Von der Geburt bis zu den Runen, ein 10.000 Wörter langer Überblick über die Geschichte von Bitcoin

Original title: The Road to Runes

Original article by Shlok Khemani

Original translation: Peisen, BlockBeats

Editors Note: This article delves into the innovation and development in the Bitcoin ecosystem, especially the progress made in the development of non-interchangeable tokens (ordinals) and interchangeable tokens (Runes). The article analyzes in detail how ordinarys and Runes have become important standards on the Bitcoin blockchain, and explores their performance in the market and the impact of social recognition. The article first introduces the background and application of the theory of ordinarys, explains how each satoshi is uniquely numbered, and explores its impact on the Bitcoin community and market. The article then turns to discuss the launch of Runes and its acceptance and market performance in the Bitcoin ecosystem. Runes not only improve transaction efficiency by storing data in the OP_RETURN field and supporting multiple tokens stored in the same UTXO, but also demonstrates its compatibility with the Bitcoin Lightning Network, which makes it stand out in the market.

In the week leading up to the latest Bitcoin halving, Runes, a new interchangeable token standard on Bitcoin, became a hot topic in the cryptocurrency space. As I tried to understand Runes and their importance, I realized how little I knew about the early development of Bitcoin and how it fundamentally works. Yes, this admission was a bit unexpected considering that I work in cryptocurrencies and Bitcoin is the largest cryptocurrency.

However, I figured if I was in this situation myself, so were a lot of other people, so I decided to dig deeper and write about it.

I retraced the path from Bitcoin’s inception to Runes. Along the way I discovered early on-chain DNS implementations, Vitalik Buterin’s first token project (no, not Ethereum), permanent ASCII art, and a blockchain game from 2015, as well as the divisions in the community that led some to call Bitcoin a “failed experiment,” the lone developer who changed the face of a trillion-dollar asset, and more.

This is the story of Bitcoin’s past and future. It deals with failed experiments and false starts. It explores the challenges of introducing innovation in a protocol that often resists change. It explains why one ten-millionth of a Bitcoin can sell for more than a million dollars. Most importantly, it discusses how social consensus is just as important to digital assets, if not more important than code.

Let’s dive in!

UTXOs

We’ll start by understanding one of the fundamental building blocks of the Bitcoin protocol: Unspent Transaction Outputs, or UTXOs.

UTXOs are the way the Bitcoin protocol tracks ownership of coins. Think of each UTXO as a title receipt – an indivisible portion of a Bitcoin that can only be spent by a specific address (owner). When ownership of a Bitcoin is transferred (one user sends it to another), it is recorded on the blockchain as a UTXO associated with the recipients address.

In the Bitcoin protocol, there is no inherent concept of account balances. Instead, Bitcoin owned by a certain address is captured as UTXOs scattered on the blockchain, and each UTXO is the output of a transaction. When an application (such as a wallet) displays their BTC balance to a user, it does so by scanning the blockchain and aggregating the UTXOs belonging to that user.

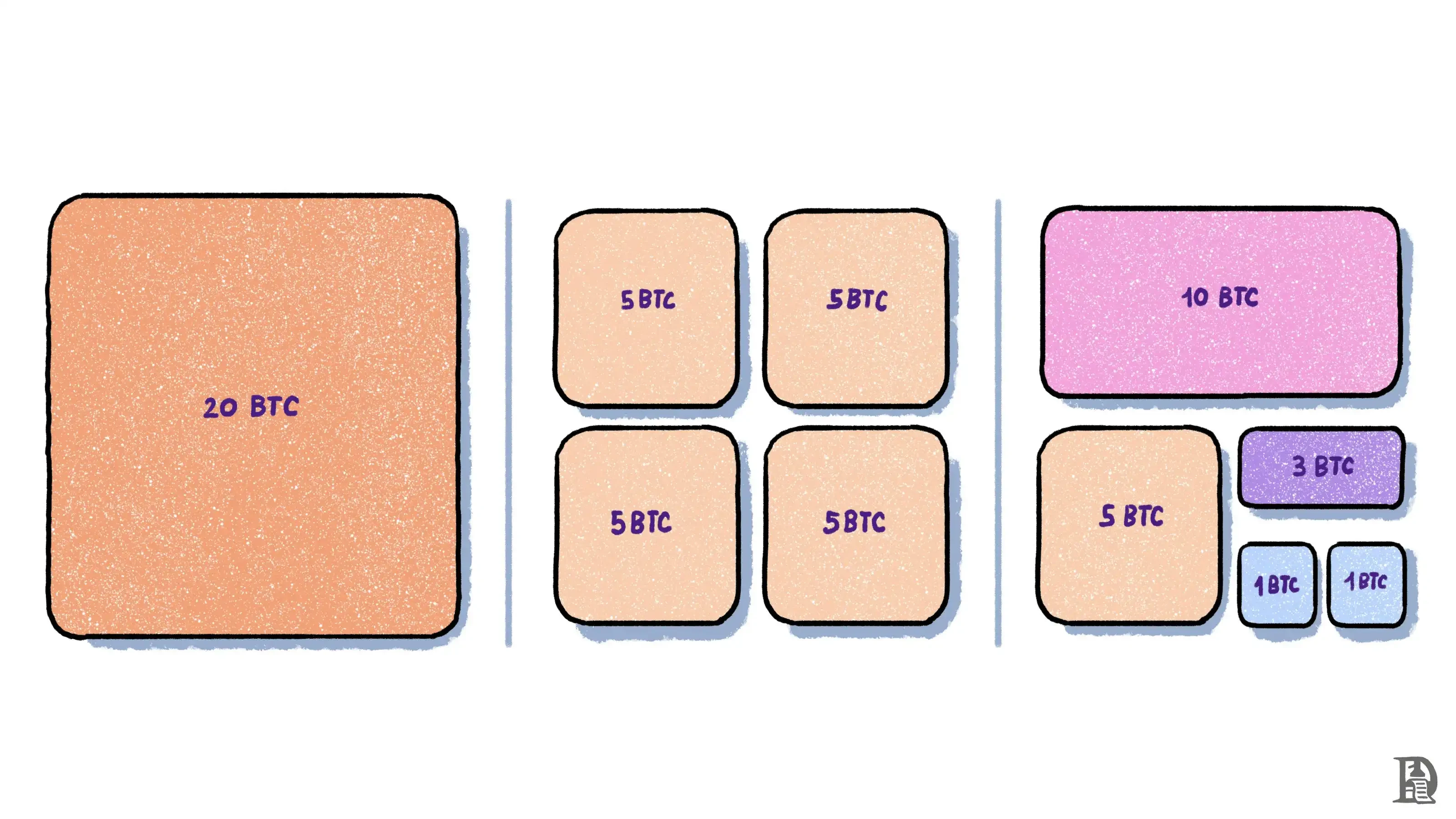

If my Bitcoin wallet shows that I own 20 BTC, that means the total value of the UTXOs associated with my public key is 20 BTC. This could be one UTXO worth 20 BTC, or four UTXOs worth 5 BTC each, or any other combination that adds up to 20 BTC.

Transactions on Bitcoin are structured as a set of input UTXOs that are consumed (or destroyed) to create output UTXOs. Imagine that Joel has the following UTXO values associated with his address:

