SignalPlus-Volatilitätskolumne (06.06.2024): ETF-Zuflüsse strömen in den Markt

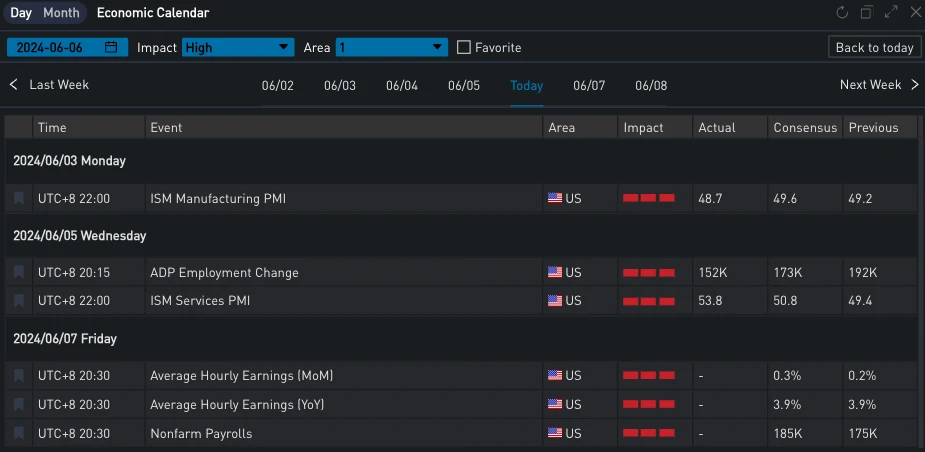

Vor der Veröffentlichung der Nichtlandwirtschaftsdaten gestern (5. Juni) lag der US-ADP-Index, bekannt als der kleine Nichtlandwirtschaftsindex, niedriger als erwartet und verzeichnete 152.000 Punkte, den geringsten Anstieg seit Januar dieses Jahres. Die Renditen der US-Staatsanleihen fielen weiter, wobei die 10-Jahres-Rendite unter die Marke von 4,31 TP9T fiel. Die drei wichtigsten US-Aktienindizes schlossen alle höher, wobei der SP und der Nasdaq um 1,181 TP9T bzw. 1,961 TP9T und der Dow um 0,251 TP9T zulegten. Nvidia stieg um 5,161 TP9T und übertraf mit seinem Gesamtmarktwert Apple und belegte weltweit den zweiten Platz.

