Black Swan und $MAX, der Anfang vom Ende der Tragödie der Hoch-FDV-Verschlüsselung

Original author: Cyril, Crypto Observer

The pain of encryption – high FDV and low circulation dilemma

The crypto industry is caught between two worlds, one that is slowly dying and the other that has yet to be formed.

Almost without exception, the tokens listed in 2024 have a common feature: extremely high FDV (fully diluted valuation) and very low circulation. These tokens will continue to unlock after the TGE (token generation event), causing a large amount of selling pressure on the market for unlocked tokens. The high FDV and low circulation model has become a pain point in the crypto industry and is widely considered to be the key reason why this bull market has not really started.

In a research report published on May 24, Binance pointed out that a total of $155 billion worth of tokens will be unlocked between 2024 and 2030, not including new tokens that may be issued in the future. Faced with this market structure, it is almost impossible for the market to continue to rise without a large amount of new funds entering the market, which is why a large number of VC coins with low circulation and high FDV have been criticized.

Hotcoins research report further pointed out that among the top 300 cryptocurrencies by market capitalization, 60 have MC/FDV (the ratio of circulating market capitalization to fully diluted market capitalization) less than 0.5, accounting for 20%. Among them, 15 have MC/FDV less than 0.2, and even tokens such as Worldcoin (WLD), Saga (SAGA), Ethena (ENA), and Starknet (STRK) have a circulation volume of less than 10%.

These data show that the current market conditions are extremely challenging, especially under the suppression of high FDV and low circulation, the recovery and healthy development of the market will be more difficult.

