SignalPlus Volatility Column (20240626): Panik lässt nach

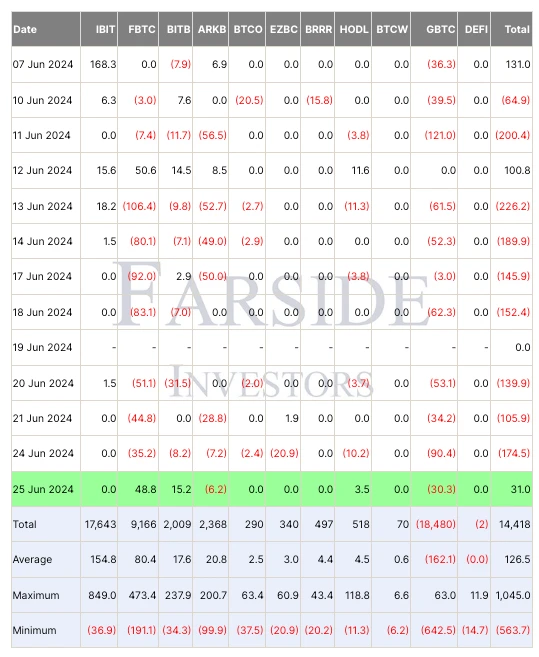

Yesterday (JUN 25), Bitcoin spot ETFs finally stopped outflows, and the uncertainty reflected in the options market also basically fell. Since the Mentougou Compensation Trustee announced on June 24 that repayments would be initiated in early July, the price of Bitcoin has fallen for a short time due to market panic. Alex Thorn, head of Galaxy Research, said in a post that the number of tokens ultimately allocated to individual creditors in the bankruptcy case was less than people thought, about 65,000 BTC (far lower than the 140,000 previously announced by the media), and the resulting Bitcoin selling pressure will be less than expected. This is mainly because some creditors chose debt acceptance (similar to FTXs packaged sale of debt) and received early payment, and the money eventually flowed to large institutions. In addition, the letter did not mention the specific repayment period, but it should not be too short, and these Mentougou creditors themselves are all early digital currency users who are proficient in technology. There is reason to believe that creditors clearly prefer long-term Bitcoin holders, so the maximum daily selling pressure is not exaggerated.

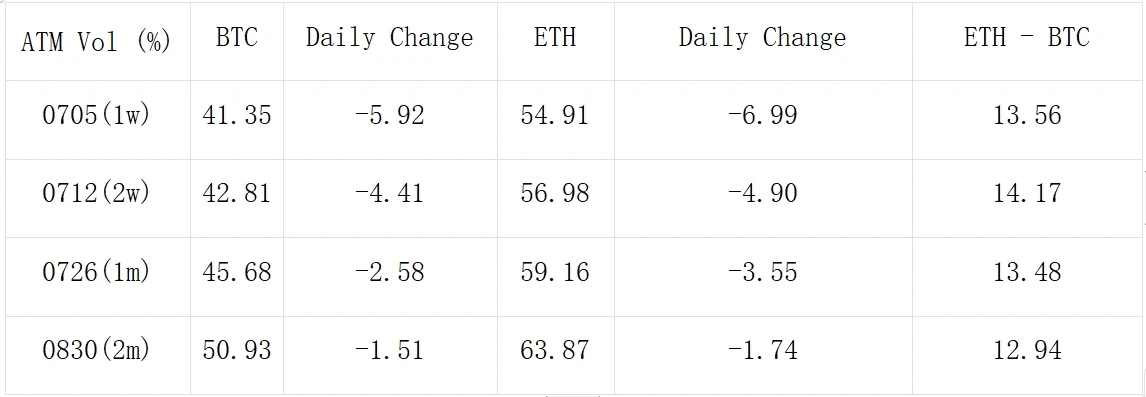

Source: Farside Investors; SignalPlus, ATM Vol.

