Bitget Research Institute: ETH ETF soll bereits im Juli genehmigt werden, Blast Coin Airdrop

In den letzten 24 Stunden sind viele neue beliebte Währungen und Themen auf dem Markt erschienen, was die nächste Gelegenheit sein könnte, Geld zu verdienen, einschließlich:

-

The sectors with relatively strong wealth creation effects are: MEME sector and TON ecological project

-

Hot searched tokens and topics: The Beacon, Blast, FET

-

Potential airdrop opportunities include: Bemo, Bedrock

Data statistics time: June 26, 2024 4: 00 (UTC + 0)

1. Marktumfeld

In the past 24 hours, Bitcoin rebounded and broke through 62,000 USDT, with a daily increase of 2.83%. Ethereum rose above 3,400 USDT, with a daily increase of 1.43%. MEME tokens generally rose, and WIF, PEPE, BONK, etc. all rose by more than 10% in 24 hours. At the same time, yesterday, the Blast Foundation announced that it would airdrop BLAST to the community at 22:00 on June 26, Beijing time. Blast announced the token economic model. The total supply of BLAST is 100 billion, 50% of which will be airdropped to the community, and the initial airdrop amount is 17 billion. Blast is currently the sixth largest on-chain economy. Bitget launched a limited-time airdrop of BLAST, and investors can keep an eye on it.

In the market, Bitcoin spot ETF had a total net inflow of 31.0131 million US dollars yesterday, the first net inflow after the net outflow in the past 7 days, and the price of Bitcoin is expected to strengthen. At the same time, there are certain positives in the Ethereum spot ETF. Gary Gensler, chairman of the U.S. Securities and Exchange Commission (SEC), said that the process of launching the Ethereum spot ETF is progressing smoothly. According to the timeline of the 8-A form submitted for the Ethereum spot ETF, it is currently highly likely that the ETH ETF will be approved in July.

2. Wohlstandsschaffender Sektor

1) Sector changes: MEME sector (PEPE, WIF, BONK)

Main reasons: Affected by the sentiment of the crypto market, Bitcoin rebounded slightly yesterday, BTC ETF had a certain net inflow, and the market wealth effect spilled over to the Meme sector; if the market maintains an upward trend, you can continue to pay attention to Meme assets. Often in the process of BTC recovery, MEME track assets will be the first to have a certain wealth effect.

Increase: Pepe (PEPE) 24 hours increase of 15.96%, dogwifhat (WIF) 24 hours increase of 17%, Bonk (BONK) 24 hours increase of 12.8%

Faktoren, die die Marktaussichten beeinflussen:

-

Ob ETH weiter steigt: Das ETH-Ökosystem Dex verfügt über eine gute Liquidität, und viele Token auf DEX lauten auf ETH. Der Anstieg von ETH kann direkt mit dem Anstieg der Vermögenswerte des ETH-Ökosystems einhergehen. Wenn der Preis von ETH weiter steigt, können die Kernvermögenswerte auf Ethereum häufig ihre Popularität beibehalten;

-

Community hype enthusiasm: PEPE is the most suitable hype group for American retail investors in terms of imagery. The group is easy to be sentimental. At the same time, PEPE is relatively active in trading, and its price is prone to surges and plunges. The main feature of PEOPLE is that the project owner has almost given up the project, but it still has a high hype popularity. The core reason for the recent surge in PEOPLE is the long squeeze. As an old MEME, FLOKI has also been active recently and is worth paying attention to.

2) Der Sektor, auf den man sich in Zukunft konzentrieren muss: TON-Ökosystem

The main reason: Notcoins popularity has boosted the activity of the entire TON ecosystem, and a large number of similar projects and improved GameFi projects have emerged. TON ecosystem currently has several high-traffic projects that have not issued tokens: TON ecosystem game Hamster Kombat claims that its user base has exceeded 100 million, and Catizens user base has exceeded 15 million, making the market full of expectations for the mass adoption of future TON ecosystem projects. These projects will bring more users and funds to TON.