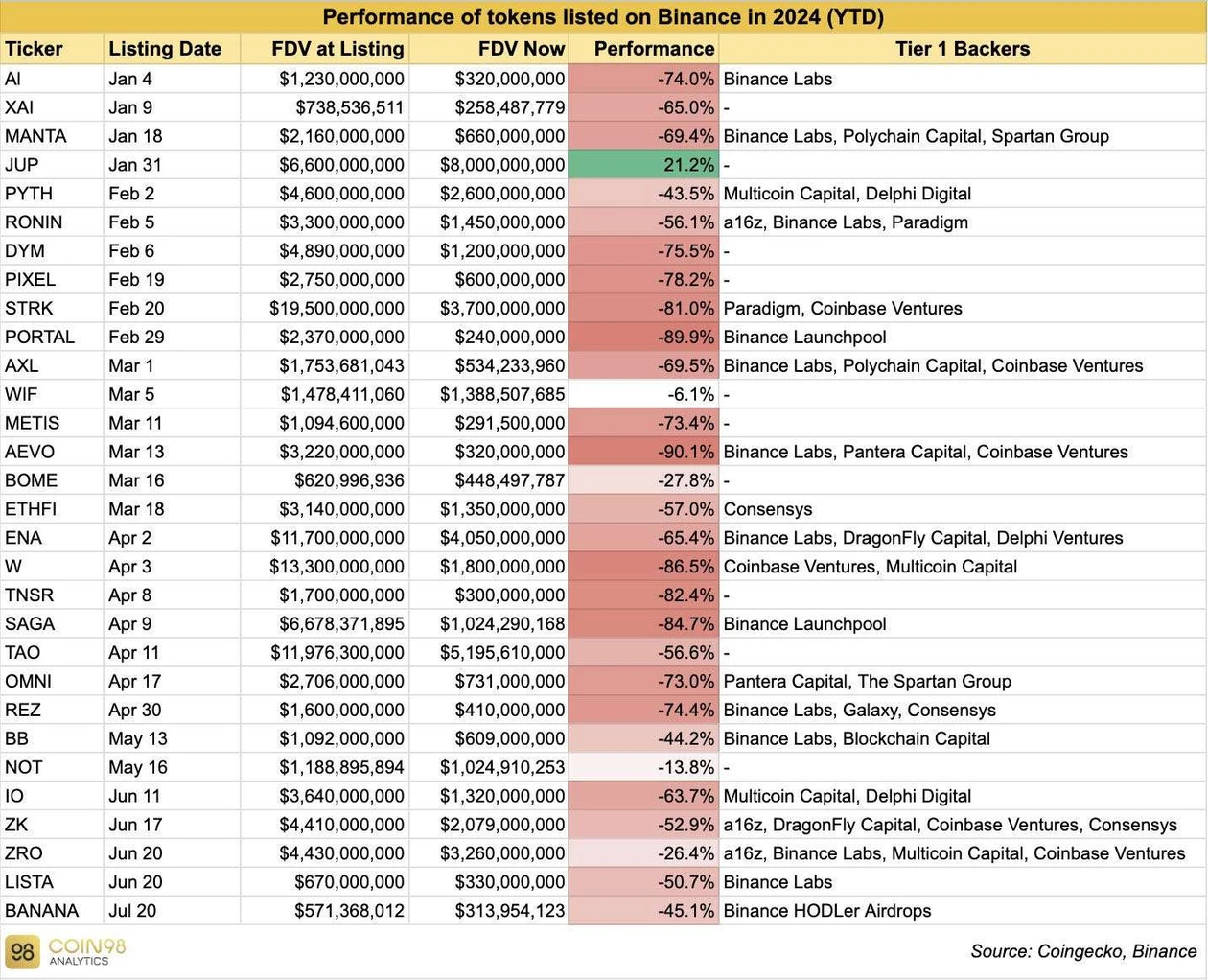

As can be seen from the table below, most of the tokens listed on Binance in 2024 have FDVs above 1 billion USD, and some tokens even exceed 10 billion USD when they are launched. Almost all of these new coins have fallen. The general understanding is that VC/KOLs are selling to retail investors, who are angrily abandoning these tokens and turning to meme tokens, as well as the supply is too small for meaningful price discovery.

(Data source: @Ryanqyz_hodl)

Black Swan and $MAX

After the market reflected on the wave of high FDV and low circulation tokens from May to August, new changes and trends are already brewing. Some clues of change can be seen from the TGE methods of some recent star projects.

The Black Swan of August 5th is destined to become a Web3 anniversary like March 12 and May 19. On this day, the mother coin $MAX of the extremely popular Web3 game platform MATR1X was launched on OKX with an opening price of US$0.2, FDV of US$160 million, and a circulating market value of US$25 million. Prior to this, MATR1X had always been regarded by investment institutions and KOLs as the leader and weather vane of this round of Web3 game track. The opening of trading with such a FDV market value shocked everyone. According to some sources, the opening price of $MAX was even lower than the chips obtained by many institutional investors, which triggered extensive discussions among KOLs around the world.

Some people may not know MATR1X. Simply put, it is a Web3 entertainment platform with popular games. It mainly develops and introduces third-party games. Let me briefly talk about the background. It has raised $20 million (it is reported that it is $30 million, and $10 million is not disclosed), and has luxury investment institutions such as Foulis Ventures (leading StepN), Hana Financial (the top chaebol in South Korea), OKX, Makers Fund (one of the three major game funds in the United States), SevenX (Top Web3 game fund), Amber (Top market maker)

