Diskussion der optimalen Token-Verteilungsstruktur: 5% von TGE freigeschaltet und Umlaufmenge von nicht mehr als 15%

Originalautor: Ronin

Originalübersetzung: TechFlow

Over the past 6 months, I have invested in 189 private/KOL rounds and identified the best performing allocation strategies.

Oh shit, why am I reading this!?

A good product and a community built around the project is awesome.

But this does not ensure further growth of the token, especially if the token economic model is only designed for the next 1-2 years.

First, the fundamentals should resolve the big pressure issue, which is why I am sharing this information with you.

Best Token Economics I Would Invest In

TGE unlocks 5-7%

Yes, we want quick profits, and we want them now. But we want to get a taste of profits at launch. With such a TGE, we get:

-

Low token circulation (which leaves a lot of room for rapid growth in market cap)

-

Stable and growing token price

-

Opportunities to liquidate positions from investor push during a bull market

11-15% of circulating supply at TGE

The unlocking system is as follows:

-

11-15% at launch —> 20% at the end of the first year —> 30-35% at the end of the second year —> then, linear unlocking for several years

3-6 month lock-up period

Investing with a 12 month lockup is a very stupid idea because our unlocking will happen in a bear market. But a 6 month lockup can help retail investors get more confident in the token, which will lead to more buying and additional liquidity.

If retail investors are confident, then investors and market manipulators will be very cautious. This means that in a few months or years we will grow steadily, which is why we will sell our tokens at market highs.

The teams vesting period is after the investors (rule)

Linear attribution

-

Daily – Very good

-

Monthly – Good

-

Quarterly – Not good

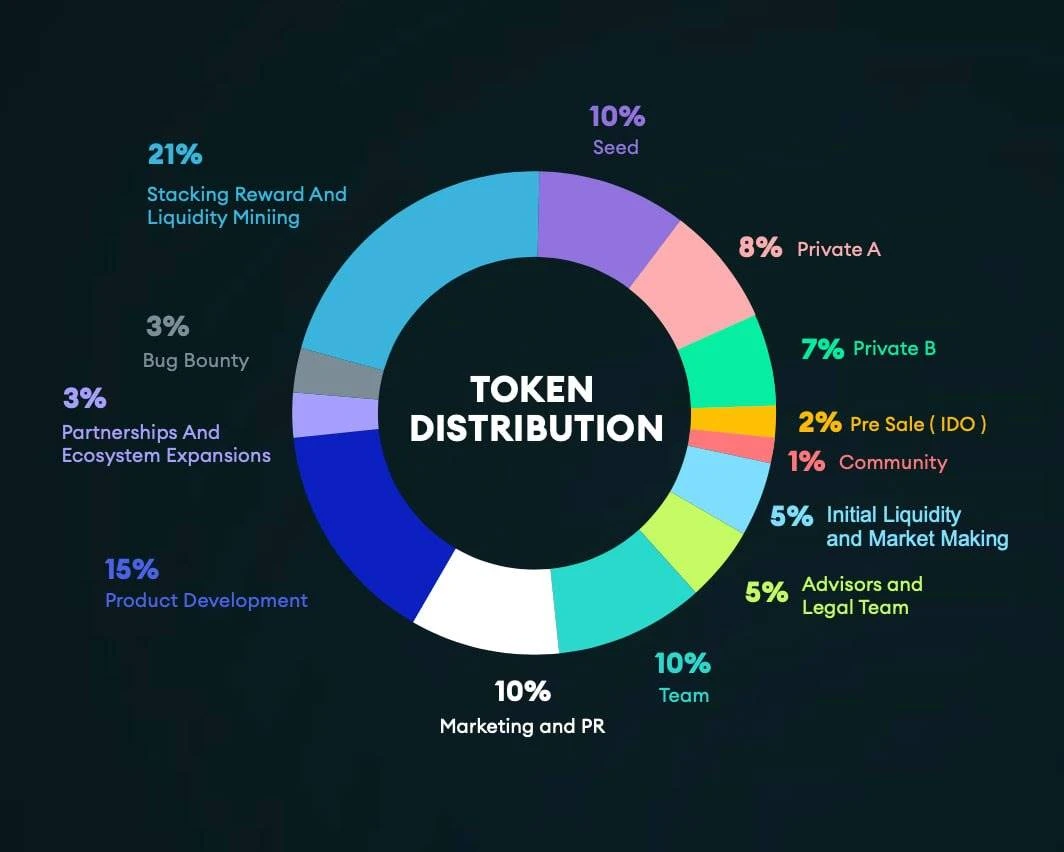

Optimal Allocation

-

30-40% for the community/ecosystem

-

15% for investors

-

15% for founders

-

25% for capital reserve

-

5% for consultants/KOL

-

5% for market makers and CEX

Ideally, the unlocking ratio on the day of TGE (Token Generation Event) is 4% for investors/advisors, 5% for public sales, and 6% for community/reserve, for a total of 15%

abschließend

If you decide to invest in any altcoin, check it against the criteria I described above.

If you decide to invest in any private/KOL rounds, also double-check the criteria I provided (but sometimes, you can look for better, faster deals).

I hope my 6 months of losses can teach at least some people how to make greater profits in your investments.

Remember! If you trade – you are gambling.

If you analyze and act on the news – you are a master.

Trading solely on hype trading, smart money moves or technical analysis is a bad idea. You also need to follow the fundamentals and current news (that is the only secret to success).

This article is sourced from the internet: Discussing the optimal token distribution structure: 5% unlocked by TGE, and circulating supply not exceeding 15%

Original author | Decrypt Compiled by Nan Zhi from Odaily Planet Daily On May 13, Roaring Kitty reappeared in the public eye. When he returned to Twitter (X platform), he didn’t even directly mention GameStop (GME), the stock whose roller coaster ride had attracted global attention and was made into a documentary. But his return still caused GME’s stock price to double in a short period of time and caused the price of the eponymous meme token GME on Solana to surge by 1,900%. What is the connection between Roaring Kitty, whose real name is Keith Gill, and bankrupt video game retailer GME and Meme Coin? Gill is the protagonist of the 2023 film Dumb Money, which tells the story of the 2021 GameStop short squeeze. Gills analysis and promotion…