Increase: Notcoin 24 hours increase of 8%;

Spezifische Währungsliste: TON, NOT, STON, GRAM, FISH

Influencing factors:

-

As the broader market continued to fall and altcoins plummeted, TON tokens and Ton ecosystem tokens performed relatively well.

-

The two leading DEXs in the Ton ecosystem are also the two protocols with the highest TVL: DeDust and STON.fi, whose TVLs have bucked the trend and increased by 12% and 3% respectively in the past 7 days.

-

The number of users of Ton ecosystems high-traffic Telegram Mini App Catizen and Hamster Kombat continues to soar, attracting market attention. The total number of users on the Catizen chain has exceeded 1.25 million, and the number of Hamster Kombat users has exceeded 150 million, becoming one of the few hot spots in the recent cryptocurrency market.

-

Pantera Capital is raising money for a new fund dedicated to investing in TON tokens. The fund, called Pantera TON Investment Opportunities, aims to raise funds to buy more TON tokens, with a minimum investment of $250,000 per backer.

3. Beliebte Suchanfragen von Benutzern

1) Beliebte Dapps

Blast: Blast released its token economics today. Blast is a Layer 2 network based on Optimistic Rollup. It was launched by Pacman, the founder of NFT market Blur. Investment institutions such as Paradigm and Standard Crypto participated in the investment. The total financing was 20 million US dollars. The main network was launched in March this year. The total locked-in amount of the Blast network exceeds 3 billion US dollars, the total locked-in amount of Dapp exceeds 2 billion US dollars, the number of user addresses exceeds 1.5 million, and more than 200 Dapps have been launched. The total supply of Blast tokens is 100 billion, 50% of which will be airdropped to the community. The first phase of Blast airdrop accounts for 17% of the total supply, of which Blast Gold and Blast Point each account for 7% of the total tokens. Due to the recent poor market conditions, many top-level projects have been launched and broken. Users are advised to handle airdropped tokens with caution, and the bullish foundation is weak.

