Wie entwickelt sich DeFi mit jedem Tag inmitten der Marktschwankungen?

Original author: Pzai, Foresight News

Yesterday, as the global market experienced huge shocks, the crypto market was not immune. On the chain, the Ethereum ecosystem alone set a record of more than 350 million US dollars in liquidation in a single day. The one wave of the market is stimulating the ten thousand waves of DeFi, and how do DeFi projects respond? Who is swimming naked when the tsunami recedes? Therefore, the author wrote this article to summarize the performance of DeFi under market fluctuations.

Stabile Münzen

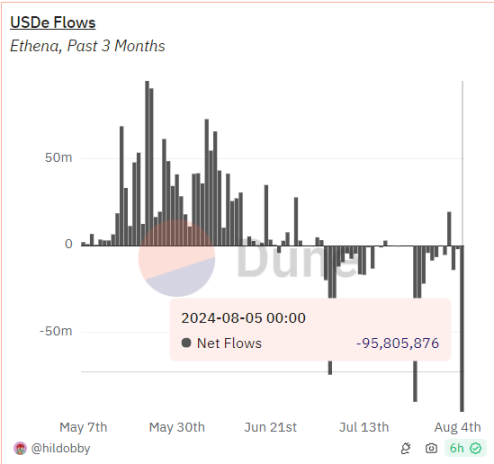

As for Ethena, its stablecoin USDe set a record of $95.8 million in outflow in a single day yesterday, and the total supply also fell from 3.6 billion at its peak to around 3.1 billion. Due to Ethenas mechanism, long positions must be maintained at a high level. As the market falls, the potential liquidation of collateral requires users to control risks and then redeem related tokens.

In addition, the stablecoin USDB on Blast briefly de-anchored to a minimum of $0.937 yesterday. Since the stablecoin ecosystem of Blast is relatively closed, and the project party has a large incentive for USDB in the early stage of the Blast chain launch, the impact of capital outflow during market fluctuations is relatively large. Now USDB has basically returned to the anchor.

