Warum die interessanteste Phase dieses Bullenmarktes noch bevorsteht

Originalautor: Krypto, destilliert

Originalübersetzung: TechFlow

The markets greatest trick is to make everyone think its all over before the real fun begins.

“Bull markets are like sex. They feel best just before they’re over.” – Warren Buffett

Here are 7 reasons why the most interesting phase has not yet begun.

The markets biggest trick

Before we dive into those reasons, let’s get some context.

The markets greatest trick is to make people think the fun is over before it begins, caused by the so-called wall of worry.

What is the Wall of Worry?

During a bull market, the market rises along a wall of worry and doubt.

Every piece of pessimistic news adds another brick to the wall, an uphill battle that determines the nature of a bull market, with fear being the fuel that drives prices higher.

Build a wall of worry

A moderate amount of FUD (fear, uncertainty and doubt) is healthy in a bull market. It keeps some people on the sidelines and provides momentum for a market rally once the skeptics turn into believers.

Despite $BTC nearing all-time highs, doubts remain regarding consumer crypto adoption, global liquidity, $ETH ETFs, and altcoins.

Biggest Opportunity

How to profit from it? Stay calm in uncertain times. Panic will only narrow your vision.

Facing danger calmly allows us to assess the situation and discover potential opportunities.

Now, let’s dive into these 7 reasons.

More liquidity coming

The main reason why the cycle peak may not have yet arrived is Liquidität .

Liquidity is expected to surge in 2025 as global macro policies ease.

Increased capital flows typically drive up cryptocurrency prices.

The market ended with a bang

In the past, the final stages of bull markets always showed an obvious parabolic pattern.

Although history does not repeat itself exactly, it often has similarities, and we have not seen such a climax yet.

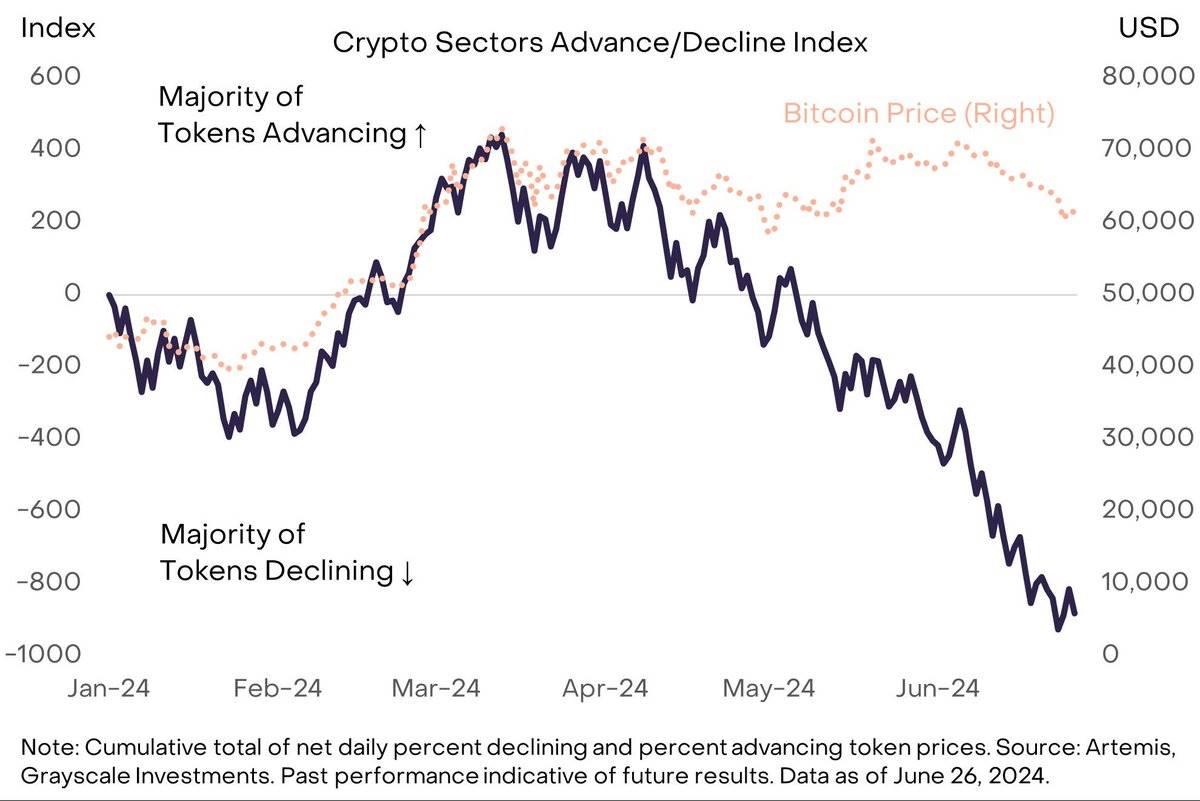

Entsprechend @Grayscale , only about 30% of altcoins are up so far this year.

The rules of the “banana zone”

The “banana zone” refers to periods of surging asset prices, which have been reliably observed in past cycles.

