Datenanalyse der Operationen der sechs großen Market Maker vor und nach dem Crash von 1985

Original | Odaily Planet Daily ( @OdailyChina )

Autor: Golem ( @web3_golem )

In addition to the influence of macro factors such as traditional financial markets, the selling by leading market maker Jump Trading was once considered to be an important factor causing the 85 decline.

In addition to the influence of macro factors such as traditional financial markets, the selling by leading market maker Jump Trading was once considered to be an important factor causing the 85 decline.

So, before and after the Jump sell-off, what actions did other top crypto market makers take? Did they follow suit and sell ETH, hold a large amount of stablecoins for risk hedging, or buy high-quality assets at the bottom? Odaily Planet Daily will analyze the public addresses of the other six major market makers from a data perspective, analyze their position changes before and after the 85 crash, and summarize them, hoping to provide readers with some reference in the treacherous market changes.

GSR Markets: Continued selling of ETH

Before the “85” crash (8.1-8.5)

Before the 85 crash, according to ARKHAM data, the total net value of the public address on the GSR Markets chain decreased from August 1 to August 5. The main changes were: ETH holdings decreased by more than 706, STETH holdings decreased by 300, stablecoin USDC holdings decreased by more than 3.34 million, and L3 holdings decreased by more than 8.56 million. The detailed data is shown in the figure below.

GSR Markets Open Interest Changes from August 1 to August 5 (Data updated at 0:00 UTC daily, source: ARKHAM)

At the same time, a separate analysis of ETH holdings found that GSR Markets transferred more than 1,000 ETH to exchanges such as Binance between August 1 and August 2.

GSR Markets ETH on-chain public address holdings changes (Source: ARKHAM)

GSR Markets transferred ETH to the exchange between August 1 and August 2

After the “85” crash (8.5-8.6)

After the 85 crash, according to ARKHAM data, the GSR Markets on-chain public address was still reducing its holdings by more than 100 ETH, but the reduction in other altcoins was not obvious.

GSR Markets Open Interest Changes from August 5 to August 6 (Data updated at 0:00 UTC daily, source: ARKHAM)

Zusammenfassung

From the on-chain position change data, it can be seen that GSR Markets most likely followed Jump to sell ETH before the 85 crash, and continued to reduce its holdings after the crash. Stablecoins have always been GSR Markets largest position as a safe-haven asset, which may indicate that it is still not optimistic about the market outlook.

Amber Group: Panic selling of ETH during the crash

Before the “85” crash (8.1-8.5)

Before the 85 crash, according to ARKHAM data, the total net value of Amber Groups public addresses on the chain increased from August 1 to August 5. The main changes were: ETH holdings increased by more than 11,500, and stablecoin USDC holdings increased by 500,000. The detailed data is shown in the figure below.

Amber Groups holdings from August 1 to August 5 (data updated at 0:00 UTC every day, source: ARKHAM)

After the “85” crash (8.5-8.6)

After the 85 crash, according to ARKHAM data, Amber Groups on-chain public address sold a large amount of ETH, with a total of more than 13,000 ETH sold, of which nearly half were transferred to exchanges.

Amber Group ETH on-chain public address holdings changes (Source: ARKHAM)

Amber Group transferred a large amount of ETH to exchanges between August 5 and August 6

Zusammenfassung

From the above position changes, we can see that Amber Group did not have much premonition before the crash, nor did it follow Jump to sell, but instead increased its holdings of ETH. However, when the 85 crash occurred, Amber Group transferred all the ETH it had increased a few days ago, and more than half of it went directly to the exchange. The position changes of Amber Group show that compared with other market makers, it did not anticipate the arrival of the black swan, but was more like an ordinary trader who was swayed by the market.

B2C 2 Group: Massive reduction of all tokens

Before the “85” crash (8.1-8.5)

Before the 85 crash, according to ARKHAM data, the total net value of the public addresses on the B2C 2 Group chain increased from August 1 to August 5. The main changes were: ETH holdings increased by 4,650, BTC holdings increased by 531.52, and 216,500 UNI, 23,000 COMP, and 32,000 DAI were also added . The detailed data is shown in the figure below.

