SignalPlus-Volatilitätsspalte (20240513): Starker Start

Last Friday, the US macro data performed poorly. The one-year inflation rate expectation in May rose from 3.2% to 3.5%. The University of Michigan Consumer Confidence Index showed weakness, falling to 67.4, offsetting the positive impact of the recent weak employment data on market risk sentiment. The US 10-year Treasury yield once returned to above the 4.5% mark, and the two-year yield, which is more sensitive to interest rate policy, rose to 4.853%. Risk assets performed relatively steadily, and the three major US stock indexes rose and fell. Among them, the Dow and SP closed slightly up 0.32%/0.16% respectively, and the Nasdaq fell 0.03%. This week, the markets focus will be on the CPI data released on Wednesday, which may become a key driver of medium-term price trends.

Quelle: Investing

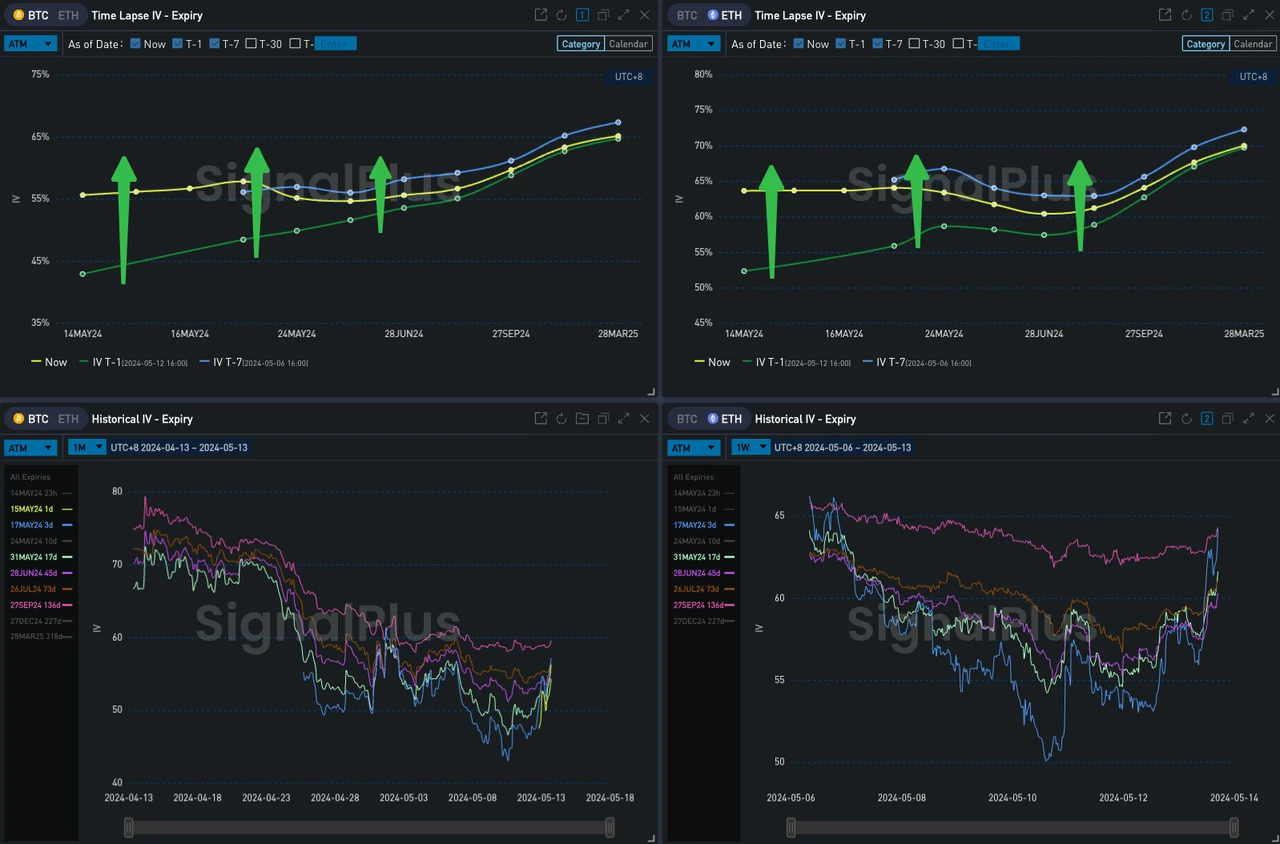

In terms of digital currency, as the beginning of the week, BTC started strongly, breaking through the 63,000 mark in the short term. The front-end implied volatility flattened and rose sharply. Among them, 17 MAY formed a local IV high under the influence of CPI uncertainty. Investors are closely watching whether consumer prices will show signs of cooling down, which will be a major boost to the market betting on digital currencies and other risky assets. On the other hand, a bad inflation report will also trigger traders concerns about economic overload and may lead to a decline in digital currency prices.