Loan Agreement

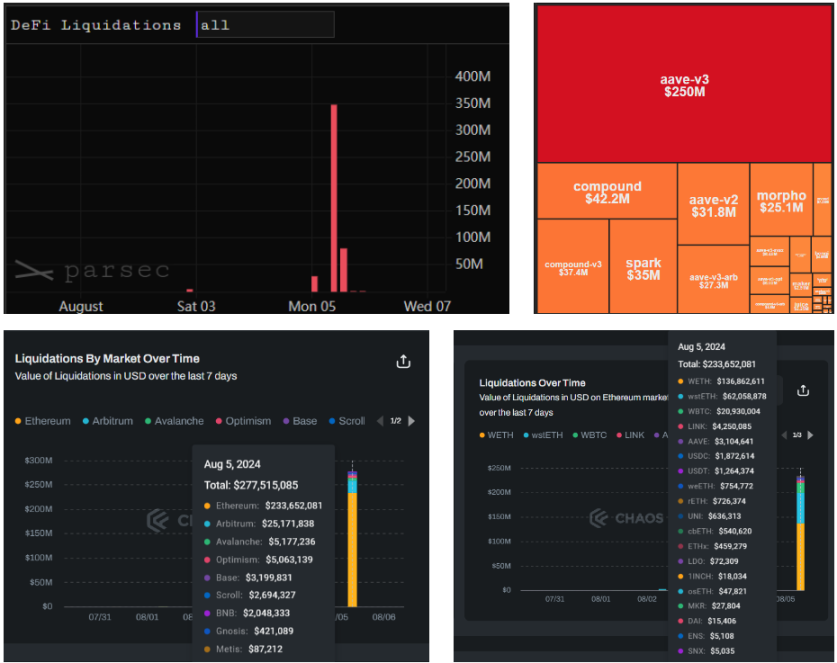

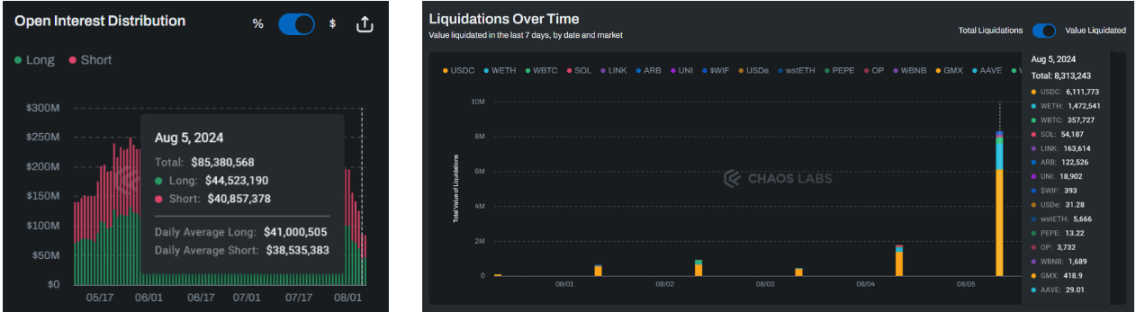

In terms of liquidation, the liquidation on August 5 was the most serious, with an overall scale of more than 350 million US dollars. According to the protocol allocation, Aave V3 had the largest liquidation amount, reaching 250 million US dollars. The second largest liquidation was Compound, with a total liquidation amount of 79.6 million US dollars. In the liquidation of Aave V3, it was mainly concentrated on the liquidation of large-scale assets of Ethereum, with the top three being WETH, wstETH and WBTC.

