ETHW hat über 200 Millionen USD angezogen. Was ist Bitwises Strategie für den Krypto-ETF-Kampf?

Originalautorin: Nancy, PANews

Ethereum’s 10th anniversary has ushered in a milestone, with 9 spot ETFs finally “passing customs” and being approved, and 8 issuers have won the victory of mainstreaming Ethereum after years of regulatory resistance. On the first day of listing on July 23, the trading volume of Ethereum spot ETF exceeded $1 billion, which is 23% of the $4.6 billion trading volume of Bitcoin spot ETF on the first day in January this year.

Although the rise in market demand will drive up the price of crypto ETFs, the competition between homogeneous products is bound to be fierce, which has been reflected in the market structure of Bitcoin spot ETFs. Among these issuers, the crypto-native institution Bitwise does not have the appeal of traditional giants such as BlackRock and Fidelity, but the scale of its crypto ETF funds is still considerable, and the tactics behind it are worth paying attention to.

Bitwise is one of the well-known crypto index fund management companies in the United States. It launched its first crypto index fund in 2017 and now offers 20 products covering ETFs, publicly traded trusts, private equity funds, hedge funds and NFT collectibles.

ETHWs first listing attracted over $200 million, and BITB received over 110 institutional investors

The recovery and prosperity of the crypto market is the premise for the development of ETFs. This year, the approval of Bitcoin spot ETFs, the US election, and the Fed’s interest rate cuts are driving a V-shaped reversal in the crypto market. As a channel for old money, these ETFs have also become one of the first beneficiaries and have ushered in a strong growth momentum.

Last night, the Ethereum spot ETF made its debut, with a cumulative trading volume of over $1 billion on the first day, mainly from Grayscale ETHE, BlackRock ETHA and Fidelity FETH. However, according to Farside Investors, the Ethereum spot ETF saw capital outflows on the day of its listing, with Grayscale ETHE bringing in a net outflow of over $480 million, but Bitwises ETHW became the main money-attracting force with a net inflow of over $200 million, far exceeding Fidelity FETHs $71.3 million and Franklin EZETs $13.2 million.

At the same time, the performance of Bitwises Bitcoin spot ETF is also quite impressive. SoSoValue data shows that as of July 22, the total net asset size of the US Bitcoin spot ETF has reached tens of billions of dollars in half a year, reaching 62.14 billion US dollars. Although the current Bitcoin spot ETF market has a significant head effect, from the perspective of capital trends, Bitwises Bitcoin spot ETF BITB is also an investment target favored by investors.