Quelle: TradingView

There are two other things worth noting. According to Cryptonews, Japanese investment consulting service company Metaplanet has clearly stated in its statement that the companys Bitcoin-first, Bitcoin-only strategy, and provides financial solutions such as long-term yen lending and regular stock issuance, adding that this is to continuously accumulate more Bitcoin rather than retain the increasingly weak yen.

Another thing is about the US election. Recently, the Biden administrations series of measures to strengthen digital currency regulation have caused dissatisfaction among investors. As a supporter of the current US President Biden, billionaire Mark Cuban suddenly turned recently. He believes that under Bidens leadership, Gary Gensler, chairman of the US Securities and Exchange Commission, has failed to protect investors and made it almost impossible for legal cryptocurrency companies to operate. He warned that if he continued to oppose Bitcoin and cryptocurrency, Republican presidential candidate Donald Trump would likely win the 2024 presidential election. In fact, Trumps attitude towards Bitcoin has also changed 180 degrees recently. In 2019, he publicly stated that he did not like Bitcoin, but recently at the Mar-a-Lago event, he generously told the participants that if you support cryptocurrency, youd better vote for Trump, which caused a sensation in the community. The remarks were described by the US media Politico as a new weapon against Biden, and the development of digital currency policies will also play an increasingly important role in the next election.

Source: Deribit (as of 13 MAY 16: 00 UTC+ 8)

