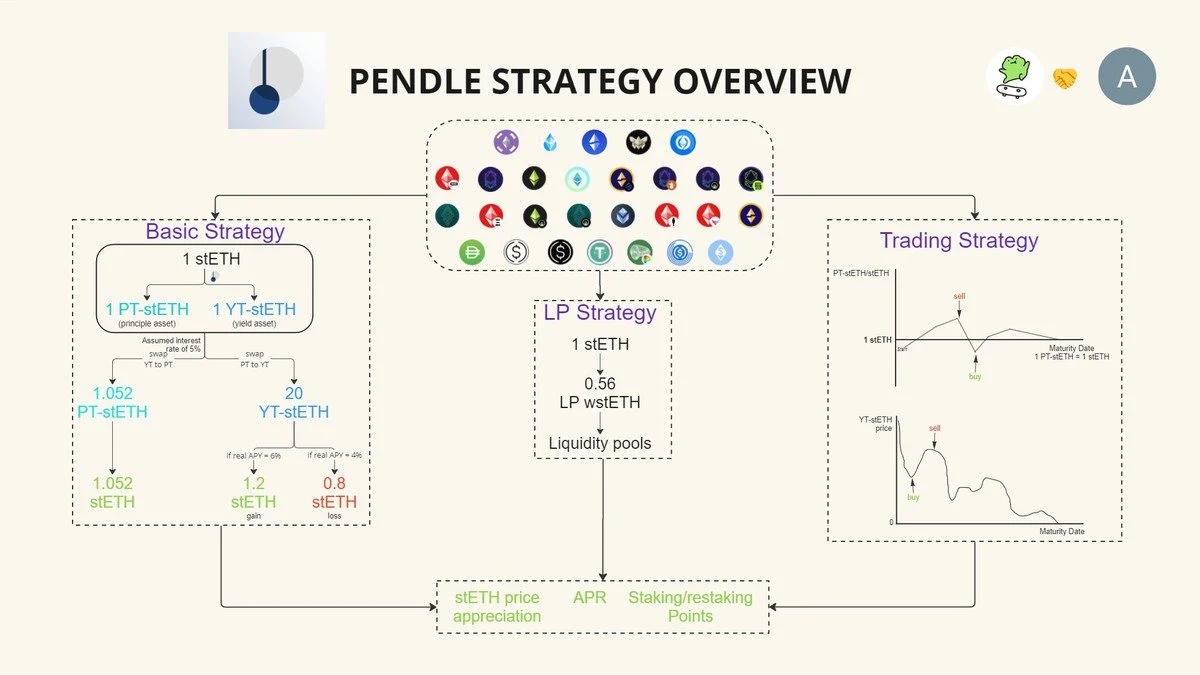

Pendle Project Research Sharing

Pendle is a place for tokenization and yield trading. First, there is a fixed interest rate. Users can deposit assets and withdraw more assets after maturity. On the other hand, there are traders who prefer the returns of high-risk speculation.

Pendles short-term hype value: LRT popularity, integrated PMF (Product Market Fit) popularity, and Binance investment.

Long-term investment value: The underlying assets of DeFi yields are still crypto assets (mainstream assets, mid-stream assets, and long-tail assets). The volatility of these assets ultimately affects the yield volatility of DeFi protocols. For example, it is not uncommon for mining projects to have a 20% yield on the first day and 0.02% before the day after tomorrow. The friction cost and time cost of adjusting positions in the middle make the final profit, so fixed-rate products are gradually in demand.

GameFi

Yale University: ServerFi, eine neue symbiotische Beziehung zwischen Spielen und Spielern

The author proposed two suggestions to improve the GameFi token economic model: ServerFi (privatization through asset synthesis); Continuous Rewards for High-Retention Players.

Unlike traditional models, ServerFi effectively promotes social mobility among players by introducing a dynamic and competitive environment where continuous value contribution is necessary to maintain status. This model not only fosters a more vibrant and inclusive community, but also provides a scalable and resilient framework for future blockchain games.

Web3 AI

IOSG Ventures: From Web2 to Web3, the next evolution of Marketplace

Essentially, Marketplace is an intermediary that connects the demand side (end consumers) and the supply side (sellers or suppliers), and makes a profit by charging a certain percentage of the transaction as a commission or service fee, or by charging an additional fee for providing value-added services (such as payment processing, product delivery, and customer support). Its core functions are access and visibility, providing a platform where sellers can reach a wide audience and buyers can easily find the goods they need; improving efficiency by aggregating supply and demand, reducing search and transaction costs, and achieving trust by providing certain security mechanisms such as evaluation systems, escrow services, and dispute resolution.