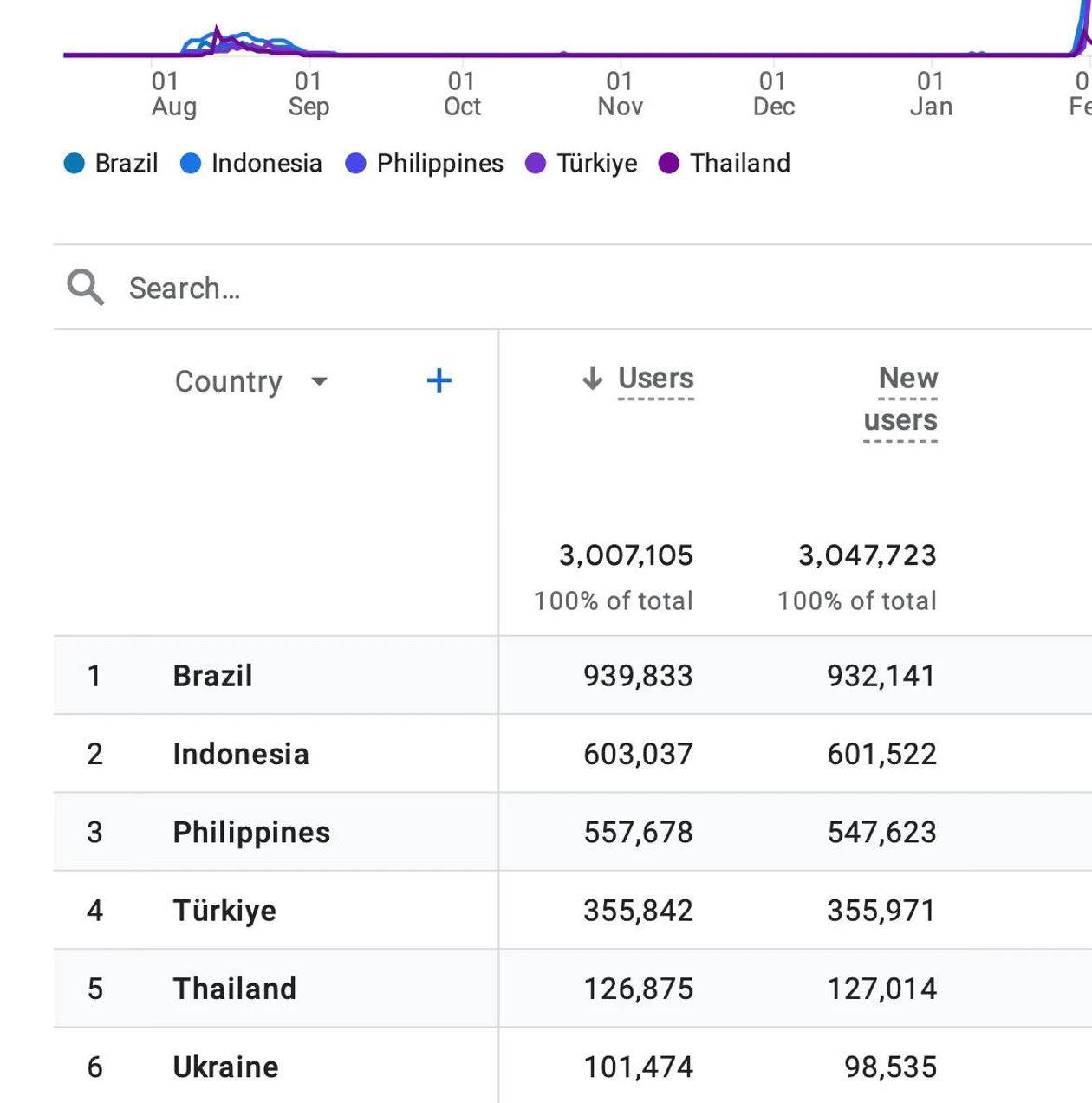

MATR1Xs first shooting mobile game MATR1X FIRE has been downloaded more than 3 million times, and these are all verified real users. According to the data from Google Play, the download volume is shown as 1 million+ (GooglePlay shows 1M+ for downloads below 5 million), and the official Google Analytics data shows that the total download volume exceeds 3 million.

(Data source: MATR1X official tweet)

For such a project with top-notch background and data, the opening of TGE with such a low FDV of US$160 million really exceeded the expectations of everyone in the market.

High popularity and huge trading volume

This kind of debut has brought a lot of exposure to $MAX. There have been a lot of discussions on Twitter and major communities. The daily transaction volume on OKX is over 100 million US dollars, and the 24-hour transaction volume ranks in the top three on OKX, only after BTC and ETH. A new coin can have such attention. We can see that the market embraces low FDV. Traders have suffered from high FDV for a long time.

(Data source: CoinmarketCap)

