Wöchentliche Empfehlungen der Redaktion (22.06.-28.06.)

Weekly Editors Picks ist eine funktionale Kolumne von Odaily Planet Daily. Planet Daily deckt nicht nur jede Woche eine große Menge an Echtzeitinformationen ab, sondern veröffentlicht auch viele hochwertige, ausführliche Analyseinhalte, die jedoch möglicherweise im Informationsfluss und den aktuellen Nachrichten verborgen sind und Ihnen entgehen.

Daher wählt unsere Redaktion jeden Samstag aus den in den letzten 7 Tagen veröffentlichten Inhalten einige hochwertige Artikel aus, deren Lektüre und Sammlung es wert ist, sich Zeit zu nehmen, und bietet Ihnen aus der Perspektive der Datenanalyse, der Branchenbeurteilung und der Meinungsäußerung neue Inspirationen in der Kryptowelt.

Kommen Sie jetzt und lesen Sie mit uns:

Investitionen und Unternehmertum

On-chain behavior analysis: How low could BTC fall in extreme cases?

According to STH-MVRV, the limit of BTC price retracement in this bull market cycle is around $43,129. In the bull market, when STH-MVRV is lower than 1, opportunities usually outweigh risks (only for BTC, not including ALT).

On June 21, the “true market fair value” assessed by the TMMP model was $44,940.

The so-called super black swan must have an impact that is at a level that challenges human life (such as a nuclear war between Russia and Ukraine); obviously, US economic recession is not high enough. Since it is an extreme value, it means it is unlikely to happen rather than it may happen.

Die Marktliquidität ist noch immer erschöpft. Wann kommt die Flut nach oben?

Volatility is not a flaw, it is a desirable feature of profitability. A lot of money is made in short bursts. Sideways trading throws the average investor out, and the market will rise just when you give up.

Prognose des zukünftigen Trends auf dem Kryptomarkt: Die Dominanz von BTC und ETH wird zunehmen

BTC dominance is on an upward trend overall; blue-chip dominance will further increase; ETH/BNB/TON rose against the trend; the impact of ETH spot ETF may be exaggerated; once market attention hits bottom, altcoins will bottom out.

Der Fear and Greed Index im Detail erklärt: Welche Leitrolle spielt die Marktstimmung?

The market sentiment index is calculated using five main weights: volatility, momentum and volume, social media, BTC dominance, and Google Trends. The two emotions of fear and greed correspond to the inherent supply and demand of the market.

If the orange fear mark in the above picture fails to last for more than 3 weeks and BTC re-enters the greed state, it often indicates the arrival of a bull market.

Although this sentiment analysis method cannot perfectly escape the top, it can almost accurately copy the bottom of the range; at the same time, the first green greed mark that appears at the end of a bear market often represents the beginning of a new bull market. When prices are low, the force that drives prices up must come from the greed of traders who want to buy at low prices, and when prices are high, the force that causes prices to fall often comes from the fear of traders who want to cash out at high prices.

Insight Data Issue 01 | AICoin OKX: How to quickly perceive the crypto market and build a data methodology? Insight Data Issue 02 | OKX CoinGlass: How to mine valuable data and cultivate mature trading thinking?

This series of articles summarizes some data and indicators worth paying attention to to help you grasp trading opportunities.

The current market cycle is driven more by macroeconomic factors than by new crypto-native innovations. This makes the market feel different from the past and lacks new applications that can attract retail and institutional investors.

Since projects are valued higher before public sales and many projects distribute tokens through airdrops, the potential gains of retail investors are greatly reduced. This change in market structure makes it difficult for retail investors to get huge returns through early investment.

FDV limits the market’s upside potential, causing the nominal value of tokens obtained by retail investors to be pegged to a higher FDV, further compressing the market’s growth space.

There is a huge liquidity mismatch between the primary and secondary markets.

Retail investors should note:

-

Be wary of projects with small market capitalization but high leverage contracts, which give large investors a very unequal competitive advantage over retail investors. When users choose to buy spot and open long contracts, the project party/market maker/institutional investor will accumulate enough buyers, and they can start to harvest retail investors again by shipping in batches.

-

Projects with higher absolute funding rates.

-

The banker does not do charity. The final cost of pulling the price is to make a profit by dumping the price. If you want to escape in advance, be careful not to become the bankers receiver. When you think this coin is a valuable coin, I want to hold it for a long time until the next bull market, it is not far from the bankers dumping. His purpose of pulling the price is to cultivate this user psychology and take over the market for himself.

In the past two months, the most noteworthy things about the BTC ecosystem, apart from UTXO Stack, are Fractal, Arch Network and Quarry launched by Unisat.

Solana’s infrastructure in the next 6-12 months should be an interesting observation. In addition to the warming of modular narratives, the launch of FireDancer’s streamlined version before the end of the year and the full version next year will improve Solana’s TPS and stability.

In terms of functionality alone: Babylon+Chakra/SatLayer = Eigenlayer.