-

10 BTC

-

5 BTC

-

1 BTC

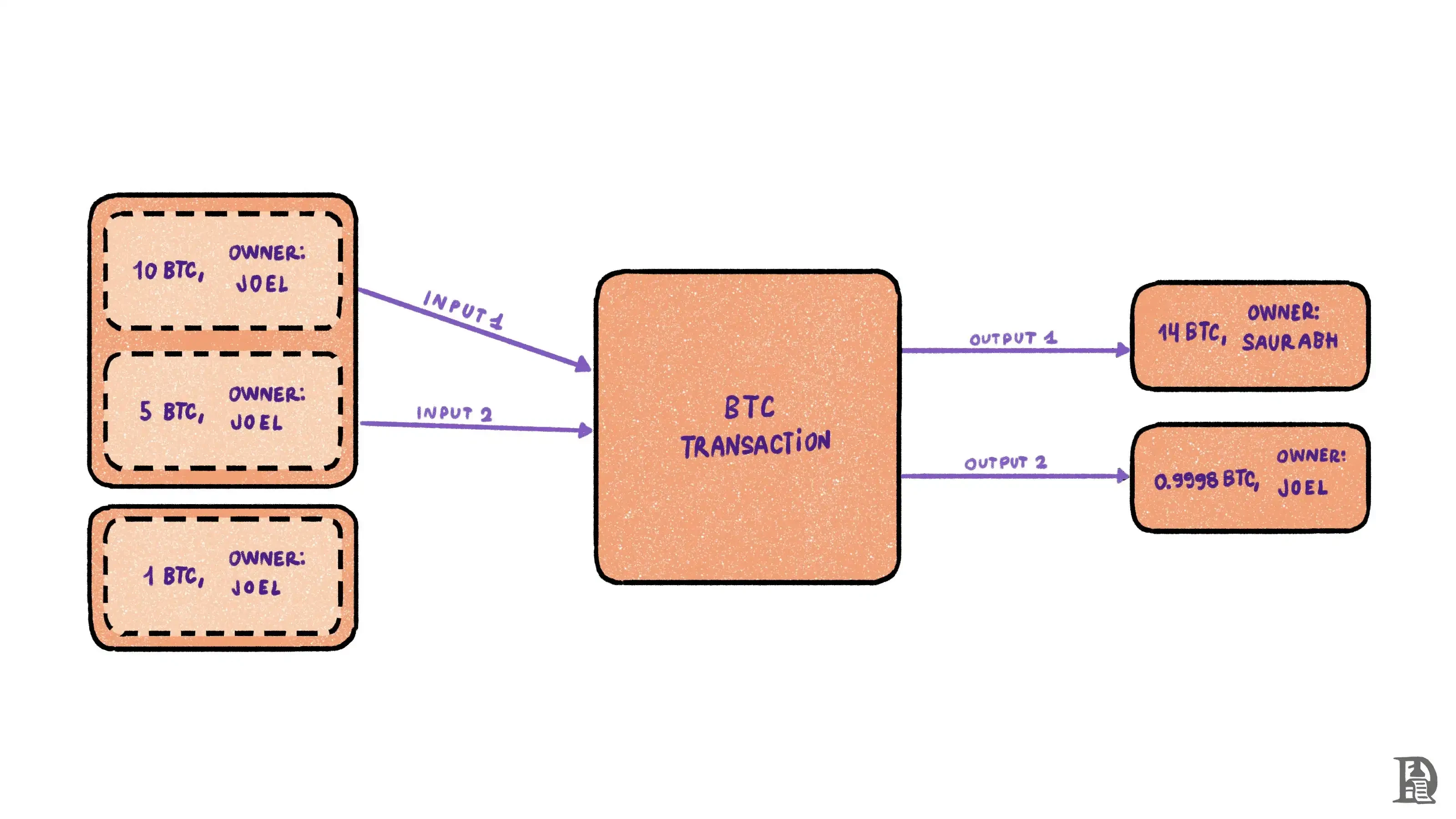

Now, if he wants to pay Saurabh 14 BTC, his wallet application creates a transaction with the following characteristics:

-

10 BTC and 5 BTC UTXOs as input (1 BTC UTXO remains unchanged)

-

14 BTC as an output sent to Saurabhs address

-

0.9998 BTC as the second output is sent back to his address

The second UTXO is the change he receives from the transaction. Why 0.9998 BTC instead of 1 BTC? He also needs to pay a transaction fee to Bitcoin miners as an incentive to include his transaction in a block. The difference between the sum of the input UTXOs and the output UTXOs (0.0002 BTC in this case) constitutes the fee for the transaction. In most cases, the heavy lifting of creating a valid transaction by setting up the appropriate inputs, outputs, and fees is abstracted away from the user and handled in the background by the wallet application.

To better understand UTXOs, think of them as monetary notes, and a Bitcoin wallet as a physical wallet. Each monetary note (like a UTXO) has a fixed, indivisible amount, while the total value stored in a physical wallet (like in the case of a Bitcoin wallet) is the sum of the values of all the monetary notes in it.

Bitcoin transactions are similar to purchasing items with cash. If I buy a $14 cocktail at a bar in New York City, I can hand over a $10 and a $5 bill and receive a $1 in change. The difference in the analogy here is that while currency notes only exist in fixed denominations (like $1, $5, $10, etc.), UTXOs can be associated with any number of Bitcoins.

(In contrast, other blockchains like Ethereum serve as a ledger for debits and credits, and track user balances within the protocol. This is similar to how a bank account tracks user balances.)

Bitcoin’s design, which chose to use UTXOs over other blockchain accounting models, laid the foundation for future token protocols to be built on top of it.

OP_Return

Satoshi Nakamoto originally created Bitcoin to create a censorship-resistant peer-to-peer electronic cash system. However, in the process, he also inadvertently created the worlds first immutable, forgery-proof, transparent, and time-stamped ledger.

Soon after Bitcoin was released, early cryptocurrency enthusiasts began to realize that such a ledger would be useful not only for payments, but could be extended to protect any important digital data stored on a resilient and distributed ledger. Applications discussed included stock certificates, digital collectibles, property ownership records, and bringing the Domain Name System (DNS) to Bitcoin.

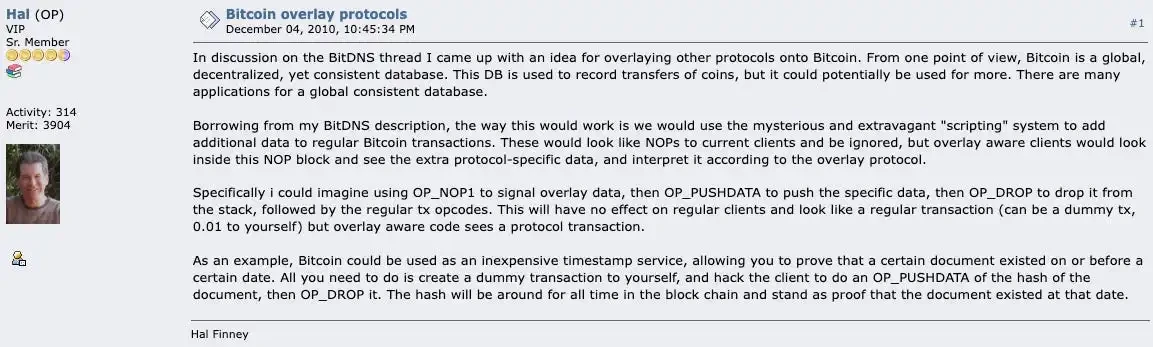

Hal Finney, a legendary computer scientist, famous Bitcoin contributor, and the person who received the first Bitcoin sent by Satoshi, proposed a solution to introduce DNS into the blockchain on the BitcoinTalk forum.

The question of whether Bitcoin should be used to store non-payment data sparked one of the first major debates in the Bitcoin community. One side sees Bitcoin as merely a payment system, and argues that storing other data (or garbage) is an abuse of its core purpose. The other side sees it as a way to demonstrate Bitcoins power, and believes that building new applications is critical to the long-term importance of the blockchain and the gradual reduction of security subsidies.

The debate also has short-term practical implications.

In the absence of a dedicated method for storing non-payment data in the Bitcoin protocol, early experimenters found a workaround. Recalling our previous discussion, a Bitcoin transaction consists of a series of input and output UTXOs. Each output UTXO has fields for the amount and the destination Bitcoin address. Developers took advantage of this 20-byte destination address field to store arbitrary non-payment data.

What does this arbitrary data consist of? As documented in this Blogeintrag , it ranges from the mundane to the creative. From tributes to Nelson Mandela to an ASCII portrait of then-Federal Reserve Chairman Ben Bernanke, from links to Wikileaks’ Cablegate documents to a PDF of Bitcoin’s original whitepaper, enthusiasts have preserved any text they deem worthy of permanent digital existence on the ledger.

This practice had a major unintended consequence. Normally, the data in the destination address field is a public key (or destination address), which the protocol maps to a private key that controls the generated UTXO. When developers began using this address field to store arbitrary data, these transactions created UTXO that could not be mapped to a private key, and therefore could never be spent. Such transactions were marked as fake payments.

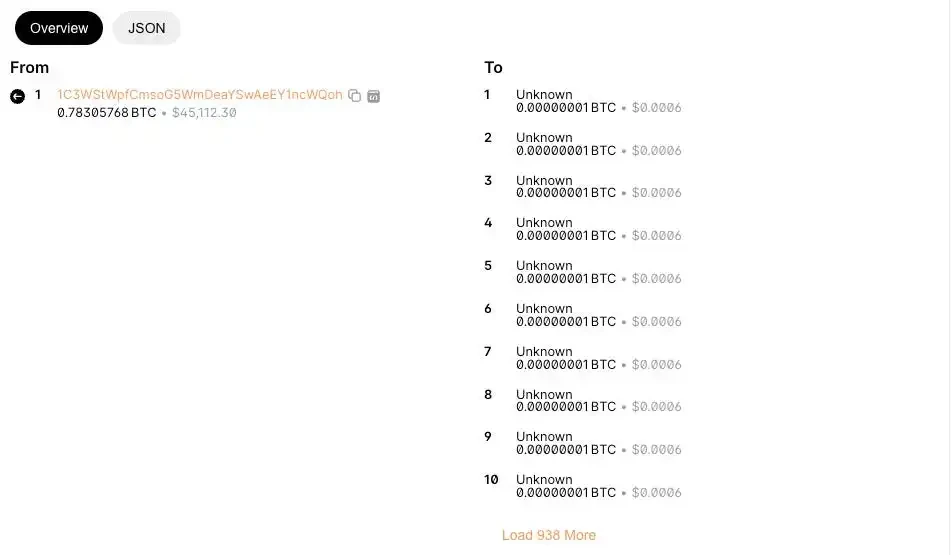

Zum Beispiel, the transaction containing the PDF of Bitcoin’s original white paper stores the data in nearly 950 output UTXOs, none of which are spendable.

Problems with storing data in UTXO outputs.

Fake payments are a problem for anyone running a full Bitcoin node. A full node maintains all valid UTXOs in the blockchain history (called the full UTXO set) and uses these UTXOs when validating new transactions. Ideally, the UTXO set should be as small as possible so that transactions can be quickly verified. However, because fake payments create UTXOs that can never be spent, they lead to UTXO bloat, an increase in the size of the UTXO set. As a result, nodes must permanently incur the cost of storing data that the blockchain was not designed to carry.