Quelle: SignalPlus

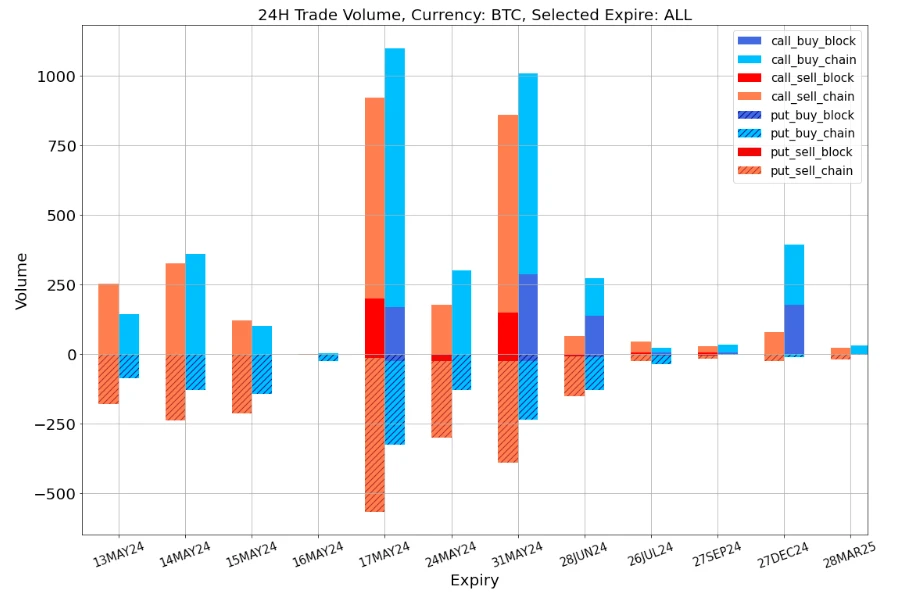

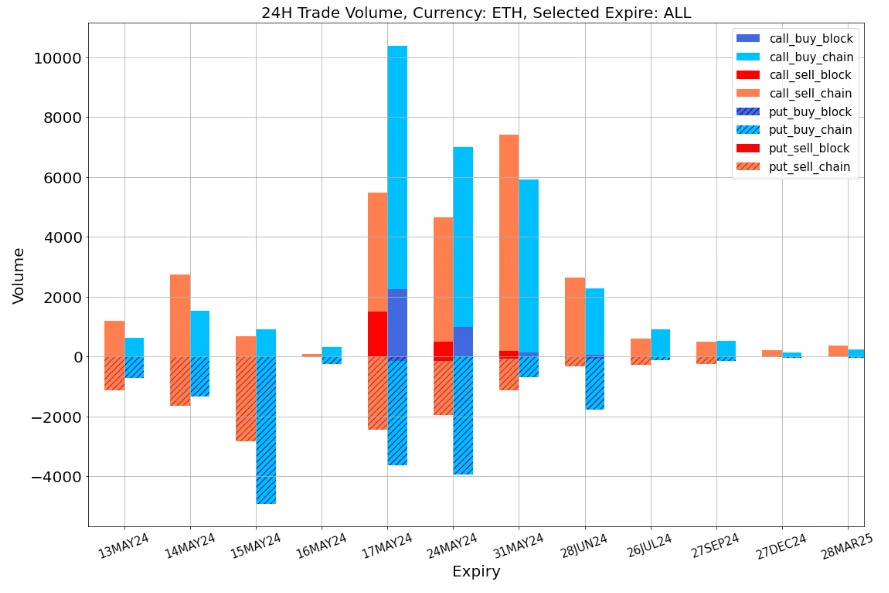

Data Source: Deribit, BTC ETH overall transaction distribution

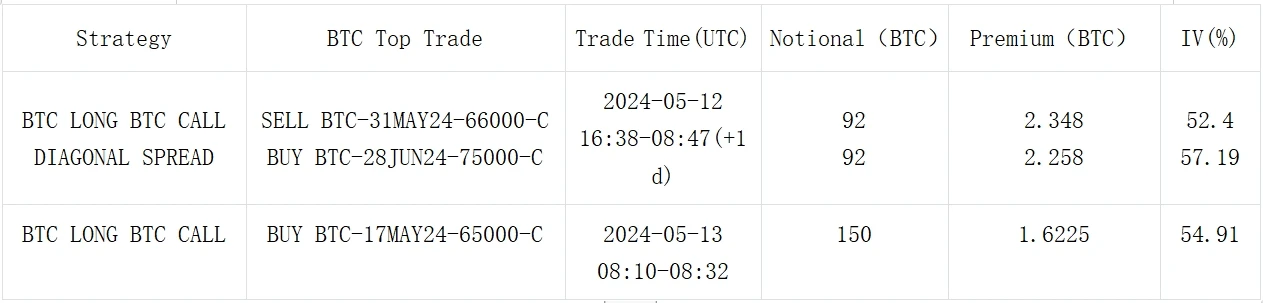

Quelle: Deribit Block Trade

Quelle: Deribit Block Trade

Sie können im Plugin Store von ChatGPT 4.0 nach SignalPlus suchen, um Informationen zur Echtzeit-Verschlüsselung zu erhalten. Wenn Sie unsere Updates sofort erhalten möchten, folgen Sie unserem Twitter-Konto @SignalPlus_Web3 oder treten Sie unserer WeChat-Gruppe (Assistent WeChat hinzufügen: SignalPlus 123), Telegrammgruppe und Discord-Community bei, um mit mehr Freunden zu kommunizieren und zu interagieren. Offizielle SignalPlus-Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240513): Strong Start

Verbunden: Krypto-Wal kauft $10,4 Millionen in Meme-Münze PEPE

Kurz zusammengefasst: Krypto-Wal investiert $10,4 Millionen in PEPE. Die Transaktion umfasst 1,238 Billionen PEPE. Der Wert von PEPE ist im letzten Monat um 29,70% gestiegen. Eine bemerkenswerte Transaktion hat den Kryptowährungsmarkt erschüttert, als ein Krypto-Wal Berichten zufolge $10,4 Millionen in die Meme-Münze PEPE investierte. Diese beträchtliche Investition, die sich inmitten eines Anstiegs der Marktaktivität vollzog, hat intensive Diskussionen über die Zukunft dieses von Memes inspirierten digitalen Vermögenswerts ausgelöst. Krypto-Wal kauft 1,24 Billionen PEPE-Token Spot On Chain, eine angesehene Kryptoanalyseplattform, hat die Transaktion ins Rampenlicht gerückt. Details über eine Multi-Signatur-Wallet namens 0x1a2e64b8a1977bf018850b377020bc33eaaac3c9 kamen ans Licht, die die Bewegung von erstaunlichen 915,85 Milliarden PEPE-Token von Binance ermöglichte. Diese erste Transaktion hatte einen Wert von ungefähr $7,75 Millionen, berechnet mit einem Kurs von $0,000008466 pro Token. In schneller Folge innerhalb der nächsten 28 Stunden…