Quelle: SignalPlus, Wirtschaftskalender; Investieren

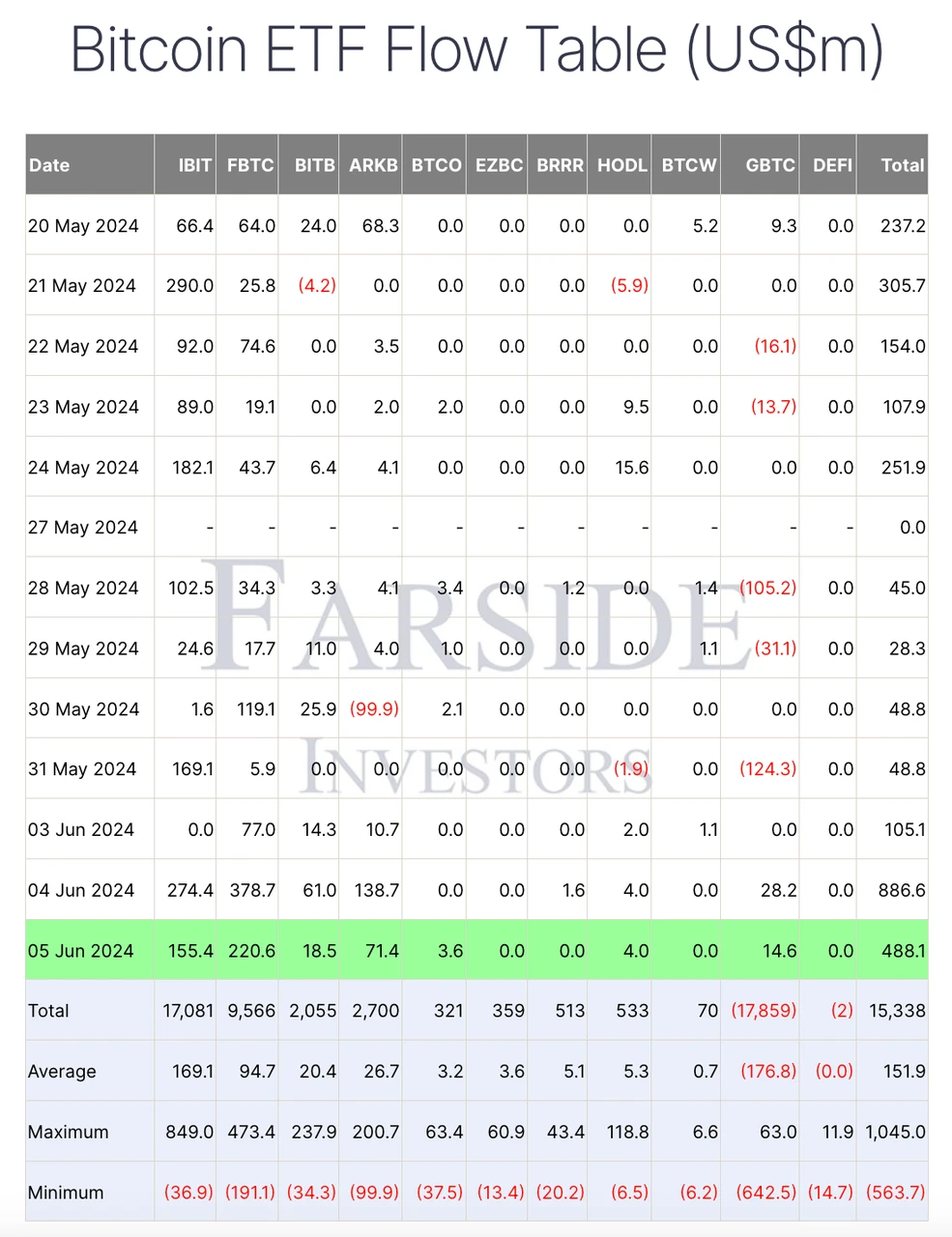

Was die digitale Währung betrifft, so stieg der BTC-Preis in den letzten Tagen unter dem günstigen Makroumfeld weiter an und forderte erneut das Widerstandsniveau von 71.600 heraus. Die Kraft, die zu diesem Anstieg beitrug, ist untrennbar mit dem beschleunigten Zufluss von ETFs in den letzten zwei Tagen verbunden. Das Kaufvolumen allein am 4. Juni betrug $886 Millionen US-Dollar und stieg gestern weiter um $488 Millionen US-Dollar.

