Ethereum Big Short-Erklärung: ETH/BTC wird ein weiteres Jahr fallen

This article comes from: Andrew Kang, co-founder of Mechanism Capital

Übersetzer: Odaily Planet Daily Azuma

Editors note: This article is an analysis of ETHs future performance by Andrew Kang, co-founder of Mechanism Capital. In the article, Andrew focused on analyzing the potential scale of capital inflows into Ethereum spot ETFs, and combined with the differences in the market structure of ETH and BTC, he made a radical prediction that the ETH/BTC exchange rate will continue to fall in the next year, and the range may be between 0.035 and 0.06.

The following is Andrew鈥檚 full text, translated by Odaily Planet Daily.

The launch of a Bitcoin spot ETF provides many potential new buyers with the opportunity to include BTC in their portfolios, but relatively speaking, the impact of an Ethereum spot ETF on ETH itself may not be so obvious.

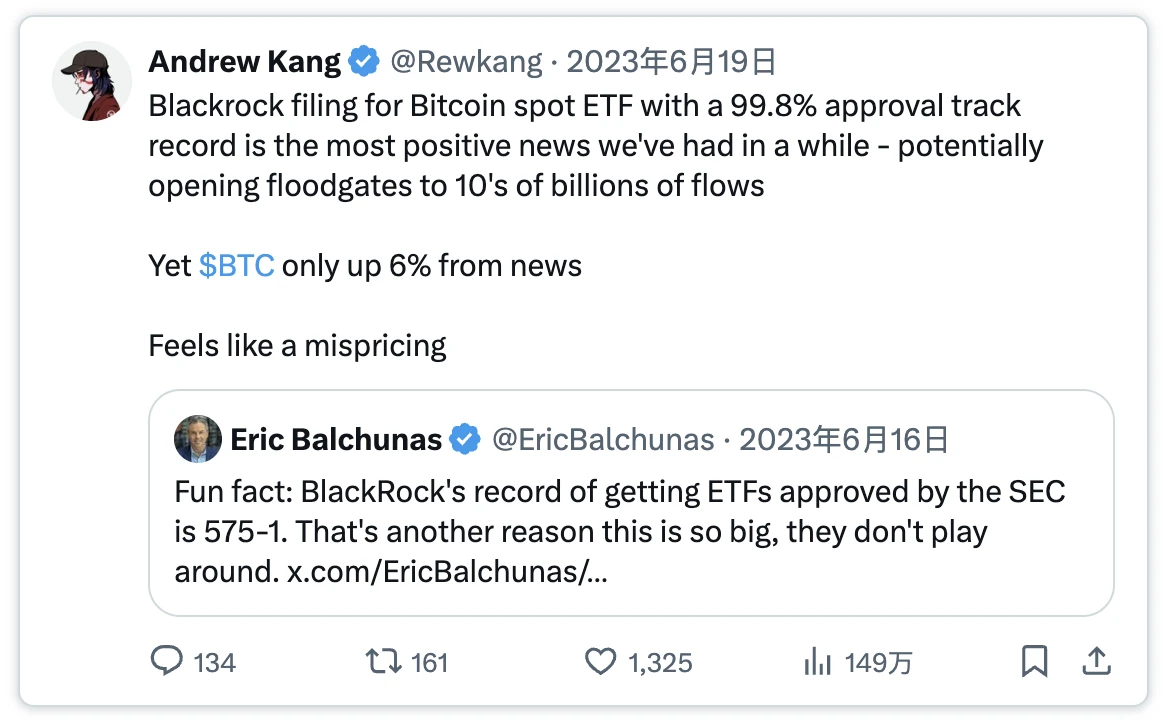

When BlackRock submitted its Bitcoin spot ETF application, the price of BTC was around $25,000, and I gave an optimistic forecast at the time. Since then, BTC has returned 2.6 times, ETH has returned 2.1 times, and if we start from the bottom of the cycle, BTC has returned 4 times, and Ethereum has also returned 4 times.

So, how much growth can the Ethereum spot ETF bring this time? First of all, I think that unless Ethereum finds an effective way to improve its economic effects, the growth space will be very limited.