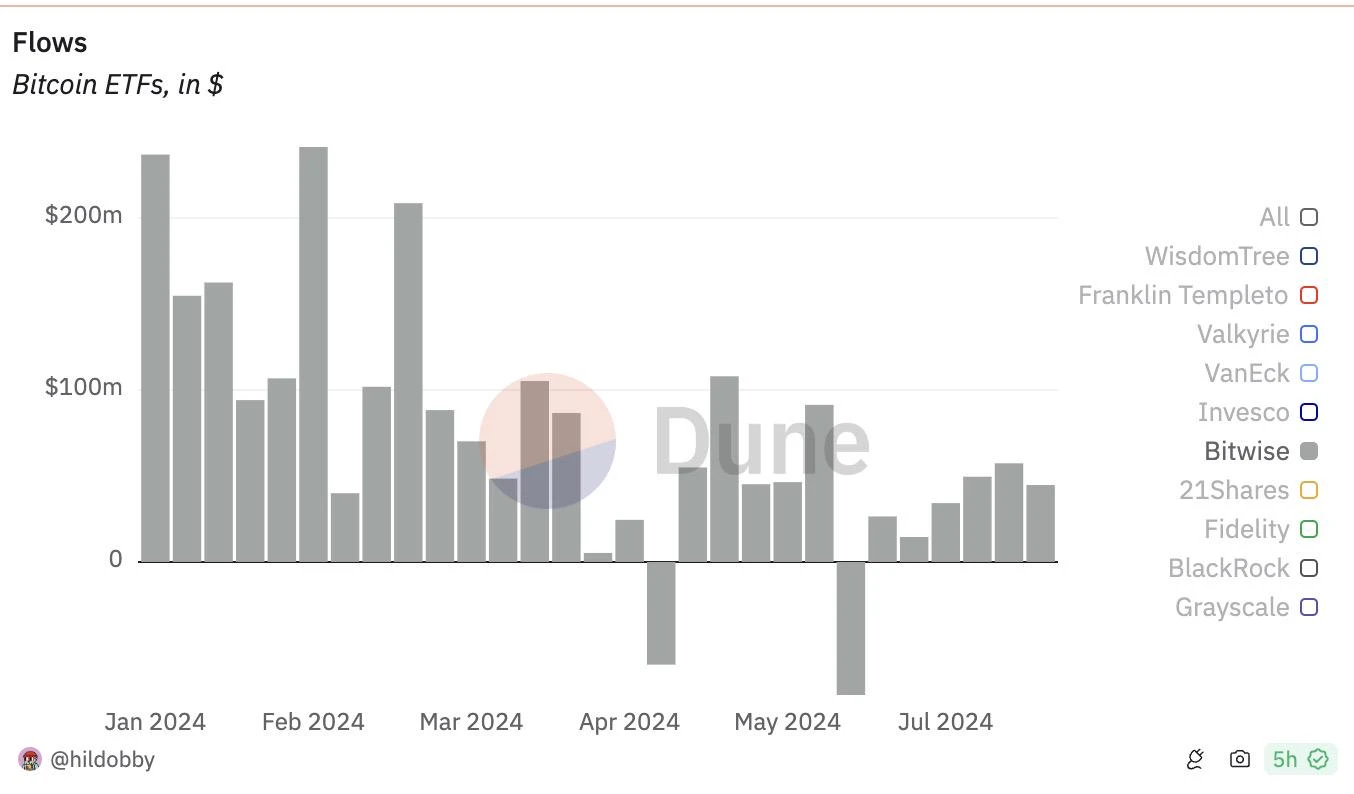

SoSoValue data shows that as of July 22, BITBs cumulative net inflow reached $2.2 billion, ranking fifth, exceeding the sum of the inflows of the six Bitcoin ETFs ranked behind, and has opened up a considerable gap with these ETFs. At the same time, BITBs total net asset value reached $2.72 billion, ranking fifth among the 11 US Bitcoin ETFs, with a market share of 4.5%. Although the overall market share is still not comparable to that of leading ETFs such as BlackRock and Grayscale, according to Dune data, BITBs weekly funds are basically dominated by net inflows, with only a few outflows.

From the perspective of price performance, since its launch, the price of BITB has risen by nearly 45.7% to $37.2. According to Fintel data, as of July 23, there were 117 listed companies that reported holding BITB, holding a total of approximately 1,067 shares of BITB, with a current value of over $390 million.

According to Fintel statistics, BITB’s holders include investment advisory firm Pine Ridge Advisers, large US market maker Jane Street Capital, hedge fund management company Boothbay Fund Management, overseas hedge fund giant Millennium Management, and options trading giant Susquehanna International Group. Bitwise CEO Hunter Horsley recently revealed that a large bank in the US has 20% of all its wealth management branches (hundreds of them) own Bitwise ETFs.

For a crypto-native asset management company without a deep traditional financial background, Bitwise has made a great start. The Bitwise Asset Management team consists of more than 60 professionals with backgrounds in BlackRock, Millennium, Blackstone, ETF.com, Meta, Google, and the U.S. Attorneys Office. Among them, Bitwise CEO Hunter Horsley was a product manager at Facebook and Instagram and graduated from the Wharton School of the University of Pennsylvania. Bitwise has received multiple rounds of financing, and investors include Elad Gi, Electric Capital, Bridgewater CEO David McCormick, Blackstone executive Nadeem Meghji, Vetamer Capital, ParaFi Capital, and Coinbase Ventures.

