97% der Inhaber sind ratlos, Arbitrums ökologische Subventionsstrategie kann den Währungspreis möglicherweise nicht retten

Originalautorin: Nancy, PANews

Arbitrum is undoubtedly one of the Layer 2 “top students” with relatively strong data performance, but the continuous decline in the coin price is its “fatal flaw”, even though its circulating market value has doubled compared to the beginning of its launch.

Nearly $2.6 billion unlocked in 4 months, 97% of holders are at a loss

Compared with the initial market value of $1.02 billion at the time of launch, the current market value of Arbitrum token ARB has exceeded $2.3 billion, but holders are unable to escape the dilemma of continuous bleeding. According to IntoTheBlock data, Arbitrums price performance is weak, and currently as many as 97% of ARB holders are in a loss state, and only 3% of holders are flat at the current price, and almost no holders are profitable.

According to CoinGecko data, ARB hit a record high of $2.26 in January this year, up 67.4% from when it was launched in March 2023, but then ARB began to fall all the way and hit a record low recently, currently down 69% from its peak. However, its circulating market value has only dropped 30% from its peak. In contrast, the price of ARBs competitor OP has increased by 235% from its peak at the beginning of its launch, and its current price has fallen by more than 65.6% from its peak, while its circulating market value has fallen by 61.2% from its peak.