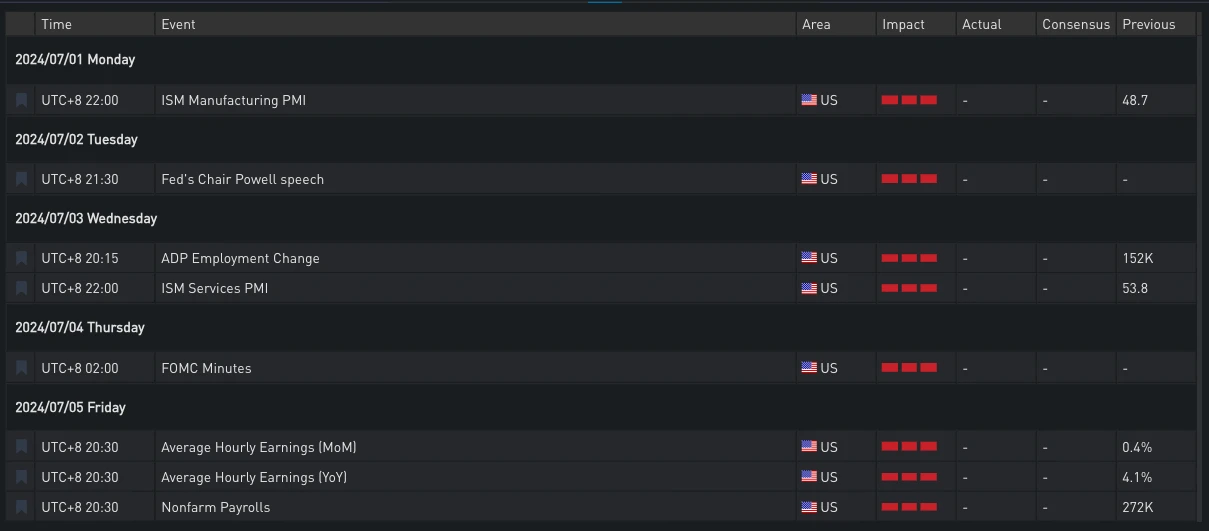

Judging from the price trend of the currency yesterday, although the price rebounded to around 62,000 and the ETF temporarily ended the outflow of funds, it still cannot change the current negative sentiment and poor liquidity. Therefore, the next macro trend should be paid attention to, such as PCE this Friday, the speech of Fed Chairman Powell next Tuesday, and the hourly wage and non-agricultural data next Friday, which will affect the market repricing and capital flow.

Source: SignalPlus Economic Calendar, Important US economic events this week

Source: SignalPlus Economic Calendar, important US economic events next week

Source: Deribit (as of 26 JUN 16: 00 UTC+ 8)

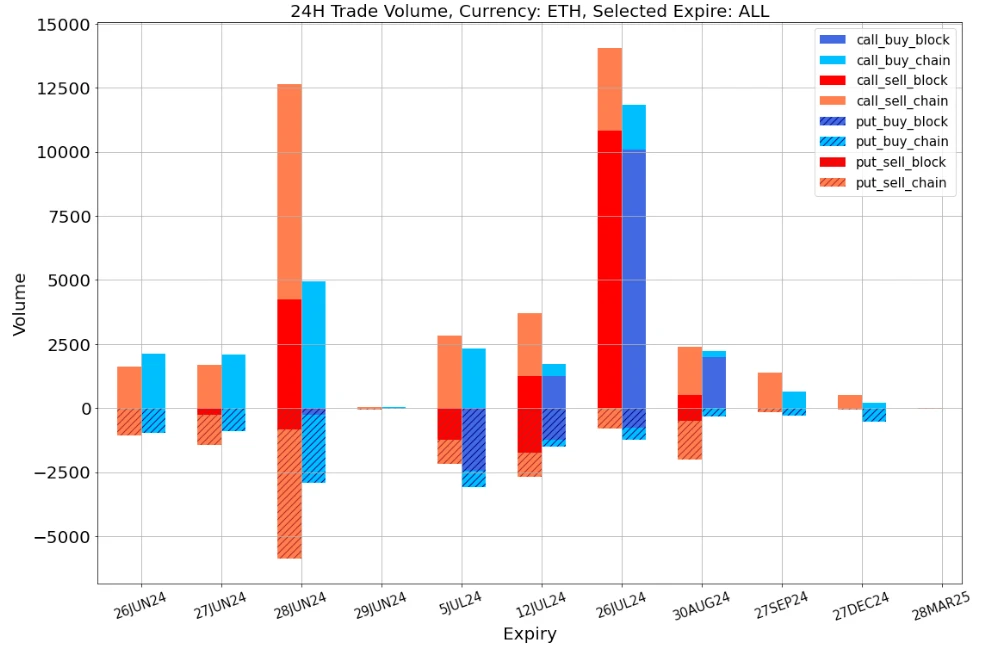

In terms of trading, after the panic subsided, BTC saw bargain-hunting of call options in late June and July. In addition, a large transaction at the end of September was also particularly eye-catching. This strategy protected the remote positions by selling 190 ATM Calls worth 62,000 in exchange for 1,140 Puts worth 48,000 at almost zero cost.