Although payment purists disagreed with using Bitcoin to store non-payment data, they could not prevent users from adding arbitrary data to UTXO outputs. As a compromise , they reluctantly allowed the inclusion of the previously banned OP_RETURN script function into Bitcoin transactions in 2014.

Their position (from what I understand of the Bitcoin 0.9.0 release notes ) is basically: Look, we dont want you to store random data on Bitcoin. Thats not what its for. But we cant stop you from using outputs to do so. So lets limit the damage youve done. Well give you a limited space to continue your shenanigans, but in the meantime we strongly recommend that you dont use Bitcoin this way. Thats not what it was designed for.

OP_RETURN accepts a user-defined 40-byte sequence of data. Although this data is stored on the blockchain, these outputs are provably unspendable and can be excluded from the UTXO set. This means that full nodes can ignore outputs marked as OP_RETURN when verifying payments, partially solving the UTXO bloat problem. I call this a partial solution because these transactions still exist on the blockchain and take up disk space.

40 bytes is not a lot of data. One English character usually takes up one byte of data space, which means that OP_RETURN can only hold a string of 40 characters at most, which is obviously not enough to store an image or a complete document. Therefore, the main use case of OP_RETURN is to store hashes of larger blocks of data.

Any digital data, when processed by a hashing algorithm, is mapped to a unique alphanumeric string, called a hash value. These hash values can be stored in the OP_RETURN field and used to timestamp externally stored pieces of data on the Bitcoin blockchain. For example, I can create a piece of art and store the hash of the image file on the blockchain. Anyone in the future can use the transaction to verify the authenticity of the image.

Services like Proof of Existence allow users to upload a document, generate a hash, and store it on Bitcoin for a fee (currently 0.00025 BTC or about $18).

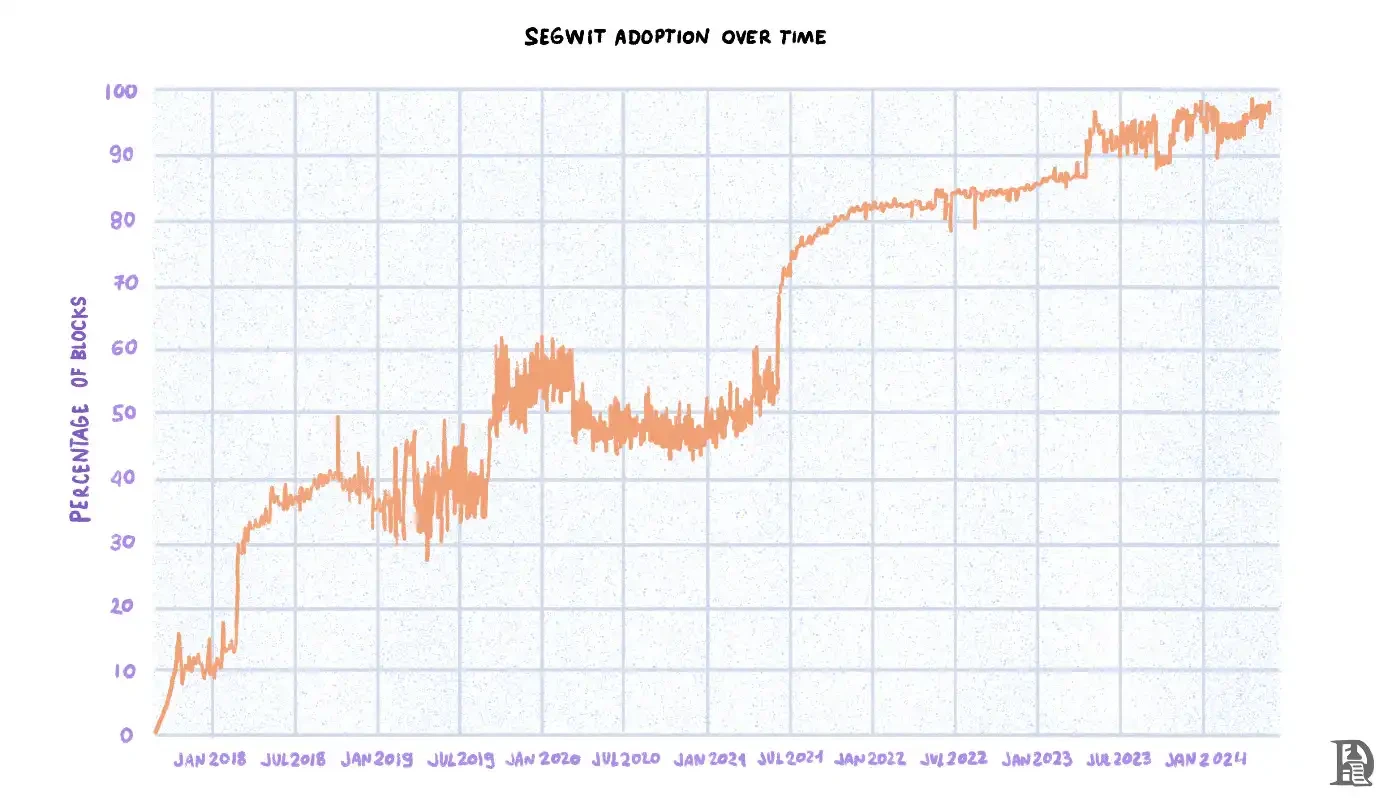

Such an obvious hockey stick chart. (Source)

The chart above shows the number of transactions containing OP_RETURN outputs over time. Notice the recent parabolic growth in the number of such transactions? We’ll discuss why this is happening shortly.

The OP_RETURN data limit was increased to 80 bytes in 2015.

Early token experiments

As Bitcoin matured, developers began dreaming of building other applications that could benefit from blockchain technology. A common application is the creation of alternative currencies or tokens with custom properties and functionality. One approach is to launch a blockchain from scratch, a path taken by early alternative coins such as Namecoin and Dogecoin. However, this approach requires launching a miner base and carries the risk of the token being centralized, at least initially.

For some, a more attractive proposal would be to create a token on the Bitcoin protocol itself, benefiting from its security and existing distribution.

Today, Vitalik Buterin is best known for being the co-founder of Ethereum, the second largest cryptocurrency after Bitcoin. However, before he founded Ethereum, Vitalik was very active in the Bitcoin community. He began his career in cryptocurrency by writing for Bitcoin Weekly. After the magazine closed, Vitalik co-founded Bitcoin Magazine , considered the first official publication in the industry.

Bitcoin Magazine October 2013 cover. You can purchase these original prints using BTC at the Bitcoin Magazine Store. This issue is currently on sale for $1,000!

In 2013, Vitalik and four other authors published the Colored Coins white paper, which described a way to store alternative currencies, commodity certificates, smart assets, and other financial instruments on the Bitcoin blockchain. This is achieved by marking or coloring Bitcoins and attaching information that specifies their intended use.

What is marked Bitcoin? Recall that BTC is stored on the blockchain as UTXOs, which are created and destroyed when BTC is transferred from one wallet to another. This mechanism makes it possible to trace the origin and ownership history of Bitcoin because it leaves a trail of transactions as it moves between wallets.

Let’s say I received a 5 BTC UTXO from Saurabh. Then, I transferred 7 BTC to Sid, consisting of a 5 BTC UTXO I received (from Saurabh) and another 2 BTC UTXO in my wallet. Now, Sid transferred 10 BTC to Joel, consisting of two UTXOs – one he received from me, and another he already had. Joel’s BTC can now be traced back to Saurabh, Sid, and me by following the transaction path that led to the UTXOs in his wallet.

Lets revisit the analogy of Bitcoin UTXOs and currency notes. Each currency note has a unique serial number that is preserved as it moves from one holder to another. The difference is that while I may not know the complete history of all the currency note holders before me (because there is no place to record this information), all Bitcoin transactions occur on a public ledger, and every satoshi (sat, the smallest unit of Bitcoin, 1 BTC = 100 million sats) can be traced back to its original owner. If there was a way to record the movement of currency notes according to their serial numbers, we would be able to trace them back to the printing press, just as we can trace each BTC to the block in which it was created.

Since BTC can be traced in transactions, metadata associated with a specific UTXO is also propagated. This is the basis of the process of marking or coloring BTC. The colored coin protocol utilizes a combination of inputs, outputs, and OP_RETURN to create and transfer tokens from one address to another.

The structure of a colored coin transaction. This is an example of a colored coin transfer transaction. The data in the OP_RETURN field defines the properties of the colored coin, while the input and output values (and some other fields not shown in this diagram) define the flow of tokens between different wallets.

There are two key points to note about the implementation of external tokens on the Bitcoin blockchain.

First, the values in the input and output fields represent actual bitcoins transferred from one wallet to another, with the colored coin label attached. This means that if I want to send x colored coins, I must also send x satoshis. The actual value transferred is the value of the colored coins plus the value of the satoshis. This is clearly a shortcoming of the protocol.

