Bitget Research Institute: CPI-Daten führten zu einem Rückgang des US-Aktienmarktes und trieben den allgemeinen Rückgang der Kryptowährung voran

In den letzten 24 Stunden sind viele neue heiße Währungen und Themen auf dem Markt erschienen, und es ist sehr wahrscheinlich, dass sie die nächste Gelegenheit darstellen, Geld zu verdienen.

The annual rate of the unadjusted core CPI in June was 3.3%, lower than the market expectation of 3.4%, and fell to the lowest level since April 2021. As a related risk asset, Bitcoin fell due to the negative impact of U.S. stocks.

-

The sectors with relatively strong wealth-creating effects are: Solana Meme, ETH ecology;

-

Hot searched tokens and topics by users are: Nillion Network, Bitcoin;

-

Potential airdrop opportunities include: Espresso, Mezo;

Data statistics time: July 12, 2024 4: 00 (UTC + 0)

1. Marktumfeld

The annual rate of the unadjusted core CPI in June was 3.3%, lower than the market expectation of 3.4%, and fell to the lowest level since April 2021. US technology stocks fell sharply yesterday, Nvidia closed down 5.57%, Tesla fell 8.44%, Meta fell more than 4%, Apple, Microsoft, Google and Amazon fell more than 2% respectively. Mainly due to the implementation of the expectation of interest rate cuts, the interest rates in the bond market will fall in the future, and prices will rise. Institutions began to withdraw from the overbought stock market and buy bonds instead. As a related risk asset, Bitcoin fell due to the negative impact of US stocks.

In the trading market, according to Arkham monitoring, in the past 24 hours, the German government wallet transferred out 10,627 bitcoins, and then recovered 4169 bitcoins from CEX. It currently still holds 9094 bitcoins (about US$522.29 million). At present, the impact of the remaining selling pressure on the market has weakened.

2. Wohlstandsschaffender Sektor

1) Sector changes: Solana Meme (MOTHER, BODEN)

Hauptgrund:

-

DWFLabs announced its latest strategic partnership with Iggy Azalea, dedicated to supporting innovative projects in the Web3 space.

-

US President Biden said at a press conference that he would not withdraw from the election.

Rising situation: MOTHER and BODEN rose by 10.8% and 21.32% respectively within 24 hours;

Faktoren, die die Marktaussichten beeinflussen:

-

SOL token trend: In the Solana ecosystem, the trend of SOL tokens will affect the price of the entire ecosystem token, because many tokens on DEX are priced in SOL. Continue to pay attention to the price trend of SOL. If SOL maintains an upward trend, you can continue to hold SOL ecosystem assets.

-

Increase or decrease in open interest: SOLs open interest rose yesterday, indicating an influx of hot money. Use the contract data on the tv.coinglass website to understand the movement of the main funds. First, look at the increase in net long positions on the contract; then look at whether the contract data shows a net increase in long positions, an increase in OI, and an increase in trading volume. If so, it means that the main force continues to buy up and can continue to hold.

2) Sectors that need to be focused on in the future: ETH ecosystem (ENS, ETHFI)

Hauptgrund:

-

Etherfis second season airdrop has been launched. Please check the website. The third season will last from July 1 to September 14, and 25 million ETHFI will be distributed.

-

Bloomberg ETF analyst Eric Balchunas predicts that the US SEC may approve the spot Ethereum ETF on July 18.

Faktoren, die die Marktaussichten beeinflussen:

-

The news about ETH spot ETF will directly affect the price of ETH and the trend of well-known projects in the ETH ecosystem. In addition, after the SEC announced that it believes that Lido and Rocket Pool staking projects are securities, whether it will further include SSV and other projects in the scope of securities considerations will also have a significant impact on the projects in this track.

3. Beliebte Suchanfragen von Benutzern

1) Beliebte Dapps

-

Nillion Network

Nillion, a decentralized public network based on Nil Message Compute (NMC), announced that it has launched the second phase of Catalyst Convergence. This phase includes: supporting developers to build and deploy Blind applications on the network; using NIL tokens from its Faucet to promote projects; interacting directly with the test network and accessing SDK functions; using Petnet for secure storage and computing; using Blind computing to manage and process sensitive data; and deploying the Nada AI software package.