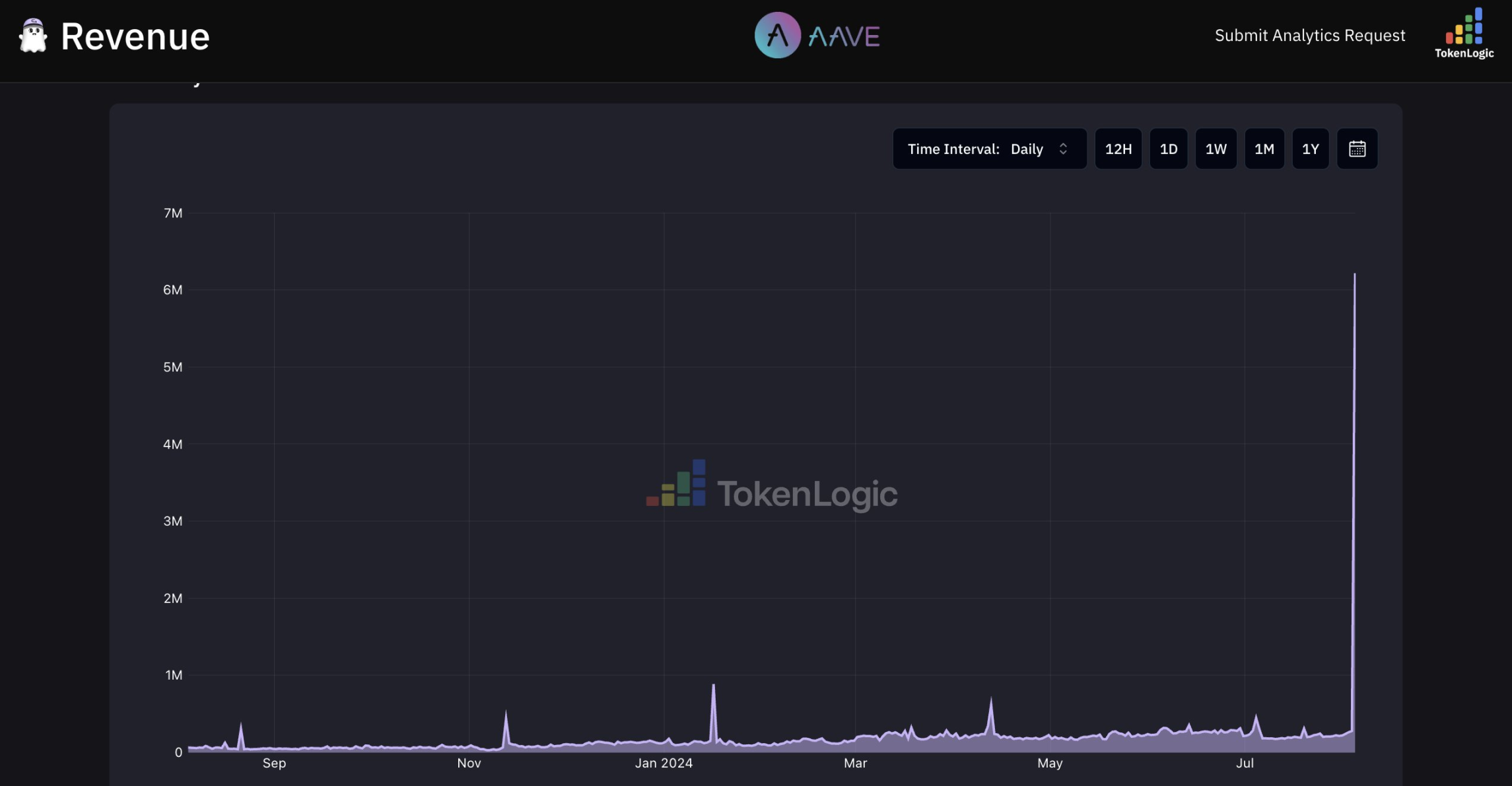

Amid market volatility, Aave also earned more than $6 million in revenue.

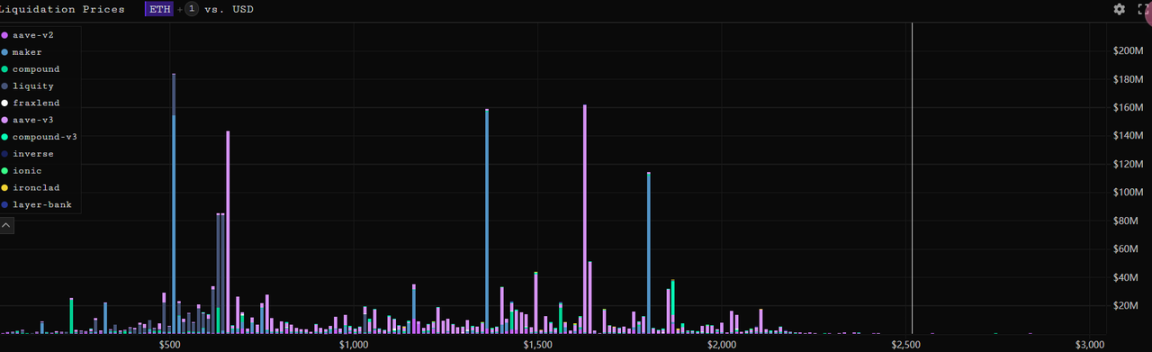

After the liquidation was completed, the overall liquidation line on the chain was below $2,000. In liquidation, due to the characteristics of the mechanism, bad debts are prone to occur when the market fluctuates greatly. For example, Aave V3 has generated a total of $350,000 in bad debts in the past seven days. In contrast, Curve Llamalend avoids most hard liquidations due to its soft liquidation mechanism, of which soft liquidation took on a liquidation share of $50.24 million on August 5.

Overall, the lending protocol鈥檚 response to this market volatility was satisfactory.

Decentralized Exchange (DEX)

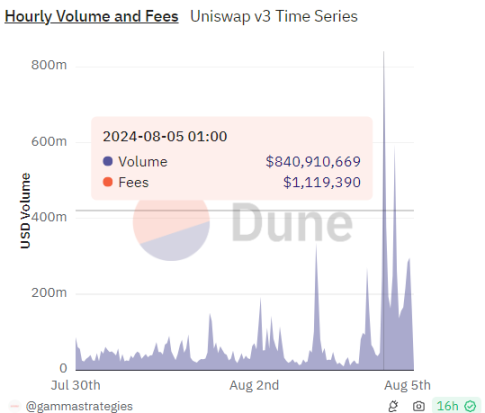

In Uniswap V3, the peak reached $840 million on August 5 and generated $1.119 million in fees for LPs.