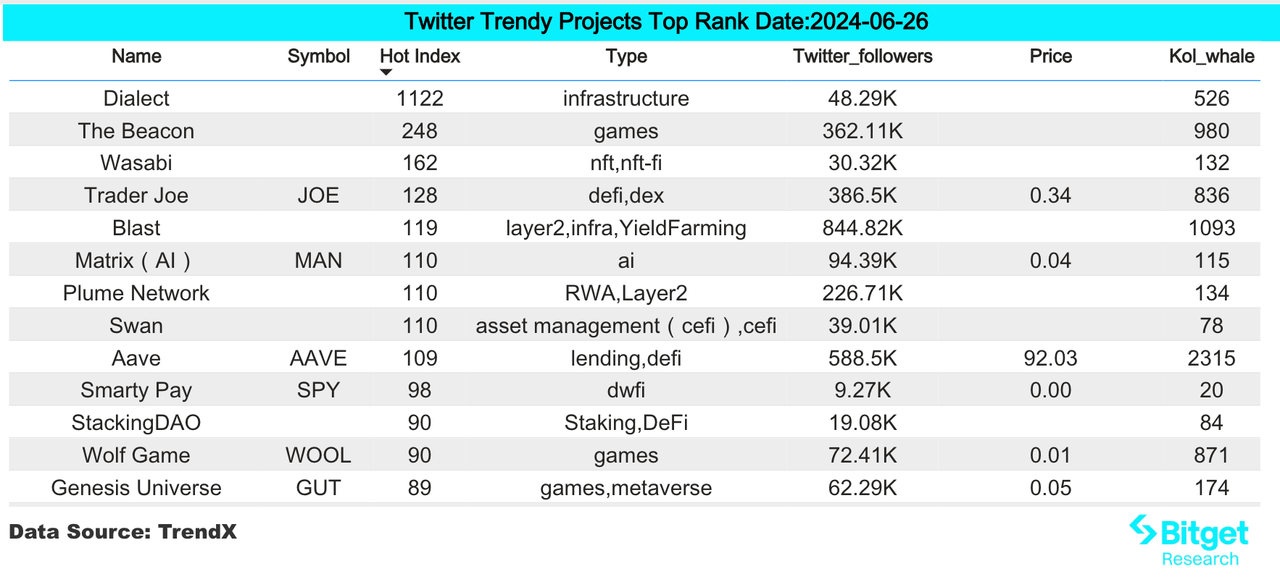

2) Twitter

The Beacon: The Beacon is a pixel-style Free 2 Play action role-playing game released by TreasureDAO on the Arbitrum chain. The gameplay includes single-player level-breaking, team adventure, casual dress-up, etc. The Beacon recently launched three large-scale events, and participants can receive token airdrops. The TGE is planned to be held shortly after the global game release, which is expected to take place in December.

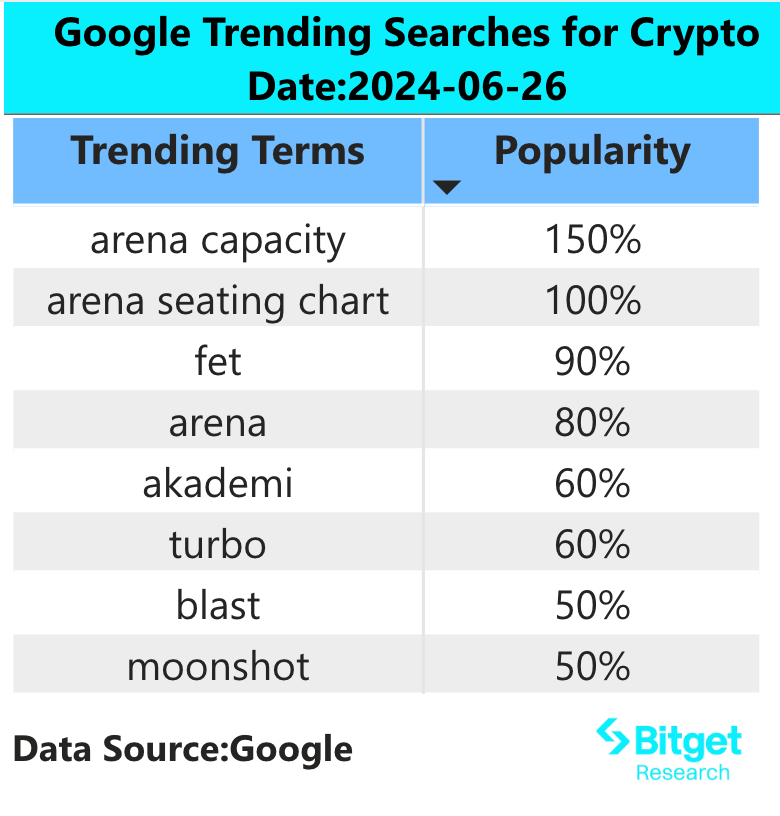

3) Google-Suchregion

Aus globaler Sicht:

FET: According to official news, the Artificial Superintelligence Alliance announced major progress and updates on the merger of ASI tokens. The first phase is scheduled to start on July 1, 2024, and the migration platform from AGIX and OCEAN to FET will be opened on the SingularityDAO dApp, allowing holders to convert their tokens to FET. The conversion rate is 1 AGIX for 0.433350 FET and 1 OCEAN for 0.433226 FET.

The second phase is the cross-chain deployment of ASI tokens. The FET network is upgraded to the ASI network. The migration contract from FET, AGIX, and OCEAN to ASI is open. EVM and other bridges are open. Trading platforms begin to migrate from FET to ASIs spot market. Currently, AI tokens are rising with the rebound of the market.

Aus den beliebtesten Suchanfragen in jeder Region:

(1) Asian countries: There is no obvious preference for searches in Asian countries, and AI projects appear relatively more frequently. The main reason is that in the past 24 hours, AI track projects such as FET, AGIX, and OCEAN have performed well.