ETF Net Inflow Analysis

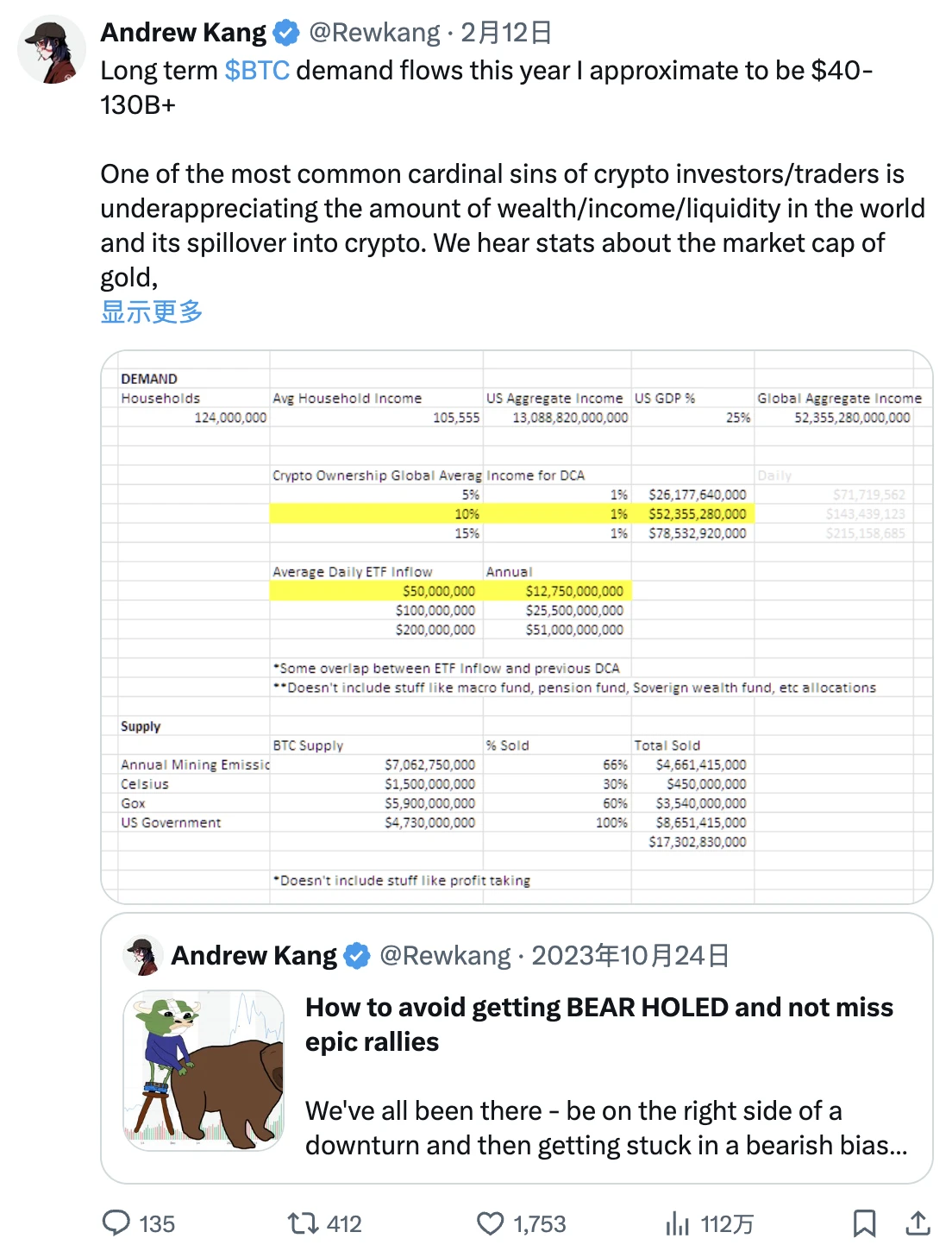

Overall, Bitcoin spot ETFs have now accumulated over $50 billion in AUM (assets under management).

This is a fairly optimistic figure. However, if you strip out the GBTC-related fund flows, you will find that the net inflow will be reduced to $14.5 billion.

In fact, this number still needs to be further reduced because it still includes many delta neutral transactions, especially some basis trades (such as buying ETFs while selling futures) and spot rotations (i.e. selling spot and buying ETFs). According to CME data and analysis of ETF holders, about $4.5 billion of capital inflows are related to basis trades; in addition, some ETF experts have pointed out that large institutions such as BlockOne have carried out huge spot rotation operations, and the scale of such transactions is expected to be about $5 billion. Excluding these delta neutral transactions, we can infer that the actual net inflow of Bitcoin spot ETFs is about $5 billion.

Based on this data, we can continue to predict potential inflows into the Ethereum spot ETF.

Bloomberg analyst Eric Balchunas has estimated that the Ethereum spot ETFs capital flow may be 10% of the Bitcoin spot ETF. This means that within six months after the Ethereum spot ETF starts trading, the reported net inflow figure may be around $1.5 billion, but the actual net inflow will be around $500 million. Although Balchunas has missed his predictions on ETF approval, I think his pessimism about the Ethereum spot ETF is informative because it reflects the broader traditional financial markets interest in the product.