Arbitrum Market Cap

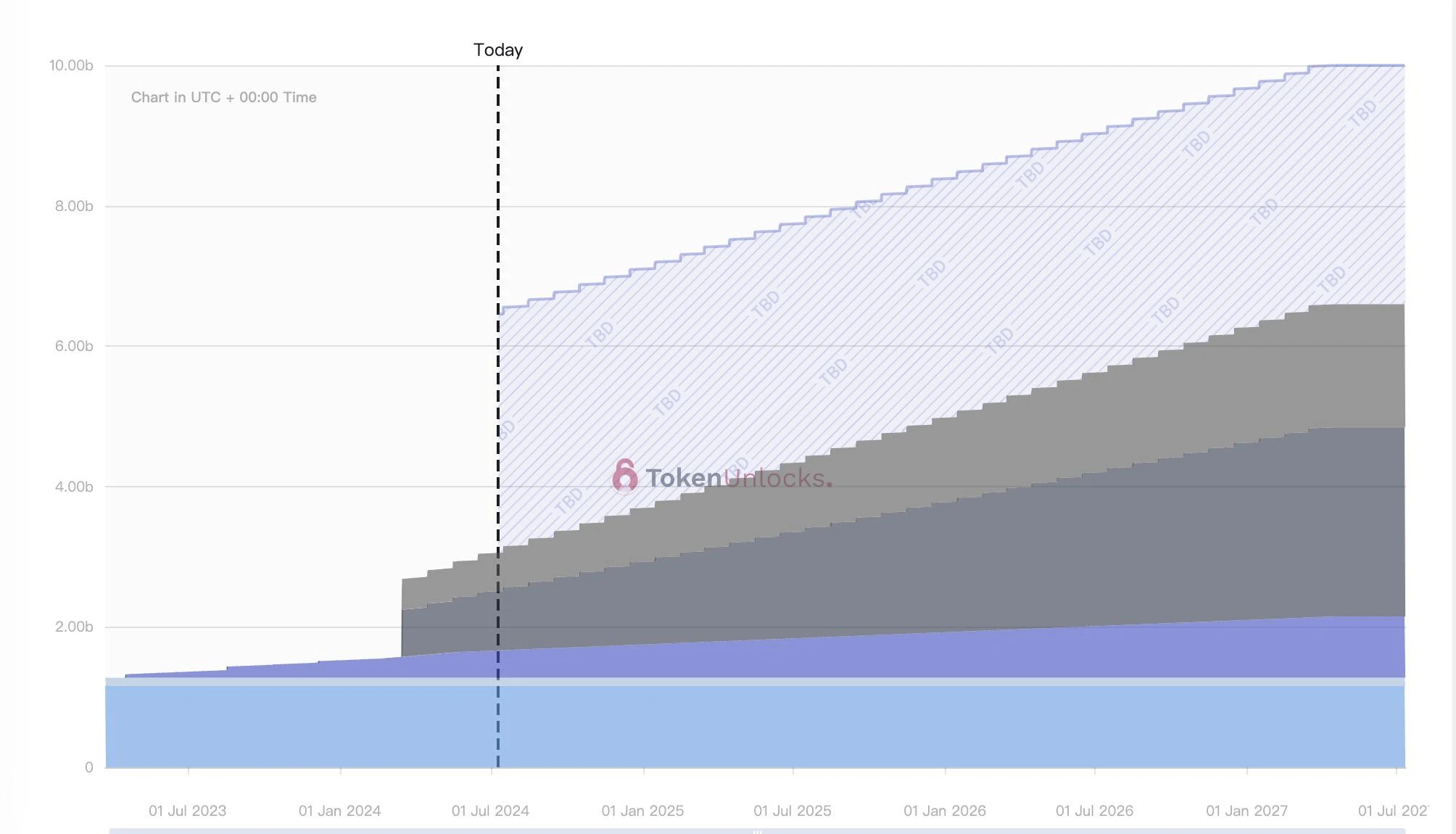

ARBs months-long decline is directly related to its large-scale token unlocking. Starting in March this year, the Arbitrum team and investors began to unlock a large number of ARB tokens. According to PANews statistics, from March to now, the Arbitrum team and investors have unlocked more than 1.38 billion ARBs, with a total value of more than 2.59 billion US dollars.

Arbitrum will also face more ARB unlocking on the 16th of each month, such as the unlocking of the new Arbitrum DAO Treasury starting in July, with a value of up to $2.41 billion, and an expected increase of about 400% by March 2027. According to Token Unlocks data, as of July 10, the unlocking progress of ARB is temporarily 31%.

If market liquidity continues to decline, Arbitrums continued massive unlocking will undoubtedly drive its token price down further. For example, crypto analysis platform DYOR recently said that given the current liquidity, if investment institutions sell 5% of the unlocked amount every month, the price of assets such as ARB may fall by 30% to 70%.

Many data still have leading advantages, and ecological subsidies may not be able to save the currency price

Although the coin price performance is not satisfactory, judging from the data, Arbitrum is still in the leading position among many L2s.

The latest data from Dune Analytics shows that as of July 10, the total number of Arbitrum accounts created exceeded 31.751 million, and the total number of transactions exceeded 800 million. The total locked-in TVB of Arbitrums on-chain bridge has exceeded 3 million ETH, and the total number of bridge addresses is about 737,000. And L2 BEAT data shows that Arbitrum One ranks first with a TVL of US$16.12 billion, accounting for 40.1% of the market; Growthepie data shows that the market value of Arbitrum stablecoins has exceeded US$4.07 billion, ranking first, with an annual increase of 116%, exceeding L2 such as Base, OP Mainnet and ZkSync Era; the number of active addresses has increased by 205% in the past 6 months, exceeding ZkSync, OP Mainnet, etc.

Arbitrums ecological data is undoubtedly subsidized by a lavish money-spending model.

Arbitrum has been playing the subsidy card to assist the development of its own ecosystem. For example, in the game sector, in June this year, Arbitrum approved a proposal of 225 million ARBs to fund game development on Arbitrum, aiming to make Arbitrum a leading blockchain in the game sector. These funds will be distributed within three years. In RWA, Arbitrum plans to allocate 35 million ARBs for the RWA development plan, aiming to achieve 1% of Arbitrums financial diversification each year through the growth of the RWA ecosystem, and has now received over 99% of the voting approval rate.

At the same time, Arbitrum is also throwing money around to sponsor projects, providing approximately US$10.6 million in grants to more than 50 projects in 2023 alone. This year, Arbitrum also launched a short-term incentive program aimed at allocating up to 50 million ARB funds from the DAO treasury to active protocols on Arbitrum. 106 projects applied for the first round of funding. This year, Arbitrum has also been continuously providing financial support for various projects. For example, Open Campus recently announced that it had received funding from the Arbitrum Foundation to launch EDU Chain, the first Layer 3 blockchain designed specifically for education; Pendle announced that it had received 1 million ARB funding from Arbitrum STIP; Synthetix launched the Arbitrum Liquidity Incentive Program, providing 2 million ARB rewards to attract liquidity providers, stablecoin liquidity and Perps trading activities; Curve Finance claimed to have received more than 237,000 ARB donations from Arbitrum to provide incentives to the Curve pool on the Arbitrum chain.

