Recession expectations were slapped in the face, BTC took advantage of the opportunity to attack $62,000

Originalautorin: BitpushNews Mary Liu

On Thursday, data released by the U.S. Department of Labor showed that the number of initial unemployment claims in the week ending August 3 was 233,000, lower than the 250,000 in the previous week and lower than the 240,000 expected by economists, reducing concerns about an impending recession in the United States. Investor sentiment improved and financial markets turned to recovery across the board on Thursday.

According to CMEs Fed Watch data, the probability of the Federal Reserve cutting interest rates by 25 basis points in September is 43.5%, and the probability of cutting interest rates by 50 basis points has dropped to 56.55%.

At the close of the day, the SP, Dow Jones and Nasdaq all rose, up 2.30%, 1.76% and 2.87% respectively. The SP 500 recorded its largest one-day gain since November 2022.

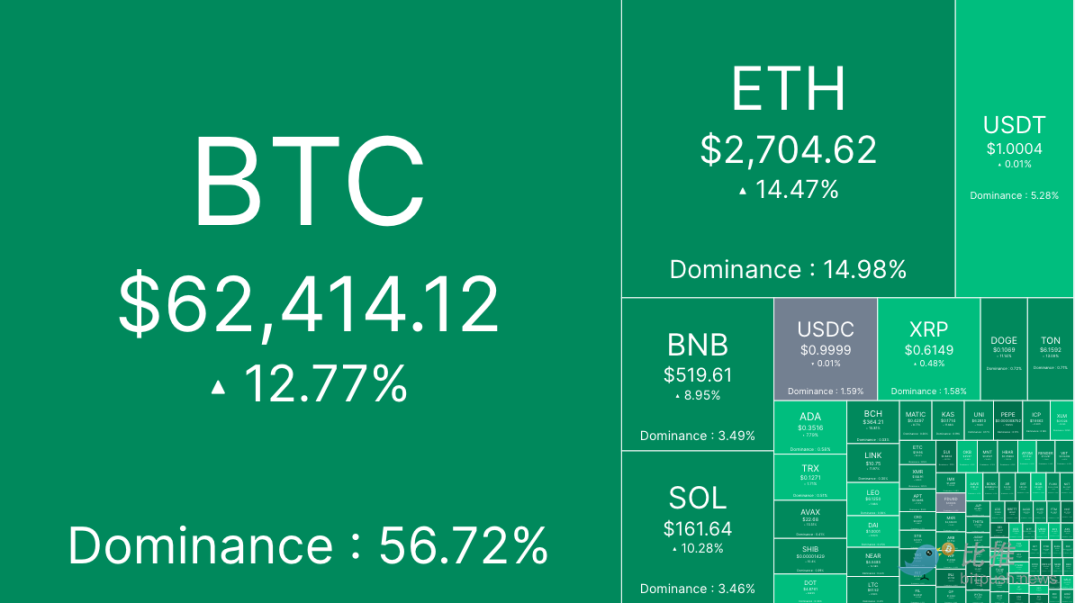

According to Bitpush data, Bitcoin rebounded from a low of around $54,700 in the early morning, and the bulls attacked all the way above $59,000. In the late trading, it broke through the support levels of $60,000 and $62,000. As of press time, BTC was trading at $62,414, with a 24-hour increase of nearly 13%.

The altcoin market was up across the board, with only two coins in the top 200 by market cap seeing losses.

Mog Coin (MOG) led the gains, up 27.4%, Sui (SUI) rose 23.6%, and Ponke (PONKE) rose 20.4%. Aave (AAVE) prEis fell 2.1%, and MANTRA (OM) fell 0.9%.

The current overall market value of cryptocurrencies is $2.09 trillion, and Bitcoin’s market share is 56.4%.

Analysts at Secure Digital Markets said: Bitcoin is beginning to regain momentum and is experiencing some volatility. We have finally seen a decisive breakout above the key resistance level of $58,000, with the price now eyeing the next targets of $60,250 and $63,000. Funding rates have stabilized across the board, and as the rally is primarily spot-driven, the signs are bullish.

Multiple positive news boosted market sentiment

On Thursday, a U.S. judge approved a consent order requiring FTX and its sister trading firm Alameda Research to pay $12.7 billion to creditors, ending a 20-month lawsuit. Many predict that as former FTX users reinvest their funds in digital assets, some of the funds will flow back into the cryptocurrency market, greatly improving market liquidity and depth.

Meanwhile, Russian President Vladimir Putin signed a bill legalizing cryptocurrency mining in the country. Ki Young Ju, CEO of cryptocurrency analysis firm CryptoQuant, said: Russia seems to be taking action to keep up with the United States. Bitcoin FOMO (fear of missing out) is heating up at the national level, and their participation will increase the hash rate, strengthen the network foundation, and diversify miners.

Ripples years-long legal dispute with the U.S. Securities and Exchange Commission (SEC) has also reached a phased result. A federal judge fined Ripple $125 million, ruling that its retail sales through exchanges did not violate any laws. After the news came out, XRP soared from $0.50 to $0.64 (up 28%), with trading volume reaching $4.2 billion (1.2 billion on Tuesday), and open interest jumped by $200 million.

Cautious optimism in the short term

Despite these catalysts, JPMorgan remains cautious about the future Entwicklung of the cryptocurrency market, which analysts believe may already be priced in. The bank said that because the price of Bitcoin is still too high relative to its production cost and gold, the average production cost of Bitcoin mining is about $49,000, and any price movement below this level will put pressure on miners, further depressing BTC prices.

Market analyst Roman said that Bitcoin’s recovery is currently progressing well, but he “still expects Bitcoin to retest $60,000 and then fall to lower levels before we attempt a potential reversal.”

The chart provided by Roman shows that the price of Bitcoin will first climb to $60,000 and then gradually fall to the support level of $54,000: The price action also shows bearishness (declining volume + rising price), so I expect the price to fall once the resistance level is reached.

,

,

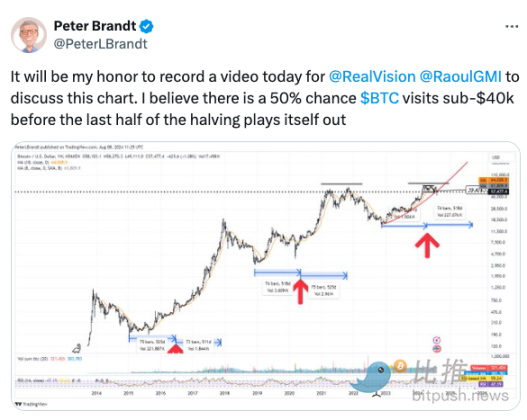

Prominent trader Peter Brandt tweeted on Aug. 8 that he sees a 50% chance that Bitcoin will fall below $40,000 before its next rally.

This article is sourced from the internet: Recession expectations were slapped in the face, BTC took advantage of the opportunity to attack $62,000

Original author: @renkingeth Summary Zero-knowledge proof (ZKP) is widely regarded as one of the most important technological innovations in the blockchain field since distributed ledger technology, and it is also a key area of venture capital. This article systematically reviews the historical literature and latest research on zero-knowledge proof technology over the past four decades. First, the basic concepts and historical background of zero-knowledge proofs are introduced. Then, the circuit-based zero-knowledge proof technology is analyzed in detail, including the design, application, and optimization methods of models such as zkSNARK, Ben-Sasson, Pinocchio, Bulletproofs, and Ligero. In the field of computing environment, this article introduces ZKVM and ZKEVM, and discusses how they can improve transaction processing capabilities, protect privacy, and improve verification efficiency. The article also introduces the working mechanism and optimization…