(2) European and American countries: There are no obvious hot spots. The tokens and terms on the top search lists of different countries are different. The focus of British and American users has returned to conservative thinking. For example, public chain projects such as ICP and SUI appear on the hot search list. The same trend exists in European countries, but the tokens they pay attention to are slightly different. Solana, ada and starknet are more popular.

4. Potenzial Luftabwurf Gelegenheiten

Bemo

Bemo is the second largest liquidity staking service provider in the TON ecosystem. Users can stake TON in the protocol to earn an annualized return of 3.9%. The current project TVL is 76 million US dollars. It is an early project in the TON ecosystem and has a large space.

The project鈥檚 official website has launched an airdrop operation, where Bemo鈥檚 application stakers can receive xtXP rewards, which can be exchanged for $BMO tokens in the future.

Spezifische Teilnahmemethoden: 1) Besuchen Sie die offizielle Website des Projekts und klicken Sie auf „Jetzt einsetzen“. 2) Verknüpfen Sie das Ton-Wallet mit dem Einsatz.

Bedrock

Bedrock is a multi-asset liquidity re-pledge protocol that started with the institutional-grade liquidity re-pledge token uniETH on EigenLayer, and later expanded to the first and largest liquidity re-pledge protocol on the IoTeX network. It will also be introduced before the launch of the Babylon mainnet, supporting liquidity pledged Bitcoin uniBTC.

Bedrocks current TVL has exceeded US$200 million, with a strong lineup of investors: OKX Ventures, LongHash Ventures, and Comma 3 Ventures led the investment, and Waterdrop Capital, Lbank Labs, Amber Group, ArcheFund, Whale Ground, and angel investors such as Babylon co-founder Fisher Yu followed suit.

How to do it specifically: If you hold ETH or IOTX, you can go to Bedrock to stake it into uniETH or uniIOTX to get staking income and future Bedrock airdrops; if you hold wBTC, you can go to Bedrock to stake it into uniBTC, and you will get staking income, Babylon airdrops, and Bedrock airdrops in the future.

Originallink: https://www.bitget.com/zh-CN/research/articles/12560603811741

Haftungsausschluss: Der Markt ist riskant, seien Sie also beim Investieren vorsichtig. Dieser Artikel stellt keine Anlageberatung dar und Benutzer sollten prüfen, ob die Meinungen, Ansichten oder Schlussfolgerungen in diesem Artikel für ihre spezifischen Umstände geeignet sind. Das Investieren auf der Grundlage dieser Informationen erfolgt auf eigenes Risiko.

This article is sourced from the internet: Bitget Research Institute: ETH ETF is expected to be approved as early as July, Blast coin airdrop

Verwandt: Am Rand geboren: Wie stärkt das dezentrale Rechenleistungsnetzwerk Krypto und KI?

Originalautor: Jane Doe, Chen Li Originalquelle: Youbi Capital 1 Die Schnittstelle zwischen KI und Krypto Am 23. Mai veröffentlichte der Chipgigant Nvidia seinen Finanzbericht für das erste Quartal des Geschäftsjahres 2025. Der Finanzbericht zeigt, dass der Umsatz von Nvidia im ersten Quartal $26 Milliarden US-Dollar betrug. Darunter stieg der Umsatz des Rechenzentrums im Vergleich zum Vorjahr um 427% auf unglaubliche $22,6 Milliarden US-Dollar. Hinter der finanziellen Leistung von Nvidia, die den US-Aktienmarkt allein retten kann, steht die explodierte Nachfrage nach Rechenleistung bei globalen Technologieunternehmen, um im KI-Bereich wettbewerbsfähig zu sein. Je ehrgeiziger die Top-Technologieunternehmen bei der Gestaltung des KI-Bereichs sind, desto mehr ist ihre Nachfrage nach Rechenleistung exponentiell gestiegen. Laut der Prognose von TrendForces wird die Nachfrage im Jahr 2024…