Eine kurze Analyse der pump.fun-Daten: Degens interne Referenz „Non-Return-to-Zero“

Only about 1.4% of tokens are eventually deployed on Raydium. If the token is not deployed on Raydium within 1 hour, consider exiting early; otherwise, there is a greater than 99% chance that your investment will be lost.

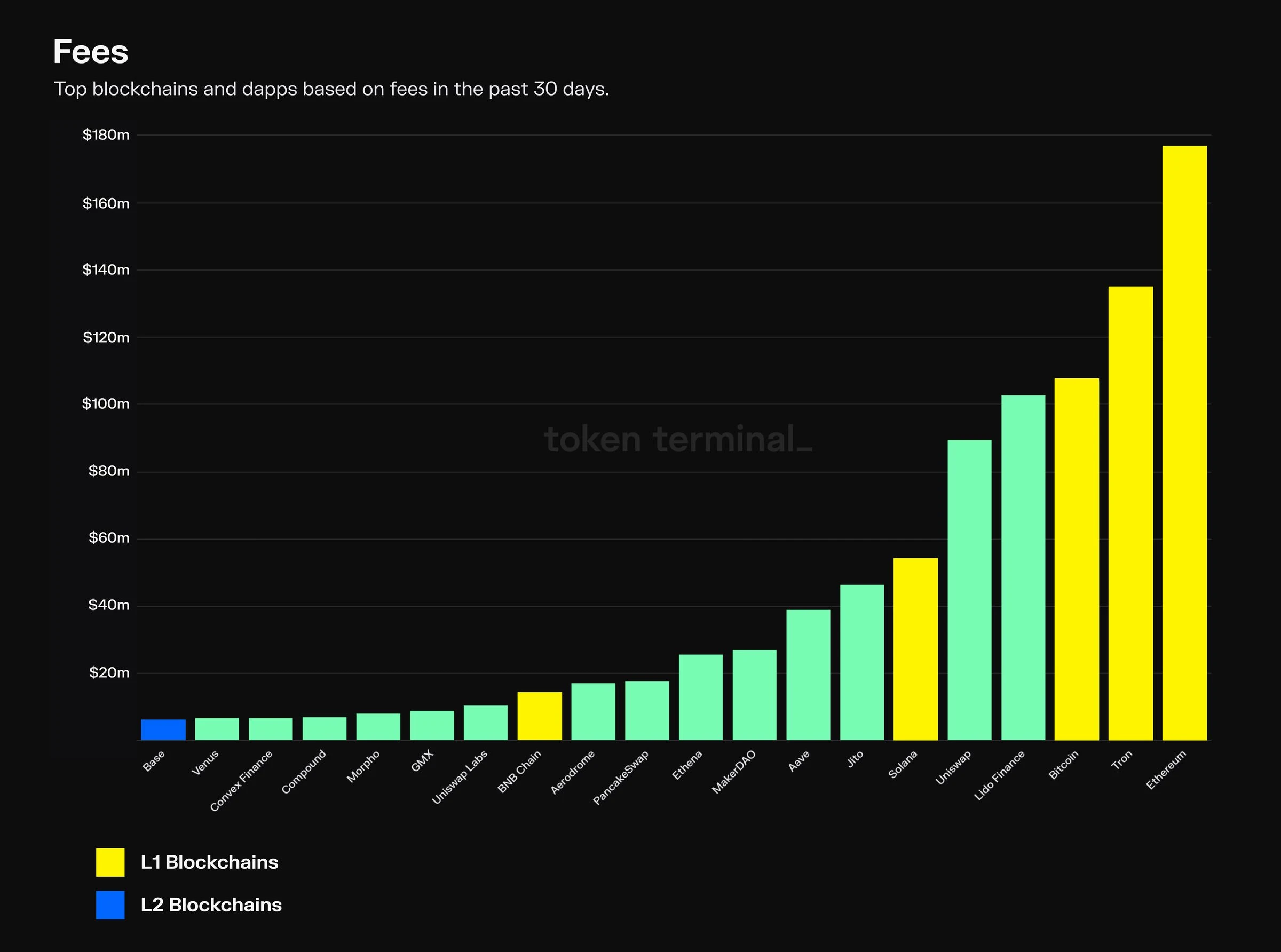

Crypto Market Rainmakers: A Review of the Top Fee-Based Protocols

Luftabwurf Leitfaden zu Chancen und Interaktionen

Recommended articles: Das Zeitalter der qualitativ hochwertigen Account-Interaktion ist angebrochen. Was ist die optimale Lösung für das Scroll-Problem? With nearly 20 million registered users, Catizen GameFi Hunter will guide you to participate in TON ecosystems popular games step by step .

Meme

The US election is approaching, this may be the most comprehensive election concept MEME collection

Such tokens are often accompanied by considerable volatility and risk, and often experience reversals of events as well as account theft and counterfeiting incidents.

This article briefly introduces some popular election concept tokens, including PEOPLE, MAGA, DJT, MAGAHAT, BODEN, STRUMP, etc. It selects the more noteworthy election concept tokens in this ecosystem from the classification of different chains for discussion, and also studies their investment value and where they can be traded.