OKX鈥檚 Industry Determination

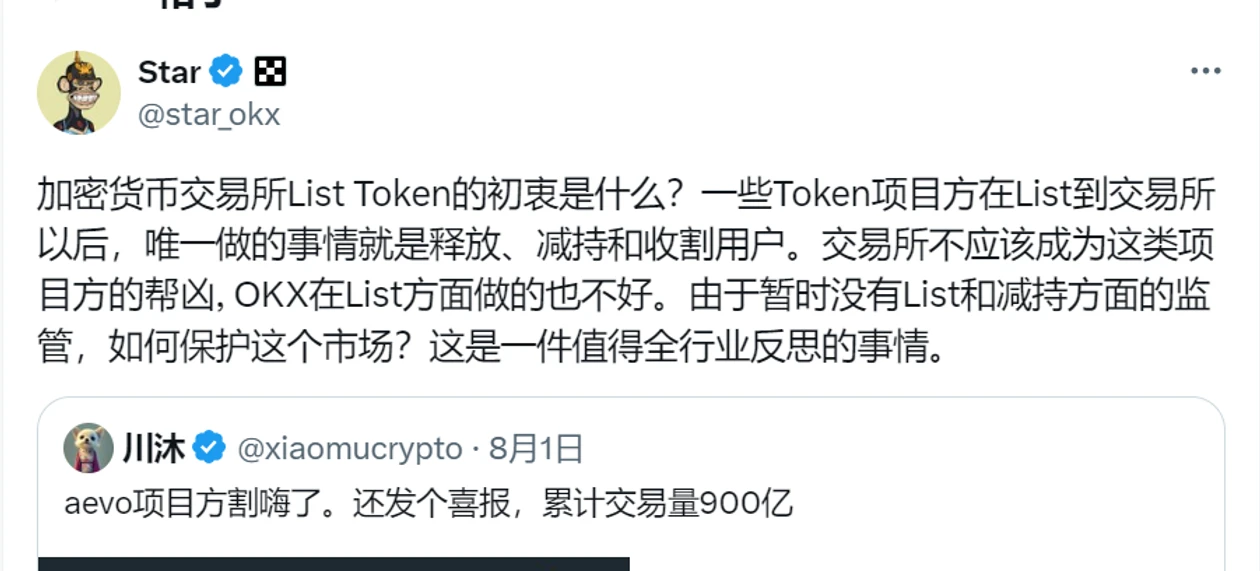

The market is beginning to have such a change, which may also be closely related to the determination of leading large exchanges such as OKX and Binance to rectify the industry. The founder of OKX publicly posted on August 2, directly pointing out the problems of the project, and pointed out that the only thing some token project parties did after TGE was to release and reduce their holdings. The exchange should not become an accomplice of high FDV and low circulation projects, and called on everyone to protect this market.

A few days later, $MAX was listed on OKX and opened with a low FDV of 160 million, as well as huge trading volume. It is hard not to associate it with OKXs industry determination. The leading exchanges have realized that the high FDV and low circulation game can no longer continue.

In addition to OKX, Binance also expressed support for small and medium-sized cryptocurrency projects, inviting high-quality teams and projects to apply for Binance listing projects, including: Direct Listing, Launchpools, Megadrops, etc. It hopes to promote the development of the blockchain ecosystem by strengthening support for small and medium-sized cryptocurrency projects with good fundamentals, organic community foundation, sustainable business model and industry responsibility.

Burning $200 million before the market opens

In addition to opening with an extremely low FDV of $160 million, MATR1X also performed a striking operation – 4 hours before the opening of trading on August 5, $MAX burned 200 million tokens.

This operation confused many people. Usually, such large-scale good news will be announced after the market closes in order to boost the price of the currency and boost market confidence. However, considering the black swan event on August 5, MATR1X may want to enhance market confidence before the market opens. The founder of MATR1X said on Twitter that they believe MATR1X has the ability to generate its own blood, and plans to continue to maintain deflation through various means and actively reduce FDV.

In addition, from the token economics of the MATR1X official website, we can see that the team and investors have burned 50 million tokens, and all investors and teams need to lock up for 12 months and unlock them in 5 years. This series of measures, including the 160 million low FDV start, the pre-market burning of 200 million MAX, the team burning 50 million, and the support of 3 million game users, all show the long-termism of MATR1X. It also shows that the TGE model of high FDV and low circulation is gradually being disintegrated.

The next round is the real application cycle

In Ryanqyzs recent popular article What is really happening in the blockchain industry , he deeply analyzed the current situation and problems of various participants in the crypto industry. He pointed out that whether it is venture capital, project parties, or market participants, they seem to be trapped in a vicious circle of only telling narratives but not focusing on practical applications. Many projects attract the public by creating unreal stories and then sell coins. There is almost no essential difference between VC coins and meme coins.

Ryanqyz further pointed out that the next cycle will be a cycle of real applications. The crypto industry has reached a stage where it can no longer rely solely on storytelling and high valuations to sell coins. In the future, only projects that can generate their own blood and verify the true commercialization of Web3 can stand out. Whether we are willing to admit it or not, the previous general rise in the market may not appear again, and pioneering projects like MATR1X that actively explore Web3 applications and do not rely on high FDV opening deserve our attention and respect.

This article is sourced from the internet: Black Swan and $MAX, the beginning of the end of the tragedy of high FDV encryption

introduce Bitcoin is currently the most liquid and secure blockchain. After the outbreak of the inscription, the BTC ecosystem attracted a large number of developers, who quickly paid attention to the programmability and expansion issues of BTC. By introducing different ideas, such as ZK, DA, side chains, rollup, restaking and other solutions, the prosperity of the BTC ecosystem is reaching a new high, and it has become the main plot of this round of bull market. However, many of these designs have continued the expansion experience of smart contracts such as ETH, and must rely on a centralized cross-chain bridge, which is the weak point of the system. Few solutions are designed based on the characteristics of BTC itself, which is related to the fact that BTC itself is not…