US-Verbraucherpreisindex-Daten deuten auf eine weitere Abkühlung der Inflation hin. Ist eine Zinssenkung im September so gut wie beschlossene Sache?

Originalautorin: Mary Liu, BitpushNews

Thursdays much-anticipated U.S. Consumer Price Index (CPI) report came in better than expected, with inflation falling to its lowest level in more than three years in June. The CPI rose 3% year-over-year, beating expectations for 3.1%, while the core CPI fell to 3.3% year-over-year, below expectations for 3.4%.

The CPI data suggests that inflation is continuing to cool, which has strengthened investors confidence in betting that the Federal Reserve will cut interest rates later this year. CME Fed Watch data shows that a rate cut in September is almost a done deal, with the data showing that the probability of the Federal Reserve cutting interest rates by 25 basis points in September is 84.6%, and the probability of a cumulative rate cut of 50 basis points is 8.1%.

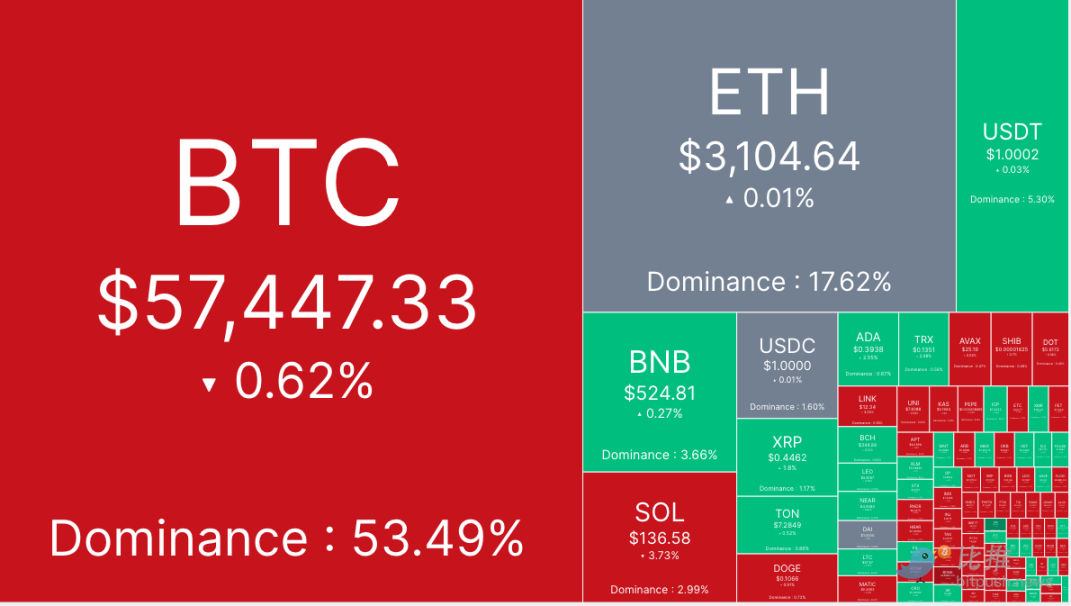

BTC has experienced a roller coaster ride. According to Bitpush data, after the release of the CPI, Bitcoin hit a high of around $59,540, then experienced a large sell-off and fell to a low of $57,200 in the afternoon. As of press time, the trading price was $57,447, a 24-hour drop of 0.5%.

The altcoin market was mixed, with the top 200 altcoins seeing mixed gains and losses. MANTRA (OM) was the best performer, up 12.5%, followed by Galxe (GAL) up 9.4%, and Stacks (STX) up 7.4%. BinaryX (BNX) was the biggest loser, down 27.5%, while Bonk (BONK) fell 8.2%, and Render (RNDR) fell 6.9%.

The current overall market value of cryptocurrencies is $2.13 trillion, with Bitcoin accounting for 53.49%.

In the U.S. stock market, large technology stocks such as Nvidia (NVDA), Microsoft (MSFT) and Meta (META) all fell, while Tesla (TSLA) ended its 11-day winning streak with a drop of more than 7.5%. As of the close of the day, the SP and Nasdaq indexes fell 0.88% and 1.95% respectively, while the Dow Jones rose 0.08%.

German governments $3 billion selling spree is coming to an end

Arkham Intelligences blockchain data showed that Bitcoin wallets associated with the German government transferred a total of 10,567 BTC worth more than $600 million to cryptocurrency exchanges Bitstamp, Coinbase, Kraken, and other service providers such as Flow Traders and Cumberland DRW in batches that day.

After today’s transaction, wallets associated with German authorities hold just 4,925 BTC, worth $285 million at current prices, which is just 9.9% of the Bitcoin originally seized from Movie 2k.