If you are creating a new currency, you almost certainly want it to be independently valued, not commingled with another currency. For example, the value of a piece of fiat currency should be what is written on it, independent of the value of the paper it is printed on. I think this is one reason why colored coins never caught on as a way to issue new tokens. Colored coins still make sense for non-monetary use cases, like issuing shares of ownership.

Second, Bitcoin does not recognize colored coins and their metadata as part of the protocol. We saw earlier that nodes can choose to ignore the information in the OP_RETURN field, which is crucial to interpreting the movement of colored coins. This means that to participate in the creation and trading of colored coins, users must use a dedicated wallet that recognizes the rules of the protocol.

If a user uses a regular wallet (designed to send and receive BTC) to interact with UTXOs that were previously involved in a colored coin transaction, they risk losing or corrupting the metadata associated with their UTXOs. Even in a future implementation of a standardized token for Bitcoin, incompatibility between wallets will remain a problem, as we will soon see.

Another early project that allows users to create digital tokens on Bitcoin is Gegenpartei . Counterparty also uses OP_RETURN to store metadata associated with the token, but unlike colored coins, Counterparty tokens are not pegged to the addresss BTC balance. This separation allows these tokens to be traded and price-discovered independently.

Independent token prices allowed Counterparty to create one of the earliest decentralized exchanges on the Bitcoin protocol. Users could submit their orders via messages (e.g., “I want to buy 10 A coins for 20 B coins”), and the protocol would hold their funds in trust escrow until the order was executed or expired.

Counterpartys native token, XCP, was initially issued fairly through Proof-of-Burn , where users must destroy BTC to mint the token. XCP acts as a utility token, allowing developers to pay the fees required to create named Counterparty coins. Counterparty also provides developers with a simple API to create tokens, transfer assets, issue dividends, and more.

Notable projects created with Counterparty include Spells of Genesis , the first blockchain-based NFT mobile game (yes, blockchain games were around back in 2015!), and Rare Pepes , an NFT collectible that retains its value even today ( the minimum price for the 298 supply set is close to $1 million as of early June 2024).

Segwit

While OP_RETURN, Colored Party, and Counterparty make it possible to store tokens on Bitcoin, their growth is hampered by a fundamental limitation of the protocol: the 1 MB block size limit.

1 MB is not a very large data capacity. A typical Bitcoin transaction is about 300 bytes, which means that a single 1 MB block can accommodate about 3,000 transactions. Since Bitcoin blocks are generated every 10 minutes, the networks transactions per second (TPS) is about 5. This throughput is far from enough for a payment network. Take Visa as an example, it processes 1,700 transactions per second and has a peak capacity of more than 24,000 transactions.

The discussion about increasing Bitcoin’s block size, like previous debates over payment and non-payment data, has divided the community into two camps.

On one side are the so-called big blockers, who advocate a hard fork (a protocol change that requires all nodes and users to upgrade their software) to permanently increase the block size to 2 MB, and subsequent periodic hard forks to continue to increase the block size. These people believe that in order for Bitcoin to be an effective payment system for millions of users, it needs higher TPS and low fees. The only way to do this is to continue to increase the block size as demand grows.

On the other side are the small blockers, who oppose hard forks and other drastic changes to the protocol. For them, Bitcoin’s value lies in part in its stability. They believe that increasing the block size will make it harder for users to run full nodes, thereby reducing Bitcoin’s decentralization and weakening its appeal as a powerful, revolutionary currency.

Blockchain Wars became one of the main topics at the time. This was a headline in the Wall Street Journal.

The big blockers eventually created Bitcoin Cash, a fork of the Bitcoin blockchain with an 8MB block size limit. On the other hand, the small blockers pushed for an upgrade called Segregated Witness (SegWit) to increase the block size without requiring a hard fork.

In addition to a series of inputs and outputs, Bitcoin transactions contain another structure that we haven’t discussed yet: witness data. Witness data includes cryptographic signatures and other verification information, and accounts for up to 65% of the transaction size.

The Segregated Witness upgrade changes the structure of blocks. After the upgrade, blocks no longer put all data (inputs, outputs, signatures) in a single 1 MB block, but are divided into two parts: the basic transaction block, which contains all inputs and outputs; and the extension block, which stores witness data.

Along with this change, Segregated Witness (SegWit) also changes the metric for calculating block capacity from data size to weight units. The weight of a block is calculated using the following formula:

Weight = Base Size × 4 + Witness Size

For example, a transaction with a base size of 100 bytes and a witness size of 200 bytes will take up 600 weight units [(100 × 4) + 200]. The new block size cap has increased from 1 MB to 4 million weight units, effectively quadrupling the block size without requiring a hard fork.

Importantly, the base block size remains at around 1 MB, preserving the original block size limit. This allows the protocol to accept both traditional and SegWit blocks, ensuring miners and nodes do not need to immediately upgrade their software to adapt to this change.

Segregated Witness was not adopted by miners overnight; it took almost 5 years for 90% of Bitcoin blocks to be Segregated Witness blocks. On the surface, this gradual adoption would seem to justify the decision to implement a soft fork. However, we can only speculate how a hard fork might have developed and affected miner behavior.

However, Segwit gives Bitcoin a much-needed TPS boost and is a key milestone in scaling the network and supporting use cases beyond BTC payments.

future development?

The 2021 Taproot upgrade is the most significant upgrade to the Bitcoin protocol since Segwit. However, unlike the contentious blocksize war, the changes proposed by Taproot were almost universally accepted by the Bitcoin community.

The Taproot upgrade combines three Bitcoin Improvement Proposals (BIPs) to implement several changes that make Bitcoin more secure and efficient. While these changes cover multiple aspects of the protocol, we will focus on those that lay the foundation for future on-chain token protocols.

The first major change brought by the Taproot upgrade is the replacement of the Elliptic Curve Digital Signature Algorithm (ECDSA) with Schnorr signatures. Blockchains rely on digital signatures – messages cryptographically signed by a users private key and verified using their public key – to operate. Digital signatures come in various forms, each following a different cryptographic scheme, some of which are more efficient than others. Moving to Schnorr signatures provides two key improvements to scalability.

First, recall that witness data, which includes signatures, takes up most of the transaction space. Compared to ECDSA, Schnorr signatures are smaller, which directly leads to space savings, allowing more transactions to fit into a single block.

Second, Bitcoin supports complex payment types such as multi-signature transactions, transactions that multiple parties must approve based on specific conditions before they can be executed. Before Taproot, multi-signature transactions required each individual signature to be included in the transaction input. With Schnorr signatures, multiple signatures can be combined into a single signature (and therefore a single input), making multi-signature transactions more efficient and private.

The Taproot upgrade also expands Bitcoin’s scripting capabilities, allowing developers to create more complex transaction conditions. The upgrade also provides a new way to store arbitrary data on the Bitcoin blockchain, providing greater flexibility than the OP_RETURN opcode discussed earlier.

In practical terms, this means that the amount of arbitrary data that developers can store in a Bitcoin transaction is now limited only by the maximum size allowed for a transaction, which is 400,000 bytes. This is five thousand times the amount of data that OP_RETURN allows.

By making transactions more efficient and allowing for greater flexibility in their content, the Taproot upgrade paves the way for the most exciting experiment yet to introduce tokens on Bitcoin.