Personally, my base case is that the Ethereum spot ETF could have 15% of the flow of the Bitcoin spot ETF. Still using $5 billion as the base, plus an adjustment factor of 33% of the market cap of Bitcoin, plus an access factor of 0.5, we get $840 million in actual net inflows and $2.52 billion in reported net inflows.

-

Note: The access factor here means that the potential flow that an ETF can bring to BTC may be greater than the potential flow that it can bring to ETH, because the potential purchasers of the two are different. BTC, as a macro-oriented asset, may be more attractive to macro funds, pensions, sovereign wealth funds, etc., while ETH, as a technical asset, may be more popular with venture capital funds, crypto funds, technical experts, retail investors and other groups. Relatively speaking, groups interested in ETH will have fewer restrictions when trading cryptocurrencies. The 50% figure is obtained by comparing the CME open interest and market value ratio of ETH and BTC.

Given the reasonable additional point made by some analysts regarding the relatively small supply of ETHE compared to GBTC, in a more optimistic scenario, I forecast actual net inflows of $1.5 billion and reported net inflows of $4.5 billion. This is roughly 30% of the Bitcoin spot ETF flows.

In any case, the actual net inflow of the Ethereum spot ETF will be much lower than the scale of derivative transactions generated by the ETF expectations, which is about $2.8 billion, and some spot front-running transactions are not included here. This shows that the expectations of the ETF have been fully digested by the market.

According to CME data, before the launch of the ETF, ETHs open interest was also much lower than BTCs – ETHs contract size accounted for about 0.3% of the supply, and BTC accounted for about 0.6%. At first I thought it was just because ETH was relatively early, but it may also indicate that the traditional financial community is not interested in Ethereum spot ETFs. Traders have made huge profits during the trading cycle of Bitcoin ETFs, and they usually have very accurate information. If they dont repeat the same operation on ETH, this may indicate that the flow performance of Ethereum spot ETFs will be relatively poor.

5 billion US dollars, how to drive BTC up?

How did only $5 billion push BTC from $40,000 to $65,000? Let鈥檚 continue to throw out the conclusion first. It didn鈥檛 do it .

There are many other buyers in the spot market. Bitcoin has truly become an investment asset with a certain degree of recognition worldwide, with many institutional buyers, such as MicroStrategy, Tether, family offices, high net worth individual investors, etc. Ethereum also has some institutional buyers, but their scale is much smaller than Bitcoin.

It is important to note that before the Bitcoin spot ETF started trading, the price of BTC had reached $69,000 and the market value exceeded $1.2 trillion. Various market participants, including institutions, hold a large amount of BTC spot. Coinbase has custody of up to $193 billion, of which $100 billion comes from institutional clients; Bitgo has reported that its asset custody scale is $60 billion; Binances asset custody volume exceeds $100 billion. Six months after the Bitcoin spot ETF started trading, the ETF only custody 4% of the total supply of Bitcoin, which is meaningful, but only a small part of the market demand.

Another difference to note is that when the Bitcoin spot ETF was launched, the market was also slightly underfunded. At the time, the market generally believed that the launch of the ETF would cause BTC to fall in the short term, with a peak as soon as it goes online. Therefore, a large amount of funds left the market before the launch of the Bitcoin spot ETF, and then bought back when it fell (magnifying the scale of ETF inflows), and when the ETF showed good liquidity, some shorts had to cover their positions. The data proves that before the Bitcoin spot ETF started trading, the size of BTCs open contracts actually fell.

The situation of Ethereum spot ETF is completely different. Before the launch of the ETF, the price of ETH had reached 4 times the low point of this round, while the price of BTC at that time was only 2.75 times the low point. In the derivatives market, the size of ETH open interest (OI) in cryptocurrency native exchanges has increased by US$2.1 billion, bringing the size of open interest close to the historical high. This means that many traders familiar with cryptocurrencies also expect ETH to achieve the same effect after seeing the success of Bitcoin ETF, and have made corresponding arrangements.

But in my opinion, the expectations of cryptocurrency practitioners may be too high, and the expectations are inconsistent with the actual preferences of the traditional financial market. People who focus on the crypto field for many years usually have a high level of attention and trust in Ethereum, but in fact, in the eyes of many capital groups in the non-cryptocurrency field, Ethereum is much less attractive as a key asset.