However, Arbitrums approach of building an ecosystem through token subsidies has also caused dissatisfaction. In the communitys view, this approach not only fails to empower tokens, but also increases selling pressure. For example, Continue Capital co-founded Pima and bluntly stated that many company leaders lack the skills to allocate resources and capital. If the retention of funds is only for predatory subsidies, it has no long-term value. The ultimate purpose of subsidies is to serve long-term monetized cash flow. KOL BITWU.ETH said that Arb is a typical low circulation, high emission ecological subsidy strategy, which ultimately leads to growing market value and fluctuating token trends. To put it bluntly, this method is to constantly sacrifice the secondary market, which is more suitable for trend traders. It is not the kind of coin that will get huge odds if you hold it. The value of these coins has long been mined by institutions and has been fully valued. In the future, there will only beta returns, no alpha returns.

In addition, Arbitrum DAO is also considering learning from the practices of technology giants to implement mergers and acquisitions to achieve ecological expansion. In May of this year, Arbitrum DAO approved an eight-week MA pilot program proposed by Bernard Schmid, the founding partner of Areta. Marketing companies, business development, infrastructure providers, stablecoin issuers and zero-knowledge technology are the most attractive potential acquisition targets. If the pilot is successful, Schmid plans to put forward a more ambitious proposal: to establish an MA department with a capital pool of 100 million to 250 million US dollars, and to identify and acquire potential targets within two years. DeepDAO data shows that Arbitrums treasury holdings are worth 2.6 billion US dollars, of which 97.4% are tokens ARB, a drop of more than 65.7% from the peak.

It is worth mentioning that Arbitrum also tries to make iterative updates in products and governance to optimize the developer and user experience. For example, in April this year, the Arbitrum Foundation planned to change the Arbitrum expansion plan to allow new Orbit chains to be deployed on any blockchain; at the end of last month, the Arbitrum Foundation proposed to adopt a new transaction sorting strategy Timeboost to enhance the efficiency and fairness of network transactions; Arbitrum announced that it will launch a function that combines zero-knowledge proof and Stylus MultiVM.

Among the governance proposals, the new ARB staking reward proposal proposed by Arbitrum has a direct stimulus effect on the token. It intends to use 50% of the sorter fees to reward staking, thereby enhancing the economic security of the DAO and reducing the risk of the treasury being attacked. DeFi researcher @DefiIgnas said that in this plan, 50% of the remaining sorter fees in the future will be used to reward ARB token stakers. Assuming an annual fee of 12,000 ETH and an ARB price of $1, this will translate into a 7% APY. This mechanism of sharing income with token holders is a wise proposal for ARB, which is in a declining state.

From the current perspective, facing the huge unlocking pressure, Arbitrum’s ecological subsidy strategy has not yet played a significant role in boosting the ARB price. As the market controversy over the low circulation and high FDV strategy intensifies, Arbitrum will face greater challenges.

This article is sourced from the internet: 97% of holders are at a loss, Arbitrums ecological subsidy strategy may not be able to save the currency price

Related: Narrative upgrade: the new focus of hype

introduction The cryptocurrency market has entered a bull market since 2024, and investment opportunities in the market continue to emerge. Historical data shows that the cryptocurrency market has the characteristics of alternating rises. Usually, BTC is the pioneer of the rising trend of the entire industry, and then other tokens will begin to follow the rise. However, unlike in the past, most Altcoins performed relatively weakly in this bull market. Although BTC rose by 70.86% in 2024, most Altcoins failed to exceed BTC in terms of growth, and some even fell. Take the leading projects in the main track as an example: ETH (the leader of the public chain) has increased since the beginning of 2024: 55.65%; ARB (leader in the ETH-L2 track) 2024 year-to-date increase: -37.81%; LDO (the leader…