Quelle: TradingView

Quelle: Farside Investors

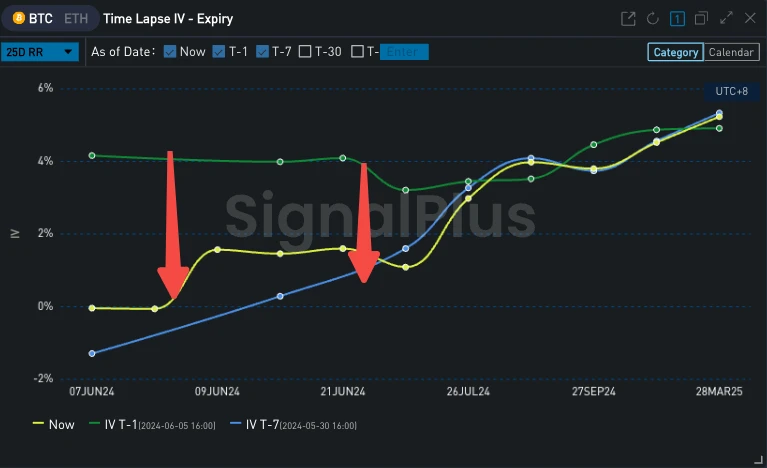

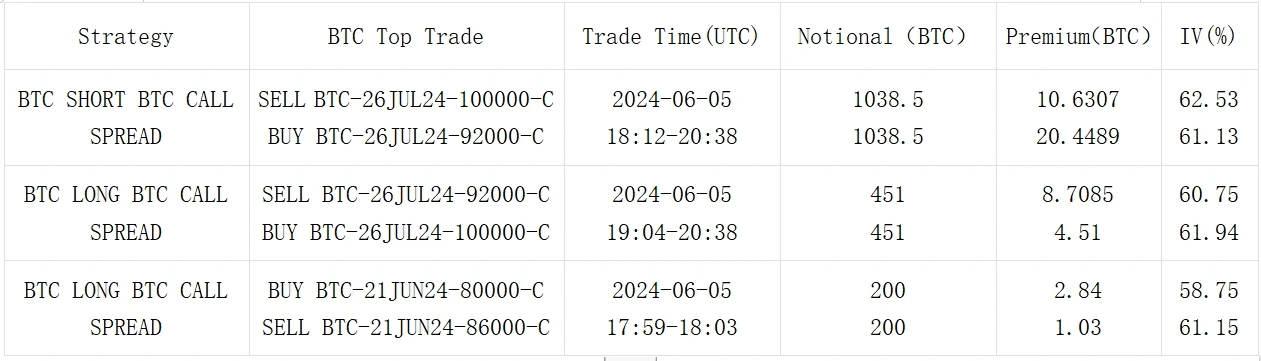

Bei den Optionen fielen BTC Front-End IV und Vol Skew gleichzeitig. Aus Handelssicht lockte der kontinuierliche Preisanstieg Händler zum Verkauf kurzfristiger Call-Optionen, und Ende Juni wurden auch Call-Spreads verkauft. Darüber hinaus geriet die letzte Single-Leg 92000 vs 100000 Buy-Call-Strategie mit mehr als 1000 BTC Ende Juli in den Fokus des Marktes, doch dann wurde fast die Hälfte der Position innerhalb einer Stunde zum Selbstkostenpreis geschlossen.

Quelle: Deribit (Stand: 6. Juni 16:00 UTC+8)

