Die Anzahl der Airdrops ist verwirrend. Soll ich diese Woche weiterhin Taikos interaktive Aufgaben erledigen?

Original | Odaily Planet Daily

Autor | Asher

This morning, with Taiko launching the TKO token airdrop query page and announcing the TKO token economic model, major money-making communities suddenly became lively, and users who participated in the interaction went to check the number of tokens they received, but with it came all kinds of resentment on social media:

-

“I heard that Taiko launched an airdrop, but when I checked, it was 0. I feel like cursing. It started in December last year. I don’t understand what this operation is.”

-

“Currently, some accounts have been given tokens for completing Galaxy Missions with more than 3,000 points, but some accounts have not been given tokens. Regarding Taiko’s airdrop, I can only think of three words: insider trading.”

-

Whats going on? We have done at least 3 testnets, including Galaxy, but in the end, we still have 0 eggs.

-

“The Taiko airdrop rules are very rough, and the coins given are also confusing. Now, the competition of misery will begin.”

-

…

Although some users posted their TKO airdrop amounts immediately, many people were generally dissatisfied with Taiko’s airdrop. Below, Odaily Planet Daily will take you to learn about Taiko, the TKO token economic model, and the team members’ responses.

Taiko Comprehensive Analysis

Einführung

Bildquelle: Offizielles Twitter

Taiko is a decentralized Ethereum equivalent of ZK-Rollup. Its purpose is to allow developers and users of dApps developed for Ethereum L1 to use these dApps on Taiko without any modification. As a result, dApps can be quickly deployed to L2, while maintaining the security of Ethereum and incurring lower transaction fees than L1. In general, the main features of the project are as follows:

-

Permissionless and decentralized : Taiko is a Based Rollup. Taiko does not have a centralized sorter, but relies on Ethereum validators to sort transactions and blocks;

-

Frictionless developer experience : Taiko uses Ethereum’s equivalent ZK-EVM (Type 1 ZK-EVM) to achieve execution-level compatibility with Ethereum, fundamentally providing “Ethereum at scale”;

-

Highly configurable and future-compatible : As a disputeable Rollup, Taiko allows application chains to define their own proof systems and adopt newer and more efficient validity proofs as technology advances without modifying Taikos core protocol.

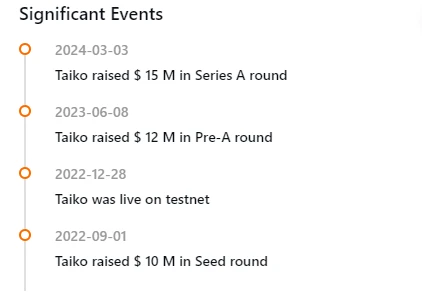

Finanzierung

According to ROOTDATA data, Taiko has raised a total of US$37 million. From 2022 to 2023, it completed two rounds of financing, raising a total of US$22 million. The first round of financing was US$10 million, led by Sequoia China, and ended in the third quarter of 2022. The most recent second round of financing was US$12 million, led by Generative Ventures. Other investors in Taiko Labs two rounds of financing include IOSG Ventures, GSR and GGV Capital, as well as angel investors such as POAP founder Patricio Worthalter, Tim Beiko and Anthony Sassano of the Ethereum Foundation.

In March 2024, Taiko announced that it had received US$15 million in Series A financing, led by Lightspeed Faction, Hashed, Generative Ventures and Token Bay Capital. Other investors in this round of financing included Wintermute Ventures, Flow Traders, Amber Group, OKX Ventures, GSR, etc.