Ordinal Theory

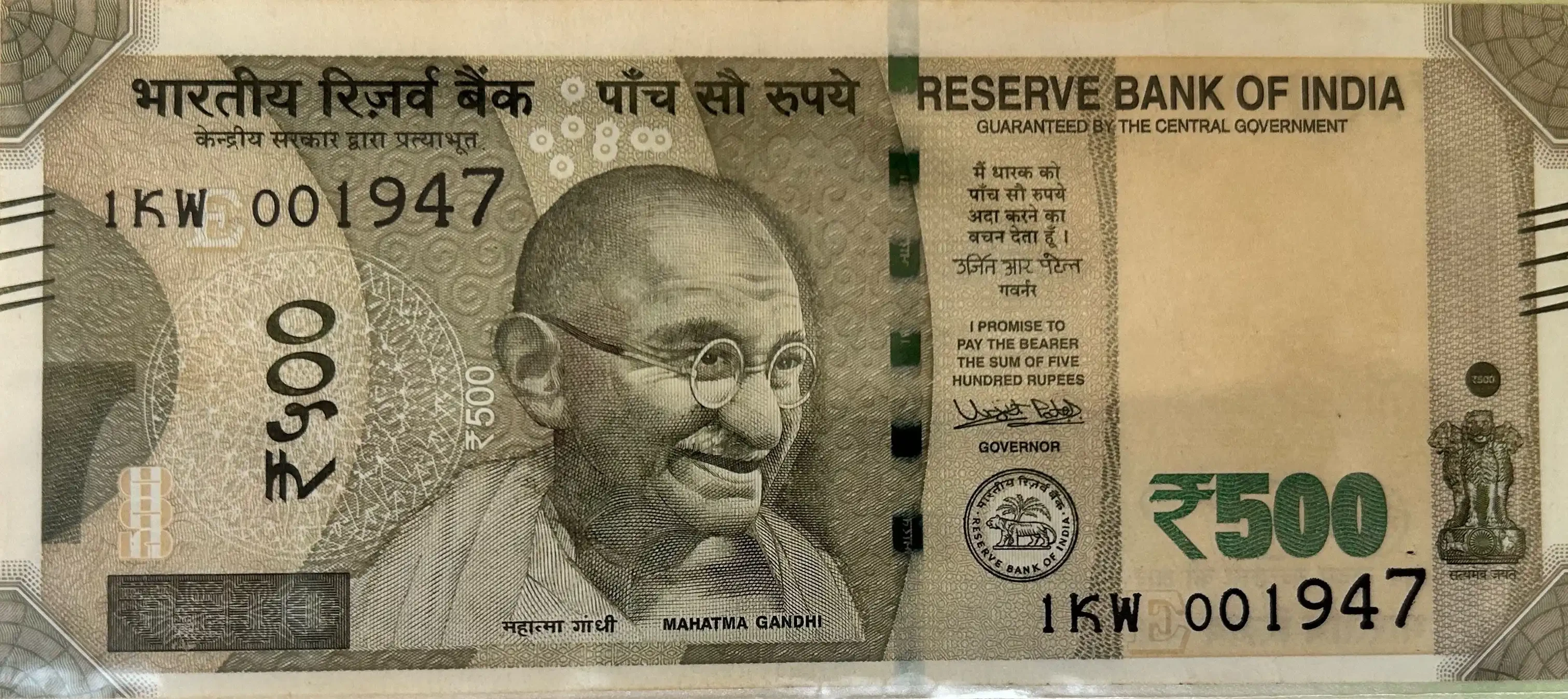

My best friend’s father, Kanwaljeet, is a numismatist, or a person who collects currency. His collection features not only historic and limited editions, but also a unique category of currency notes that he collects specifically for their serial numbers. For example, he owns a 500 Indian Rupee (INR) note with the serial number “001947,” corresponding to the year India gained independence. He paid 750 INR for the note, and now it’s worth 1,000 INR because of its serial number.

Money has a special place in society, serving as both a medium of exchange and a symbol of status, freedom and power. We work for it, it sparks conflict and some cultures hold it in awe, all of which shows its importance. This also explains why money has become a popular collectible and highlights the work of numismatists.

Bitcoin is a new form of money: the first instance of a cryptocurrency. Now over fifteen years old and a trillion-dollar asset class, Bitcoin has become popular enough that enthusiasts have assigned it a provenance and historical value. But how does one determine the historical value of a digital currency?

This brings us to Casey Radamor and his theory of Ordinals.

When a central bank issues currency, each note is assigned a serial number in the order in which it was printed. Similarly, the Ordinals theory is a conventional numbering system used to assign a serial number to each satoshi (sat) of Bitcoin, whether they already exist or are mined in the future. Lets see how it works.

Recall that the origin of each satoshi can be traced through the UTXO model. Satoshi are created as rewards when miners mine Bitcoin blocks and are numbered in the order in which they are mined.

For example, the first mined block, the genesis block, rewards the miner with 50 BTC. Since each bitcoin contains 100 million sats, the reward for the first block contains sats numbered 0 to 4,999,999,999. The second block contains sats numbered 5,000,000,000 to 9,999,999,999, and so on. Therefore, the last satoshi will be numbered 2,099,999,999,999,999.

Ordinals use a first-in, first-out (FIFO) system to track the numbering of sats between UTXOs. When a Bitcoin transaction consumes a UTXO, the sats are split into newly created UTXOs in the order they appear in the output.

For example, if the genesis block miner received a UTXO containing sats numbered 0 to 4,999,999,999, and they wanted to isolate a specific satoshi, such as the 21 millionth satoshi, they would construct a transaction structure like this:

Ordinals assign a unique number to each satoshi, thus making them somewhat non-interchangeable. I say “somewhat” because when making a Bitcoin payment, merchants generally don’t care about the specific satoshis that make up the payment, thus maintaining fungibility in that transaction scenario. However, for collectors like Kanwaljeet who are looking for a specific numbered satoshi, satoshis are very much non-interchangeable.

As the theory of Ordinals gained popularity, the emergence of BTC collectors — people who seek out rare Bitcoins — became inevitable (Wired magazine published an excellent article documenting their world). What is the definition of rare Bitcoin? It covers a range. Casey Radamor provides a framework for assessing rarity:

In reality, rarity is largely subjective, depending on what numbers are collectively considered valuable. Kanwaljit collects notes numbered 150847 because it represents the date of India’s independence. For currency collectors from other countries, the number may be completely irrelevant. Similarly, Bitcoin hunters prize Satoshis for a variety of reasons, from the obvious, like they were mined by Satoshi Nakamoto, to the more mysterious, like the Satoshi numbers forming a palindrome.

Rare satoshis are traded not only on Marktplatzs like Magic Eden and Magisat, which provide users with charts and guides to help them accurately assess the value of the satoshis they are purchasing, but also at traditional auction houses like Sotheby’s, where a rare satoshi can sell for more than $150,000 .

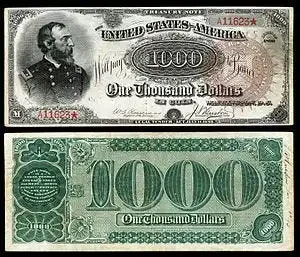

Recently, Bitcoin mining pool viaBTC auctioned an epic satoshi (the first satoshi from the most recent halving) for 33.3 Bitcoins, equivalent to over $2 million. This amount compares favorably with the most expensive fiat currency note sale ever, a rare $1,000 Treasury note issued in 1890 that sold for over $3 million at auction in 2014.

Remarkably, the “Watermelon” note, so named because of the shape and color of the back, is still valid legal tender today!

In addition to creating a class of digital currency collectors, the Ordinal Theory, by assigning a number to each satoshi, also opens up the next step in Casey Radamors plan: introducing digital relics into Bitcoin.

Inscription

The release of the Taproot upgrade in 2021 coincides with a major wave in the crypto industry: the rise of NFTs (non-fungible tokens). In 2021, over $25 billion in NFTs were traded, with the majority of that trading happening on Ethereum. Pixel art, monkey pictures, sports moments, photos, music, sneakers, coffee coupons, even simple English words — there’s an NFT for just about everything. This movement marks the biggest intersection of crypto with mainstream media and brands, and has attracted more new people to crypto than any other use case to date.

Now, a lot has been written and discussed about the debate over whether NFTs, or even digital art as a category, are inherently valuable, so we won’t go into that. What’s important is that at least a portion of the Bitcoin community, including Casey, saw what was happening on other chains, especially Ethereum, and decided to bring it to Bitcoin as well.

If Bitcoin is going to have a standard for NFTs, Casey wants it to be “free from the lingering legacy of its predecessors.” His solution: inscriptions. From Casey’s blog post on inscriptions:

Inscriptions are digital artifacts, digital artifacts are NFTs, but not all NFTs are digital artifacts. Digital artifacts are NFTs that are required to be close to their ideal standards. To be a digital artifact, an NFT must be decentralized, immutable, on-chain, and unlimited. The vast majority of NFTs are not digital artifacts. Their content is stored off-chain and can be lost, they exist on centralized chains, and have backdoor administrator keys. Worse, because they are smart contracts, they must be audited one by one to determine their properties.

Inscriptions do not suffer from these flaws. Inscriptions are immutable and on the oldest, most decentralized, and most secure blockchain in Bitcoin. They are not smart contracts and do not need to be audited one by one to determine their properties. They are true digital artifacts.

Heres how they work.

Inscriptions inscribe data onto individual satoshis, which are then tracked by the Ordinal Theory. To tag a specific satoshi with certain data, developers must create a transaction that isolates that satoshi and places it in the first output of a Bitcoin transaction. The data itself is stored in the transaction witness (an upgrade introduced by SegWit) and in the script path appended script introduced by the Taproot upgrade.

Since the inscriptions are engraved on the satoshis, they can be moved, traded, bought or sold through simple Bitcoin transactions. However, like previous token standards, they require a wallet that recognizes the protocol and structures transactions accordingly. In other words, you dont want your wallet to accidentally send an inscribed satoshi as part of a normal transaction.

Each inscription is also assigned an index number that is numbered in the order in which it was created. Thus, we know that over 70 million inscriptions have been created to date. Furthermore, while you can create collections of inscriptions (just as you can on Ethereum), each inscription in the collection requires a separate transaction to create (and therefore a fee). These properties eliminate what Casey sees as a weakness for NFTs on smart contract blockchains like Ethereum.

What can be stored in the inscription? Almost any content format supported by the web, including PNG, JPEG, GIF, MPEG, and PDF files. It also supports HTML and SVG files that can be executed in a sandboxed environment (they cannot interact with external code). In addition, inscriptions can be linked to each other, so content from other inscriptions can be remixed. While most users choose to simply inscribe a Satoshi into a JPEG, some enterprising people have experimented with inscriptions like full video games.

Some developers realized that this flexibility in content could be used to create further token standards for Bitcoin.

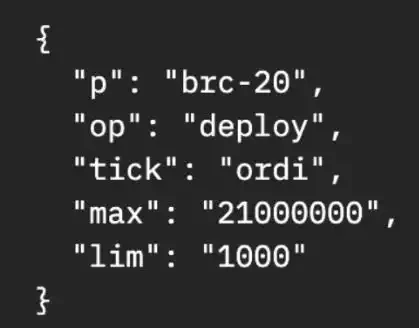

The most notable of these experiments is the BRC-20 protocol created by domodata. While Inscriptions were originally conceived as a way to introduce non-fungible tokens to Bitcoin, the BRC-20 standard (a play on words for Ethereum’s ERC-20 token standard) uses them to create a standard for fungible tokens on Bitcoin.

