io.net, im Wert von $1 Milliarden, ist auf Binance Launchpool gelistet, das nächste große Geld kommt

Original | Odaily Planet Daily

Autor | Asher

This morning, Binance announced that its 55th new coin mining project is io.net (IO), and will launch IO/BTC, IO/USDT, IO/BNB, IO/FDUSD and IO/TRY trading markets at 20:00 Beijing time on June 11. As soon as this news came out, major money-making communities immediately became active. Next, Odaily Planet Daily will take you to understand the io.net project, IO token economy and over-the-counter trading.

io.net comprehensive analysis

Projektbeschreibung

Bildquelle: Offizielles Twitter

io.net is a decentralized computing network that has built a two-sided market around chips. The supply side is the computing power of chips (mainly GPUs, but also CPUs and Apples iGPU, etc.) distributed around the world, and the demand side is artificial intelligence engineers who want to complete AI model training or reasoning tasks. Its mission is to integrate millions of GPUs into its DePIN network.

The core team was originally established to engage in quantitative trading, and until June 2022, they had been focused on developing institutional-grade quantitative trading systems for stocks and crypto assets. Due to the need for computing power in the backend of the system, the team began to explore the possibility of decentralized computing, and eventually focused on the specific issue of reducing the cost of GPU computing services.

Finanzierung

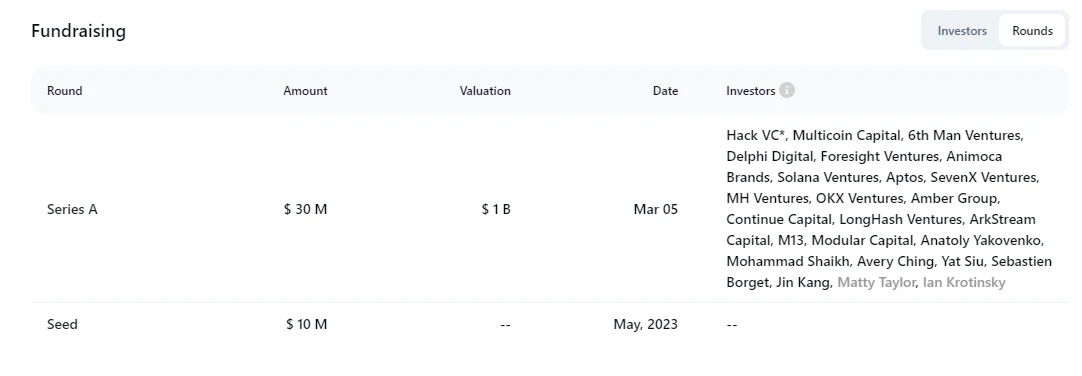

ROOTDATA data shows that io.net has completed its second round of financing, with the latest valuation of US$1 billion and a total financing amount of up to US$40 million, einschließlich:

-

On May 1, 2023, it announced the completion of a $10 million seed round of financing;

-

On March 5, 2024, it announced the completion of a US$30 million Series A financing round, led by Hack VC. Other investors included Multicoin Capital, Delphi Digital, Foresight Ventures, Animoca Brands, Continue Capital, Solana Ventures, Aptos, LongHash Ventures, OKX Ventures, Amber Group, SevenX Ventures and ArkStream Capital.