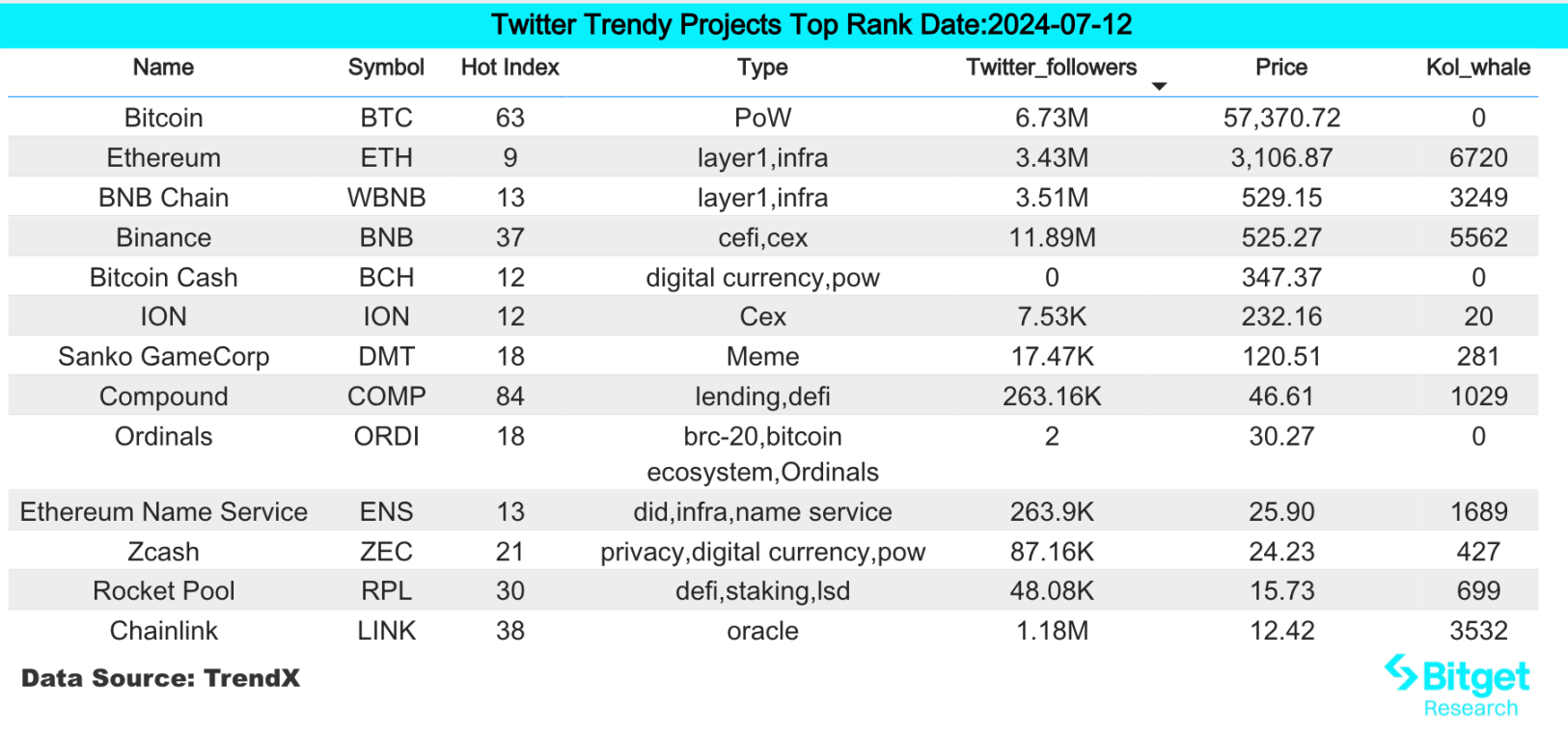

2) Twitter

Bitcoin:

Affected by yesterdays CPI data, BTC has a certain decline in the past 24 hours. Todays Fear and Greed Index is 25, and the level has changed from fear to extreme panic.

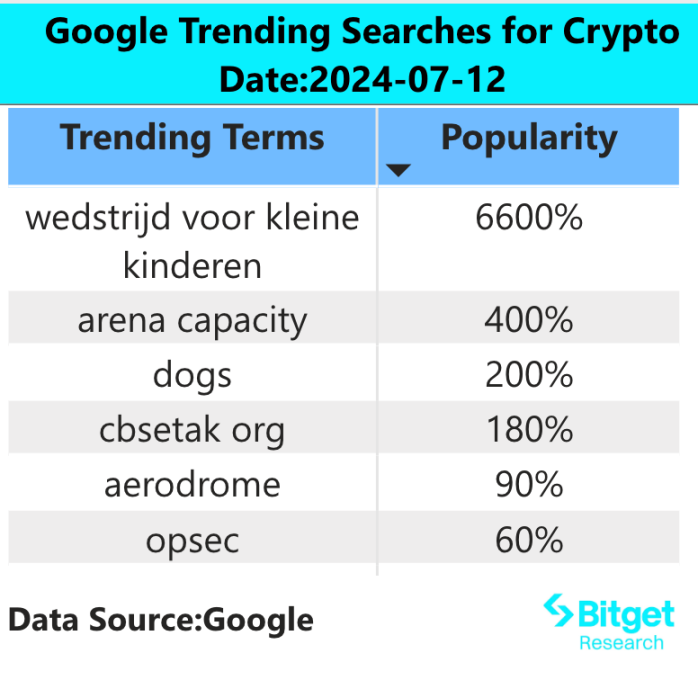

3) Google-Suchregion

Aus globaler Sicht:

Aerodrome:

Since the Base-based DEX Aerodrome announced that Coinbase Ventures acquired AERO tokens in the secondary market, it was found that the Coinbase Ventures address has purchased at least 4.7 million AERO (about $2.7 million). In addition, TradingVaults used by Coinbase Ventures also holds 1.5 million AERO (about $936,000). The last batch of purchases was completed 8 days ago, and all acquired tokens are locked in the Aerodrome ecosystem.