The competition among the three major ETFs, Bitwise is bullish on crypto assets

Competing in first release, speed of volume, rate reduction, fee exemption…all publishers are secretly competing for a position.

In order to gain greater scale and liquidity among its many competitors, Bitwise has made efforts in aspects such as issuance time, transaction fees and ecological support.

The early bird catches the worm, which is why the ETF business usually presents a distinct first-mover effect. As one of the first approved Bitcoin spot ETFs, Bitwise submitted its application as early as October 2021, and was finally approved in January this year after multiple rejections by the SEC. In the application for Ethereum spot ETF, although Bitwise applied later than other competitors, it is still the first player, and Bitwise is also the first issuer to disclose that the Ethereum spot ETF seed fund is US$2.5 million.

At the same time, in order not to fall behind in the fiercely competitive track, the fee rate has also become a breakthrough for issuers to create differentiated competitive advantages, which is also the most effective way to compete. In terms of fees, BITB is the lowest among all Bitcoin spot ETFs, with a management fee rate of only 0.2%, and the management fee for the first six months of the first $1 billion in assets is 0; ETHWs fee rate is 0.2%, second only to Franklin Templeton EZET and Grayscale Ethereum Mini ETF ETH, and the first $500 million or the first 6 months of fees are waived. Obviously, low fees are an important way for Bitwise to win capital inflows.

In addition to the above conventional expansion strategies, Bitwise has also won the favor and recognition of the crypto community by providing financial support for the development of the Bitcoin and Ethereum ecosystems.

At the launch of BITB, Bitwise announced that it would donate 10% of BITBs profits to three non-profit organizations that fund Bitcoin open source development, BrinkOpenSats and the Bitcoin Development Fund of the Human Rights Foundation. These organizations play a key role in improving the security, scalability and availability of the Bitcoin network. And these donations will be made at least once a year for the next 10 years to further support the health and development of the Bitcoin ecosystem; similarly, ETHW will donate 10% of the funds profits to Ethereum open source developers Protocol Guild and PBS Foundation. The donation plan will also last for at least 10 years and will be carried out annually. The recipient organizations may change according to annual reviews. And in order to ensure transparency, BITBs Bitcoin address and ETHWs Ethereum address have been made public.

It is worth mentioning that Bitwise is highly bullish on the prospects of crypto assets. Bitwise CIO Matt Hougan recently said that the inflow of Bitcoin spot ETFs, Bitcoin halving, the change in political attitudes of Ethereum spot ETFs, and the prospect of interest rate cuts by the Federal Reserve have all created a better long-term environment for cryptocurrencies. Coupled with the strong growth of the stablecoin market, Layer 2 development, and the increasing involvement of institutions such as BlackRock in this field, the right combination of developments in the second half of the year may easily push Bitcoin to $100,000. In addition, while the price of ETH is expected to be volatile in the first few weeks after the Ethereum ETF goes online, as funds may flow out of the trust after the $11 billion Grayscale Ethereum Trust (ETHE) is converted to a spot ETF, the price of ETH will exceed $5,000 and set a record high by the end of the year. If the flow is stronger than many market commentators expect, the price may be even higher.

This article is sourced from the internet: ETHW has attracted over 200 million USD. What is Bitwise’s strategy for the crypto ETF battle?

Related: SocialFi Exploration: Solana Actions Blinks vs. Ethereum Farcaster Lens

Original author: YBB Capital Researcher Ac-Core TLDR Recently, Solana and Dialect jointly launched the new Solana concept Actions and Blinks to realize one-click Swap, Voting, Donation, Mint and other functions in the form of browser plug-ins. Actions enable efficient execution of various operations and transactions, while Blinks ensures network consensus and consistency through time synchronization and sequential recording. These two concepts work together to enable Solana to achieve high-performance and low-latency blockchain experience. The development of Blinks requires the support of Web2 applications, which first and foremost brings up issues of trust, compatibility, and cooperation between Web2 and Web3. Compared with ActionsBlinks and FarcasterLens Protocol, the former relies on Web2 applications to obtain more traffic, while the latter relies more on the chain to obtain more security. 1. How Actions…