As for GMX, on August 5, its positions dropped by about 30% compared with the previous day, and it liquidated $8.3 million in assets, mainly in USDC.

Re-pledge

As one of the core assets of Ethereum today, the outflow of re-pledged assets is also quite significant under market fluctuations. For example, Renzo鈥檚 pledged token ezETH has been depegged to a minimum of 0.876 WETH.

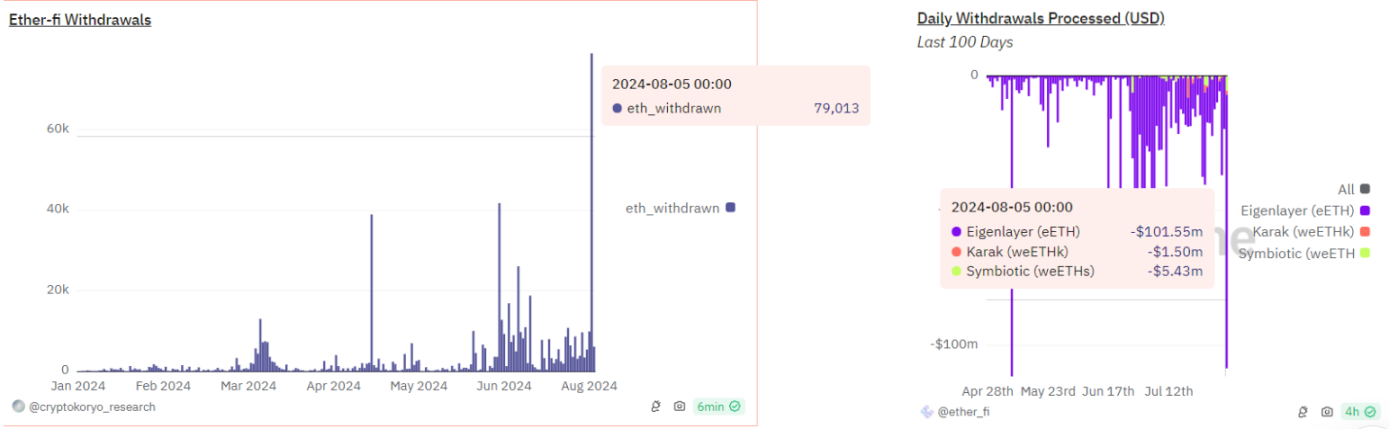

In terms of protocol outflow, taking ether.fi as an example, 79,013 ETH were withdrawn on August 5, with a total value of more than 100 million US dollars, most of which were eETH withdrawals from Eigenlayer. With a liquidity of more than 77,000 ETH and a DeFi utilization rate of more than 73%, the protocol does not have an overall run risk.

Overall, the Lido stETH withdrawal queue has not shown a significant growth trend, and the main LST on the chain has remained stable. Therefore, there is no systemic risk in the re-staking ecosystem as a whole.

Quellen:

https://parsec.fi/layout/cryptoian/_N3 3 MkeM

https://community.chaoslabs.xyz/aave/risk/liquidations

https://dune.com/ether_fi/etherfi

https://dune.com/hildobby/ethena

This article is sourced from the internet: With each passing day, how does DeFi perform amid market fluctuations?

Original title: “Solana Need L2s And Appchains?” Original article by Yash Agarwal Original translation: Ladyfinger, BlockBeats Editor’s Note: As a high-performance public blockchain platform, Solana is facing unprecedented development opportunities and challenges. In this article, Yash Agarwal takes a panoramic and in-depth look at the key issues in the Solana ecosystem – modularity, application chains, and Rollups, and how they work together to drive Solana towards a broader future. Introduction A month ago, Vibhu, the founder of DRiP, the top free NFT distribution application on Solana, made a statement that sparked widespread discussion: Solana will and needs to have Layer 2 and Rollup. He expressed this view because DRiP loses about $20,000 in value per week as SOL prices and network congestion rise. The increase in Solana network activity has…