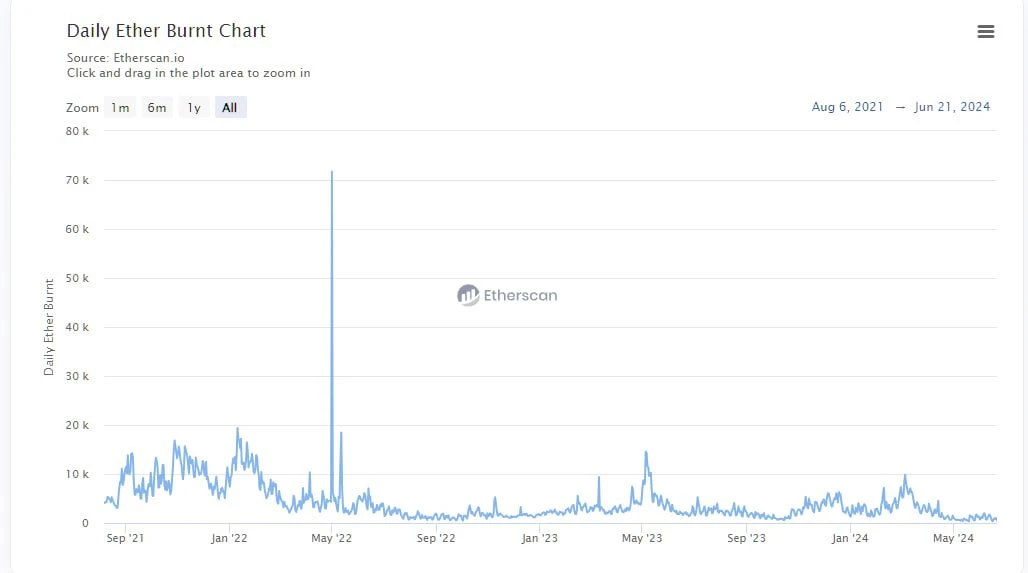

When we promote Ethereum to traditional finance, we often use technical assets as the entry point, emphasizing its value as a global computer, Web3 application store, decentralized financial settlement layer, etc. This argument still has some appeal in previous cycles, but if you put the actual data on the table, you will find that this promotion model is not so convincing.

In past cycles, you could cite the growth rate of transaction fees to show how DeFi and NFTs would create more fees and cash flow for Ethereum, thereby shaping Ethereum into a tech asset similar to tech stocks. However, in the current cycle, the quantification of these fees has had the opposite effect – data shows that Ethereums fees are stagnant or even negative. Although Ethereum itself is still a sustainable cash machine, how will analysts prove to their family offices or fund bosses that the current price of ETH is reasonable based on figures such as $150 million in monthly revenue, a 300x price-to-sales ratio, and a negative price-to-earnings ratio?

In addition, I think there are not many delta neutral trades around ETFs in the first few weeks after the ETFs start trading for two main reasons. First, the sudden approval of ETH caught many people by surprise, and the issuer did not have enough time to market the ETF to large institutions; second, for ordinary ETH holders, there is less motivation to convert their positions to ETFs, because it means they need to give up the yield that can be achieved through staking, DeFi farming, etc. Although the current overall staking rate of ETH is only 25%.

Does this mean that ETH will return to zero? Of course not, at a certain price point, ETH will still be considered valuable, and when BTC continues to rise in the future, ETH will also be driven up to a certain extent.

Before the launch of the Ethereum spot ETF, I expect ETH to trade in the range of $3,000 to $3,800; after the launch of the ETF, my expectation is $2,400 to $3,000. However, if BTC rises to $100,000 in the fourth quarter or the first quarter of next year, this may drive ETH to a new high, but the exchange rate between ETH and BTC will be lower.

I expect the ETH/BTC exchange rate to continue to fall over the next year, probably between 0.035 and 0.06. Although our observable sample is small, we do see that the highs of the ETH/BTC exchange rate have become lower in each cycle, so it would not be too surprising to see this happen again.

This article is sourced from the internet: Ethereum Big Short Declaration: ETH/BTC will fall for another year

Related: Opinion: The altcoin bull market is coming, it鈥檚 time to buy on dips

Original author: CryptoAmsterdam Original translation: TechFlow Is the altcoin bull market coming? This article will express my views from the following two aspects. There are different stages of a bull market, and I think the altcoin bull market has not yet begun. Why I think a lot of people miss out and how I do it. cycle All assets, on any time frame, will show similar cyclical structures. Focus on the weekly cycle, which is what we usually refer to as a bull market on the higher time frames. Bull Market Bear Market Consolidation period Doubt period (1) Bull Market Phases 4 and 5 are where the parabolic rise occurs. The cycle structure applies to BTC, and you can find market structure in the fluctuations at each cycle stage. Bull…