Crypto Market Sentiment Research Report (2.–9. August 2024): Ist die Rezession da? Die US-Arbeitsmarktzahlen außerhalb der Landwirtschaft fielen im Juli

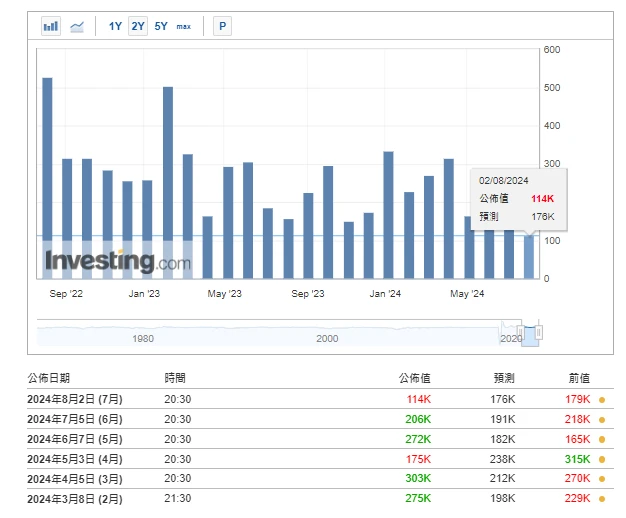

Recession has arrived? US non-farm payrolls in July fell far short of expectations

Bildquelle: https://hk.investing.com/economic-calendar/nonfarm-payrolls-227

The US non-farm payrolls report for July surprised the market, with the number of new jobs hitting a three-and-a-half-year low and the unemployment rate rising to a three-year high, triggering the Sams Rule, a recession indicator with 100% accuracy. Panic spread rapidly, and traders began to bet on the possibility of a 50 basis point rate cut in September, and predicted that the rate cut this year would exceed 110 basis points. This week, both US stocks and Bitcoin rebounded after a significant decline.

-

The Sahm Rule is an indicator proposed by economist Claudia Sahm to predict economic recessions. The rule is based on changes in the unemployment rate and has a trigger condition: if the three-month moving average employment rate is 0.5 percentage points lower than the highest employment rate in the past 12 months, then the indicator is triggered, indicating that the economy may be about to or has entered a recession.

There are about 40 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

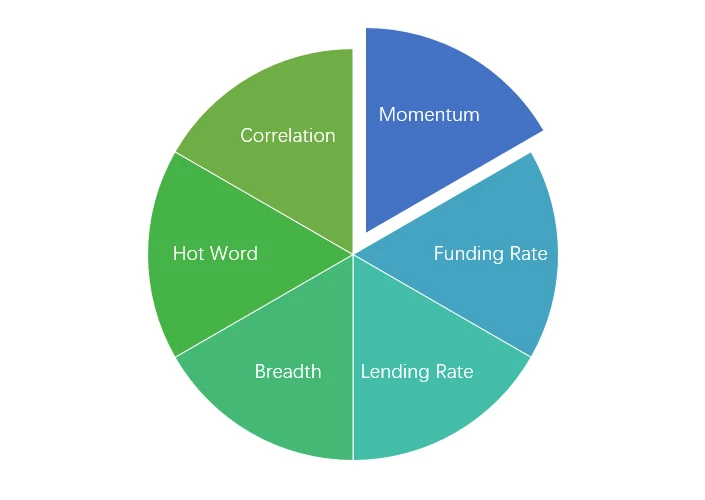

Analyse des technischen Marktes und der Stimmungslage

Komponenten der Stimmungsanalyse

Technische Indikatoren

Price Trends

BTC price fell -5.61% and ETH price fell -16.26% in the past week.

Das obige Bild ist das Preisdiagramm von BTC der letzten Woche.

Das obige Bild ist das Preisdiagramm von ETH der letzten Woche.

Die Tabelle zeigt die Preisänderungsrate der letzten Woche.

Preis-Volumen-Verteilungsdiagramm (Unterstützung und Widerstand)

In the past week, BTC and ETH fell to a low level and formed a new dense trading area before rebounding.

Das obige Bild zeigt die Verteilung der BTC-Handelsgebiete mit hoher Dichte in der vergangenen Woche.

Das obige Bild zeigt die Verteilung der ETH-Handelsgebiete mit hoher Dichte in der vergangenen Woche.

Die Tabelle zeigt die wöchentliche intensive Handelsspanne von BTC und ETH in der vergangenen Woche.

Volumen und offenes Interesse

In the past week, both BTC and ETH had the largest trading volume when they fell to 8.5; the open interest of BTC and ETH both fell sharply.