Quelle: SignalPlus

Quelle: SignalPlus

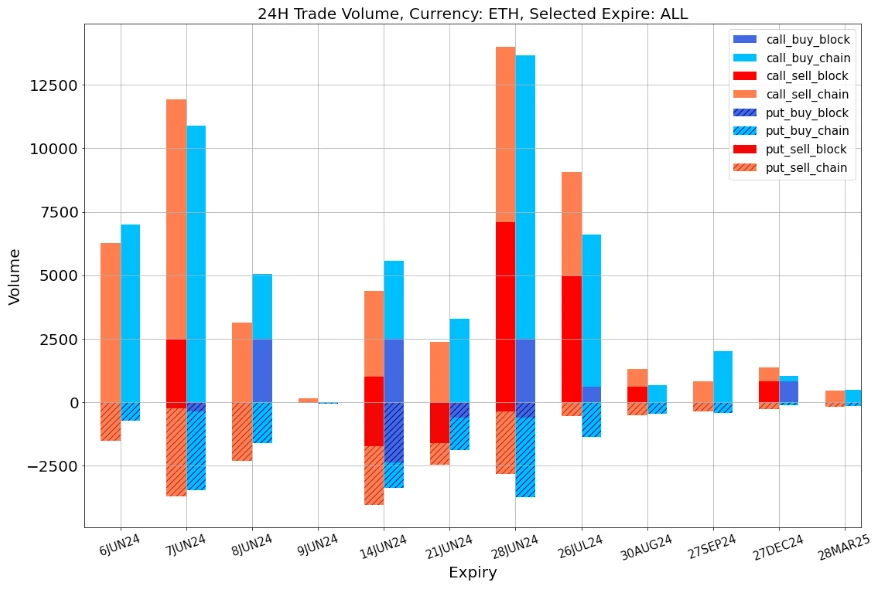

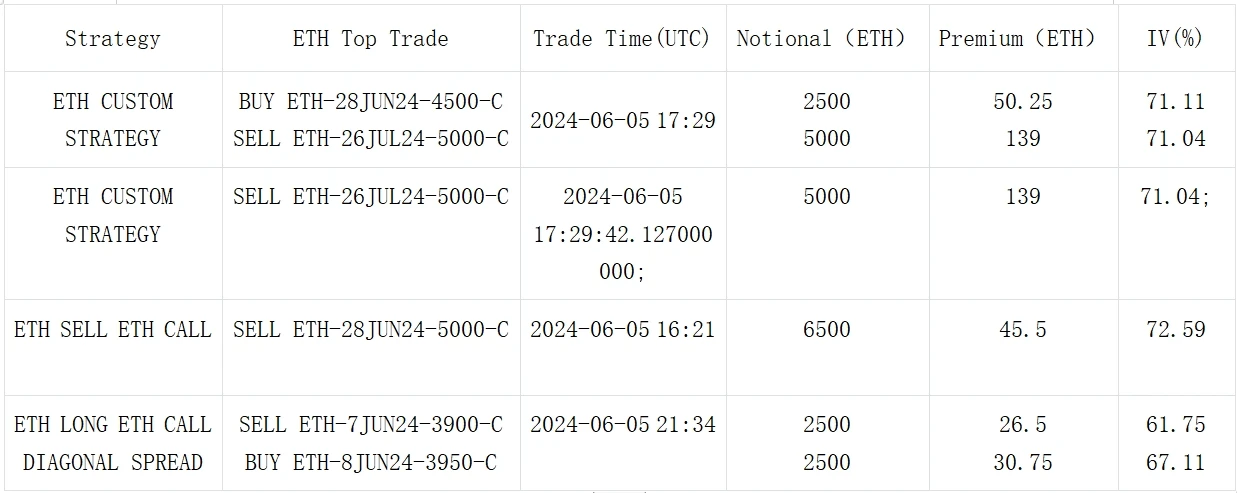

Datenquelle: Deribit, Gesamtverteilung der ETH-Transaktionen

Datenquelle: Deribit, Gesamtverteilung der BTC-Transaktionen

Quelle: Deribit Block Trade

Quelle: Deribit Block Trade

Sie können im Plugin Store von ChatGPT 4.0 nach SignalPlus suchen, um Informationen zur Echtzeitverschlüsselung zu erhalten. Wenn Sie unsere Updates sofort erhalten möchten, folgen Sie unserem Twitter-Konto @SignalPlus_Web3 oder treten Sie unserer WeChat-Gruppe (Assistent WeChat hinzufügen: SignalPlus 123), Telegram-Gruppe und Discord-Community bei, um mit mehr Freunden zu kommunizieren und zu interagieren. Offizielle SignalPlus-Website: https://www.signalplus.com

Dieser Artikel stammt aus dem Internet: SignalPlus Volatility Column (20240606): ETF-Flüsse strömen in den Markt

Kurz gesagt: Die jüngste Rallye und das Ausbleiben einer solchen haben viele Altcoins an den Rand einer möglichen Rallye gebracht. Ravencoin (RVN) und Akash Network (AKT) erleben eine Windwende, möglicherweise in Richtung eines Anstiegs. Theta Fuel (THETA) wird ebenfalls explodieren, obwohl es auf dem Tageschart ein rückläufiges Muster aufweist. Die Volatilität des Kryptomarktes im April führte dazu, dass Bitcoin und viele Altcoins ein beträchtliches Wachstum verzeichneten. Einige Altcoins haben diese Gelegenheit jedoch verpasst, bereiten sich aber darauf vor, dies im Mai zu tun. BeInCrypto hat diese Analyse erstellt, um weniger bekannte Coins ins Rampenlicht zu rücken, die im kommenden Monat Gewinne einfahren werden. Augen auf Theta Network (THETA) Der Preis von Theta Fuel (THETA) hat im April und in der zweiten Märzhälfte nichts als einen Rückgang erlebt. Der Altcoin…