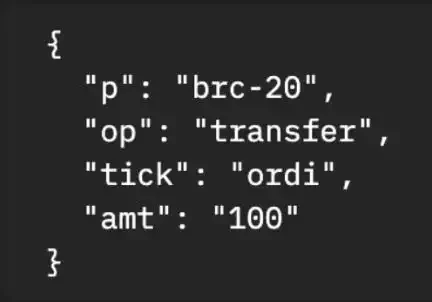

The mechanism itself is very simple: deploy, mint, and transfer exchangeable tokens on satoshis using JSON data blocks. For example, this is what the inscription to deploy ORDI (the first BRC-20 token) looks like:

This inscription defines the parameters of the ORDI token, designating it as a BRC-20 token, setting a maximum supply of 21 million units at deployment, and limiting each minting transaction to 1,000 units. By inscribing such JSON data onto Satoshis, developers can create, manage, and transfer fungible tokens directly on the Bitcoin blockchain.

Similarly, BRC-20 tokens can be transferred by creating a new inscription containing the following data:

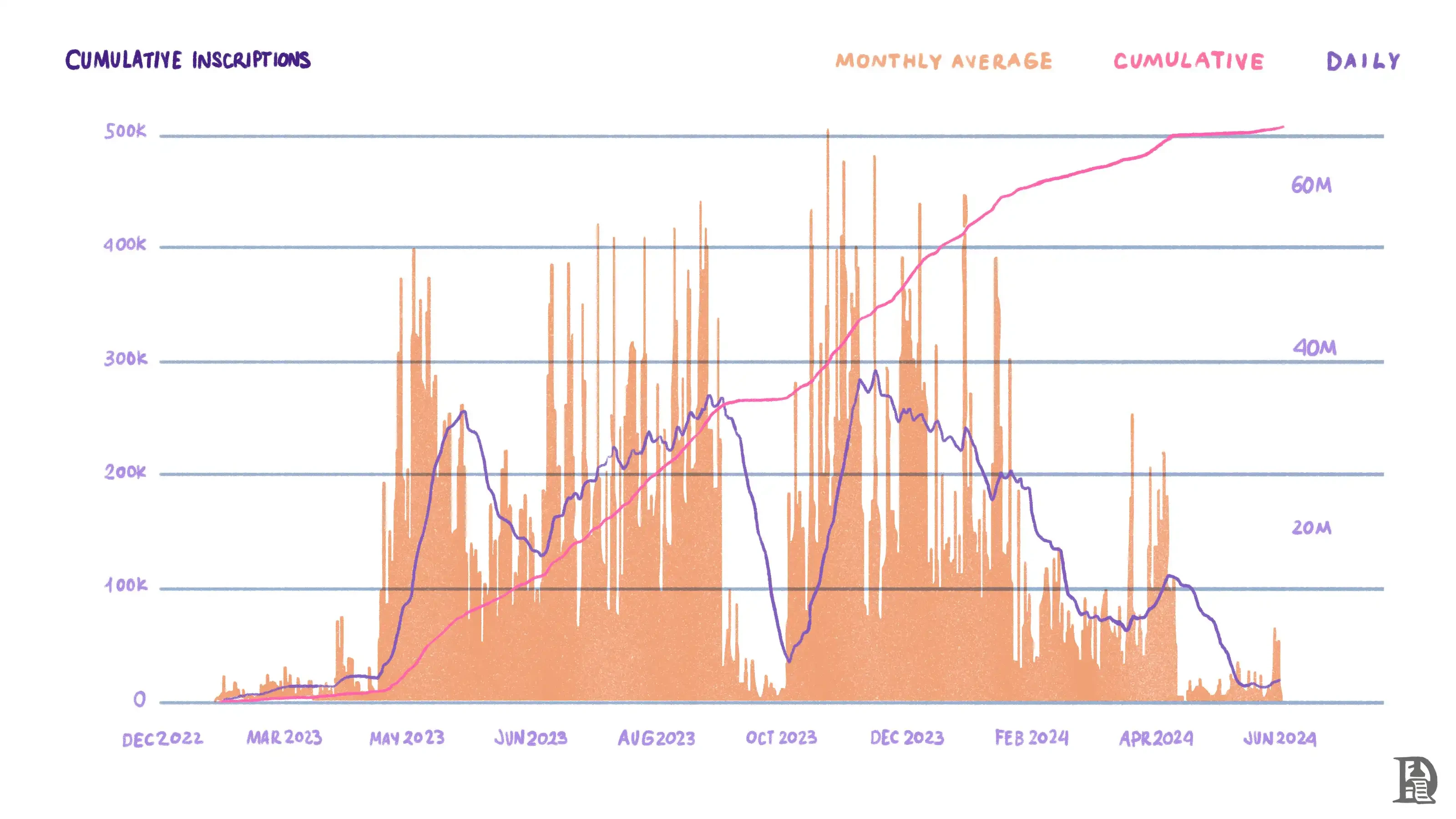

Inscription and the underlying BRC-20 protocol built on top of it have collectively driven a massive wave of attention, capital, and activity into the Bitcoin blockchain. Multiple meaningful on-chain metrics have risen dramatically, including miner fees, the percentage of full blocks (defined as blocks that completely fill the 4MB limit), the size of the mempool, the adoption rate of the Taproot upgrade, and the number of pending transactions in the mempool.

Number of inscriptions over time (source)

This surge in activity means that Inscriptions can be considered the first token standard to be meaningfully adopted on Bitcoin. Top Ordinals (another name for Inscription Collections) still maintain a strong base price several months after their launch. These include NodeMonkes (0.244 BTC), Bitcoin Puppets (0.169 BTC), and Quantum Cats (0.306 BTC). The first BRC-20 token, ORDI, has a market cap of over $1 billion and is listed on top exchanges such as Binance.

Why did Inscription succeed while Colored Coins, Counterparty, and other experiments failed? I think there are two reasons.

First, inscriptions were introduced after the Segwit and Taproot upgrades, which means that inscriptions benefit from a more mature Bitcoin protocol. Larger block sizes, lower fees, and greater data flexibility allow inscriptions to avoid the complex and circuitous implementation routes of their predecessors.

Second, the timing was perfect. The creation of Inscription coincided with the 2021 cycle, and almost anyone who follows internet trends has heard of NFTs. Crypto traders are already used to trading them. Even ORDI, launched at the bottom of the bear market, benefited from perfect timing. Just a few weeks before its launch, the memecoin PEPE on Ethereum set off a short-lived memecoin frenzy in a dry market, and ORDI took advantage of this opportunity to achieve market capitalization.

Runen

Finally, all this background brings us to our destination: runes.

In addition to BRC-20, a host of other protocols have attempted to leverage Inscription to bring fungible tokens to Bitcoin. This has created a fragmented token landscape, with each implementation having its pros and cons. The opportunity is there to create an excellent fungible standard like Inscription did for non-fungible tokens.

And it got caught! Casey Radamor has stepped in again, this time with the Rune Protocol (Rune for short), which aims to become the de facto fungible standard for Bitcoin tokens. His motivation is simple: “Bitcoin deserves a decent token standard.”

So how does Rune differ from other standards like BRC-20? A few weeks ago, my colleague Saurabh wrote an excellent article explaining Rune in detail and how it improves upon it. For a deeper dive, read his article.

Here are the key points.