io.net has completed its second round of financing, totaling US$40 million

Token Economics

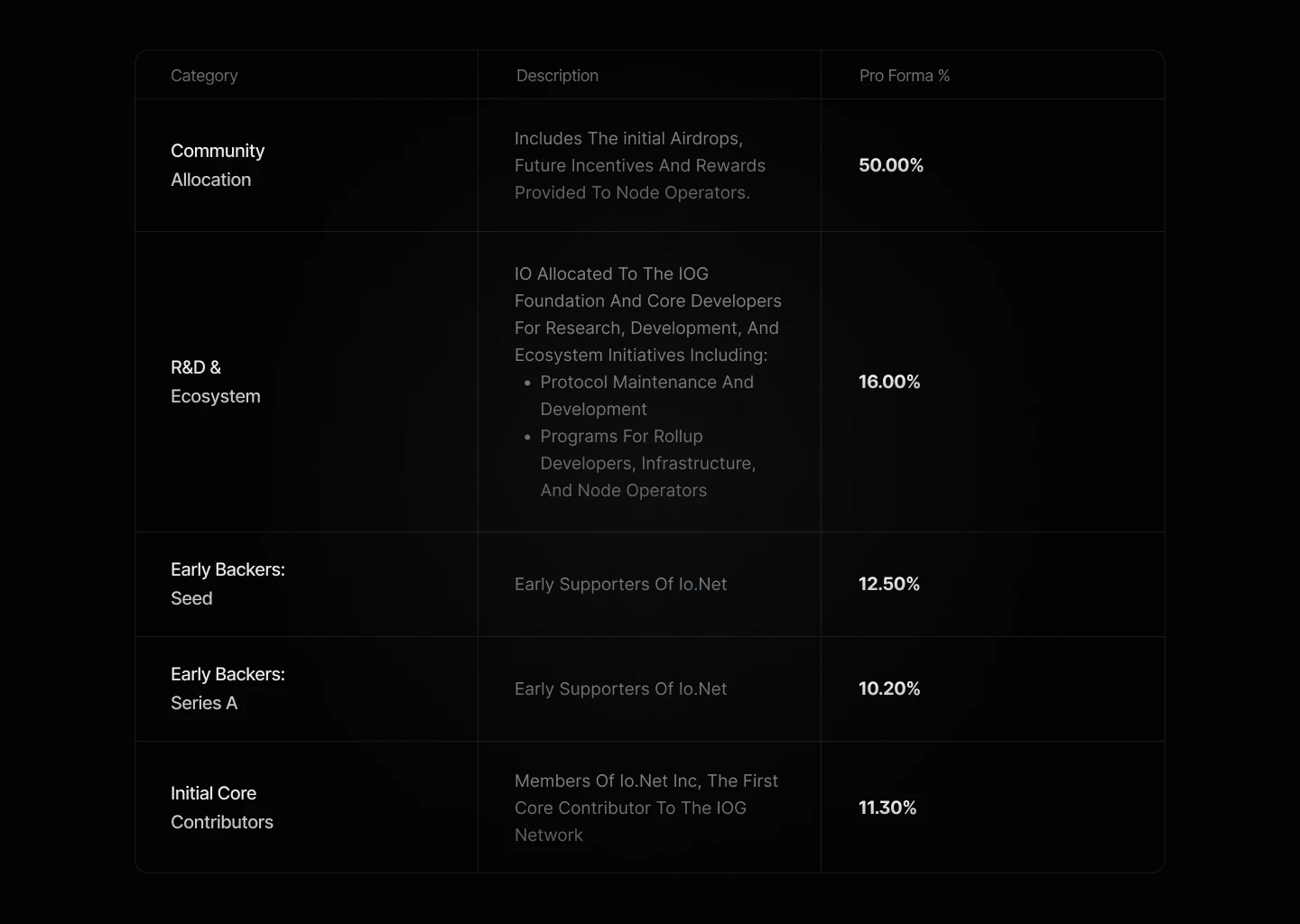

According to the official document released by io.net, its native token is IO, the maximum supply of tokens is fixed at 800 million, and the initial supply is 500 million IO. The specific distribution is as follows:

-

Gemeinschaft: 250,000,000 IO, 50.00% of the total supply;

-

RD and Ecosystem: 80,000,000 IO, accounting for 16.00% of the total supply;

-

Seed investors: 62,000,000 IO, 12.50% of the total supply;

-

Series A investors: 51,000,000 IO, 10.20% of the total supply;

-

Hauptbeitragende: 56,500,000 IO, 11.30% of total supply.

Gleichzeitig, the transfer restriction period of IO allocated to investors is three years. The transfer restriction starts from the end of the 13th month and is lifted in 24 equal parts from IO until the 36th month of the first distribution date; the transfer period of IO allocated to io.net employees is four years. The transfer restriction starts from the end of the 13th month and is lifted in 36 equal parts from IO until the 48th month of the first distribution date.