A successful Marktplatz platform is inseparable from: demand liquidity and the compound nature of demand.

As technology continues to develop and the tokenization trend accelerates, the Web3 market platform will expand to more consumer goods and traditional assets, creating a new market of new demand + new supply, providing innovative value propositions for both supply and demand sides, such as more complex data and computing resource markets, intellectual property and patent markets, energy/environmental assets and usage rights markets, diverse consumer goods and collectibles markets, and personal time and professional skills service markets.

Problem als Methode: ein neuer Rahmen zum Verständnis der Kettenabstraktion

The purpose of abstraction is to hide complexity, and the level of abstraction in the context of Web3 is often higher than that of Web2 (and therefore more difficult);

Modularization lowers the threshold for building a public chain, and chain abstraction includes the re-architecting of public chain relationships and improving user/developer experience;

Cross-chain asset transfer, cross-chain communication, interoperability, and chain abstraction: a subset of concepts centered on coordinating state modifications (transactions) on different chains (but often filled with middle ground in actual use);

The intent-based chain abstraction solution has become a popular architecture, and many component products may gradually move towards the final form of chain abstraction in the form of puzzle pieces;

The current discussion and construction of chain abstraction in the industry has not yet broken the superstition of infra-based. The establishment of chain abstraction as a real problem is inseparable from the activity on the chain, modularization progress, and the entry of new users and developers;

The future of chain abstraction is not a bright and smooth road. It is necessary to consider the impact on long-tail public chains and the exploration of non-DeFi applications.

Check out 5 potential AI projects that you can’t miss

Nillion, Grass Network, Ritual Network, Allora Network, Peaq Network.

Heiße Themen der Woche

In der vergangenen Woche in terms of policy and macro market, the US PPI rose less than expected in July, and economists expect the Fed to start a series of interest rate cuts from September ; the Feds mouthpiece: The debate at the Feds September meeting will focus on a 25 basis point rate cut or a larger 50 basis point rate cut ; Bank of America: The market is pricing in four rate cuts this year , and it is not believed that Powell will go against market pricing; the US Internal Revenue Service released a new draft of the crypto tax form , which no longer requires filling in wallet addresses and transaction IDs;

In terms of opinions and voices, Adam Cochran: venture capital is slowing down investment in the crypto field , and the returns from holding BTC/ETH alone can exceed those of index funds; Matrixport Market Observation: the crypto market lacks supporting hot spots in the short term , and rational investment or low-price positions can be made; BitGo CEO responded to the controversy of the WBTC project : willing to assist Maker DAO in due diligence to alleviate community concerns; Dragonfly joined Crypto.com and Coinbase in opposing the CFTCs proposed ban on prediction markets ; Justin Sun: participating in WBTC is a strategic move aimed at promoting industry decentralization;

In terms of institutions, large companies and leading projects, Animoca Brands is considering an IPO in Hong Kong or the Middle East in late 2025 or early 2026; Binance Launchpool and Super Earn will list Toncoin (TON) ; EigenLayer announced the launch of the AVS Incentive function ; MakerDAO has passed and implemented a proposal to reduce the size of WBTC collateral ; GM (gm.ai) has started airdrops and token trading;

In terms of data, the median Gas usage of the Ethereum network hit a new low in the past five years; Elon Musk did not mention cryptocurrency or Bitcoin in his live interview with Trump , but Pumpe.Spaß issued more than 10,000 tokens within 3 hours during the period… Well, it was another week of ups and downs.

Beigefügt ist ein Portal zu die Reihe „Wöchentliche Empfehlungen der Redaktion“.

Bis zum nächsten Mal~

This article is sourced from the internet: Weekly Editors Picks (0810-0816)

Related: 1confirmation founder: 4 suggestions for crypto consumer app builders

Original author: Nick Tomaino, founder of 1confirmation Original translation: Luffy, Foresight News My strongest belief over the next 10 years is that crypto apps will permeate every aspect of culture. Over the past 10 years, crypto apps have been primarily in deep tech and finance, but over the next 10 years, we will see crypto consumer apps collide with news, politics, sports, health/fitness, music, live video, podcasts, and more. These apps will be among the most useful and valuable ever. This view seems to be contrary to the current mainstream investors, who have been pouring large sums of money into unoriginal zero-sum products. While the market is hyped about the Nth scalable L1 and yield-yielding stablecoins, developers are quietly building products that will enable new consumer behaviors that will help…