Bitlayer kündigt $11 Millionen Serie-A-Finanzierung zum Aufbau der Bitcoin-Rechenschicht an

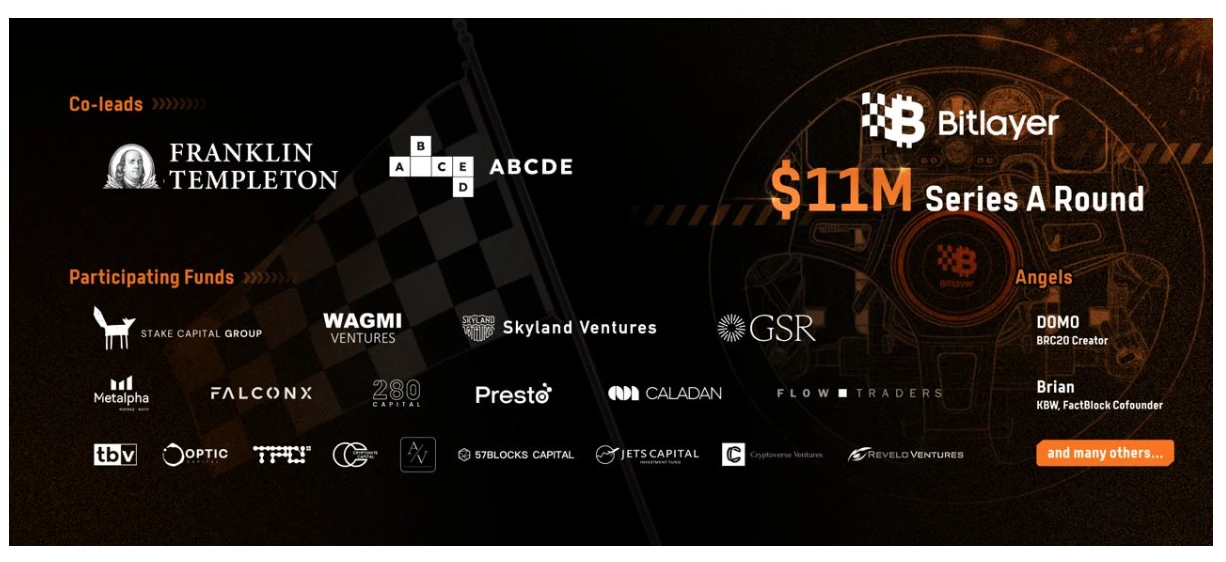

On July 23, Bitlayer, the first Bitcoin second-layer project based on BitVM, announced the completion of a US$11 million Series A financing round . This round of financing was jointly led by first-tier investment institutions Franklin Templeton Digital Assets and ABCDE Capital. Framework Ventures, which previously led Bitlayers seed round, also continued to participate in this round of financing.

In addition to the lead investors, investment institutions such as Stake Capital Group, WAGMI Ventures, Skyland Ventures, Flow Traders, GSR Ventures, FalconX, Metalpha, 280 Capital, Presto Labs and Caladan, as well as well-known angel investors such as BRC 20 founder DOMO and FactBlock KBW co-founder Brian Kang also participated in this round of financing.

Bitlayer is a Bitcoin Layer 2 project strategically invested by Franklin Templeton, a Bitcoin spot ETF service provider. The cooperation between the two parties marks an important milestone, which not only demonstrates Bitlayers leading position in technological innovation in the entire Bitcoin ecosystem, but also shows that traditional financial institutions are increasing their recognition and support for blockchain technology.

“We are honored to work with these top funds to help the Bitlayer ecosystem grow,” said Charlie Hu, co-founder of Bitlayer Labs. “The participation of leading blockchain industry institutions in Bitlayer’s Series A round shows our leading position in the Bitcoin ecosystem. Our goal is to build a native Layer 2 with Bitcoin security equivalent to Bitcoin finality and make Bitcoin history.”

Regarding this lead investment, BMAN, managing partner of ABCDE Capital, said: After leading the last round of financing (Bitlayer), we are very happy to continue to lead the A round of financing for Bitlayer. Bitlayer has stood out among Bitcoin Layer 2s, accumulating more than $500 million in TVL and 300 ecological projects, and building the most prosperous Bitcoin Layer 2 ecosystem. As it achieves native verification on Bitcoin, Bitlayer will become the first native Bitcoin Layer 2, which is a groundbreaking moment in Bitcoin history.