Pepes big rebound: a look at the frog meme family tree and the culture behind it

The article introduces Pepe, the eponymous token Pepecoin, Smug Pepe, MonkaS, Apustaja (Apu), Ashbie, Peepo, and Groyper.

Bitcoin-Ökosystem

Casting tools: Ybot, GeniiData;

Data analysis tools: GeniiData, satosea.xyz;

Mempool Snipe Tools: Rune Blaster, Goldmine, Magicsat.io.

DeFi

Kann DeFi wiederbelebt werden?

Farming points and airdrop hunting seem to have evolved into a new form of DeFi.

“During this bull run, I’m excited about EigenLayer, Pendle, Gearbox, Hivemapper, and sports betting and prediction market protocols; I also dream that after this bull run ends (perhaps at the bottom of the next bear market), we will have a stablecoin that is as safe as USDT/USDC but provides a sustainable yield of at least 5%. This market undoubtedly has huge potential.”

Heiße Themen der Woche

In the past week, Mt.Gox will begin distributing BTC and BCH repayments in early July ( Key Questions and Answers on the Mt.Gox Incident ); Analysis: MicroStrategys purchase of BTC offsets the German governments selling pressure ; Trumpf plans to speak at the Bitcoin 2024 conference in July; VanEck submits Solana Trust Fund application;

In addition, in terms of policy and macro market, Gary Gensler: The approval of Ethereum spot ETF is progressing smoothly and is waiting for the issuer to make appropriate disclosures. The current securities laws apply to the encryption field , and a large number of industry entities have not complied with the regulations; Coinbase Chief Legal Officer: Request the US SEC to provide the closing investigation documents that ETH is not a security ; The US Federal Accounting Standards Advisory Committee regards seized cryptocurrencies as non-monetary property; Cathie Wood intends to vote for Trump because of his excellent economic performance;

In terms of opinions and voices, James Seyffart, ETF analyst at Bloomberg: This is a round of ETF bull market ; Andrew Kang: Ethereum spot ETF has far less impact on the market than Bitcoin, and ETH has limited upside ; Andrew Kang, co-founder of Mechanism Capital: ETH/BTC will have to fall for another year ; GSR is bullish on SOL report: It can rise 8.9 times in a bull market, and 1.4 times or 3.4 times in a bear market or normal market conditions; Delphi Labs CEO : FDV is not a Meme, high unlocking does not mean that the project will return to zero, and the structural short-selling opportunities of cryptocurrencies will be more than any other asset class; He Yi: The trading platform does not have pricing power , and the era of wool-pulling may be coming to an end; Jupiter co-founder: Airdrops are gifts , not rewards, loyalty programs or growth methods; Wormhole Foundation co-founder: Support the points plan , which can reduce the workload of the teams anti-witch; Scroll co-founder: Big investors who are disappointed with Blast can deposit Scroll, we will not PUA ; Jupiter co-founder Meow Call for the establishment of a PPP-type mutual aid community;

In terms of institutions, large companies and leading projects, Metaplanet, a Japanese listed company, plans to issue 1 billion yen bonds to increase its holdings of Bitcoin ; Solana launches ZK Compression ; Solana releases a new feature Blinks ; Blast issues airdrops ( token distribution details ); Dexscreener releases Moonshot, a competitor to pump.fun ;

From a data perspective, LayerZeros daily trading volume has plummeted by more than 95% compared to its peak; Trumps chance of winning on Polymarket has reached 65%, setting a new record high;

In terms of security, the X account of the famous rapper 50 Cent was stolen by hackers, and he promoted the meme coin GUNIT and Rug to earn $300 million ; CoinStats was attacked and 1,590 crypto wallets were affected. Users were reminded to transfer funds immediately. Its CEO said that all security measures are being taken to restore services and isolate attackers ; DeFiance Capitals official X account was stolen; Farcana clarified: the third-party market maker was attacked , and the official wallet and FAR smart contract were not affected… Well, it was another week of ups and downs.

Beigefügt ist ein Portal zu die Reihe „Wöchentliche Empfehlungen der Redaktion“.

Bis zum nächsten Mal~

This article is sourced from the internet: Weekly Editors Picks (0622-0628)

Headlines Hong Kong Bitcoin Spot ETF has held 4,218 BTC since its listing three days ago On May 3, according to HOD L1 5 Capital monitoring, the Hong Kong Bitcoin Spot ETF has held 4,218 BTC in the three days since its listing, and each ETF holds at least 1,000 BTC. The group that stole 1,155 WBTC using the phishing address has sold all the tokens for 22,960 ETH On May 4, according to on-chain analyst Ember’s monitoring, the group that had previously used a phishing address to steal 1,155 WBTC (worth approximately $70.8 million) has sold all 1,155 WBTC in exchange for 22,960 ETH. Currently, these 22,960 ETH are stored in 10 wallet addresses. As of May 3, global Bitcoin spot ETFs hold a total of 930,083 BTC On…