Token-Wirtschaftsmodell

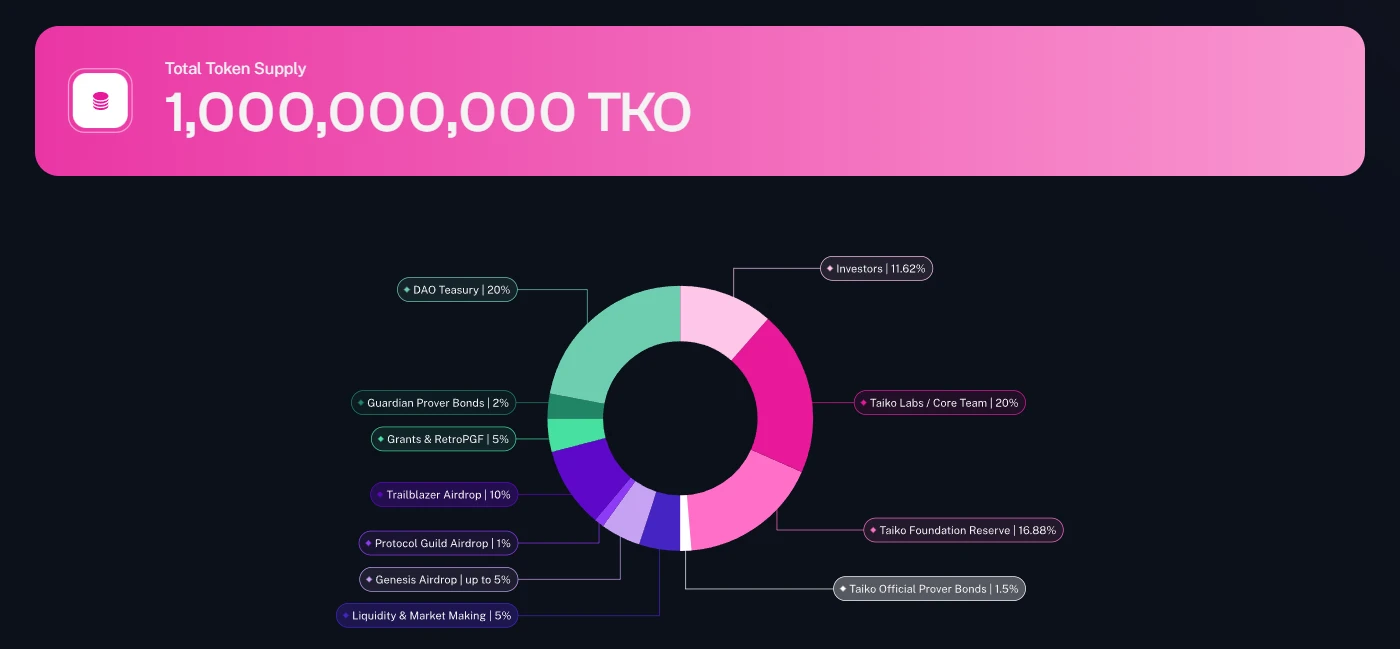

According to the official information released by Taiko, the total supply of its native token TKO is 1,000,000,000 , und das spezifische Verteilungsverhältnis ist wie folgt:

-

Taiko Labs/Core Team: 200,000,000 TKO, accounting for 20.00% of the total supply;

-

DAO Teasury: 200,000,000 TKO, accounting for 20.00% of the total supply;

-

Taiko Foundation Reserve: 168,800,000 TKO, accounting for 16.88% of the total supply;

-

Investoren: 116,200,000 TKO, accounting for 11.62% of the total supply;

-

Trailblazer Luftabwurf: 100,000,000 TKO tokens, 10.00% of the total supply;

-

Genesis Airdrop: up to 50,000,000 TKO tokens, accounting for 5.00% of the total supply;

-

Liquidity and market making: 50,000,000 TKO, accounting for 5.00% of the total supply;

-

Grants RetroPGF: 50,000,000 TKO, 5.00% of the total supply;

-

Guardian Prover Bonds: 20,000,000 TKO, accounting for 2.00% of the total supply;

-

Taiko Official Prover Bonds: 15,000,000 TKO, accounting for 1.50% of the total supply;

-

Protocol Guild: 10,000,000 TKO, 1.00% of the total supply.

(According to the information provided on the official website, the total allocation ratio of each part only accounts for 98% of the token supply.)

Response to the Token Airdrop Controversy

As the Taiko airdrop was full of complaints on social media, community members were asking: What are the specific rules for token distribution? Why didn’t I get a single TKO token after so many rounds of testnets? What is the specific distribution ratio for the Galaxy Mission after so many rounds?

In this regard, danielwang.eth, co-founder and CEO of Taiko, said: In order to avoid unnecessary disputes, we will not disclose the detailed TKO Genesis airdrop rules. Our goal is fairness, but we cannot satisfy everyone. Congratulations to those who received TKO and apologize to those who did not receive TKO.

Bildquelle: Taiko co-founder and CEO danielwang.eth tweet

As soon as this statement came out, resentment in the community soared, and there was a lot of criticism, saying that the team was clearly engaging in insider trading!

Interestingly, after the token airdrop, Taiko released a new task in Galaxy, with a score of 300 points and a deadline of Mai 27. So, will you continue to participate in the interaction?

Taikos Latest Galactic Mission

This article is sourced from the internet: The number of airdrops is confusing. Should I continue to complete Taiko’s interactive tasks this week?

Related: Meme Coin PEPE Sets the Path to New All-Time Highs

In Brief Pepe declined by more than 26% in the last four days and is now testing a crucial support floor. The investors are showing conviction, shifting of 36 trillion SHIB into mid-term holders addresses. Whales are also beginning to collect PEPE after over two weeks, bringing in $26 million in a day. Pepe’s price mirrors the broader market’s corrective phase, finding itself at a critical support threshold. Yet, the narrative from this juncture could take a positive turn, buoyed by investor confidence that remains steadfast. Pepe Investors Hold Steady Despite a 26% drop recently, Pepe’s outlook appears geared towards recovery, driven by investor optimism. This sentiment is captured by the transition of tokens from short-term to mid-term holders, indicating a deeper commitment to holding onto their investments for potential…