Oben im obigen Bild ist der Preistrend von BTC dargestellt, in der Mitte das Handelsvolumen, unten das offene Interesse, hellblau ist der 1-Tages-Durchschnitt und orange der 7-Tages-Durchschnitt. Die Farbe der K-Linie stellt den aktuellen Zustand dar, grün bedeutet, dass der Preisanstieg durch das Handelsvolumen unterstützt wird, rot bedeutet, dass Positionen geschlossen werden, gelb bedeutet, dass Positionen langsam akkumuliert werden und schwarz bedeutet, dass der Zustand überfüllt ist.

Oben im obigen Bild ist der Preistrend von ETH dargestellt, in der Mitte das Handelsvolumen, unten das offene Interesse, hellblau der 1-Tages-Durchschnitt und orange der 7-Tages-Durchschnitt. Die Farbe der K-Linie stellt den aktuellen Zustand dar, grün bedeutet, dass der Preisanstieg durch das Handelsvolumen unterstützt wird, rot bedeutet, dass Positionen geschlossen werden, gelb bedeutet, dass Positionen langsam angesammelt werden und schwarz bedeutet, dass Positionen überfüllt sind.

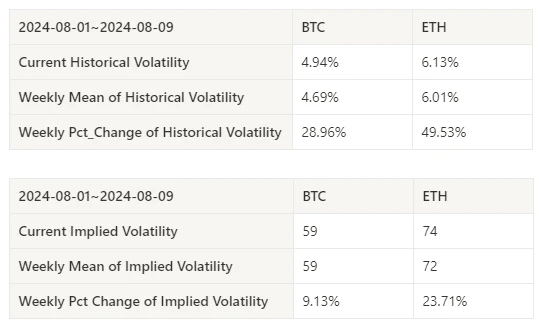

Historische Volatilität vs. implizite Volatilität

This past week, historical volatility for BTC and ETH was highest at 8.5, while implied volatility for both BTC and ETH increased.

Die gelbe Linie ist die historische Volatilität, die blaue Linie die implizite Volatilität und der rote Punkt ist der 7-Tage-Durchschnitt.

Ereignisgesteuert

The non-farm data of the past week was significantly lower than expected, which pushed the mainstream currencies to continue to decline for several days after the data was released.