IO initial allocation of 500 million

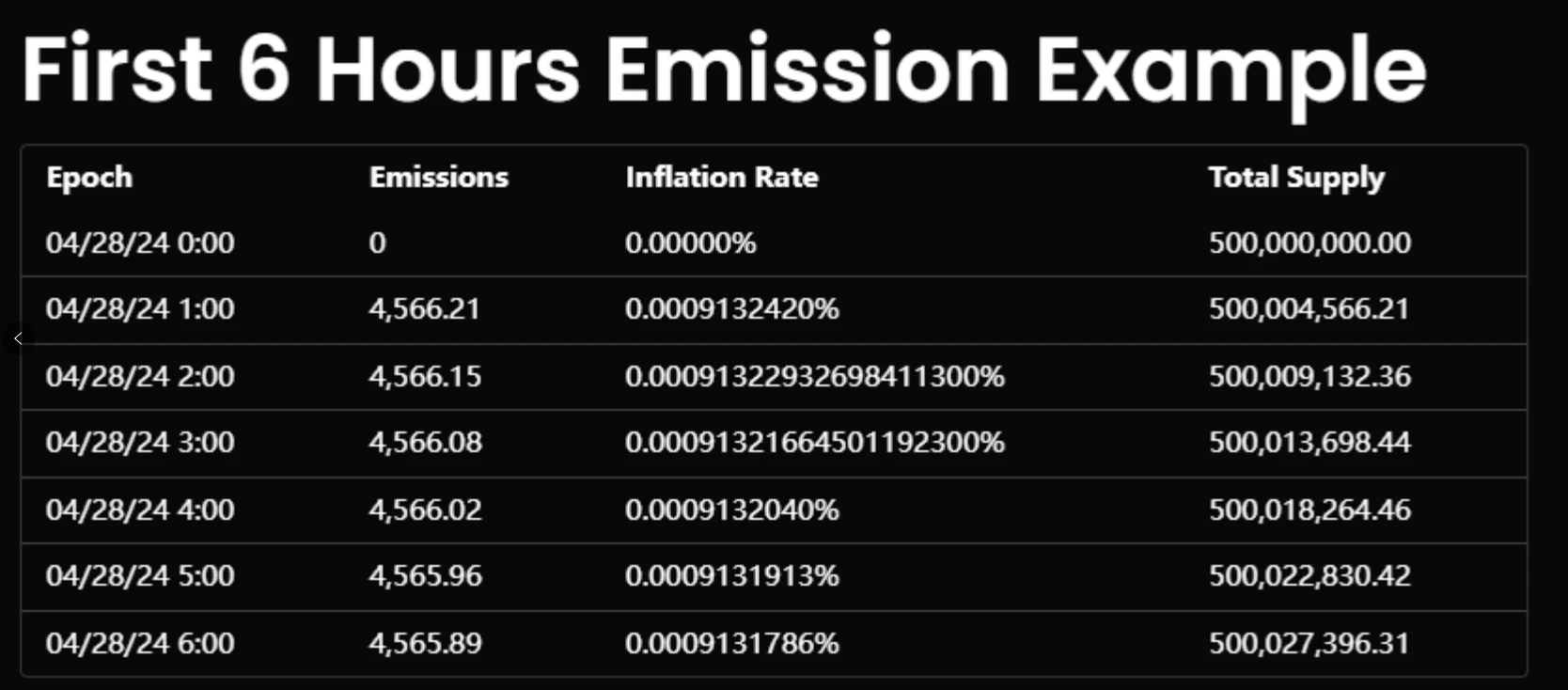

The remaining 300 million tokens will be issued and paid out as rewards to vendors and their stakers, which will occur every hour. Rewards are paid out to vendors and their stakers on an hourly basis for 20 years. Rewards follow a deflationary model, starting at 8% in the first year and decreasing by 1.02% per month (about 12% per year) until the 800 million IO cap is reached. IO uses a programmatic token burn system, where the revenue generated by io.net from the IOG network is used to purchase and burn IO. The IO burn mechanism adjusts the number of IOs to be burned based on the price of the IO.

IO token release in the first 6 hours

OTC

As early as May 8, Aevo launched the io.net (IO) Pre-Launch . With the launch of Binances 55th new coin mining project today, the price broke through US$4.3 and was temporarily reported at US$4.36. The 24 -hour trading volume was US$16,000, and the 24 -hour increase was 14.39%.

At the same time, IO was also launched on the Pre-Market of Whales Market, and the total transaction volume of IO ranked first in the Pre-Market, reaching 5.93 million US dollars . Currently, on the Whales Market platform, the price of IO is temporarily reported at 4.95 US dollars, with a 24- hour increase of 27.6%.

In general, IO is about to be listed on Binance, and the community discussion has suddenly become hot. The money-making party who previously completed the io.net Galaxy Mission and obtained a senior status in the official Discord has finally reached the season of harvest.

This article is sourced from the internet: io.net, valued at $1 billion, is listed on Binance Launchpool, the next big money is coming

Related: Is Bitcoin (BTC) Price Headed for a Sharp Downturn? Key Indicators Examined

In Brief Bitcoin rallied, achieving a notable 12.7% gain over seven days, reaching around $72,750 before retracing. Key indicators suggest a near-term downturn, with bearish signals in the daily and 4-hour charts. BTC’s further trajectory depends on its ability to hold the $69,000 support level, with potential downside targets analyzed. The price of Bitcoin (BTC) reached a higher high recently but has not yet surpassed the all-time high (ATH) of around $73,800. Over the past week, BTC saw an increase from approximately $64,500 to around $72,750 before experiencing a decline again yesterday. Bitcoin Rallies: A Notable 12.7% Gain Over Seven Days After reaching a local low at approximately $64,500, BTC experienced a significant rally, resulting in a price increase of around 12.7%. However, since yesterday, the BTC price has been…