Aus den beliebtesten Suchanfragen in jeder Region:

(1) There are no obvious characteristics in the Google Trends hot searches of Asian countries. BTC has become the focus of market attention. In addition, the Ton ecological game project hamster kombat is on the list, and the market is paying attention to the airdrop opportunities of this project.

(2) There are no obvious characteristics in the hot searches in European and American countries. Coinbase, Crypto AI and other hot topics are on the list. There is no consensus on the tracks and projects that are being paid attention to. Bitget has become the CEX that British users are paying attention to.

Potenzial Luftabwurf Gelegenheiten

Espresso

Espresso is a shared sorter market project that uses ZK-Rollups. The project mainly solves the consensus and interoperability between various Layer 2s. The core of Espressos strategy is to focus on privacy and decentralization, and the core members of the project are members of the Applied Cryptography Research Group at Stanford University.

The project recently announced the completion of a USD 28 million Series B financing, led by A16Z, with participation from Polychain, Coinbase Ventrues Sequioia, Sequioia, etc., making for a luxurious financing lineup.

Specific participation method: The project is currently in its early stages. Users can participate in the early project by participating in the verification node, and may obtain early airdrop qualities. For specific implementation, please refer to the official document: https://docs.espressosys.com/sequencer/guides/running-a-sequencer-node

Mezo

Mezo ist ein BTC Layer 2-Projekt, das sich auf das BTC-Ökosystem konzentriert, BTC-Inhabern hilft, Geld in der Kette zu übertragen und zu verwalten, und die Entwicklung des BTC-DeFi-Systems vorantreibt. Mezo gab kürzlich den Abschluss einer Finanzierungsrunde in Höhe von $21 Millionen bekannt, an der Institutionen wie Pantera Capital, Hack VC, Multicoin Capital und andere führende Institutionen der Branche beteiligt waren.

Der Beamte hat bereits seinen BTC-Verpfändungsplan bekannt gegeben und einen Überweisungsmechanismus eingeführt. Es bestehen große Erwartungen an die Airdrops des Projekts und es befindet sich derzeit in der Anfangsphase der ersten Operationen.

Spezifische Teilnahmemethoden: 1) Besuchen Sie die offizielle Website des Projekts und finden Sie den Einladungscode in Discord. 2) Geben Sie den Einladungscode ein und verknüpfen Sie die Unisat-Brieftasche. 3) Zahlen Sie BTC ein.

Weitere Informationen zum Bitget Research Institute: https://www.bitget.fit/zh-CN/research

Das Bitget Research Institute konzentriert sich auf On-Chain-Daten und das Mining wertvoller Vermögenswerte. Es fördert hochmoderne Wertinvestitionen durch Echtzeitüberwachung von On-Chain-Daten und regionalen Hot Searches und bietet Krypto-Enthusiasten Einblicke auf institutioneller Ebene. Bisher hat es Bitgets-Benutzern weltweit wertvolle Vermögenswerte im Frühstadium in mehreren beliebten Sektoren wie [Arbitrum Ecosystem], [AI Ecosystem] und [SHIB Ecosystem] zur Verfügung gestellt. Durch eingehende datengesteuerte Forschung schafft es einen besseren Vermögenseffekt für Bitgets-Benutzer weltweit.

Haftungsausschluss: Der Markt ist riskant, seien Sie also beim Investieren vorsichtig. Dieser Artikel stellt keine Anlageberatung dar und Benutzer sollten prüfen, ob die Meinungen, Ansichten oder Schlussfolgerungen in diesem Artikel für ihre spezifischen Umstände geeignet sind. Das Investieren auf der Grundlage dieser Informationen erfolgt auf eigenes Risiko.

This article is sourced from the internet: Bitget Research Institute: CPI data caused the US stock market to pull back, driving the overall decline in the crypto market

In the cryptocurrency market, data has always been an important tool for people to make trading decisions. How can we clear the fog of data and discover effective data to optimize trading decisions? This is a topic that the market continues to pay attention to. This time, OKX specially planned the Insight Data column, and jointly with mainstream data platforms such as CoinGlass and AICoin, starting from common user needs, hoping to dig out a more systematic data methodology for market reference and learning. The following is the second issue, in which the OKX Strategy Team and CoinGlass Research Institute jointly discussed the data dimensions that need to be referenced in different trading scenarios. It involves topics such as capturing trading opportunities and how to cultivate scientific trading thinking. We…