Stimmungsindikatoren

Momentum-Stimmung

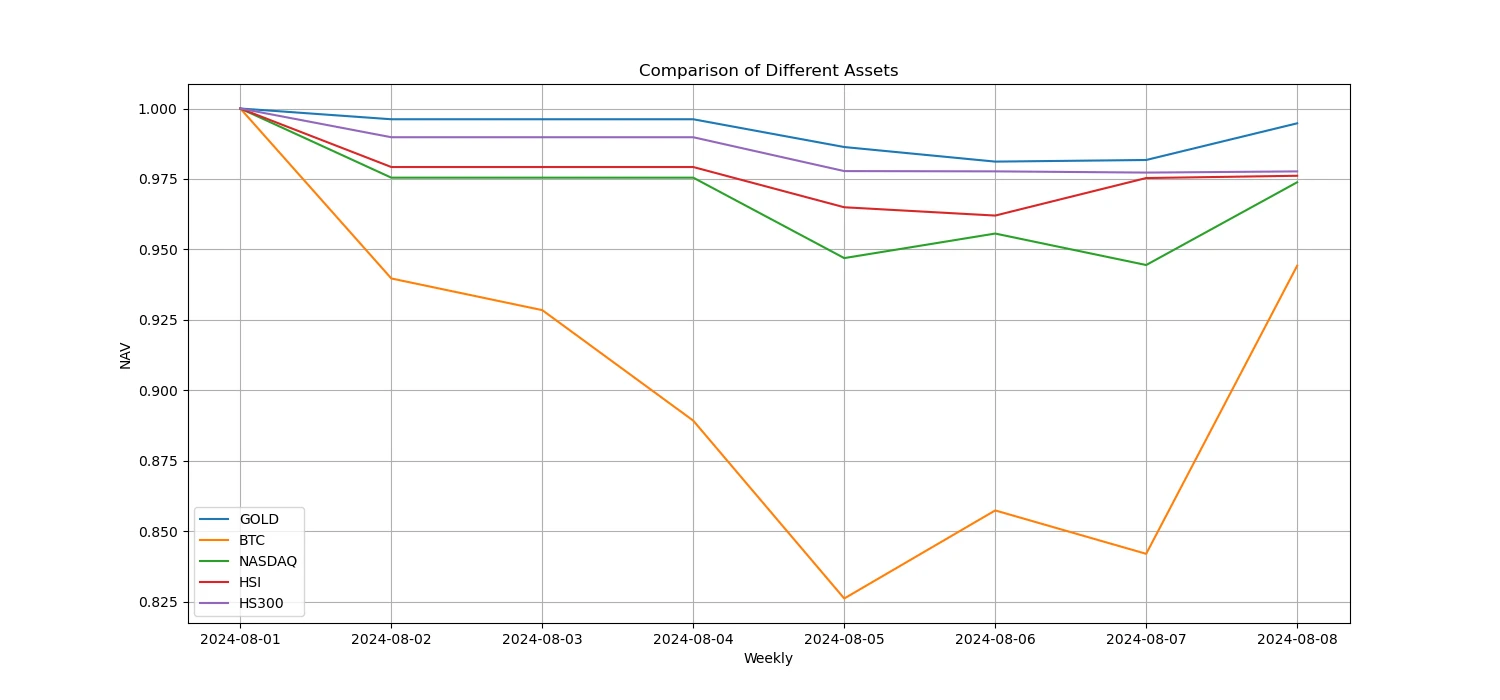

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, gold was the strongest, while Bitcoin performed the worst.

Das obige Bild zeigt den Trend verschiedener Vermögenswerte in der vergangenen Woche.

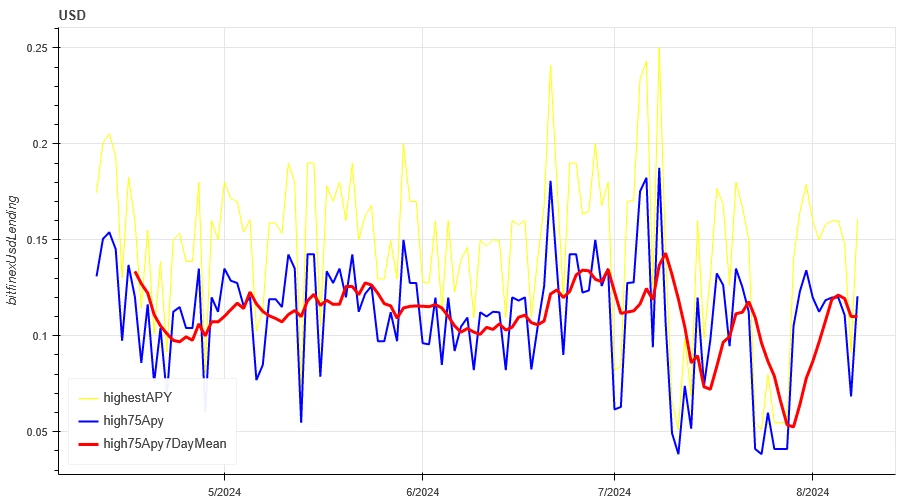

Kreditzins_Kreditstimmung

The average annualized return on USD lending over the past week was 11.1%, and short-term interest rates remained at 12.1%.

Die gelbe Linie stellt den höchsten Preis des USD-Zinssatzes dar, die blaue Linie entspricht 75% des höchsten Preises und die rote Linie ist der 7-Tage-Durchschnitt von 75% des höchsten Preises.

Die Tabelle zeigt die durchschnittlichen Renditen der USD-Zinssätze für verschiedene Haltetage in der Vergangenheit

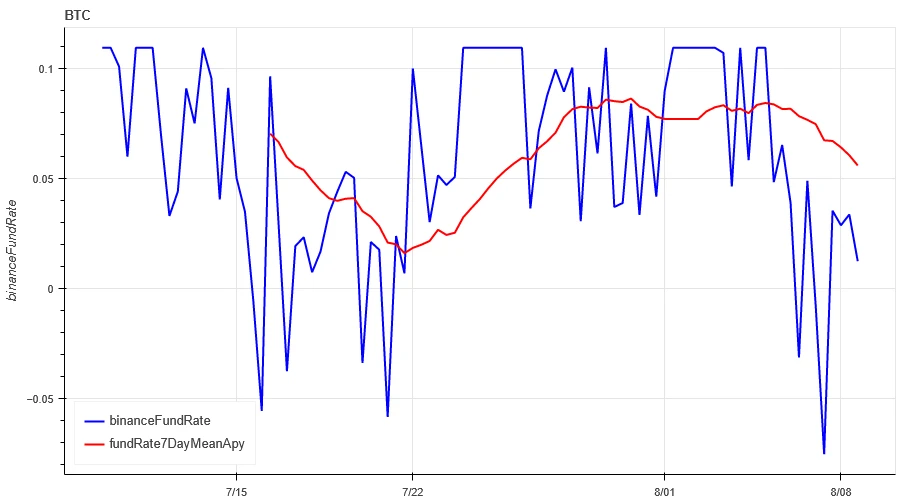

Finanzierungsrate_Vertragshebelstimmung

The average annualized return on BTC fees in the past week was 5.8%, and contract leverage sentiment was gradually declining.