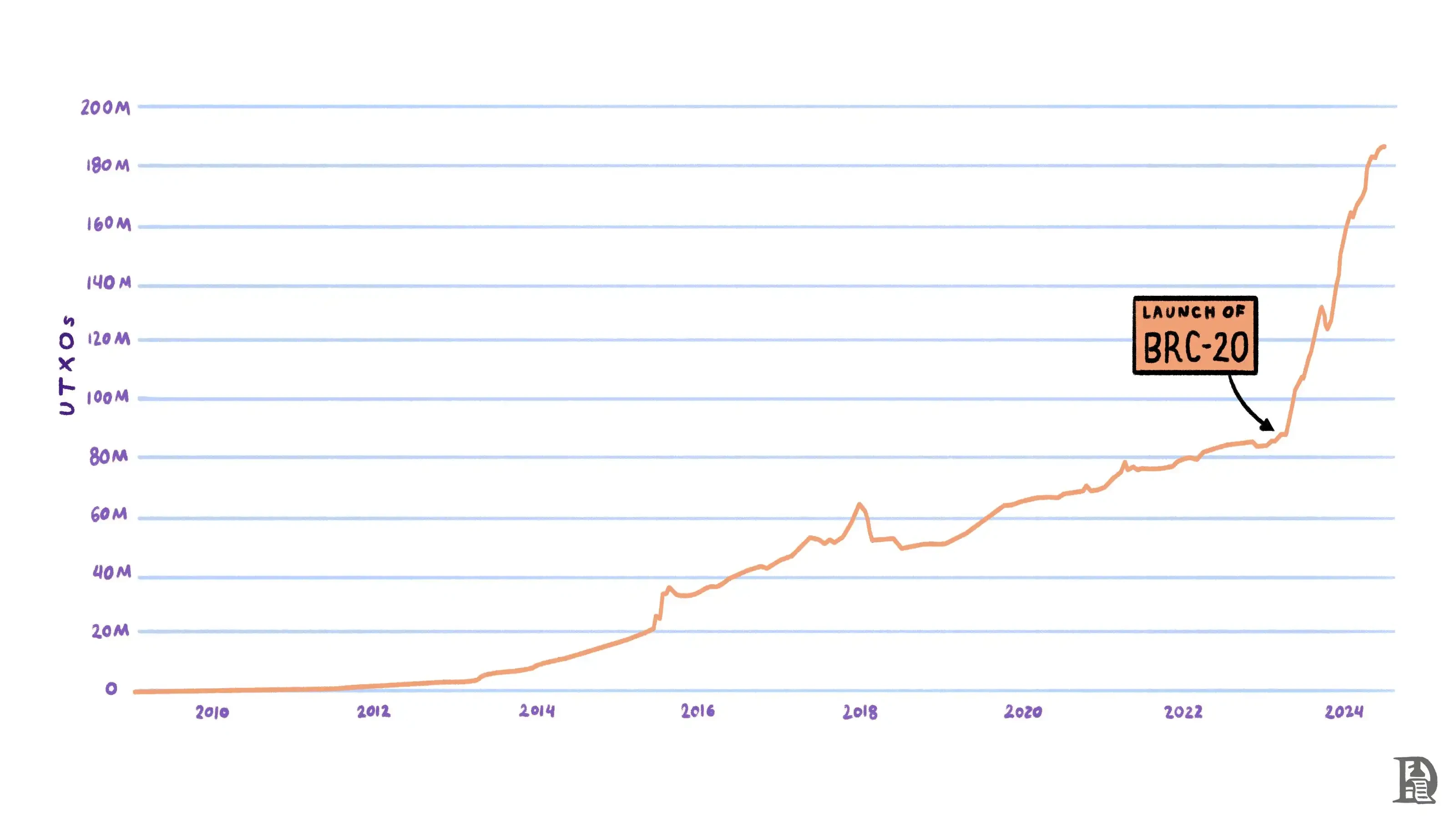

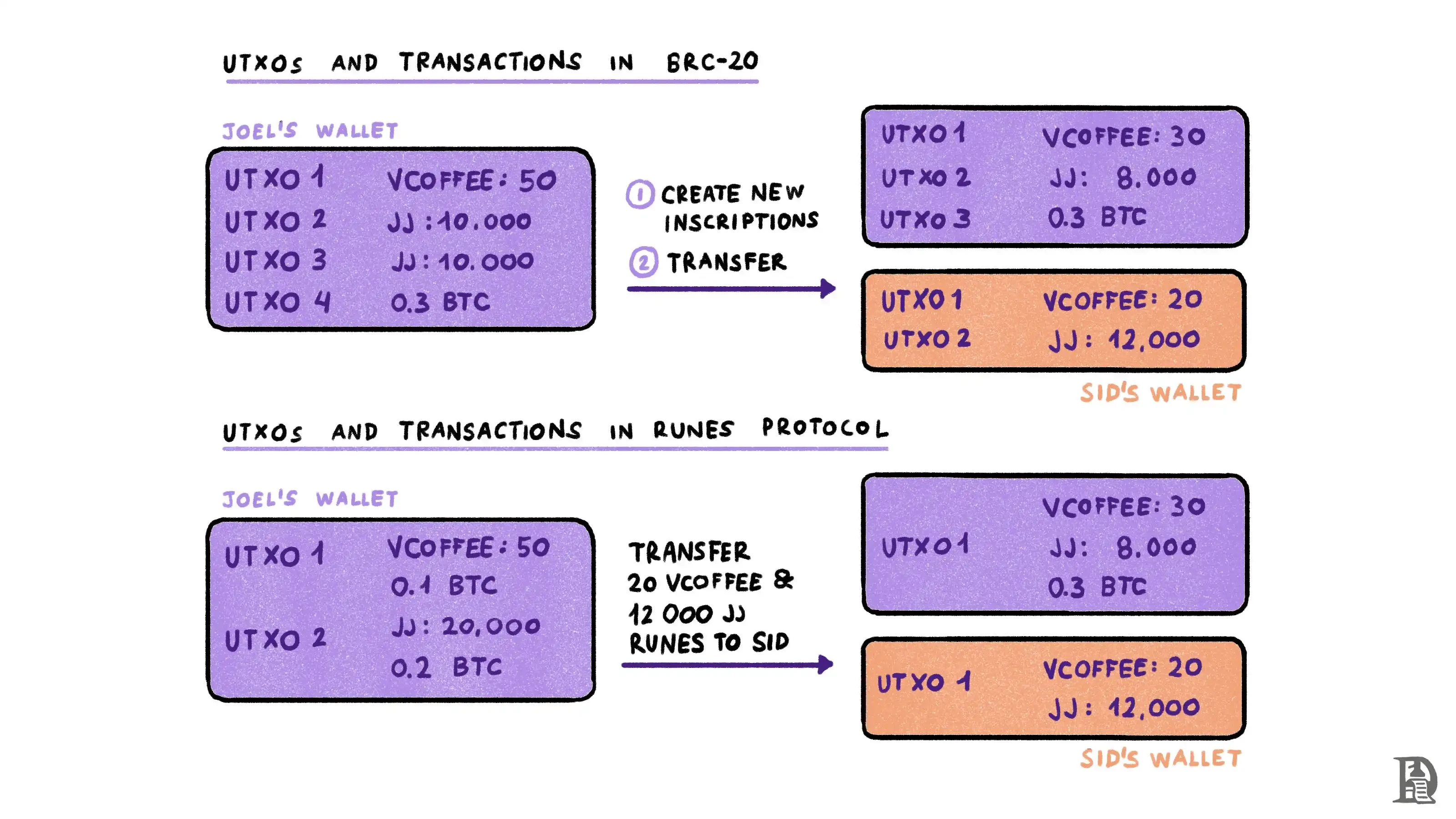

Recall that a BRC-20 token creates a new inscription every time it is deployed, minted, or transferred. In addition, each token is stored in a separate UTXO. The protocol does not specify how to include multiple tokens in a single UTXO. This leads to UTXO bloat, in other words, UTXO expansion.

UTXO quantity over time (source)

Runes simplifies this process. First, instead of using inscriptions, it stores data in the OP_RETURN field. Second, it allows users to hold multiple tokens, including Bitcoin, in the same UTXO, which makes transfers more efficient and reduces UTXO bloat. Third, it is compatible with the Lightning Network, Bitcoins scaling solution. (Remember that surge in OP_RETURN transactions we saw earlier? Now you know what caused this.)

The launch of Runes was timed to coincide with the latest Bitcoin halving event, and came with considerable hype. While Ordinals had already proven successful (albeit with a slow start), and during a bear market, Runes launched as the price of Bitcoin more than tripled.

Given the hype, many (including me!) felt that the aftermath was less than promising, at least according to the consensus on Crypto Twitter (CT). It was not uncommon to hear comments such as “runes failed” or “runes is dead.”

However, data on the blockchain paints a very different picture.