B2C 2 Group’s position changes from August 1 to August 5 (data updated at 0:00 UTC every day, source: ARKHAM)

After the “85” crash (8.5-8.6)

After the 85 crash, according to ARKHAM data, B2C 2 Group reduced its holdings of almost all tokens and exchanged them for stablecoin assets for risk hedging. Among them , BTC reduced its holdings by more than 1,000, ETH reduced its holdings by more than 19,000, BNB reduced its holdings by more than 4,000, LINK reduced its holdings by more than 59,000, and COMP reduced its holdings by more than 23,000. The detailed data is shown in the figure below.

B2C 2 Groups position changes from August 5 to August 7 (data updated at 0:00 UTC every day, source: ARKHAM)

At the same time, a separate analysis of ETH found that B2C 2 Group transferred a large amount of ETH to Robinhood, Coinbase and some unknown addresses on the chain between August 5 and August 6.

Changes in holdings of public addresses on the B2C 2 Group ETH chain (Source: ARKHAM)

Amber Group transferred a large amount of ETH to Robinhood and other unknown addresses from August 5 to August 6

Zusammenfassung

From the above holding data, we can see that B2C 2 Group did not follow Jump to reduce its holdings of ETH before the 85 crash, but instead increased its holdings; however, after the crash, it quickly reduced almost all of its tokens, but most of them were transferred to unknown addresses. Although there is no obvious evidence that it is selling, the largest position currently held by B2C 2 Group is the safe-haven stablecoin, which also indirectly reflects that it is not very optimistic about the market outlook.

Amber Groups current holdings

Wintermute: We have been increasing our holdings before and after the crash

Before the “85” crash (8.1-8.5)

Before the 85 crash, according to ARKHAM data, the total net value of public addresses on the Wintermute chain was growing from August 1 to August 5. The main changes were: stablecoins USDT and USDC holdings increased by more than 104 million, ETH holdings increased by more than 14,930, WBTC holdings increased by 104.74, and 4 million PEPE holdings were also increased . The detailed data is shown in the figure below.

Wintermutes holdings from August 1 to August 5 (data updated at 0:00 UTC every day, source: ARKHAM)

After the “85” crash (8.5-8.6)

After the 85 crash, according to ARKHAM data, the public addresses on the Wintermute chain not only did not sell off a large number of holdings, but continued to increase their holdings. The main changes are: stablecoins USDT and USDC holdings increased by more than 62 million, WBTC holdings increased by 131.5, and 329.8 trillion PEPE and 690,000 DAI were also increased . The detailed data is shown in the figure below.

Wintermutes holdings from August 5 to August 6 (data updated at 0:00 UTC every day, source: ARKHAM)

At the same time, a separate analysis of ETH found that Wintermutes on-chain ETH holdings did not change significantly during the 85 crash and Jumps large-scale sell-off of ETH, and the total holdings still exceeded 16,000.

Wintermute ETH on-chain public address holdings changes (Source: ARKHAM)

Zusammenfassung

Although Wintermute increased its holdings of stablecoins for risk hedging before the crash, it also increased its holdings of ETH; at the same time, after the crash, in addition to adjusting its holdings of stablecoins for risk hedging, it continued to increase its holdings of BTC, and there was no large outflow of ETH that had previously flowed in. Judging from these on-chain position change data, Wintermute did not seem to have a violent panic reaction to the 85 crash and Jump sell-off, and was relatively optimistic about the market outlook.

Flow Traders: Sell ETH but buy BTC at the bottom

Before the “85” crash (8.1-8.5)

Before the 85 crash, according to ARKHAM data, the total net value of the public address on the Flow Traders chain was decreasing from August 1 to August 5. The main changes were: ETH holdings decreased by 633.93 pieces, BTC holdings decreased by 142.69 pieces, and stablecoin holdings decreased and changed significantly. The detailed data is shown in the figure below.

Flow Traders position changes from August 1 to August 5 (data updated at 0:00 UTC every day, source: ARKHAM)

At the same time, a separate analysis of ETH found that the public address on the Flow Traders chain increased its holdings of ETH on July 31, but transferred more than 7,000 ETH to the exchange from August 1 to August 2.