Datenquelle: Deribit, Gesamtverteilung der BTC-Transaktionen

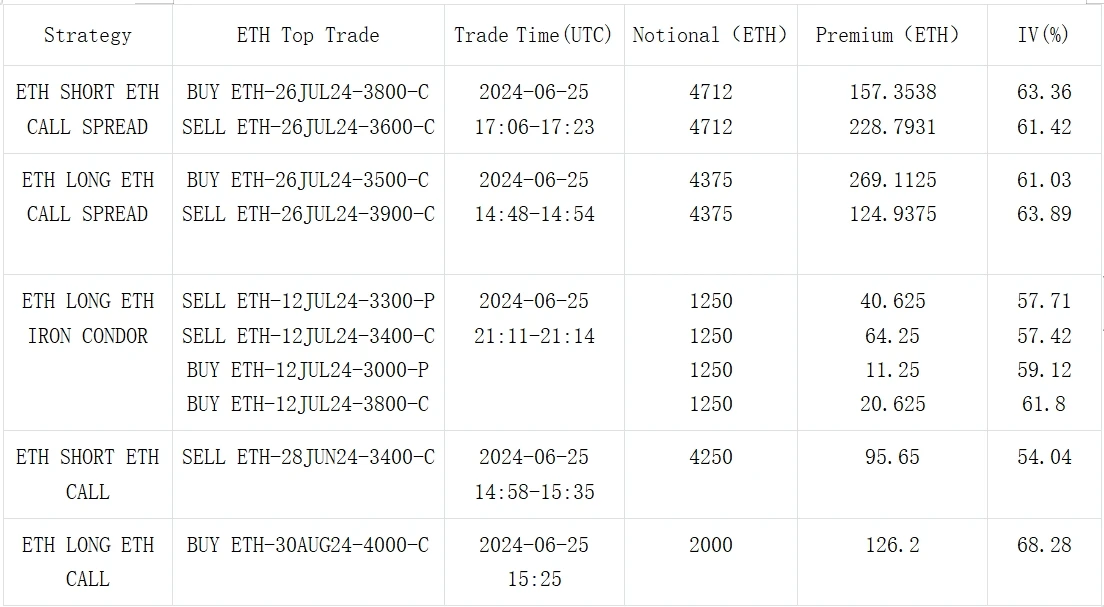

Datenquelle: Deribit, Gesamtverteilung der ETH-Transaktionen

Quelle: Deribit Block Trade

Quelle: Deribit Block Trade

Sie können im Plugin Store von ChatGPT 4.0 nach SignalPlus suchen, um Informationen zur Echtzeitverschlüsselung zu erhalten. Wenn Sie unsere Updates sofort erhalten möchten, folgen Sie unserem Twitter-Konto @SignalPlus_Web3 oder treten Sie unserer WeChat-Gruppe (Assistent WeChat hinzufügen: SignalPlus 123), Telegram-Gruppe und Discord-Community bei, um mit mehr Freunden zu kommunizieren und zu interagieren. Offizielle SignalPlus-Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240626): Panic subsides

Verwandt: Ein kurzer Blick auf 10 vielversprechende Token von a16z, BlackRock und Coinbase

Originalautor: Atlas, Crypto KOL Originalübersetzung: Felix, PANews Risikokapitalgeber investieren täglich Millionen von Dollar in verschiedene Altcoins und treiben so die Preise dieser Altcoins in die Höhe. Das Verfolgen der Wallets der Top-Risikokapitalinstitute und Wale und das Beobachten ihrer Bestände kann zu übermäßigen Gewinnen führen. Crypto KOL Atlas hat mehr als 100 Fonds-Wallets und profitable Wale gescannt, ihre Wallets analysiert und alle Projekte überprüft und die Fonds mit der besten Performance in Web3 ausgewählt, darunter a16z, BlackRock und Coinbase. Hier sind die 10 vielversprechendsten Token, die es hält. PANews Hinweis: Dieser Artikel soll Marktinformationen liefern und stellt keine Anlageberatung dar, DYOR. Compound Labs (COMP) Ein DeFi-Protokoll für Kredite, das es Benutzern ermöglicht, Zinsen auf Kryptowährungen zu verdienen, die in einem seiner Pools hinterlegt sind. Marktwert: $386…