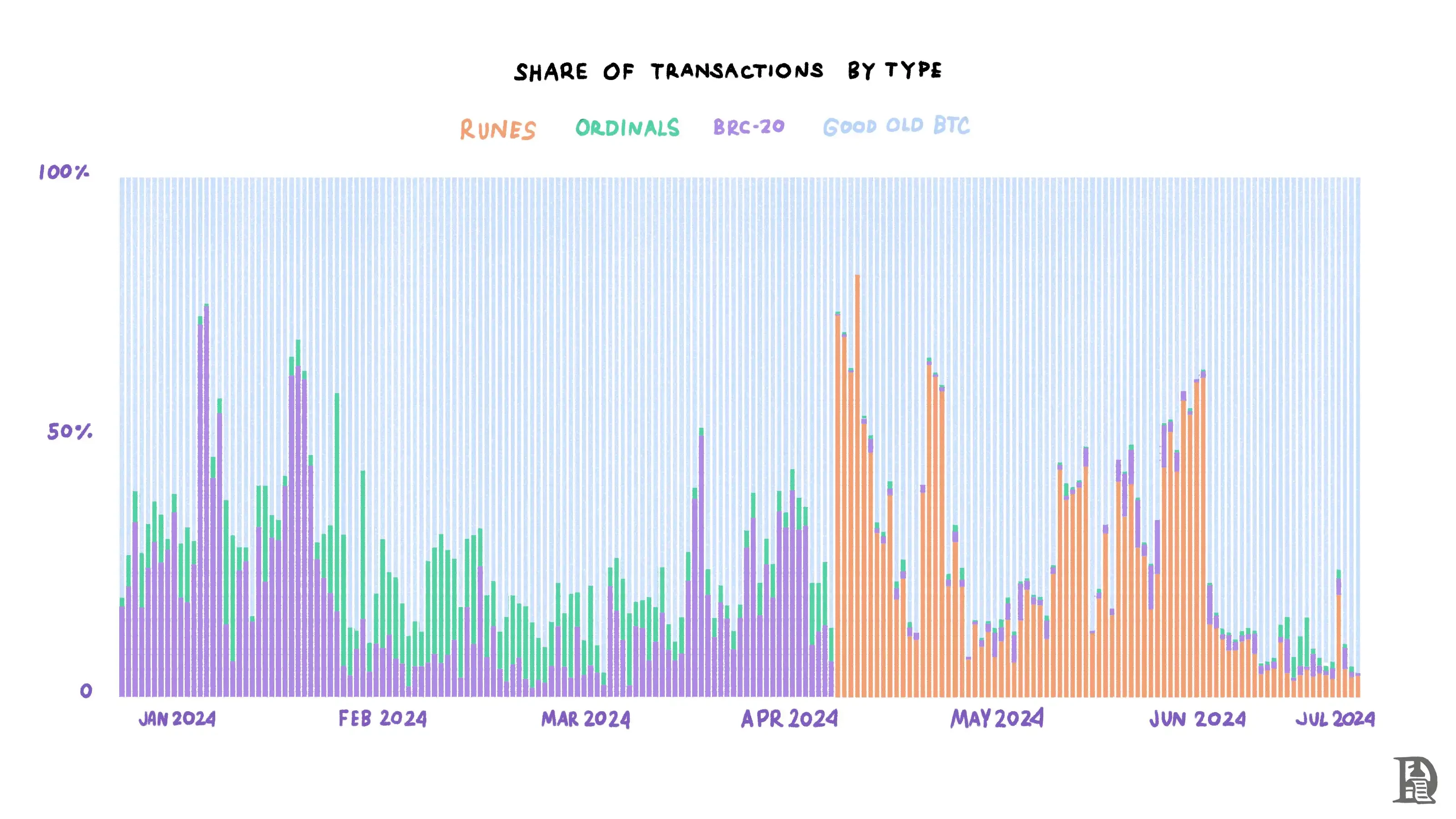

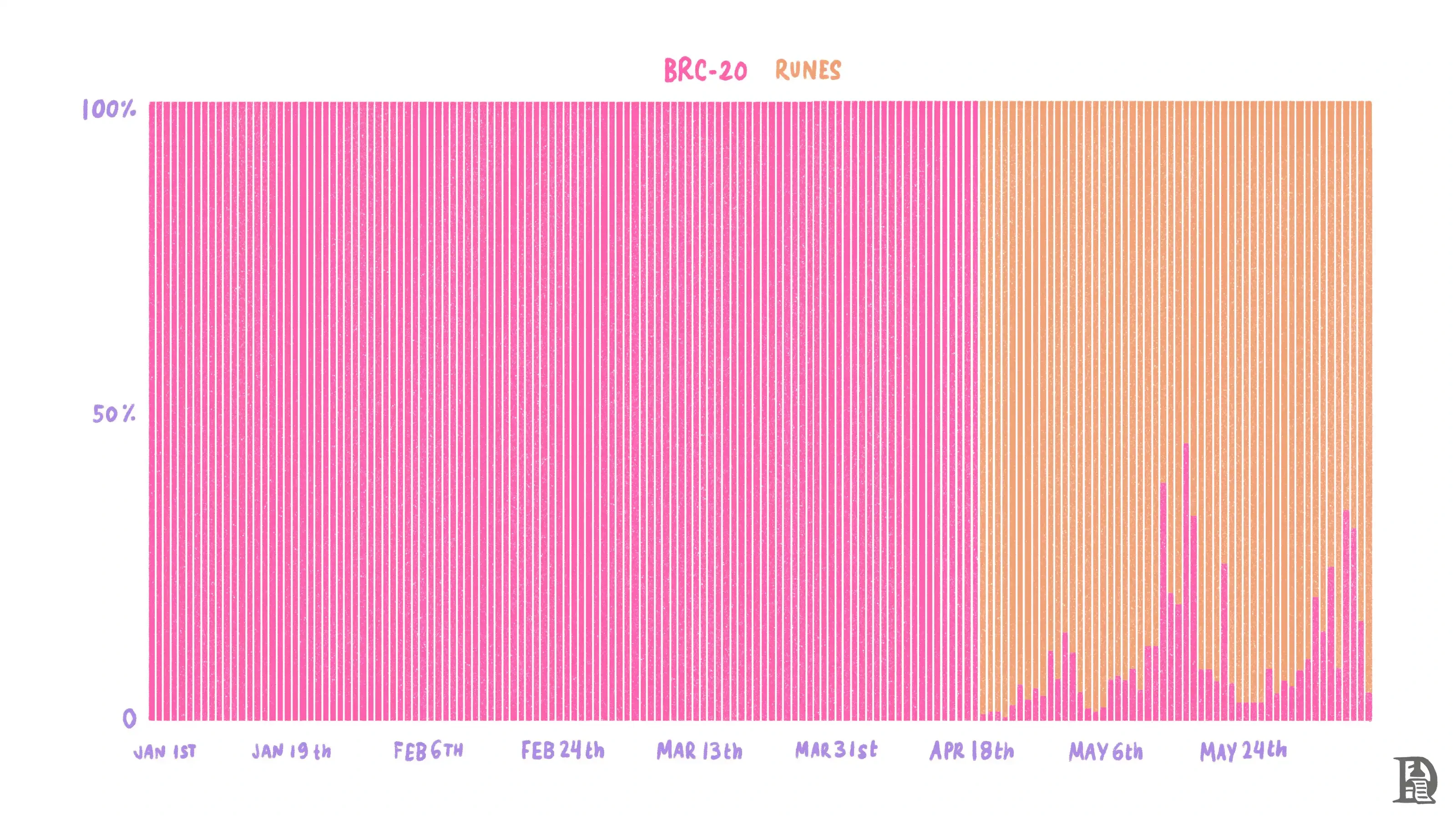

Source: @cryptokoryos on Dune

Source: @cryptokoryos on Dune

Runes dominates non-payment Bitcoin activity. On most days since its launch, its trading volume exceeds that of ordinarys and BRC-20 combined, and it seems to have replaced the latter as the most popular interchangeable token standard on Bitcoin. This is also reflected in the market capitalization of Runes, which has surpassed BRC-20. Despite this, it has not yet been listed on any major centralized exchange.

We are still early in the Runes journey. Without the presence of centralized exchanges, Runes (and other fungible tokens) are still traded on a slow order book system. Trading is slow due to Bitcoin’s 10-minute block time, which limits high-frequency trading. Given the lack of decentralized exchanges on Bitcoin, it is also not currently possible to directly exchange one Rune for another (it must first be settled into BTC). Additionally, the user experience is still complicated. As with previous token standards, holding and trading Runes requires a special wallet.

These challenges have hampered its wider adoption.

Some parting thoughtsOne of the reasons Bitcoin is valuable is that it is the first purely digital currency that is fully backed by code and uninfluenced by centralized actors or power brokers. However, it is striking to what extent innovation around token standards built on top of Bitcoin relies on social consensus.

Runes or ordinals, for example, are not part of the Bitcoin protocol. They are, as Casey likes to call it, an opt-in perspective on Bitcoin. You can think of them as conventions that exist because of social coordination. Yet, they are worth billions of dollars because enough people agree on them socially.

Yes, Runes are a vastly improved fungible token standard compared to its predecessor. However, a big reason for its widespread adoption is the support of Casey Radamor and the social capital he has built over the years. This also explains why people readily accept unorthodox rules like the initial limit of 13 characters for Rune names.

We also believe that NFTs on Bitcoin have found product-market fit. Because NFTs have relatively low liquidity and low transaction frequency, Bitcoin’s 10-minute block time does not pose a barrier to their existence. Furthermore, given that Bitcoin block space is the most valuable block space in the industry and inscriptions reside entirely on-chain, the appeal of owning digital art in this new medium will continue to exist.

I looked at the top 10 NFTs and tokens on Ethereum and Bitcoin. The full analysis is Hier

Fungible tokens, on the other hand, are severely limited by Bitcoin’s slow block times and lack of an automated market maker. Despite this, their market cap has surpassed ordinarys. The top ten ERC 20 tokens on Ethereum have a market cap 64x higher than the top ten NFT collections. For Bitcoin, that ratio is still only 7.7x. Once we find ways to make them trade more efficiently, the potential upside could be huge. What might those methods look like? Perhaps Bitcoin’s Layer 2 solutions can provide the answer.

But that’s another story.

This article is sourced from the internet: From its birth to Runes, a 10,000-word review of the history of Bitcoin

Related: Metrics Ventures Alpha: In the fiercely competitive Solana LSD track, can Jito stand out?

Jito Network is the first protocol in the Solana ecosystem that combines MEV and liquidity staking businesses, and uses MEV income as a staking reward, which increases the protocol staking income. The figure below is a high-level abstract of the Solana fund flow in the Jito protocol. Jito occupies an absolute leading position in both the MEV and liquidity staking businesses of the Solana ecosystem, and with the substantial growth of the Solana ecosystem in this round of the market, the two businesses of MEV and liquidity staking have also achieved rapid growth. This research report will analyze Jitos technical principles and business progress from the two aspects of MEV and liquidity staking, as well as possible growth points and investment points for Jitos future business. 1 MEV Leader: Reshaping…