This phenomenon is driven by a 4-year global liquidity cycle since 2008, which typically peaks in the autumn.

We are currently in the summer phase.

(Thanks to @RaoulGMI )

Post-halving performance

Bitcoin’s post-halving performance suggests there is more upside.

Historical data shows that the macro peak usually occurs 200 days after the halving.

Currently, post-halving volatility is normal.

(Thanks to @RaoulGMI )

Four-year cycle theory

The four-year cycle is like astrology for cryptocurrencies, and it may just be influenced by global liquidity cycles and election seasons that affect the market.

If history repeats itself, the peak is expected to be reached in October 2025 (about 16-17 months later).

(Thanks to @BobLoukas )

Foreshadow Fallacy

As there are more “foreshadows” in the cryptocurrency market, the signals for each cycle seem to come earlier.

This makes it easy for people to mistakenly believe that the cycle has ended, when in fact the new phase has not yet begun.

New phases usually bloom later in the cycle with a mood of experimentation and optimism.

(Translators note: Foreshadow fallacy refers to the fact that in the cryptocurrency market, due to the earlier and earlier appearance of previous signals, people tend to mistakenly believe that the market cycle has ended, but in fact the new market stage has not yet begun. This phenomenon causes investors to miss later market opportunities because they prematurely believe that the market has reached its peak or is about to fall back.)

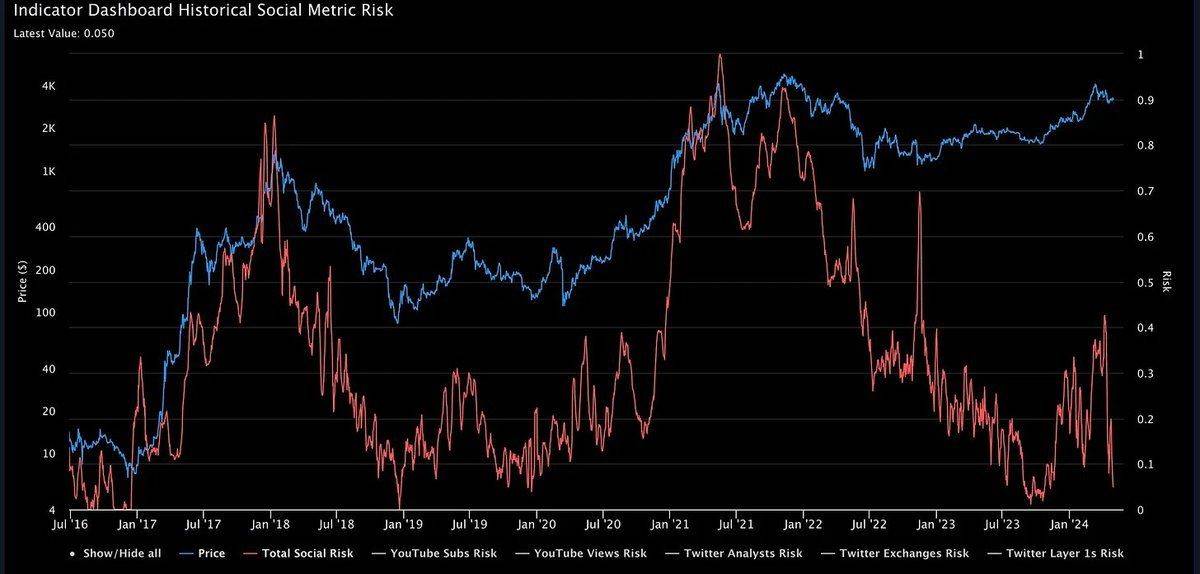

Very low social risk

The most interesting and dangerous times in the markets are usually associated with extreme manias.

In the first half of 2024, the social risk in the market is very low – the market is not overheated, but rather appears unusually quiet.

Currently, there is little to no interest in altcoins from retail investors.

(Thanks to @intocryptoverse )

Zusammenfassen

-

The final stage of a bull market is usually the most dramatic advance.

-

A wall of worry can make people mistakenly think the bull market is over.

-

Liquidity is expected to rise, banana zone may be coming?

-

The 4-year cycle suggests that the macro peak could occur in 2025.

This content is purely educational and not financial advice.

This article is sourced from the internet: Why the most interesting phase of this bull market has yet to begin

Related: Cycle Capital: DOG leads the return of rune popularity, when will the track explode?

Original author: Alfred @GametoRich, Cycle Capital 1. What is a Rune? At the beginning of 2023, the BRC-20 standard proposed based on the Ordinals protocol set off a wave of construction and speculation around BTC assets, and promoted the hot attention and capital influx of BTC second-layer, Defi and other ecological infrastructure, which played a positive role in the long-term development of the BTC ecosystem. However, the hype of BRC-20 also brought about Bitcoins network congestion and redundant data. In response to this, Casey Rodarmor, the creator of the Ordinals protocol, proposed the Runes protocol in a blog in September 2023, which will build a replaceable token protocol based on BTC UTXO, which is the Rune Protocol. The Runes protocol was officially launched on April 20 this year when Bitcoin…