Changes in holdings of public addresses on the ETH chain of Flow Traders (Source: ARKHAM)

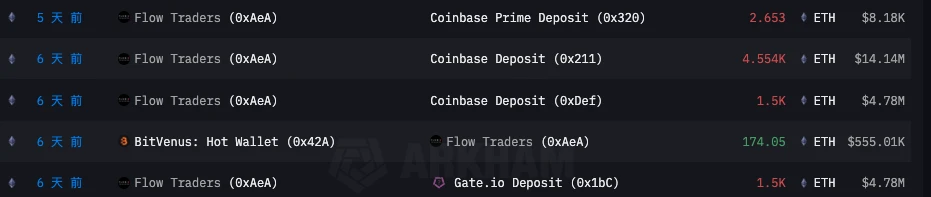

Flow Traders moved a large amount of ETH to exchanges between August 1 and August 2

After the “85” crash (8.5-8.6)

After the 85 crash, according to ARKHAM data, the public address on the Flow Traders chain began to increase its holdings of BTC in large quantities, from 797.31 to 1,650, a total of 852.69; at the same time, it also increased its holdings of more than 750 MKR, while the stablecoin holdings remained unchanged. The detailed data is shown in the figure below.

Flow Traders position changes from August 5 to August 6 (data updated at 0:00 UTC every day, source: ARKHAM)

Zusammenfassung

Flow Traders seemed to have foreseen the crash, and the on-chain public addresses reduced their holdings in advance. In particular, a large amount of ETH was transferred to the chain the day before, but then transferred to the exchange in large quantities the next day. If it was a sell-off, it would be a perfect escape from the top. At the same time, Flow Traders still had confidence in BTC after the crash, and increased its holdings by more than 800 coins in total.

Judging from the position change data on the chain, Flow Traders carried out ETH top-escape and BTC bottom-fishing operations before and after the 85 crash and during the Jump sell-off. The excellent trading made it one of the beneficiaries of this market fluctuation.

DWF Labs: Holding a copycat and not moving

Before the “85” crash (8.1-8.5)

Before the 85 crash, according to ARKHAM data, the DWF Labs public on-chain address held mostly altcoins, and the largest holdings were TRADE, GALA, DEXE, etc. Although the passive depreciation of the net asset value decreased, there was no obvious flow of tokens, and the detailed data is shown in the figure below.

DWF Labss holdings change from August 1 to August 5 (data updated at 0:00 UTC every day, source: ARKHAM)

After the “85” crash (8.5-8.6)

Even after the 85 crash, according to ARKHAM data, the DWF Labs public on-chain address holdings did not change or swap much. The detailed data is shown in the figure below.

DWF Labss holdings change from August 5 to August 6 (data updated at 0:00 UTC every day, source: ARKHAM)

At the same time, a separate analysis of the changes in ETH holdings found that the ETH held by DWF Labs public on-chain address did not change significantly before and after the crash.

DWF Labs ETH on-chain public address holdings changes (Source: ARKHAM)

Zusammenfassung

From the above holdings data, it can be seen that although the cryptocurrency market has experienced a sharp decline and other market makers are operating, DWF Labs belongs to the group that lies flat. Even though it has a lot of altcoins in its hands, it still does not exchange them for stablecoins and other assets for risk hedging. This may be because it is optimistic about the future market or has enough confidence in the altcoins it holds.

This article is sourced from the internet: Data analysis of the operations of the six major market makers before and after the 85 crash

Related: Specialization vs. generalization, which is the future of ZK?

Original author: mo Original translation: Luffy, Foresight News Specialization or generalization, which one is the future of ZK? Let me try to answer this question with a picture: As shown in the figure, is it possible that we will converge to a magical optimal point in the trade-off coordinate system in the future? No, the future of off-chain verifiable computation is a continuous curve that blurs the lines between specialized and general purpose ZK. Allow me to explain the historical evolution of these terms and how they will converge in the future. Two years ago, dedicated ZK infrastructure meant low-level circuit frameworks such as circom, Halo 2, and arkworks. ZK applications built using these frameworks are essentially handwritten ZK circuits. They are fast and cheap for specific tasks, but are…