Die blaue Linie ist die Finanzierungsrate von BTC auf Binance und die rote Linie ist der 7-Tage-Durchschnitt

Die Tabelle zeigt die durchschnittliche Rendite der BTC-Gebühren für verschiedene Haltetage in der Vergangenheit.

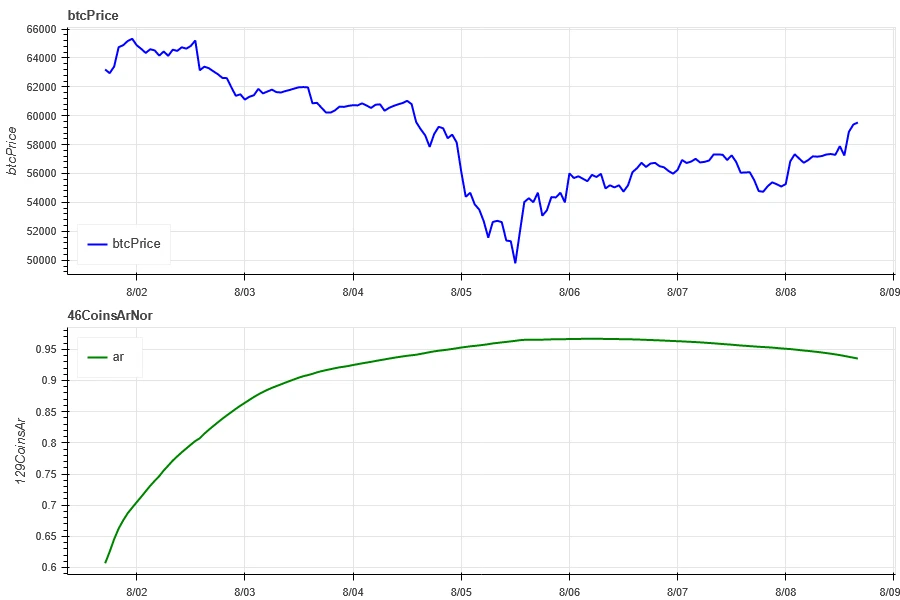

Marktkorrelation_Konsensstimmung

The correlation among the 129 coins selected in the past week was around 0.95, and the consistency between different varieties rose to a high level.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx , imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

Marktbreite_Gesamtstimmung

Among the 129 coins selected in the past week, 6.3% of them were priced above the 30-day moving average, 12% were priced above the 30-day moving average relative to BTC, 9% were more than 20% away from the lowest price in the past 30 days, and 10% were less than 10% from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market maintained a downward trend.

The picture above is [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot , icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

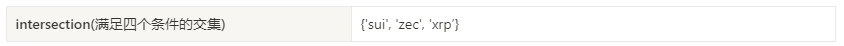

Zusammenfassen

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) fell sharply on August 5, when the volatility and trading volume of these two cryptocurrencies reached a peak. The volume of open contracts decreased significantly, while the implied volatility increased simultaneously. Bitcoins funding rate continued to decline, which may reflect the weakening interest of market participants in its leveraged trading. Market breadth indicators show that the prices of most cryptocurrencies fell, and the entire market continued to be under pressure. In addition, the non-agricultural data was significantly lower than expected, which pushed the mainstream currencies to continue to decline for several days after the data was released.

Twitter: @ https://x.com/CTA_ChannelCmt

Webseite: kanalcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (August 2–9, 2024): Has recession arrived? U.S. non-farm payrolls in July fell far short of expectations

Related: Must-read guide: Play with the TON ecosystem and seize early dividends

Original author: Biteye core contributor Viee Original editor: Biteye core contributor Crush Have you started to FOMO TON? These past two days, I have been crazy about posting black and white dog MEMEs and showing off my points. I thought the bull market was back. Today, Biteye will teach you how to play in the TON ecosystem and seize potential airdrop opportunities. We have organized this thread into a mind map, please take it if you need it. 01 Wallet Introduction The first step to participate in the TON ecosystem is to use a wallet. Currently, there are 49 wallets that support the TON chain. Here are two of the most popular ones: Wallet and TON Space Wallet Wallet is Telegrams native centralized custodian wallet, similar to WeChat Wallet, which…