This means that at the current pace, the German Bitcoin sell-off could end as early as Friday or early next week, as the wallet has sold around 35,000 Bitcoins so far this week.

This could help ease concerns in the market, where traders have been focusing on on-chain movements of potential large sellers in the market over the past few weeks, linking the recent decline to selling pressure.

JPMorgan Chase: Expects market rebound to begin in August

Although Bitcoin has struggled to gain momentum due to a number of factors, most analysts, including JPMorgan, believe that the outlook will turn around.

According to a research note released by JPMorgan, liquidations in crypto markets should begin to subside in July, with markets expected to rebound from August.

Despite the expected improvement in market sentiment, the bank lowered its year-to-date net cryptocurrency flow forecast from $12 billion to $8 billion, saying it doubts the previously estimated $12 billion level can be sustained for the rest of the year given Bitcoin’s high price relative to its production costs.

“The expected decrease in net flows is mainly due to the decline in Bitcoin reserves at exchanges over the past month,” analysts led by Nikolaos Panigirtzoglou said.

Analysts highlighted the liquidation of Bitcoin by Mt. Gox creditors and the German government’s selling of Bitcoin as possible reasons for the decline in reserves.

Brian Dixon, CEO of Off the Chain Capital, said in a report: In my opinion, the decline in Bitcoin prices over the past week is due to the German government selling Bitcoin from previously seized illegal transactions. Their government has transferred thousands of Bitcoins to exchanges and market makers for sale.

He added: “I think it is a mistake for the German government to sell Bitcoin because it should hold Bitcoin in its treasury reserves, which will bring strategic geopolitical advantages to Germany as Bitcoin continues to appreciate in value.”

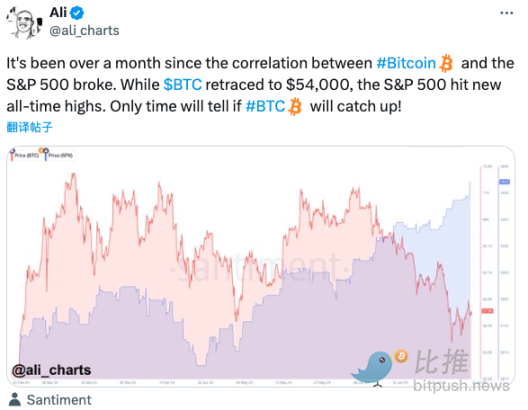

Historically, Bitcoin has been positively correlated with the SP; however, this correlation began to weaken in late May as U.S. stocks surged while Bitcoin struggled with sideways and declines. Ali Martinez, a market analyst at X Platform, said that this situation may soon change, and Bitcoin has the potential to quickly catch up through rapid price increases.

In a follow-up tweet, he noted: “The Bitcoin Accumulation Trend Score indicates a shift in investor sentiment, with many now choosing to accumulate BTC after a period of selling since April.”

According to Bitcoin Therapy author Arsen, the recent sideways price action is typical of a Bitcoin bull cycle, and he believes that BTC prices will reach around $300,000 before the current bull run ends.

He said in the article: When you are afraid, smart money is doubling down, and thats because this kind of decline is nothing new. As you can see, Bitcoin hits a record high every 4 years: 2012: Bitcoin rose from $12 to $1,000 = an increase of about 9,000%; 2016: Bitcoin rose from $650 to $19,000 = an increase of about 3,000%; 2020: Bitcoin rose from $8,000 to $69,000 = an increase of about 1,200%; 2024: ?

Arsen added: “Note that in each successive cycle, Bitcoin’s returns have fallen by about 60%, which means that the increase in this cycle could be 450%, or a price of about $330,000 per Bitcoin.”

This article is sourced from the internet: US CPI data suggests that inflation continues to cool, is a September rate cut almost a done deal?

Related: Bitget Research Institute: Bitcoin ETF funds continue to net outflow, zkSync coin airdrop

In the past 24 hours, many new popular currencies and topics have appeared in the market, which may be the next opportunity to make money, including: Sectors with strong wealth creation effects are: blue chip public chain sector, ETH ecological projects Hot search tokens and topics by users: UXLINK, ZKSYNC, IO.Net Potential airdrop opportunities include: Nile Exchange, Spark Data statistics time: June 12, 2024 4: 00 (UTC + 0) 1. Market environment Yesterday morning, Bitcoin fell to 66032 USDT, down more than 5.5% in 24 hours, and rebounded to 67500 USDT in early trading this morning. The daily volatility is high. In the past 24 hours, the entire network has been liquidated for $255 million, of which long orders have been liquidated for $236 million and short orders have been…