Kevin Farrelly, Managing Partner at Franklin Templeton, said: “We believe Bitlayer’s unique capabilities and technology have the potential to unlock new use cases and opportunities for Bitcoin, and we look forward to exploring opportunities with the Bitlayer team and our other Bitcoin Finance-focused products. This investment underscores our commitment to supporting innovation in the digital asset space.”

Since the establishment of the team, Bitlayer ( https://www.bitlayer.org/ ) has been committed to developer deployment, ecosystem construction and user acquisition. Currently, Bitlayer has achieved several milestones, including the release of the Bitlayer technical white paper, the launch of the developer incentive airdrop plan, the launch of Mainnet-V1, the launch of the Dapp ranking competition and the series of Bitlayer first mining festivals, and has achieved many results.

According to DeFiLlama data ( https://defillama.com/chains/Bitcoin%20Sidechains ), the current total locked asset value (TVL) on the Bitcoin Layer 2 chain is approximately US$1.2 billion. Among them, Bitlayer has jumped to the top of the TVL in this track with a share of 32.78%, followed by Merlin, Rootstock and CORE with shares of 18.27%, 14.75% and 13.61% respectively, ranking second, third and fourth.

In addition, Bitlayer is building the largest Bitcoin Layer 2 ecosystem. Currently, there are hundreds of projects being built in the Bitlayer network, covering infrastructure and developer tools, wallets, DeFi, NFT, games and metaverse, as well as RWA and many other sections, showing a booming development trend.

The Future of Bitlayer

The Bitcoin community has long been committed to achieving scalability while maintaining core security and decentralization principles, but many existing solutions often cannot take both into account, and the market has a huge demand for solutions that can solve the trilemma at the same time.

The funds raised by Bitlayer in this round of financing will be used to strengthen Bitlayers global expansion and support more teams to build native protocols on Bitlayer. By providing a faster and more cost-effective transaction experience, Bitlayer will accelerate the application of Bitcoin in the DeFi field and pave the way for its mass adoption.

On the technical side, after launching Mainnet-V1 on April 15 this year, the Bitlayer development team has been working on Mainnet-V2, a Bitcoin-native rollup whose Layer 2 state transitions will be supported by a Bitcoin-friendly proof system that combines ZK and fraud proofs.

In the future, with the full support of strategic investors and ecosystem partners, Bitlayer will continue to drive the tremendous growth and adoption of Bitcoin and become the leading Bitcoin Layer 2 infrastructure.

About Franklin Templeton Digital Assets

Franklin Templeton Digital Assets is part of global investment management firm Franklin Resources, Inc. [NYSE:BEN], whose subsidiaries operate as Franklin Templeton and serve clients in more than 150 countries. Franklin Templeton Digital Assets has been active in the digital asset ecosystem since 2018, building blockchain-based technology solutions, developing a range of investment strategies and operating a node validator.

About ABCDE

ABCDE is a venture capital firm focused on investing in leading crypto builders. It was co-founded by Huobi co-founder Du Jun and former Internet and crypto entrepreneur BMAN, who have more than 10 years of experience in the crypto industry. ABCDEs co-founders have built multi-billion dollar companies in the crypto industry from scratch, including listed companies (1611.HK), exchanges (Huobi), SaaS companies (ChainUP.com), media (CoinTime.com) and developer platforms (BeWater.com).

Über Bitlayer

Bitlayer is the first Bitcoin security equivalent Layer 2 based on BitVM. The core goal of Bitlayer is to solve the trade-off between security and Turing completeness of Bitcoin Layer 2 through cryptographic innovation and blockchain engineering implementation.

Bitlayer is committed to becoming the computing layer of Bitcoin, aiming to introduce hyper-scalability to Bitcoin while inheriting its security and providing users with a high-throughput, low-cost transaction experience.

Bitlayer official website: https://www.bitlayer.org/

Bitlayer official Twitter: https://twitter.com/BitLayerLabs

Bitlayer Official Medium: https://medium.com/@Bitlayer

This article is sourced from the internet: Bitlayer announces $11 million Series A funding to build Bitcoin computing layer

The Black Summer of the crypto market has just passed, and the price of Bitcoin has rebounded but is a little weak, and the direction of market sentiment is still unclear. Research organization Glassnode recently released a report titled Surviving the Sell-Off , and the data in this report shows some interesting situations. In the past month, first, the continuous outflow of ETFs led to the decline of the market, and then panic. The German governments selling of Bitcoin actually affected the price of Bitcoin more in terms of market sentiment. The selling pressure itself did not have as much impact on the price of Bitcoin as the community imagined. So after more than ten days of continuous inflows into the ETF, what is the impact of the potential selling…